Fed May Pause Rate Hikes

That at least seems to be the expectation right now.

Federal Reserve Chairman Ben Bernanke and his colleagues appear ready to call a halt to the longest unbroken stretch of Fed interest rate increases in recent history, providing at least temporary relief to millions of consumer and business borrowers.

But the pause in interest rate increases could be short-lived as Fed policy-makers deliberated behind closed-doors on Tuesday. They’re confronting rising inflation pressures in the form of a relentless surge in energy prices and new data that wage pressures are intensifying.

The central bank has not missed a chance to boost interest rates since it started the current credit tightening campaign in June 2004, the longest unbroken stretch of Fed rate hikes in recent history.

It has nudged the federal funds rate up by a quarter-point at each of 17 consecutive meetings, going from a 46-year low of 1 percent to the current level of 5.25 percent.

But financial investors believe that trend will change Tuesday with the Fed deciding it does not need to raise rates further, at least for now, because of growing signs that the economy is slowing.

Obviously, if the Fed does raise interest rates the stock market will move downward, and probably by a fair amount.

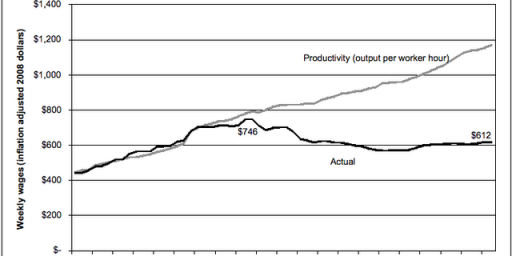

What could be worrying the Fed though is the report from the BLS that productivity has taken a sharp downward turn last quarter while compensation is still pretty high. Productivity overall was up only 1.1% while the previous quarter saw productivity grow at 4.5%. Hourly compensation is up 5.1% vs. 6.9% last quarter. The unit labor cost though is where we start to see the problem. Unit labor costs reflect changes in both hourly compensation and productivity. Last quarter the unit labor cost increased by 2.3%, but this quarter it was 4%. This could mean higher prices down the road and signal future inflation.

More here.

“The time is ripe for the Fed to pull the plug on this tenacious two-year-old tightening cycle,” Merrill Lynch economist David Rosenberg said.

He added: “We are amazed at the number of folks out there who still feel the need for the Fed to raise rates further because of elevated inflation pressures.

“There is simply nothing the Fed can do about the current inflation backdrop right now. Everything the Fed does now will exert its ultimate impact in the summer of 2007, when we may very well be dusting off the deflation books once again.”

Plus there is this part that discusses in further detail why another rate hike is unlikely.

Data out Tuesday showed that US workers’ productivity slowed abruptly to grow by just 1.1 percent in the second quarter, compared with a clip of 4.3 percent in the first three months.

But at the same time, unit labour costs — a key inflation gauge — rose 4.2 percent in the second quarter, compared with a gain of 2.5 percent in the prior period. It was the sharpest jump since the end of 2004.

The report was consistent with a raft of figures that have pointed to the US economy slowing down on the one hand but building up inflation on the other.

The government said Friday that US employers added just 113,000 new jobs in July. The jobless rate ticked up to 4.8 percent from 4.6 percent in June. But average hourly earnings rose by more than expected.

Such signs that the US economy is finally hitting the brakes, after years of stellar growth, have encouraged futures markets to ascribe odds of more than 80 percent that the FOMC will stand pat.