Government and Creating Jobs

Yes, government does create jobs.

During the debate last night, Governor Romney repeated an extremely common Republican theme:

During the debate last night, Governor Romney repeated an extremely common Republican theme:

ROMNEY: Government does not create jobs. Government does not create jobs.

Now, before I start on my response, let me note that I am certainly of the position that the overwhelming focus of the economy ought to be the private sector and that the key to a strong economy recovery is to be found in the private sector. This is caveat that really should be unnecessary, but there it is just in case it isn’t obvious.

Back to the quote: to me, the statement that “government does not create jobs” is an attempt at setting up a false dichotomy between the public and private sector (and is part of the GOP’s simplistic rhetorical war against government in general). It is also empirically untrue.

I find the false dichotomy problematic because it is part of what I think is a central problem for the Republican Party: the demonization of government. This is a problem because governance is difficult-to-impossible if one pretends like government is always the problem and that the only goal for those in elected office ought to be the shrinking, if not the drowning in a bathtub, of government.

And, of course, Republicans don’t really believe this as much as they think they do, or else they would not be in favor increasing defense spending. This is, of course, where the Venn diagram of this discussion overlaps with the job creation portion because one can ask: is being a soldier a job? And, more specifically, was it created by market forces or was it created by public policy (i.e.g., by government)?

Well, of course, a soldier draws a paycheck, pays taxes, and buys things in the broader economy that, in turn, helps to maintain (and even create!) private sector jobs. Indeed, beyond the soldier, one great way to create a pile of private sector jobs in the middle of nowhere is to build a military base.

But, forget soldiers: teachers, fire fighters, county sheriffs, highway construction workers, etc. are also all real jobs created by the government.

There is no way around this.

Beyond that, the private sectors needs the public sector to create an environment in which to function, which includes basic things like: public order and a court system to uphold things like titles and contracts (not to mention all the infrastructure that we all need). And, certainly, the general climate created by the government impacts the behavior of the private sector (and that can mean a lot of different things).

So, the question is not some silly false dichotomy between “real” private sector jobs and “fake” public sector ones, or empirically false statements like “government does not create jobs” but, rather, what the proper policies ought to be vis-a-vis these jobs as well as the general legal regime under which all employers and employees function. But, of course, that requires taking governance seriously.

Now, I suppose that the focus here is “create” (although even there I am not sure how a job created by legislation is any less a job than one created by the market—again: paychecks, taxes, and spending ensue from both). I suppose that if one wants to be reductive one can argue that other people create jobs. There is no need for a policeman, a teacher, a factory worker, or really much of anything without other people being involved. Or one could say that either without the dollars of people deployed in the purchasing of privately produced goods or paying tax dollars to support public services then there are no jobs.

Now, are there limitations to how many jobs that government can create? Of course—but that is true of the private sector as well. Really, the issues is one of balance, not about stark dichotomies.

If I could boil down my frustration with the GOP to one simple, specific critique: they do not seem serious about governing and I think that Romney’s quoted statement is indicative of that fact. As such, I am not (and please, certain commenters take note) calling for a command economy in which the government directs job creation. I am, however, asking for recognition of reality, which includes understanding that public sector jobs are real and necessary.

A parting thought: we have, as a country, lost of lot of public sector jobs over the last several years which has had a negative impact on the unemployment rate. I am pretty sure this means those were real jobs.

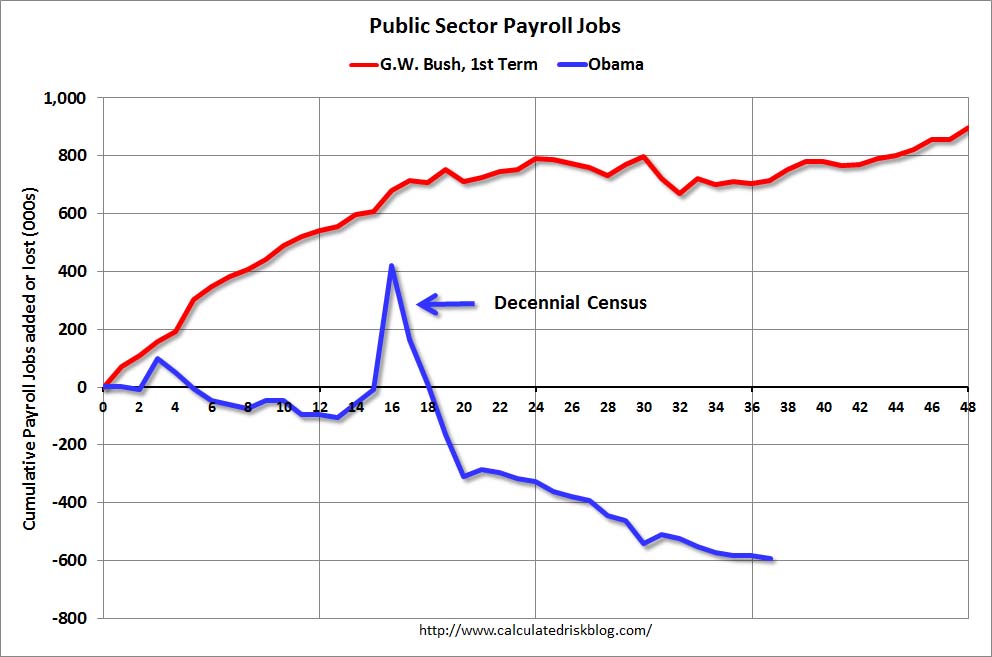

Also, a parting chart (good thing those aren’t real jobs represented by that blue line!):

(Source)

Usually someone more math oriented than I pops up to remind that:

GDP = private consumption + gross investment + government spending + (exports − imports)Now, we all want growth. Most of us measure growth as GDP. And while many of us like to cut deficit government spending, it does come right off the top. Also, as that very important Wolfgang Munchau piece at the Financial Times noted, there is a multiplier at work.

This is very bad news for budget cutters. Not only does removing $1 in spending reduce GDP by $1 directly, it also reduces it by something like $0.50 in knock-on effects.

Thanx for the chart, Steven.

Pretty soon we will hear again about the “job creators”. Let me just say that private individuals (or companies) create jobs in the same way as the surfer creates the wave. Economies create jobs, and they destroy jobs.

The question is, What policies give us good economies? And I don’t believe slavering all over the shoes of the rich to be good economic policy.

Is being a soldier a job?

Paying people to dig ditches is worthless.

Paying someone to dig a ditch, shoot from it for awhile, and then get killed in it ended the Great Depression.

It’s American magic we are talking about, not logic.

I’ve also thought it was always a false statement. Really, what is the difference between a government and a corporation in terms of the economy? Different rules of engagement, different governances, etc. I mean, just what was the British East India Company? A private enterprise? A government? The answer is yes. It even had its own army.

This is part of the much broader conservative disconnect from reality. If you graphed “reality” and “GOP” you’d see them diverge some time around Roe v. Wade. Ever since then conservatives have had to believe either that they could outlaw abortion nationwide and lock women and their doctors in prison. Or that women in Virginia could be locked up but women in Maryland would not. Both are absurd and unrealistic.

But once you start the divorce proceedings from reality, why not continue? Why not believe that cutting taxes raises revenue? Why not believe that defense jobs are stimulants but every other type of government job is not? Why not believe that slashing regulation means a healthier economy despite the examples of every single wealthy nation on earth? Why not believe that if the rich get richer the poor will also magically become richer? Why not believe that firing people is job creation? Why not believe the earth is 6000 years old and Adam rode around on a dinosaur?

In the end why not believe that the President is simultaneously a Muslim and a Communist? Once you stop caring about reality conservatism is easy.

If government is holding us back and the less government the better for the economy, why are places like Somalia such a freakin’ mess?

(I really wish libertarians would think about it: show me a country with a decent GNP that doesn’t have a government.)

Economically the best thing for this country will be the election of Romney…and yes…I believe this nation is stupid enough, collectively, to do that.

At that point the Republican Party will return to doing what it has always done…which is to spend money like a drunken coked-out AWOL Air Nat’l Guardsman, and grow the Government in massive ways. Republicans are always Keynsians when they are in office. Romney pointed to the Reagan economy but failed to say that the debt grew 300%, taxes went up, and the size of Government exploded.

If Obama was growing Government the way Republicans do…the UE would be around 6% and all the feedback loops would be firing and growth would be accelerating. Republicans have obstructed that at every single turn since the stimulus…because they knew that was their onlyhope at regaining the White House. McConnell said it best.

My problem with Romney is not his fantasy economic program that will never, ever, be enacted…but on Foreign Policy, which he has proven repeatedly he has no aptitude for, and the SCOTUS.

I’m an older white guy so my rights will always be protected by the old white guys on the bench…but if I had daughters, or if I was not white, I would never let Romney near the keys to the Supreme Court.

Well, this is an argument about semantics and perspective. Does government hire people, yes. But, why do they employ these people? How do they pay these people. The employ your police, teachers and soldiers, I notice you avoid the social workers, etc. in the wealth distribution sectors of government, as a service to the society as a whole. The government is a consolidated effort of the people but paid for by the productive. Remove the private enterprise and the police, teachers, etc. become scarce as the government can no longer employ them regardless of the number of citizens, students or level of crime. So while the government can hire people, can employ people, it does not create jobs in the same manner as private enterprise, which creates job out of whole cloth to meet some need either locally or, in the case, of much industrial work, in far away places. A military base that opens in the middle of no where hires people but using funds extracted from more distant citizens. A mine or oil field that opens in the middle of no where creates jobs to extract resources or produce goods to meet a need of people far and wide, citizen and non-citizen. It is only the initial investment that is money moved from another locality and that investment is expected to provide returns to that initial locality.

This is an excerpt from the New England Township discussion in John Fiske’s Civil Government in the United States (1890)

Brilliant.

The field of “political science” is a misnomer; it should be described as “political policy” or some-such. At least then there would be less temptation to claim that “government does not create jobs” is an “empirically false statement[].” Obama says government does not create jobs. Numerous economists point out that government necessarily must tax or borrow the money it spends in order to spend it, and government action creates dead weight loss, and thus the government cannot net jobs.

I don’t really care if people reading this agree or disagree about job creation; its your belief system, live with it. I will not insist that your views are empirically false.

@ JKB…

Name one Economy that has grown while also shrinking the size of it’s Government.

For extra credit…

Name one similar sized economy that has dug out of a similar hole faster than the US has dug out of this one under Obama. And discuss the role Government played in that process.

Otherwise…STFU…

@PD Shaw: That then becomes a discussion of what “create” means.

Yet, I will push back and note that the teacher hired has a job and the teacher fired not longer has a job. This strikes me as empirically true.

@PD Shaw:

I believe I covered the basics of this by noting that the context of job creation requires the presence of government.

A complex, modern economy requires a legal context, i.e., government for private sector actors to functions. I would consider this an empirically true observation as well.

Governments don’t create jobs. Governments make transfer payments. At a certain level this is a debate about semantics. But the underlying economic dynamic is important and, sadly, nearly always gets lost in translation.

When the government purchases a F-15 fighter it doesn’t “create” jobs. It transfers money from taxpayers to a private defense contractor. Or it borrows money and transfers that money to a private defense contractor. Or some combination of both. The private defense contractor might add jobs, but those are being funded by public money. In final equilibrium adding public sector or public sector-related jobs funded by taxes is a zero sum game nominally and in real terms is a net loss, because taxes to fund one project squelch job creation elsewhere. If we financed 100% of all public sector hiring with debt then in some metaphorical sense it would “create” jobs, but at the cost all other things being equal of higher interest rates (which reduce job creation) and higher inflation (which reduces job creation). Again in final equilbrium pretty darn close if not exactly to a zero sum game.

That’s the key item about which the left for all these decades has been insouciant. That’s why people like Ludwig von Mises are rolling over in their graves. Public sector jobs are funded by public money. Public money is not a panacea. Eventually the bill comes due.

Obviously the public needs firemen and policemen. But that misses the point. Nobody is saying that we shouldn’t have firemen and policemen. Nobody is saying that firemen and policemen are not “employed.” They are. At the public’s expense!

The Republican platform on military spending is not a job creation platform. The left has been playing that gotcha’ canard forever. It’s tired. It’s hackneyed. The GOP wants to spend more money on the military because they want a stronger military. FWIW I happen to think we need to spend a lot less money on the military. But the platform really is about spending and foreign policy priorities.

So when you hear a Republican say “government doesn’t create jobs” you have to think three dimensionally. Otherwise you’re missing the key points.

There are also plenty of private companies that provide services to the public sector. Did the government create those jobs? Well, no. But they are definitely part of the extended economy of government employment–and that doesn’t even get into areas like restaurants near federal office buildings, for which a large part of their revenue is supported by government employment.

Here’s the thing I find funny/troubling about this Romney remark. He says government does not create jobs, yet (I think it was earlier in the debate) Romney harks back to the Reagan recovery as a sign that is what we should expect.

The last I checked government jobs under Reagan skyrocketed in his tenure. While also increasing the deficit in his effort to get the economy back on track.

http://en.wikipedia.org/wiki/Reaganomics

So, if Romney believes the government does not create jobs, and that he will be better than Obama in balancing the budget, while simultaneously touting Reagan as a blueprint for how he will go about do it…

At which point do we not laugh hysterically?

What the F is Tsar talking about?

Spock playing 3-D Chess?

Look at the friggin’ chart Tsar. That’s a delta of 1.4M+/- jobs. Real god-damned jobs. Teachers teaching kids. Firefighters and Cops protecting property. Air Traffic Controllers keeping the sky safe. Food inspectors keeping food safe. Things that need to be done, and that are best done by the collective. Paid for by the collective. Public Service paid for by Public Money. That does not make them any less necessary than private sector jobs. That does not make them any less valuable than Private Sector jobs.

It’s not 3 dimensional. It’s really pretty f’ing simple. I need a service. I pay for a service. I prefer the elderly live out their lives in dignity. I pay for that dignity. See…simple.

What is 3-dimensional…what isn’t simple…is the Republican contortion act of advocating an extremeist ideology that they have never actually pursued…much less accomplished. Not once. Ever.

Now you can go back to watching Star Trek re-runs in your mother’s basement.

@JKB:

Quick question… does the US postal service operate by extracting funds from it’s “customers?”

Tsar says:

When I purchase a cup of coffee at Starbucks it doesn’t “create” jobs. It transfers money from my pocket to the Starbucks company.

Explain the difference.

@Tsar Nicholas:

So let’s say the government is willing to take on a risk that credit markets would only assume at high interest rates (student loans). Does the development of human capital come at a net loss to the economy? Does the existence of firemen and policemen come as a net loss to the economy or a net gain? If it’s the former, then why have them at all, and if it’s the latter, then how are they not creating jobs?

Too many inherent assumptions go along with the Mises crowd. At some point you guys have to realize you’re talking in tautologies.

@ Michael Reynolds…

Exactly.

It’s all the same mechanism.

The players change is all.

The fact that Republicans are unable to recognize this should disqualify them from anything other than serving coffee at Starbucks.

How does it matter whether my trash is picked up by the city or a private company? There’s no reason for one of those not to create jobs while the other does.

@JKB:

No, economics is more than semantics.

That is straight-up false when you have deficit spending, but even if we were in a balanced budget alternate reality, a discussion could be had about various multipliers, and which sorts of spending generate the greatest knock-on benefit.

The privately owned small grocery store that is diagonally across the street from the State of Texas office building that I work in operates at about half of its normal staffing when we have skeleton crew days. The privately owned breakfast/lunch place on the ground floor closes at 10:30 am on those days and just has two employees in to serve breakfast tacos and beverages for a half-day instead of the normal six or seven.

People that argue that the government doesn’t create jobs ignore not only the primary effect of government employees performing societal tasks that need to be performed, but all the multiplier effects of those employees’ salaries into the economy as a whole.

@David M:

Exactly. If we got rid of public firemen, there would still be a need for firemen. But does that mean the public firemen’s jobs were fake but the private ones are real?

@PD Shaw:

Actually, isn’t your statement false in our system of fractional reserve banking?

You assert that you want an objective belief system. Your ball, sir.

(That nations often “inflate away” debts, rather than taxing for them, is part and parcel of that fractional reserve banking system.)

@Console:

But then we contract it out to a non-union For Profit corporation and that makes it all good. See? If somebody other than employees make money off of the need, than it magically becomes a positive within the economy.

In other words, if our Galtian Overlords aren’t getting a cut off the top, the leeches are engaged in a redistribution of wealth.

For what it’s worth, a nearby city fired their firemen and contracted with a neighbor to provide services. As long as fires behave statistically everything should be fine.

If governments can’t create jobs how does one explain state owned enterprises (SOEs) like those in Singapore that generate between 20-23% of GDP?

@john personna: “You assert that you want an objective belief system. Your ball, sir.”

I asserted no such thing. What I would like to see is fewer people claiming their own views are the only objectively correct ones and that any other view is lie. One may reasonably disagree with Obama’s view that “governments do not create jobs,” but if you start believing its an empirical falsehood, akin to mocking the law of gravity, then you are doing a disservice to science and to public discourse.

@john personna: Do you live in an area prone to extended drought and/or wildfires? Our regional (Central Texas) aid compacts got pushed to their limits last fall when there were several smaller wildfires that broke out while most of the regional teams were assisting with the Bastrop Wild Fire. It was pretty frightening.

If government doesn’t create jobs Tsar had better explain how come we have national laboratories. Or do you think that the US economy (and military) will do better if we don’t have NIST, NREL, Argonne, SLAC, Oakridge, and Los Almos?

Somehow I don’t think sitting around and waiting for the private sector to invent the atomic bomb in WWII would have been that productive…..

And if you by-gosh are so absolutely assured that the Only Proper Way is to stop the government from all government research (goodbye NIH) and for us to sit around and twiddle our thumbs until the private sector takes up the slack—do you really think we’re that competitive with a country which DOES have government science spending and has no problem whatsoever in dumping a lot of money towards a technology in which said country wants to gain a strategic lead?

Hope you like learning Chinese, Tsar…

@ Grumpy…

My favorite is the Grand Coolee Dam On the Columbia River. Fought tooth and nail by small-minded Republicans…it was, at the time the largest man-made thing ever built.

The dam powered aluminum smelters in Longview and Vancouver, Washington, Boeing factories in Seattle and Vancouver, and Portland’s shipyards. No dam…no Seattle.

In 1943, its electricity was also used for plutonium production in Richland, Washington, at the Hanford Site. No dam…no Nukes to win the war.

We can’t do anything like this today…because it’s more important to give tax cuts to the rich…than to invest in the future.

@PD Shaw:

Are you arguing nothing a government can do will ever result in a net increase in jobs? There is no circumstance where public action can create employment that the private sector would not have? Seems highly unlikely.

@Steven L. Taylor: I am not an economist, and I will cheerfully defer to any non-right wing economist that comes along and supplements or corrects me. And this is of necessity brief and simplified.

You quote PD Shaw.

Numerous ideologically motivated economists do say that. It’s called Ricardean equivalence. It is more or less true in normal times, but not at the zero bound (which I will leave as an exercise for PD Shaw to look up) which is where we are. Whenever they bring this up, other economists point out that the mechanism by which it works is that government borrowing raises interest rates and drives other borrowers out. What are interest rates right now?

However, I’d like to get to two classical fallacies, one of which you touch on, the more important one, not.

The first is the classical conservative belief that some spending, and some jobs, are morally unworthy and therefore somehow don’t really count. They have broadened this to count all government jobs as unworthy and unreal. Any real economist will point out the obvious truth that a dollar earned brewing beer, then spent on consuming beer, and therefore driving the production of another dollars worth of beer is a dollar of earnings, a dollar of demand, and a dollar of GDP just as much as a dollar earned, spent, and producing crucifixes. As far as economics is concerned, every government job Paul Ryan has ever held was as much a job as any private sector job. To claim otherwise doesn’t even rise to silly.

The second point, which you did not touch on, is AGGREGATE DEMAND. AD, and essentially only AD, creates jobs. Investment can create jobs, but no one invests unless they anticipate DEMAND. If, at the zero bound, the government, or the Jesuits, buy an additional $100,000 worth of beer, or crucifixes, that creates a job for a brewer or crucifix maker. See Ricardean equivalence, above. There is no economic mystery about this, only political complications.

Here is an interesting article on wasteful government spending and makes a valid argument for voting out every incumbent: Democrat, Republican, Tea.

http://news.yahoo.com/blogs/power-players-abc-news/wasteful-spending-tax-dollars-martian-menus-non-profit-105911755.html

Four years and nothing has changed and I am not trying to single out Obama. The power rests in the Congressional committees and subcommittees, and in the vast byzantine bureaucracy that continues to grow exponentially and uncontrollably. Throw out every agency, program, and bureau. Start over with a blank sheet of paper. Put the Supreme “Court” justices for election: every 6 years. Reform democracy!

@Clanton: I remember when Sen. Proxmire used to take down a gov spending program in the newspaper on a regular (weekly?) basis. Coburn will probably be just as effective with his list as was the departed Senator and his cast of villains.

@rudderpedals: Probably. I think it was Sen. Proxmire who broke the story about that infamous government grant to some university for a study on why children fall off of tricycles!

@Tsar Nicholas:

That’s just profoundly horseshit. All business make transfer payments. A business takes my money and transfers it, au fond, to its employees. Who then take that money and transfer it to employees of other enterprises. And if the transferring is robust enough, more jobs, to create more transferring, are created. And so on. How does that differ, logically, from government transfer payments?

@Tsar Nicholas: ” Nobody is saying that firemen and policemen are not “employed.” They are. At the public’s expense!”

This is probably the biggest pile of gibberish you’ve ever posted — and that’s saying a lot. If firemen and policemen are employed, they have jobs. Jobs created by the government. Which ends your moron argument — even though they are paid out of tax money.

The hilarious thing about the righties trying to defend this idiotic proposition is that they have to assume that while public employees are paid out of money collected in taxes from the citizens — making this a “transfer payment” not a job — private employees are apparently paid in fairy dust that falls from the sky.

Or wait — it’s paid from sales of product or service? But that means this money is also coming from those same poor citizens who are paying taxes as well. So this is a transfer payment, not a job!

Oh, but wait — you say these employees are being paid by the citizens for producing a product or service? The citizen pays the corporation — directly or through another set of middlemen — and then the corporation pays the employee? How is that any different from citizens paying the government, which then pays the employees for services (or sometimes good) rendered?

Of course, there is no difference. It’s just gas blowing from the backsides of pseudo-intellectuals trying to justify low taxes for billionaires.

@michael reynolds: Say, it only took you a dozen words to say what I spent paragraphson. Maybe this is why your books are selling better than mine…

@john personna: The IMF’s most recent WEO update suggests the fiscal multiplier is much higher than most austerians were willing to admit:

http://www.imf.org/external/pubs/ft/weo/2012/02/pdf/text.pdf

@john personna:

Excepting of course that there is no evidence of correlation between reserve levels and the money supply.

http://www.federalreserve.gov/pubs/feds/2010/201041/201041pap.pdf

Post-Keynesians have been making this point for decades.

@PD Shaw, @Ben Wolf:

Ben, you are more extreme than I, but in this case I think we both agree that PD is full of it.

PD, you are full of it. Your claim was that since governments “must” tax to support spending, there will always be the tax downside to any spending. There way too many paths for the government to spend without tax for that to be true. They can spend by several flavors of money creation, they can spend by several flavors of uncovered deficit, they can spend by granting oil leases, they can pseudo spend by mandating other people to spend. On and on.

The first time any government spent by money creation (to name one) it became an emperical falsehood.

BTW, I assume all through this you really mean “Romney’s view,” since he was the one who repeated “Government does not create jobs” last night.

I see from one of your links that Obama has said it too. Ok fine, then he is full of it too. Pandering.

That describes most of what you write…obviously you will never stop projecting…

@john personna: You can’t read. I never took a position other than “government does not create jobs” is not an “empirically false statment.”

That’s rich given this statement of yours:

The you go on to mention “money creation”, i.e., inflation, the cruelest tax of all, especially for the poor and aged.

“several flavors of uncovered deficit”, an obligation secured by the taxes in the future, even future generations

“oil leases” – a tax impose by keeping land and resources out of the private sector thus limiting the size and wealth of civil society

“pseudo spend by mandating other people to spend.” – a selective tax but still government control of spending even if the cash doesn’t pass through government hands.

Each are taxes even if not collected by the tax man directly. Only the “oil leases” might be considered a benign tax since it comes from land either retained by the government or taken through eminent domain

If government doesn’t create jobs because it’s really the taxpayers that do, then businesses don’t create jobs either, capitalists do. If you have a business but didn’t seed the startup money yourself, you didn’t build that. You didn’t create those jobs. You are nothing.

@PD Shaw:

You scared me there for a minute, but I am saying “government does not create jobs” is an “empirically false statement.”

@JKB:

Let me get this straight. I say economics is more than semantics, and then you use a semantic argument to say that “inflation is tax.”

BTW, on this larger question of debt and progress …

The post-WWII model serves as an example. Many of us enjoyed great fortune in the years 1950-2000. All those years we were paying down our fathers’ debt. Well we paid down part and inflated away part, which is key.

We did it with great growth, prosperity, technological innovation, and improvement to material standard of living.

sure the gov’t creates jobs, and we have to pay for them forever. the private sector creates jobs that pay the taxes to create gov’t. jobs.

@john personna: maybe we need a good old world war to decimate the worlds population and dominate industry again! it’s sad but true.

@bill:

Probably all we need is 50 years of innovation. I think we should be able to get that on the cheap. We don’t need to spend hundreds of millions of dollars on Solyndras. We only need to drop tens of millions on state colleges. Via Scientific American:

In praise of Small (and Cheap) Science

@bill:

the private sector creates jobs that pay the taxes to create gov’t. jobs.

As we all know, police officers, teachers, bureaucrats, park rangers, garbage collectors, soldiers not in combat zones, and other people employed by government pay no taxes at all! Only private sector workers pay taxes in the imagination of wingnuts!

BTW, on the subject of whether spending always comes from taxpayers, now or later, a commenter at The American Conservative did a more patient expansion than I. Here.

(Ben and I only disagree on the respect with which this cycle is limited.)

@mantis: paying taxes on income derived from taxes…..c’mon- really!? sure, cops can generate some “revenue” via fines and drug hauls but by and large they are paid via taxation, and it’s not a bad thing.

@bill:

Are you saying government employees don’t pay taxes?

@mantis:

I think bill is observing that in a fixed money economy there are declining returns from taxation and spending. Of course, we do not have a fixed money supply, which has been my point in the last half of the thread.

@john personna:

Trying to derive conclusions from economic identities can be problematic. They are problematic in that people don’t know about, don’t care about them, and wont say, “Oh, wait!!! You mean if imports go up I can’t save?!?! Okay then.”

Now that doesn’t mean economic/accounting identities aren’t helpful. But they should be seen as a check on any theory not as primary source used to derive a theory.

Maybe, if you believe the right macro economic theory.

See my above comment. That $1 in deficit spending is borrowed, so it is possible that it is simply $1 less in GDP, but it possible it could be used somewhere else. And if that is the case we may still get the multiplier effect. Maybe.

As I said, be careful trying to derive conclusions from accounting/economic identities. They are really nothing more than tautologies and as such trying to derive much of anything useful from them is problematic.

From a microeconomics perspective this should be restated as: Government does not create jobs, on net. The reason for this is deadweight loss. Now, the macroeconomic perspective is that the multiplier will offset that loss and we can have, on net, more jobs.

But note…there is a very interesting word in that last sentence: can

It is not a sure thing.

And before everyone thinks that the issue is as simple as how big is the multiplier it also depends on which macroeconomic theory you believe. How many macroeconomic theories are there? Lots.

neo-Keynesians

Monetarists

New Classicals

New Keynesians

Post Keynesians

Austrian Business Cycle Theory

Real Business Cycle Theory

Modern Monetary Theory

Post Keynesians.

Not all of these lead to multipliers.

@Steven L. Taylor:

Oh well, sure if you are going to say that an economy is impossible sans government (it isn’t by the way) then you can’t have anything really without government. Without government there’d be literally nothing as we’d all starve to death in short order. Right?

If you make the conclusion you are trying to show is true as a starting assumption, then really just delete the frigging post Steven.

@Steve Verdon: I would submit that an economy on a national scale requires government. And, of course, when speaking in terms of contemporary electoral politics and Romney’s claims, I am pretty sure that we are talking about an economy on a national scale.

Whether that means I should delete the post is another issue, I suppose.

@Steven L. Taylor:

Let me try to explain the problem here with that nonsense. What you are saying is that government creates all jobs. That by simply creating a legal system jobs magically appear. That is errant nonsense.

Government is not creating those jobs via the legal system. It is creating the environment where private actors in the economy can create jobs.

In other words, your observation in absolutely no way what so ever explains why we have unemployment. Why should we have unemployment? After all we have a legal system provided via government?

Having a legal system in place certainly helps promote job creation, but by itself does not create jobs. It still requires firms, individuals willing to engage in trade.

@gVOR08:

No, it is a result derived from basic microeconomic supply and demand models. The math is simple and clear. Taxes impose a deadweight loss which means that transactions that, absent taxes, would have taken place don’t. Those transactions are lost as are their benefits to society. Further, since output must necessarily fall it also holds that employment of the factors of production must also fall. As such, there is reduced unemployment. The money the government takes plus that which is lost due to the deadweight loss means that the government cannot employ more factors of production than were lost.

This does not mean taxes should be zero though. For one thing, if the taxes are being raised to pay for a public good that provides more benefit to society than the deadweight loss then the taxes and spending are probably a good thing. Of course, we’d want to structure taxes in such a way to reduce the negative impact of deadweight loss.

No it is not. Ricardian Equivalence has to do with government borrowing and spending. Robert Barro demonstrated in a particular theoretical setting that government spending via borrowing does not result in a net gain for GDP since people will reduce their spending by an exact amount to offset the future taxes the borrowing entails. There is no discussion of deadweight loss. Ricardian Equivalence is about the timing of taxes and how the exact timing is irrelevant. Deadweight loss is the impact of actual taxes–i.e. there is no timing issue.

Aggregate demand does not exist save as a convenient theoretical construct. Note that is talking about aggregate demand for a single good–e.g. apples. Going from there to aggregate demand for an entire economy is even more dubious.

@Steve Verdon:

Indeed. Good thing that that is not what I said.

@Steven L. Taylor:

Try the (Ukraine) Free Territory, no government (or very, very minimal one) and an functioning economy for a pretty large number of people.

My criticism of your comment above is that you are assuming as true that which you are trying to prove. As such the entire post is a useless exercise in circular reasoning.

@Steve Verdon: I would suggest that, as one your comments above indicates, you are not understanding my point.

For the sake of argument I will assume that the communication error is mine and I will try harder in the future.

@Steven L. Taylor:

You sure implied it very strongly when replying to PD Shaw. Maybe you forgot what you wrote. A shortened version of your response very much looks like:

There can’t be any jobs without government (e.g. a legal system), therefore government created all jobs.

It was a nice dodge around PD’s point about deadweight loss instead of dealing with the point he raised.

So, why not answer the questions now, if you can:

Can government on net create jobs? If so, how do you deal with the deadweight loss argument? A multiplier effect?

@Steve Verdon:

Except that is not what I said. There is a difference (and a rather important one) between the notion that government creates the conditions under which jobs can be created (and therefore is vital to the process) and saying “government created all jobs” (which is not what I said).

@Steven L. Taylor:

So…again, can government, on net, create jobs?

You seem awfully reluctant to answer this. I’ll take, a yes, a no and even a maybe.

By the way, both candidates make the “false dichotomy” claim, not just Romney. Obama believes that the government can “create jobs” so he believes it just as Romney does.

@Steve Verdon: First, I picked on Romney because of the quotation in question.

But, yes, I think government can create jobs.

I recognize that you disagree.

@Steven L. Taylor:

It isn’t that I disagree, but that we really should get certain points established. The deadweight loss problem is, to me a significant problem. Obviously at the extreme government wont be sufficient at providing jobs, at least not for long. That is, if government were to provide (directly, as in hire and pay) for 100% of the jobs in the economy it would not work.

Maybe in the middle it might. Maybe there is a multiplier effect. But see my list of schools of thought in macroeconomics. I see that area as….well alot of wishful thinking where personal biases get injected into the subject. And that is just the macroeconomists. When you get lay people involved…well look at this comment, and amalgam of ignorance and bias.

This is why I often appeal to/rely on microeconomics since it doesn’t have nearly the problems macroeconomics does. You’ll have to look long and hard to find an economist that does not believe that demand is a decreasing function of price, for example.

@Steve Verdon:

I thought, on multipliers, were were listening less to theorists than to competing data miners.

The miners bring us back an opposite sort of problem. If they do find something that happened in condition A, it is a fuzzy transition to assert that it will indeed happen again in a condition too far removed. Maybe it happens in condition A’ but not in condition B.

On the money supply, given a fiat currency with fractional reserve banking and etc., we have a burden to manage it. It simply can’t be left unmanaged. And we have both theorists and again data miners trying to tell us what we can, can’t, or should do at the moment.

(I can listen to all else being equal stories, and they are good for teaching economic concepts, but I think they have limited application in our world. A world with all levers and controls moving at once. We might just be better off with economic history at that point. That is, given similar conditions in the past, what worked, and what did not.)

@Steve Verdon:

It has been tried. Fully communist systems with 100% state employment worked to a degree. They just failed in competition to market economies. They could not provide the same growth. That growth differential is probably pretty much your deadweight loss.

Of course, we have limited growth at the other end as well. Somalia suffers all kinds of loss (deadweight again?) due to lack of infrastructure, law, etc.

The sweet spot must be somewhere in-between. And if it is somewhere in-between, I’m not sure that the right can assert that ANY government jobs program has too much inefficiency and loss associated with it. It may just be moving you toward the sweet spot.

@john personna:

If you don’t have an underlying theory your empirical results can vanish (e.g. Philips curve). Economics is a behavioral science as such you should start with models of how people behave (in an economic environment). Derive testable models and then test them. And always be prepared to back up and modify the theoretical model based on empirical findings.

In short, it is a two way street. Going only one way can lead to dubious conclusions.

This shows a misunderstanding why we use models. We use models to abstract and simplify away from the real world so we can isolate various phenomenon. We do it every where and in every science, both “hard” and “soft”.

Sure, if you want to have a slave based economy it might work indefinitely. My point was in an economy like ours we can’t have the government employ 100% of the workers for very long. Might I suggest this parable?

FFS….what is it with people and Somalia.

Somalia is a case of a country with various factions warring over which is to be in control of the government. Not exactly a good model for a country with no government. It is like saying, the U.S. in 1862 was an example of a country with no government.

Ahhh the good old middle ground fallacy.

Wait I thought you said it must be in the middle….now you aren’t so sure?

If it is moving you towards the “sweet spot” then by definition it is inefficient. And you have made a huge leap from…some government is (probably) a good thing to…hey all jobs programs are okay cause they will move us to the sweet spot…how that happens who knows.

@Steve Verdon:

I hope they can find economic relationships, like multipliers, from direct comparisons (between two places, or two times). If they can’t, if measured economic data has no intrinsic meaning, and has different meaning for students of every economic school, cue M. Reynolds or the worst skeptic of economics. That makes the field useless to anyone in the real world, outside the schools of economics.

In the hard sciences we don’t do that. We can measure the temperature and pressure of a gas. We can apply sound, or light, or nuclear bombardment. We can collect data all though that. We can tell you the relationships, how temperature changed when you applied pressure or vis versa. We don’t need a theory to get the result.

In a robust science you create a theory from data, and then go back to test it again with new data. If it fails you discard your theory, you don’t split into fourteen schools of chemistry!!!

@Steve Verdon:

But, of course, no one is making such an argument. Not even close, quite frankly.

@Steve Verdon:

Somalia is one of handful of cases of statelessness and therefore to near governmentlessness. The fact that it is wracked with violence is, in significant measure, a result of its lack of a state. Other examples that leap to mind include portions of Colombia and Afghanistan outside of Kandahar. Places that lack states tend to be fairly unpleasant, contra the notion that if the government just would get out of the way all would be fine. This is why it gets brought up.

@Steven L. Taylor:

When you have different factions warring over which is to run the State-i.e. each faction forms its own state, it really isn’t accurate to call it stateless. A civil war…fine. Chaos, fine. An example of anarchy of one stripe or another? No.

As opposed to places with lots of government like the former Soviet Union, North Korea, China under Mao…how many people have died in those places where there is a very, very strong central government?

@john personna:

All sciences start with models, both “hard” and “soft”. They derive testable hypotheses and then based on the results modify the theory. This is not shocking nor specific to just economics. For example, when Newton’s theory failed to predict the motion of Uranus accurately, the theory was not junked instead the specific hypothesis was rejected; that there are only 7 planets in the solar system. And this is just one aspect of science as well. For example the Principle of Parsimony/Ockham’s Razor is another factor. For example, the geocentric model of the solar system worked pretty well in terms of predictions…but the Copernican model was much, much simpler. Kepler offered a refinement with elliptical orbits. In this case you see both the “evolutionary” aspect of science I’m talking about as well as the Principle of Parsimony.

And I’ll note an inherent bias in your first paragraph above, namely:

Right there your bias is showing. If no evidence of a multiplier can be found, then the data is meaningless…never mind that it just could be that there is no multiplier and that the data is not meaningless.

You don’t have to discard it necessarily, you can always modify it. That is how things work in biology for example. When something comes up that suggests the current version of Darwinian evolution is incorrect, they don’t junk the whole theory, they modify it since the theory still does very, very well for most other phenomena.