Comparative Recoveries

The US is doing better than peer economies.

Via WaPo, Falling inflation, rising growth give U.S. the world’s best recovery.

The $28 trillion U.S. economy weathered multiple shocks over the past year and returned to the growth path it was on before the pandemic. The size of the economy, adjusted for inflation, regained its pre-pandemic peak in early 2021. Through the end of September, it was more than 7 percent larger than before the pandemic. That was more than twice Japan’s gain and far better than Germany’s anemic 0.3 percent increase, according to British Parliament data.

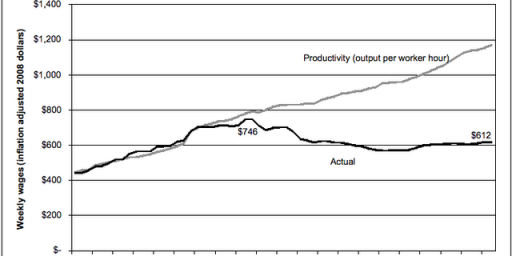

For most Americans, the growth paid off in the form of higher wages. Over the four years through September, the most recent comparison available, U.S. wages — after inflation — grew 2.8 percent.

Most other countries in the Group of Seven industrial democracies saw a decline, according to Treasury Department data. Italian wages sank by more than 9 percent over that period, while German workers earned 7.2 percent less than they had before the pandemic.

It looks like we actually pulled off a soft landing and walked away clean.

That’s really rare. I don’t know enough to suss out whether that’s structural or because of central bank interference, or the right combination of both, but it’s damn impressive.

Janet Yellen needs a pay bump and a hefty bonus. As do folks at the Federal Reserve.

@de stijl: The Fed didn’t start hiking interest rates until March 2022. According to the report, “The size of the economy, adjusted for inflation, regained its pre-pandemic peak in early 2021.” So, it ain’t the Fed. Or, for that matter, Yellen, who took off January 26.

According to the report:

@de stijl:

Somewhere, John Maynard Keynes is smiling.

Oh, to be a fly on the wall in collegiate economics departments, as they grapple with the meaning and implications of all this.

In many metaphors about banking, an analogy is made that money is to the economy what blood is to the body.

If so, then capital accumulation is like an internal hemorrhage that makes a clotted mess somewhere inside the body, and impedes the circulation of blood and intercellular fluids.

I think if you are well informed you realize that inflation has been common throughout the world. That makes it less likely that inflation in the US was solely due to Biden. You also realize that we recovered faster and better than all other large nations and that just about every other economic number than inflation is good. However, many people either dont know about the rest of the world or dont care. They dont know or dont care that the other numbers are good. All they care about is that inflation was bad for 2 years and they just know it was Biden’s fault. Most people being financially better off doesnt change their opinions.

Steve

@steve:

When I got a low mark on a test, I often pointed out I’d still done better than most other classmates. My parents were singularly unimpressed, telling me they didn’t give a damn about the other children.

I remember the response to the Great Recession pretty acutely. I was graduating college in 2007 to a job market that resembled the fiery* pits of Mordor. The progressive blogosphere was alive at the time with calls to spend our way out of recession. Yglessias was pointing out that interest rates on government borrowing were essentially 0; grab that fucking money and boost the economy. Every other day Krugman came out with a post pointing out how utterly stupid it was to cut our way out of a recession.

We got a decade of lackluster growth, though I suppose you could at least point out that it was indeed growth.

Anyway, on behalf of all the Millennials who entered the workforce at that time, and I guess on behalf of the late-2000s progressive blogosphere (though I was just the audience): fucking told you.

Kathy- Its more like grading on a curve where you got the highest grade but all of the scores were below ordinary passing grade. In that situation either everyone gets an F or you give the person at the top an A. So the way I would look at it is we have never managed an economy coming out fo a pandemic, or at least since 1918. We did the best in the world. Maybe it could have been better but that is unknowable.

Steve

@steve:

We can compare various metrics, from GDP growth to purchasing power, as they are post pandemic and what they were like before.

As an aside, I was never graded on a curve. Not once.

@Neil Hudelson:

Around 2010 or so, when things were recovering, I recall hearing an economist, I forget who, argue that governments should cut back spending and/or implement austerity measures during good economic times, and spend like there’s no tomorrow during bad ones.

I don’t know how effective that is, but it seems like a better idea than to draw down spending when it’s most needed.

@Kathy:

That’s pretty much what Keynes said. We don’t seem very good at the first part. And in 2009 we should have done more of the second. Part of why Obama didn’t was the deficit built up in good times under W.