Gasoline, Oil and Natural Gas Prices Surge

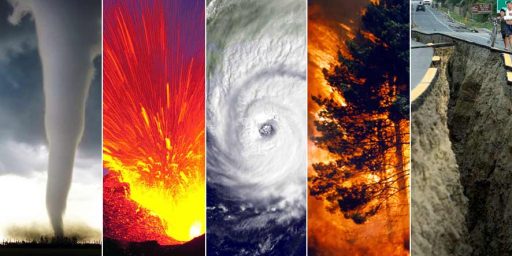

The drivers appear to be the shut down of 11 refineries along the gulf coast, the decrease in crude oil stockpiles. As for natural gas the increase in prices is due to the strengthening of a tropcial storm in the Carribean.

Eleven refineries along the Gulf of Mexico are closed because of Rita and Katrina, which struck last month. Offshore oil output in the Gulf remains shut. Prices extended gains after the Energy Department reported that gasoline supplies rose 4.4 million barrels to 199.8 million in the week ended Sept. 23. Crude-oil stockpiles fell more than expected, the report showed.

…

Natural gas surged to a record on concern that tropical weather may cut production that has been crippled by two hurricanes in the last month. The U.S. National Hurricane Center said today that a “vigorous” tropical system in the Caribbean Sea was strengthening. So-called tropical waves can mark the beginnings of a hurricane.

According to the Department of Energy, 7 refineries accounting for 1.7 million barrels per day of refinery capacity were in the directly in the path of the hurricane and damage to these facilities and the lack of electricity are keeping others offline. In short, about 15% of the U.S. refining capacity is now offline (which speaks rather well of my shirt cuff calculations). The following graphic gives you an idea of the magnitude of what we are talking about,

According the Deptarment of Energy’s daily report a large number of natural gas processing facilities are offline.

Over a dozen gas processing plants have confirmed that they are off-line owing either to flooding, lack of supplies, an inability to move stored liquids, or safety precautions (see September 26 Report).

The combined capacity of the plants that are offline is around 10 billion cubic feet per day. Definitely not a good thing for those who heat their homes with natural gas and with winter coming on fast.

There is no shortage of Oil.

Ref: http://news.independent.co.uk/business/news

Read the article entitled “Oil Reserves are Double previous Estimates”

A quote from the Saudi Oil Minister “Now, there are no takers” followed up in the next paragraph where the Oil Minister is quoted “Give us the customers and we will pump the oil”

There is NO reason that the price of crude should be rising. There is an overabundance of oil available.

Herb,

Domestic stocks are low, that means there could a temporary shortage for refineries in this country since it could take awhile for existing supply to realign itself. Of course, for this to happen prices would probably have to change–i.e. go up.

If that is true, it could only that the oil companies are NOT buying oil, hence, existing stocks are low, The question now becomes, Why are existing stocks low? And Remember, Bush and the DOE released 30 plus million barrels of oil to ease the so called shortage. To date the oil companies have only taken 11 million barrels of the 30 plus million barrels available to them . In other, there is no common sense or logical reason that existing stocks should be low.

And lastly, There is no shortage of oil.

And, why should the price go up in order to replenish low existing stocks? I thought prices were dictated by Supply and Demand. If they are not a supply/demand issue, then why were the American people constantly told that high crude prices were so dictated because or the increased demand from Asia and China. (Prior to Katrina that is) What I want to know is what criterion really dictates oil prices. the supply/demand argument just don’t hold water. ( or (oil if you prefer).

This entire issue had best be cleared up or the entire will be in serious economic trouble. A report yesterday indicated that consumer confidence declined 19 points and a report today says that late Credit card payments are at an all time high, attributed to the high price of gasoline.

This indicates to me that the economic situation is getting worse. And, once again, I can tell you a fact, people in my area are already talking about a lot smaller holiday season than in previous years.

And lastly, There is no shortage of oil.

Gosh I believe EVERYTHING the Saudi’s say…

That figures

Nice blog.I like this site.

Nick

http://www.yahoo.com

It appears that no one can provide the answers to my previous questions, so I can only conclude that in the case of the oil companies that,

Supply and Demand applies to increase crude prices when it appears that there is or will be a shortage, But

When there is an abundance or oil available, supply and demand do not apply, and,

Low crude inventories, ( the oil companies are not buying oil) are the reason for crude oil price increases so that inventories can be replenished and supply and demand are no longer a factor for pricing.

Make you wonder just what the next excuse will be for a price increase.

But, don’t worry about it, the oil companies will think of something, you can be sure.

I think it is kinda funny that Herb hangs so much belief on one Saudi spokesman. I mean, even if we stand back and delay judgement, we have to admit that Ali al-Naimi is on one exteme and Matt Simmons is on the other. There is certainly “uncertainty” in oil supply right now.

I actually think we are near the end of cheap “light sweet crude” … but there is more of the heavy stuff, and even more of the very-heavy (tar sands, etc.).

The interesting thing to see will be the degree we have to move to heavy and very-heavy sources, how fast we can move, and what the economic/environmental effects of that shift to heavy crudes will be.

Question: When we buy oil from the Saudis, Canadians, or whomever, are we buying crude oil or refined gasoline ready to go in to cars? That makes all the difference in the world, I think.

Or why not T. Boone Pickens? Isn’t he a little more known and trustworthy than this new guy … al-Naimi? He’d new at least to me.

http://www.mensnewsdaily.com/archive/k/king/2005/king091605.htm

Oops, wrong link (although that story above isn’t too bad).

http://www.nytimes.com/2005/09/10/business/10nocera.html?ex=1128139200&en=e6ee0ac6e1d87c0c&ei=5070

BTW Eric, we buy refined gasoline, and export it as well. It is a pretty dynamic market.

Odo:

It’s not that I put so much trust in the Saudi Oil Minister, but lacking any word from the oil companies other than “Excuses” is better than what we are hearing.

Ont thing I learned a long time ago and most likely you also, is,

“MONEY TALKS” and while I do think that the Saudis are funding and supporting terrorists when it comes to business and making (Or stealing) a buck, the Saudis will be there to take it.

On top of that Mr. Ray Tillman attended the same oil meeting and if the oil was not available, then he surely would have debunked the Saudi Oil Minister. If the oil were not available, and Tillman did not say a word, then that makes him and Exxon Mobil a part of the untruth.

I am really shocked that there a lot of people here that uphold and make excuses for the oil companies while they are getting it stuck to them at the gas pumps. Unbelievable.

One last thought:

I have not heard or seen any denials of the Saudi oil availability from any US oil companies or the US Government. Have any of you?

The main thing I’ve noticed, for the last six months, is assurances from the Saudis that they will raise production, and thus lower crude oil prices.

They have not done that, I think because they are not able. It is widely documented that existing wells etc. need to run at full blast in order to satisfy the current market.

It seems quite possible to me that there could also be a refinery “shortage” … but here is the real contra-indicator to that: If we were short on refinerise, not oil, then oil would be cheap at the same time gas was expensive.

Given that crude oil and gasoline prices have risen together, that seems an excellent proof that this is an oil, and not a refinery, shortage.

There is some cross-over between these concerns though. Most of our refineries are set up for light sweet crude, and I believe that is what is in shortage. More of the world’s crude suppliers are giving us heavier oils, which call for a different sort (and more expensive?) refinery.

So, it could be that the refinery shortage actually relates to the light sweet crude shortage, and the Saudis want more refineries ready to accept heavy sour oil.

It wouldn’t surprise me if that was where your “no takers” comes from … no takers currently for any more heavy sour crude … the crappy stuff.

Odo:

I would like you to post a comment about a few things;

Saudis are at full capacity on pumping

How are our refinery’s set up. ie: light or heavy crude.

Remember that approximately 10 % of our oil comes from the Saudis. Some from Iraq, Some from Venezuela, some from Kuwuat as a few other med east countries.

My understanding, just from reading the energy blogs and the newspaper articles they point to, is that the Saudis are pumping at full capacity (perhaps to the point of “damaging” their resavoirs, see Matt Simmons), and that the vast majority of our US gas refineries use light crudes.

I did a search on “heavy sour” and “refinery” and hit this:

“Anyone who watches the oil market in any detail knows that the problem is not a shortage of crude oil. Indeed there is oversupply of certain types of crude oil – heavy, sour –and it is being sold at a discount. The problem lies in a shortage of refining capacity, which is owned predominantly by western multi-national and lies mainly in the industrialised countries.”

http://www.khilafah.com/home/category.php?DocumentID=11864&TagID=1

For what it’s worth, I think our problem is one of “transition” … we have to transition from the light sweet crude because we can’t find more of it fast enough.

I’m afraid the future will force us to use crappier oils as the good stuff gets used up.

One note, while heavy crude sells at a discount, because of the difficulty of refining heavy crude, it doesn’t sell at that huge a discount. It is itself very high in terms of historical prices.

Summary:

Light sweet crude is expensive because supply is very tight.

Gasoline is expensive because light sweet crude is expensive, and because there aren’t currently enough refineries to handle the heavier grades which are in greater supply.