Initial Estimate Shows Economy Grew 4.1% In Second Quarter

The economy grew at an exceptionally strong pace according to the first estimate of GDP growth, but several caveats remain.

Heading into today’s release of the first estimate of Gross Domestic Product for the second quarter of the year, it was expected that growth for the period from April through June would show the economy growing stronger than it has in the past several reports, with most estimates forecasting somewhere in the area of an annualized rate around 4%, which is stronger than we’ve seen in the past four years. As it turns out, those estimates were largely correct, and the Bureau of Economic Analysis reports that the economy grew at a 4.1% rate during the second quarter:

Real gross domestic product increased at an annual rate of 4.1 percent in the second quarter of 2018 (table 1), according to the “advance” estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.2 percent (revised).

The Bureau emphasized that the second-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see “Source Data for the Advance Estimate” on page 2). The “second” estimate for the second quarter, based on more complete data, will be released on August 29, 2018.

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased (table 2).

The estimates released today also reflect the results of the 15th comprehensive update of the National Income and Product Accounts (NIPAs). The updated estimates reflect previously announced improvements, and include the introduction of new not seasonally adjusted estimates for GDP, GDI, and their major components. For more information, see the Technical Note. Revised NIPA table stubs, initial results, and background materials are available on the BEA Web site.

The acceleration in real GDP growth in the second quarter reflected accelerations in PCE and in exports, a smaller decrease in residential fixed investment, and accelerations in federal government spending and in state and local spending. These movements were partly offset by a downturn in private inventory investment and a deceleration in nonresidential fixed investment. Imports decelerated.

Current-dollar GDP increased 7.4 percent, or $361.5 billion, in the second quarter to a level of $20.4 trillion. In the first quarter, current-dollar GDP increased 4.3 percent, or $209.2 billion (table 1 and table 3A).

The price index for gross domestic purchases increased 2.3 percent in the second quarter, compared with an increase of 2.5 percent in the first quarter (table 4). The PCE price index increased 1.8 percent, compared with an increase of 2.5 percent. Excluding food and energy prices, the PCE price index increased 2.0 percent, compared with an increase of 2.2 percent (table 4).

In an article written before the numbers were released, Ben Casselman at The New York Times cautioned against using these numbers as a guide for where the numbers might go for the rest of the year and he repeats that caution in a post written after the numbers were posted this morning:

Economic growth surged in the second quarter — but don’t expect the boom to last.

The second-quarter acceleration was widely anticipated by economists, a result of a confluence of events unlikely to recur. Most economists expect growth to slow in the second half of the year.

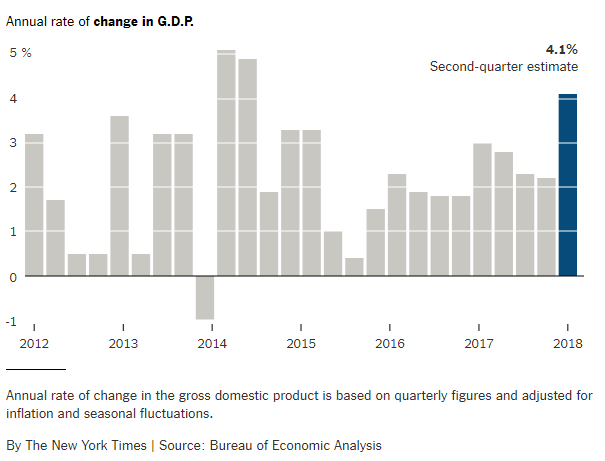

Still, recent data does suggest that the pace of growth has picked up this year. Some economists think full-year growth in gross domestic product could hit 3 percent in 2018 for the first time in the nearly decade-long recovery, a prospect that became more likely following Friday’s strong numbers. The second quarter was the first time since 2014 that economic growth topped 4 percent in a quarter; the economy reached that level or higher just four times during the eight years of the Obama administration.

“The bottom line is that the economy is doing better,” said Diane Swonk, chief economist for the accounting firm Grant Thornton.

Mr. Trump, who had said on Thursday that he would be happy with any growth figure above 4 percent, celebrated what he called the “amazing” G.D.P. number in remarks at the White House on Friday. And he pushed back against economists who say the second quarter’s growth rate is unsustainable.

“This isn’t a one-time shot,” Mr. Trump said. “I happen to think we’re going to do extraordinarily well in our next report, next quarter.”

Friday’s figures were pumped up by a surge in exports, which accounted for a quarter of the total growth for the quarter. Paradoxically, the export boom was driven in part by mounting trade tensions, which led foreign buyers to stock up on American products before their governments imposed tariffs.

The trend is particularly clear in exports of soybeans, which were up more than 50 percent in May from a year earlier. Those buyers presumably didn’t want more soybeans than usual — they just wanted them sooner. Exports will almost certainly slump in the third and fourth quarters, and will turn into a drag on overall G.D.P. growth.

“We’re getting explosive growth in the second quarter because of trade,” said Ellen Zentner, chief United States economist for Morgan Stanley. “You’ve got a big hole on the other side of that.”

Friday’s strong figures also reflected an increase in government spending tied to the budget deal that Congress passed this year. Federal spending rose at a 3.5 percent rate in the second quarter. The effects of the spending deal won’t be quite as short-lived as the trade bump, but they are likewise temporary; economists think the impact on growth will peak late this year.

For a better sense of the underlying pace of growth, economists often look at an alternative measure that strips out trade, government spending and the volatile inventories component. That measure, known as “final sales to private domestic purchasers,” rose 4.3 percent in the second quarter, up from 2 percent in the first three months of the year.

Government spending isn’t the only policy elevating economic growth. Republican tax cuts are probably also playing a role, although the effects are hard to quantify. Consumer spending rebounded in the second quarter after slumping in the first.

“Consumers got a decent amount of cash after the tax cuts,” said Joseph Song, senior United States economist for Bank of America. “We are starting to see some of that play out.”

Whether those policies are a good idea is another question. Many economists question the wisdom of passing what amounts to a deficit-funded stimulus package when unemployment is low and the economy is strong. Few outside the White House think a growth rate of 4 percent is sustainable in the long term.

Supporters of the tax cut have argued that it will stimulate business investment, which will allow the American economy to grow faster in the long term. But Michael Gapen, chief United States economist for Barclays, said there was little evidence of that so far. Friday’s report showed that business investments in equipment grew at their slowest pace since late 2016. That makes it more likely that the tax cuts will lead the economy to overheat, rather than paving the way for a more sustainable period of stronger growth.

“Business spending is not picking up the way proponents of the tax cut had hoped,” Mr. Gapen said. “We could be putting ourselves in the position where we get a boom followed by a bit of a bust.”

The Wall Street Journal is slightly more optimistic but also focuses on the fact that these figures are likely to mean that the Federal Reserve Board will continue its policy of gradually raising rates, a move that could help to slow the economic growth rate down to at least some degree:

WASHINGTON—The U.S. economy grew at the strongest pace in nearly four years during the second quarter, powered by a rebound in consumer spending, exports and firm business investment.

Gross domestic product—the value of all goods and services produced across the economy—rose at a seasonally and inflation-adjusted annual rate of 4.1% from April through June, the Commerce Department said Friday. That was a pickup from the first quarter’s revised growth rate of 2.2%.

Economists surveyed by The Wall Street Journal expected a 4.4% growth rate. The second-quarter growth reading was the strongest since the 4.9% annual rate reported for the third quarter of 2014.

Compared with the second quarter a year ago, output grew 2.8%.

The robust report makes it highly likely the Federal Reserve will continue gradually raising short-term interest rates to prevent the economy from overheating. Central bank officials have raised rates twice this year, and penciled in two further increases this year and three in 2019.

The Fed is widely expected to leave its benchmark rate unchanged at its policy meeting next week and then increase it in September by a quarter-percentage-point to a range between 2% and 2.25%.

Trade played a large role in the second quarter’s bumper growth. Net exports added 1.06 percentage point to the quarter’s 4.1% GDP growth rate, as exports rose strongly.

Earlier this month, the Commerce Department said U.S. soybean exports surged in the second quarter, delivering an outsize boon to economic growth even as China shifted much of its sourcing to Brazil in response to its worsening trade relations with the U.S. The export rally likely reflected efforts by buyers to get their soybeans before China’s 25% retaliatory tariffs on U.S. soybeans, which hit in July.

Inventories subtracted 1.00 percentage point from the quarter’s GDP growth rate. Both trade and inventories tend to be volatile categories.

Strong consumer spending helped boost growth alongside trade. A low unemployment rate, steady job and wage growth and the late-2017 tax overhaul may have encouraged spending by consumers and businesses in the second quarter. Consumer spending, business investment and government spending all rose.

Consumer spending accounts for more than two-thirds of total economic output. Friday’s report said personal-consumption expenditures rose at a 4.0% annual rate in the second quarter, the strongest rate of growth since the fourth quarter of 2014. Spending on durable goods alone contributed 0.64 percentage point to the second-quarter rate, the Commerce Department said. As Americans spent more, they saved less. The personal saving rate was 6.8% in the second quarter, down from 7.2% in the first

As this chart from The New York Times shows this is the first time that we’ve seen a quarterly number this good in four years:

As a preliminary matter, it’s worth emphasizing that this is an advance estimate of the state of the economy in the second quarter. We’ll get a better idea of what the economy is doing when the second and final revisions come out at the end of August and September respectively. It’s also worth noting that this is a quarterly number and that the actual annual rate for the year is likely to be significantly different. At the present time, for example, the Federal Reserve is estimating that the economy will grow at 2.8% for the entirety of 2018 and that we’ll see slightly slower growth rates for 2019 (2.4% estimate) and 2020 (2.0% estimate) respectively, with longer-term growth beyond that being somewhere in the range of 1.8% to 2.0%. To be fair, some private analysts have forecast that growth for all of 2018 will be higher for the current year, but even their estimates are still saying that we shouldn’t expect growth to be much higher than 3.1% to 3.2% for the entire year. Those same private analysts are projecting that growth in the third quarter, which ends in September, would be roughly 3% in the third quarter and 2.9% in the fourth quarter. That’s healthier than what we’ve seen for the past several years, but not exactly the impressive rate of growth that President Trump and Republicans promised during the 2016 campaign.

Additionally, as noted by both the Times and the Journal, there were several elements contributing to the number we got today that is unlikely to continue into the rest of the year. The first is the fact that the second quarter saw an unusually high number for soybean exports and other exports that pre-date the announcement of tariffs and retaliation that we’ve seen from China, Europe, Canada, and Mexico. Arguably, that increase was due to the fact that both buyers and sellers were anticipating that tariffs were about to increase and acted accordingly before trade policy changed. Whatever the case, increased exports such as this are generally not something that sustains itself from quarter-to-quarter, to begin with, and that’s likely to be even truer in future economic reports that will likely be a more accurate reflection of the impact of the trade war on the economy.

Notwithstanding that, and not at all surprisingly, the President took credit for the strong report today, and it’s likely that this will become a strong part of the GOP message going forward:

WASHINGTON — President Trump exulted in data on Friday that showed economic growth accelerated in the second quarter, reeling off a list of statistics to make a case, during a midterm election year, that his administration should get the credit for the humming economy.

“Once again, we are the economic envy of the entire world,” Mr. Trump declared outside the South Portico of the White House, flanked by his top economic advisers. “As the trade deals come in, one by one, we’re going to go a lot higher than these numbers.”

The Commerce Department estimated that growth in the second quarter of 2018 rose to 4.1 percent, the fastest quarterly rate since 2014. Economists have questioned whether growth can continue at such a pace, but Mr. Trump and his advisers argued it was more than a “one-time shot,” citing, among other factors, gains in business investment and productivity that they said resulted from deep cuts in corporate taxes.

“This is a boom that will be sustainable,” Mr. Trump’s chief economic adviser, Larry Kudlow, said, “frankly as far as the eye can see.”

More from Politico:

President Donald Trump on Friday morning touted a Department of Commerce report estimating that the nation’s gross domestic product grew 4.1 percent in the last quarter.

“These numbers are very, very sustainable. This isn’t a one-time shot. I happen to think we’re going to do extraordinarily well in our next report next quarter. I think it’s going to be outstanding,” Trump said on the White House’s South Lawn, flanked his vice president, treasury secretary, commerce secretary and economic advisers. “I won’t go too strong because then if it’s not quite as good you’ll not let me forget it. But I think the numbers are going to be outstanding. We’ve accomplished an economic turnaround of historic proportion.”

(…)

Trump also celebrated reductions in U.S. trade deficits that he said are the result of his hardline trade policies, including the imposition of tariffs on China as well as on allies and partners like Canada, Mexico and South Korea. Those tariffs have brought heavy criticism onto Trump from congressional Republicans who have long pushed for fewer trade barriers.

These positive numbers, as well as what seems to be a generally optimistic view that seems to exist regarding the state of the economy, is likely to enure to the benefit of Republicans in the upcoming election and could prove decisive in close races. Ordinarily, the state of the economy and the individual economic security of voters is among the strongest motivators when it comes to determining who they will vote for. If we enter the final months of the election season with a strong economy, then that could help Republicans stave off a blue wave even if it doesn’t completely prevent Democrats from taking control of one or both Houses of Congress. This is partly reflected in the fact that while the President’s overall job approval remains very negative, his job approval on the economy is essentially the exact opposite, with 50.4% approving of the President’s performance in this area and 42.3% disapproving. With numbers like this, the economy could be the thing that helps to save the GOP to some extent in November.

So by running up a massive deficit by shoveling tax money into the pockets of the rich, Trump has managed to almost – but not quite – reach Obama’s best quarters.

You can tell this news was very exciting and positive by the way the Dow suddenly leapt up. . . um, I mean dropped. . . 97 points as of this writing. S&P down. NASDAQ down. Yeah, the enthusiasm is electric!

So everyone rushed to move a lot of goods ahead of idiotic tariffs…and GDP growth clocked in at around the 5th strongest of Obama’s presidency?

Real economists (ones not named Kudlow) think this number is goosed by ~.6%…so real GDP growth is ~3.5%.

Get back to me when growth consistently lives up to Dennison’s campaign promise of 4% sustained.

@Daryl and his brother Darryl:

Meantime…and to Reynold’s point…

When Paul Ryan became speaker the deficit was $439B.

This year…$890B.

Next year…$1,085B.

All the tea-baggers that used to whine about the debt are now crowing about fake growth.

I guess debt only matters when the president is black.

@Daryl and his brother Darryl:

That is wrong. A calumny! A slander! Here, let me fix:

GDP has grown at 3.22% per year from 1947 to 2017. We should all be pleased by the current report and simultaneously recognize that it is not exceptional. It might drop next quarter under the influence of nothing more mysterious than deviation toward the mean.

I would guess that in the Middle Ages there were times of drought, and the peasants grumbled about the crappy job the king was doing, and there were times of good weather, and the king took credit for the good crops.

@Michael Reynolds: High GDP growth always scares the markets, because it can lead to interest rate hikes.

@Leonard:

Good point.

Also don’t forget the mess that’s rolling towards us called Brexit. I expect a nice little crash either in October (when nothing gets decided between the EU and the UK) or at the actual date of drop-out (March 31st, 2019). Or it could be at some point between the two, such as when a large U.K. manufacturer decides to stop waiting for things to get solved and jumps out of the U.K.

@Michael Reynolds:

Skipping the drivel…….. The market almost assuredly had already priced in the number. Stick to “see spot run…”

These numbers are very, very sustainable. This isn’t a one-time shot. I happen to think we’re going to do extraordinarily well in our next report next quarter. I think it’s going to be outstanding,..

The market almost assuredly had already priced in the number.

So you don’t know anything.

@Daryl and his brother Darryl:

I bought a car earlier than I planned for this very reason: just in case a trade war drove automobile prices upward.