Good Jobs News

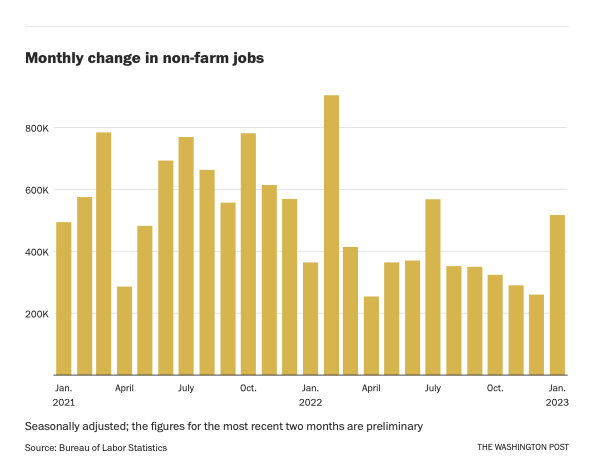

I will confess, I wasn’t sure what I expected, but it was a lower number than this (via WaPo): Employers added 517,000 jobs in January, astonishing labor market growth.

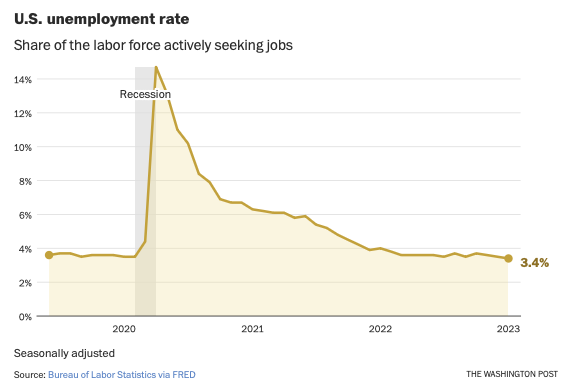

The labor market shattered expectations in January, as the economy added 517,000 jobs and the unemployment rate dropped to 3.4 percent, a low not seen since May 1969, according to data released Friday from the Bureau of Labor Statistics.

Here are some of the larger sectors:

More than 128,000 jobs were added in leisure and hospitality in January, with the largest gains in bars and restaurants. Professional and business services added 82,000 jobs in January. And employment in health care rose by 58,000 jobs, reflecting the aging population and a backlog of demand for healthcare as the economy emerged from its coronavirus lockdown.

I shan’t attempt any economic analysis, but will say that this runs counter to the narratives that a) the economy is in bad shape, and b) that no one wants to work.

Here’s why that’s bad for Biden….

LOL

And right below that in WAPO is

I sometimes feel economic reporting leaves something to be desired. Perhaps the issue is really the very fast recovery of the hospitality industry after COVID.

Jerome Powell vows the beatings will continue until morale worsens

Look for the GQP to claim it’s because the red wave in the midterms.

Now the inflation numbers will be interesting. They’ve been trending down over the past several months and there is little anecdotal evidence that inflation is back on the rise.

The job numbers will put some upward pressure on payrolls, but that isn’t a bad thing. To borrow a bit of R logic, if deficits caused by tax cuts are acceptable, then a bit of inflation caused by wage growth is also OK.

The NYT article on this noted that wage growth has slowed slightly, to 0.3 percent compared to December. So, despite the job gains, wage growth slowed ever so slightly.

This Biden recession really sucks. If trump was still in the White House none of this would ever have happened. Will we never learn???

Labor force participation is still historically low. It would be interesting to know which cohorts are staying out of the labor force and why (I haven’t researched this and don’t have the time).

Also, while this is good news, I think it will be a data point for the Fed to justify further interest rate increases out of concern about a wage-price spiral leading to further inflation, which in turn increases the chances of a recession later on. The Fed just raised rates a quarter point and indicated there are more to come. I’m more on the side of those like Kevin Drum, who think the Fed should stop raising rates and take a wait-and-see approach as the effects of the existing increases take effect over time.

@OzarkHillbilly: I know you are being sarcastic but I suspect that if we were to get our news from Fox we would believe we are in an economic flameout.

@Andy:

The biggest group of people who left the labor force during COVID was over 55 people. The pandemic just hastened the start of the big boomer retirement a few years

Does anyone ever go read the actual report that comes with that 517,000 number? It’s seasonally adjusted, but they don’t tell you what that adjustment was. They show the corrections made to initial reports for 2022 monthly numbers, with initial errors over 100,000 in both directions. They go on at great length about corrections due to finally getting the census results incorporated properly. They say clearly that changes in methodology make time series comparisons difficult.

Seasonal adjustments can be hilarious. I remember one January when the report was that retail “gained” 30,000 jobs. That turned out to mean employers only laid off 170,000 holiday temp workers, not the anticipated 200,000.

@Michael Cain:

Yeah, that’s a well-known problem that the media largely ignores. We’ll have to see what the final numbers are in a few months.

@Andy: I’d be very interested to know the ages and situations of the most affected. I know a few people in their late 50’s/early 60’s whose decision to retire was accelerated by the pandemic. Absent that, they would have kept working but now that they are retired they aren’t going back. I wonder if the same thing applied to people who dropped out to become the primary care giver during the remote schooling era. It may be years before they return to the labor force.

@Stormy Dragon:

I would have thought that started in 08 with the Financial Crisis. My FIL got put out to pasture because he was an old, expensive middle manager. Oh, wait, excuse me, it was because of something something Fox News told him. He’s freaking delusional about economic reality and doesn’t like to think about how the economy is partly designed to grind up and discard White men like him. I mean, that’s all a bunch of CRT hokum.

Re: labor force participation–with the caveat that anecdotes are not data, I have noticed that a lot of pension-eligible people I know (especially teachers) and those who had been in positions for a long time (a lot of librarians) quit working during the pandemic. These are people who are under age 65 but typically around/over age 55 who just decided they didn’t want to go back to low-paying jobs, especially if they already qualified for a pension.

I can see the sense in that. The loss of income wasn’t that big, and yet they wouldn’t show in retirement numbers due to age.

@Andy:

Shorter Andy:

https://www.outsidethebeltway.com/good-jobs-news/#comment-2772984

@Jen: And, incidentally, a few of these former teachers have been able to secure either part-time retail or part-time WFH gigs that make up around 75-90% of the income they gave up, at half the hours.

@Beth: From your lips to God’s ears:

…or feminist hokum. Fact is, white men are privileged in the economy – getting better jobs and better salaries, but that’s only because the white guys hiring them think they can squeeze more out of them. It’s not because anybody actually cares about them.

At some level they understand that. And it infuriates them. But they have an ecosystem, also funded by those rich white guys, that tells them who to blame for it because it couldn’t possibly be the job creators.

We have replaced a lot of social relationships with money relationships. This has made us rich, even below the top tier, but it has had a social and health cost that is also very big. It’s just not (yet) denominated in money. Let me (remember, I’m a small-town kid) give an example of that:

When I was young, from time to time my father would collect me up and we would go in to a place called Stafholt, also known as the Icelandic home. (There were a lot of Icelandic descent people in my community, scaling “a lot” for a small town, of course). It was an “old folks home”.

We would go visit the old folks. We would visit two or three or four of them, and dad would nod and say a few words to a dozen more. Because he knew them at some level. There were all these long-standing social ties. I’m not sure this kind of thing exists even in that same town any more. Those visits represent the sort of social ties that keep eroding as work demands more of us, and we respond by cocooning at home. Dad belonged to a local Lions Club, who he hung out with once a week, and for special activities.

So when he became a retired white guy, he didn’t have the sort of resentment many have today. He still had a place in the community, and value in the eyes of many others. This is sorely lacking today, for everyone, I think.

@Jay L Gischer:

You still have a lot of this in small towns. Though, even there it’s lessening some. The small community where I live (4 municipalities totaling about 6k people over ~50 square miles) has approximately 70 civic organizations (Lions, Rotary, Optimist, Masons, etc.) which are active in the community.

John may have closed up his auto shop, but everybody still says hi. The lunch lady that retired somewhere in the early 90s still gets stopped in the grocery store and receives compliments on her pizza burgers and those white-cornmeal bars (SO GOOD!).

There’s less of it from the 20-30 crowd, but that’s because a lot of them don’t have history around here. Their parents moved in from the cities.

Meh. The ‘liberal media’ will still helpfully inform us how these gangbusters jobs numbers mean the

Red WaveBiden Recession is still guaranteed.@jen, @markedman, @stormy,

Those are all very logical reasons, thanks.

@daryl and his brother darryl:

I’m not sure what the link to your comment is supposed to imply.

@gVOR08: Journalists are largely innumerates with no proper education in economics so of course it leaves something to be desired.

@Andy: Drum is utterly wrong and his writing about US Fed is an embarrassement of a melange of superficial understandings of both central banking tools, misunderstandings of econometrics and weak economics. What Drum argues for is essentially a re-run of the Central Banks broadly policy errors of start-stop wait-and-see of roughly 1968 through end 1970s.

@Lounsbury:

I’m not a finance guy, so will admit my ignorance here.

But IMO the gist of what Drum (and it’s not just Drum, but some actual experts) are suggesting is concern about the Fed overshooting on interest rate increases and causing an unnecessary recession. I think that is a real concern.

@Andy: This paper was published just a week ago and I think you will find it interesting.

The Great Resignation Was Caused by the COVID-19 Housing Boom

@Mikey: That’s certainly interesting, but what are people doing, pulling equity out to live off of? (If so, yikes.) Or, do they just feel more flush, and so safe to stop out of the workforce?

I’m always baffled by people making life changes based off of the perceived value of investments that can change (like 401K balances, or housing/real estate value). In my mind, those values are not concrete until you cash them out/sell your home.

Oh wait…turns out this jobs report was only about jobs George Santos claimed to have.

@Andy: yes some of the MMM left economist wing who are deeply bought into inflation denialism and minimising. You may more profitably be informed by Krugman who is a proper solid macroeconomic specialist albeit not a financial specialist.

There is no precision in such things as the lagging and noise in economic data is too much. However, both the econometric historical record of the 70s period globally and more recent specific cases as Turkey amply show the dangers of inflation entrenching that demonstrably arises in “wait and see” leading to reaccelerations, which in context of ongoing feed through as pricing pressure builds tension into supply chains as like a series of small slip faults building tension to a large earthquake, here consumer price rises.

Current rates remain by multi decade standard quite modest, and frankly a return to such is healthier than the regime since 08 crisis which has induced unhealthy distortions (as see increasingly dubious chase for return by pensions which is a significant contribution to the bizarre IT tech valuations).

I spent 07 to 011 on various Central Bank committees, the actions of post 08 were necessary but not healthy for long term. Not generally not for middle classes or otherwise. Quite fine for my class as debt levered fund speculation has done nicely, for great returns to High Net Worth.

@Jen:

A reverse mortgage is an awful idea, but for someone ready to downsize anyway selling their home can provide a pretty sizable bump to the retirement income. Where I live in Southern Ontario housing prices have declined a bit but there is still a good opportunity to cash out for people who want to move to a smaller quieter area. It is anecdotes, not data, but half a dozen acquaintances from my company sold their homes here and moved to the Maritimes where housing costs maybe 35-40% of what it does here. None of them were under 55 and none intend to work again.

@Jen: Teachers with 30 years service–which, coincidentally, makes them roughly 52-62–have been retiring early (before Social Security eligibility) for almost as long as I’ve been teaching. Outcome-Based Education followed closely by No

WitnessesChild Left Behind from the mid-90s and on triggered a wave of retirements and Race to the Top repeated the effect about a decade later. COVID-19 appears to be at the root of another round in my area where the schools I’ve been substituting at have churned about a third to half of their staffs.@Mu Yixiao: The fact that “You still have a lot of this in small towns” doesn’t necessarily mean that people who are retiring should consider moving to small towns, though. Those social connections are fairly reliably reserved for those who’ve been in the town for 50, 60, 70 years and people who came back to it to retire rather than for any but the most relentlessly outgoing new residents. Not a complaint, just an observation from a relentlessly introverted person who is returning to a place I originally moved to in 1994.

(But I do sometimes run into young people who remember me fondly from teaching in the high schools or at the community college. Those are nice experiences. 🙂 )

@Jen: Had I kept the house that I bought in 1979 instead of selling it to buy a house for my soon-to-be-ex wife, I would have been able to move back into a house with a 1200% ROI (I paid ~$50k, the current Zestimate is $640k). Eventually, I would have moved from that house with some sort of significant sheltering from capital gains tax. Even if I paid the whole nut on the capital gain, my income reserves would be several times what they are.

TL/DR: Yeah, a lot of us really CAN cash out the gains on our property to live on if we choose to. Especially people such as myself who can find/are content living in an efficiency/studio unit in a lower rent area. For most people, it’s not a wise choice, tho. You have to have been an early entry buyer.*

*And I’m not even the buyer I could have been. Luddite can tell you that I passed on buying a house 2 or 3 years earlier at $24,000 because even though it was new construction, it was only so-so on finish details. A house in the same neighborhood was selling for $86k or so already when I started looking again in late ’78.

@Pete S: While I don’t think reverse mortgage is superior to cashing out (see anecote above), it may only be a bad idea to the extent that you’re foreclosing on said domicile being part of your estate. Personally, I’d cash out, but I don’t care where I live. I know people who went the reverse mortgage route because they both couldn’t bear to part with their homes and also couldn’t afford to continue living in Seattle Metro on their retirement income stream. I can’t justify the choice, but then again, I don’t have to.

@Lounsbury:

Seems to me that’s the problem, which leaves a pretty wide uncertainty range when it comes to policy.

Again, I don’t know what the answer is, but I don’t exactly trust that the Fed does either.

One of my soapboxes is criticizing the economics profession generally as having little skill when it comes to macroeconomic prediction.

@Andy: It is then a populist soapbox based on misperception.

There is really no human profession that has any skill in prediction of the future in the way popular perception desires, which is simply witchcraft translated into modern terms. Modern macroeconomics has the tools and data (being rough) to analyse and to an extent forecast broad trends – the forecasting of the results of the Turkish central bank doing more or less what you and Drum naively call for re wait and see on inflation over the past year – have been fairly clear but then the policy error so gross it is and was something like as your expression goes ‘hitting the broad side of a barn.’

Forecasting that an Egypt or a Ghana will run into a crisis in a five year timeline roughly – all things being equal [which is rarely a real case] – due to deep imbalances also driven by horrid government policy, also achievable – although no precision on years as crisis oft can be papered over and deferred.

This is what one has to live with.

The econometric history data give across multiple geographies and globally for the world for the roughly 1968-1982 period very ample basis to not do what Drum is arguing (never having admitted his “team transitory” analysis was utterly wrong in a sustained way, unlike e.g. Krugman who is while a Left oriented economist also a very good macroeconomist) via superficial data, superficial understanding of the econometrics and a rather large dollop of politically motivated reasoning.

Now of course one can believe in tedious populist left and right conspiracy mongering about deep conspiracy financiers ruling the world or you may take an observation that if all major Central Banks are following similar analytical lines on the danger of entrenchment of inflation, that it is not merely “The Fed” but a number of professional teams that have arrived at similar conclusions in respect to the deep drivers on ongoing inflation risks.

The short of it is as this is not a forum for explaining central bank approaches for inflation (or deflation), that CBs do not rely merely in CPIs and headline (nor simplistic fit-to-my-story trendlines for a graph).

@gVOR08: “I sometimes feel economic reporting leaves something to be desired. Perhaps the issue is really the very fast recovery of the hospitality industry after COVID.”

‘Liberal’ media reporting on the economy makes more sense is you replace ‘workers’ with ‘uppity peasants’.

@Andy: “It would be interesting to know which cohorts are staying out of the labor force and why (I haven’t researched this and don’t have the time).”

Last I heard, the biggest exit was people over 55. There was a surge in early retirements. (I wonder who many of those people were forced out).

I suspect that the immigration crackdown has had an effect. That has to be several percent of the labor force gone.

@Barry:

In my case, I had been tentatively planning retirement THIS year (2023), but had a small stroke in Sept 2020 (not COVID related), then my employer offered a 6-month bonus for the ‘close to retirement’ cohort if they would just leave.

So I did.

The fact that after six months my employer had re-hire me as a temp for a further six months to cover my position until they could fill it was just financial gravy 🙂

‘seasonal adjustments’. It’s all downhill from here.

@JKB:

Have you been paying attention to how England is doing after a long period of conservative rule? It’s not pretty…

https://foreignpolicy.com/2023/02/03/britain-worse-off-1970s/