The 0.001 Percent

The "99 percent vs. the 1 percent" debate obscures the real income inequality picture.

Derek Thompson argues that the “99 percent vs. the 1 percent” debate actually obscures the real income inequality picture.

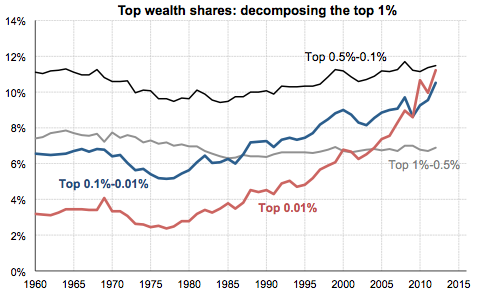

An amazing chart from economist Amir Sufi, based on the work of Emmanuel Saez and Gabriel Zucman, shows that when you look inside the 1 percent, you see clearly that most of them aren’t growing their share of wealth at all. In fact, the gain in wealth share is all about the top 0.1 percent of the country. While nine-tenths of the top percentile hasn’t seen much change at all since 1960, the 0.01 percent has essentially quadrupled its share of the country’s wealth in half a century.

It turns out that wealth inequality isn’t about the 1 percent v. the 99 percent at all. It’s about the 0.1 percent v. the 99.9 percent (or, really, the 0.01 percent vs. the 99.99 percent, if you like). Long-story-short is that this group, comprised mostly of bankers and CEOs, is riding the stock market to pick up extraordinary investment income. And it’s this investment income, rather than ordinary earned income, that’s creating this extraordinary wealth gap.

This isn’t exactly news. I’m not an economist or business journalist and I’ve known for years that the concentration is at the very, very top. But, yes, if the root cause of income inequality is that a handful of people make their living off of investments, then, to the extent it requires a public policy response, it has to be aimed there rather than at ordinary income. That means raising the top marginal rate—which may nonetheless make sense for other reasons—won’t address the issue. Rather, we’d need to change the way we treat investments that serve as income rather than those held long term, such as in our retirement and college savings accounts. And, naturally, we should fix things such as the carried interest rule that got so much attention in the last presidential campaign because of Mitt Romney and Warren Buffett.

But Thompson closes with a point that seems to undermine his central thesis:

The 0.1 percent isn’t the same group of people every year. There’s considerable churn at the tippy-top. For example, consider the “Fortunate 400,”the IRS’s annual list of the 400 richest tax returns in the country. Between 1992 and 2008, 3,672 different taxpayers appeared on the Fortunate 400 list. Just one percent of the Fortunate 400—four households—appeared on the list all 17 years.

Now there’s your real 1 percent.

If the most extreme manifestation of inequality is this variable, it’s not obvious why we need to eliminate it. If we had a top 0.001 percent that was essentially an aristocracy, it would certainly be a problem. But if it’s fluid, with most people and families falling out of the class and being replaced by others, it’s not obviously problematic, so long as it’s truly earned. I don’t begrudge Bill Gates his billions; Paris Hilton, on the other hand, is a different story.

I’m not so we can or need to eliminate it, but we should be trying to mitigate it for a number of reasons. The libertarian argument goes something like this: The only way such huge margins can ever be obtained is for reasons other then merit, hard work, or personal brilliance. Indeed if the churn is so dynamic then it stands to reason that those gains are due to policies, fluctuations, and existential forces that have little to do with outstanding performance by these individuals.

I mean right off the bat things like the carried interest deduction is outrageous and a distortion of the market as is the lower rate on capitol gains in general (all of the reasons to tax CG at a lower rate or not tax it at all boils down to artificially incentiveizing the economy as if there is only one super human on the face of the planet that is in a position to take advantage of any given business opportunity). While higher marginal rates on very high incomes are a pretty blunt instrument to address the income equality issue it does have the advantage of acting as a governor on how many business opportunities one person can hoover up.

Very broadly speaking, the only thing that financial institutions do for the economy is provide it with liquidity and frankly I think think that the amount of money that is being skimmed off the top to provide that liquidity is pretty outrageous and need to be the focus of the regulatory regime. To paraphrase the poet, the “liquidity is too damn high”. In any rational free market we would not be paying such a high premium to simply move stacks of money from lower to higher valued uses. But the game is literally rigged.

James, except that in that last part of your article, you’re talking about income, whereas the chart says wealth. I don’t have the numbers in front of me, but I’m pretty damned confident that the families at the top of the wealth list is a hell of a lot less fluid than the income list.

Then the problem becomes that, if we decide that mitigation (redistribution) is desireable, wealth is a harder to redistribute than income, at least politically.

@Ben:

Yes a very good point because the fact is that these families and individuals exert an enormous amount of control over the political process for pretty much one narrow end; to make sure they stay in the top .01 percent. That is why Adam Smith preferred to tax property. The problem is that property is hard to tax. The problem is mostly figuring out who to establish the value of any given piece of property. Stocks and bonds might be easy, real estate is trickier, and possessions would be a mine field (Art, baseball cards, coins).

@Rick DeMent: I largely agree. I think there are reasons to tax gains from long-term investments, whether it’s real estate or stocks, differently than ordinary income. It makes sense to incentivize those investments. My problem is with “investments” that are essentially income. And I can’t think of a single reason for the carried interest rule.

@Ben: Yes, fair point. The easiest way to go after it is through estate and gift taxes but they’re horribly unpopular politically.

I think it depends entirely on what you consider normal or desireable. When I was in college, the top 1% wealthiest accounted for about 25% of the wealth. Now they account for about 50%.

The second question, neither answered nor even asked, is whether policies have been jiggered to account for the change. I think they have. I think that only some of the .01% have been able to create their enormous wealth with any skill other than the ability to manipulate and exploit the system.

The policies in question cover a broad range: trade, immigration, economic, labor, financial, intellectual property, the list is practically endless. Walmart wasn’t just created with retail acumen. it depends on trade and zoning policies, just to name two.

The most recent example of what I’m talking about occurred during the financial crisis. We didn’t have to save the bankers along with the banks but we did. That’s ” this group, comprised mostly of bankers and CEOs”. Those aren’t the Michael Jordans. They’re the beneficiaries of government policy.

@James Joyner:

I suspect that their popularity is in direct proportion to how the question is phrased.

” Long-story-short is that this group, comprised mostly of bankers and CEOs, is riding the stock market to pick up extraordinary investment income. And it’s this investment income, rather than ordinary earned income, that’s creating this extraordinary wealth gap..”

Would it surprise anyone to find out that a lot, maybe most, of this investment income was made by jiggering the stock market? See, The Wolf Hunters of Wall Street in today’s Times. These guys figured out that time really is money.

@sam: I saw a bit of this on “60 Minutes” last night following the conclusion of Kentucky-Michigan basketball game.

It may be clumsy, but the fact is it did address the issue for about forty years until John Kennedy started this trend of reducing the top marginal rate.

@sam: Yes, another Michael Lewis must read.

@James Joyner:

Yes and I absolutely understand those reasons(and in some cases I agree with them), however someone needs to explain why this isn’t exactly like the government “meddling” in the economy which many who are of a libertarian strip reflexively argue against in any other case. My point is that the incentives only need to deliver an optimal level of liquidity to the market, nothing more. Anything beyond that is simply a give away to those who make their money in one specific kind of economic activity. If mine were the world to run I think I would allow long term investment activity to be treated differently in only two ways. First that the profit should get to be averaged out over a period of time equal to the term of the investment holding, and second it should be indexed for inflation over the same term. Other then that it should be treated as income.

I just feel that a lot of the special treatment that capitol gains gets is nothing more then a big wet kiss to the FIRE industry secured though an army of lobbyists.

@Rick DeMent:

“I just feel that a lot of the special treatment that capitol gains gets is nothing more then a big wet kiss to the FIRE industry secured though an army of lobbyists.”

I think the treatment of carried interest is a far bigger one. And one that has no real justification in either economics or policy.

And yet, any attempts to remove it are strongly fought by the top 1% and immediately fail. All of which provides an easy refutation of the argument that Congresscritters aren’t influenced by campaign contributions.

I do find it hilarious that James thinks income inequality might not be that much of the problem because the composition of the top .001 percent changes year to year.

It’s not actually that these people who drop off the list are suddenly applying for part time jobs at Burger King. The fact that there’s someone marginally richer than them just means they’ve plummeted into the top .005 percent.

Not sure how that is warding off the growth of the aristocracy.

@James Joyner: @Rick DeMent: I’m not entirely sure it does make sense any longer to incentivise investment, at least not in the ways and to the extent we do. The bubble and the absurd fragility of the banks before the ’08 collapse was largely driven by what was called the “savings glut”. There was a lot of hot money chasing too few real opportunities. There is a generally unstated assumption underlying a lot of economic thought, that the choke point in the economy is the availability of capital. This was the case for a long time. I’m not sure it still is.

There is also a conflation of capital formation with wealthy individuals which need not be true. In the 70s and 80s economists noted that the middle class, in 401Ks, mutual funds, pension funds (remember them), made plenty of capital available. At the time it was observed that if the super wealthy died, and did somehow take it with them, it would make very little difference to the economy.

Bottom line, if the middle class is healthy, the economy grows, and everyone does better, even the super wealthy. Raising the smaller boats brings in the tide. We’re trying to save the .01% from themselves.

@James Joyner: Read “Rich Dad, Poor Dad” for an eye-opener. Short version: there are far too many ways for the wealthy to legally avoid (not “tax-evasion”) most of taxes you mention. Estate taxes, Gift Taxes, High income taxes …

Hint: Warren Buffet. His Bershire Hathaway, inc. thrived during those “high tax-rate” hey-days. And he paid very little in income taxes, his children won’t pay estate taxes, etc. etc.

Legally and (arguably) ethically.

Well look…this discussion needs some perspective.

It only takes $100K to put you in the top 5%…and your effective tax rate will probably be in the 15% range.

Romney made $22M in 2010, which puts him in the top 00.1%…and his effective tax rate was 14%.

Now does anyone here think that $100K and $22M should be paying the same (roughly) rates?

Then you have Ryan and his GOP cronies talking about a debt crisis (someday, maybe) if we don’t eliminate Medicare and slash SS and eliminate aid for the poorest amongst us.

It’s all just nonsense.

The problem with attacking carried interest, which I agree is being abused, is that this is yet another solution that’s not going to do anything. We have been through this before with attacking corporate perks or stock options and we’ve only seen it get worse. We basically have an entire elite class of people who can get obscenely wealthy by manipulating the tax code and financial regulations. The responses to this are … to make the tax code more complex and the financial laws more opaque.

I think we’d better off burning them to the ground and starting over with a tax system that is designed to raise revenue rather than “encourage investment” and a financial regulatory structure that’s designed to prevent fraud not prevent the last financial crisis.

@Hal_10000: Well carried interest is a specific invention, not a loophole. But yes. Fundamentally, I prefer taxing consumption rather than income, but it makes it harder to redistribute via the tax code.

Of course, all of this negates the history of the thing.

Lowering the top marginal rate borough more jobs and thereby more income to the rest of us, as well as raising the number of dollars collected in taxation. (You guys have heard of Reagan, right?)

Let’s put some perspective on this.

Let’s by government fiat, take all the money from the so-called 1%. I mean, forget income. Let’s take it all. It doesn’t make a dent in the debt incurred by government spending, nor would it, if redistributed, amount to more than enough money to buy one meal for everyone else.

So, no monetary difference at all, and less jobs created. Tell me, what is the compelling interest, here?

@Eric Florack:

Put down your kool-aid for a minute and answer me this: we currently have near historic low tax rates. How low does the tax rate have to go before we see all these jobs and the rest of us start seeing more income????

INAPPROPRIATE AD HOMINEM ATTACKS DELETED – EDITOR

Well 9.5M more people won’t be bankrupted by illness…so that’s a step in the right direction.

http://www.latimes.com/nation/la-na-obamacare-uninsured-national-20140331,0,5472960.story#ixzz2xXuhljEu

Umm, yea. He was the one that sent the deficit through the roof, while Republicans cheered. So in one comment, you are both decrying government debt, while praising the man who really got that ball rolling.

Stupid on several levels. First, the oft repeated canard about “taking it all” – no one is talking about this except so called conservatives. Second, to say that the total wealth of the 1%, which is about a third of the wealth of the country, would make no difference does not even rise to the level of a mental midget argument. I not that, as is your habit, you provide no actual data to support your claims.

@anjin-san:

I’m on ghe road so references are a bit scarce.

And I never said that anyone was suggesting taking it all.

I simply use it as a tool to expose the gaping hole in the logic.

As in, even if you were to take it all, the positive effects would need nil, and negative reactions would abound.

As for Reagan raising the debt,. No.

That was the Democrats in Congress, who instead of sticking to their agreement to cut spending, spent $1.65 for every dollar of increased revenue brought in by the rate cuts. Had the congress stuck to their promise, there would have been no debt by the end of Reagans second term. But kept promises? Hell, boy, these are Democrats.

@C. Clavin: they’ll be dead. Hard to work up medical bills, that way.

The article this post links to talks about individuals…but what about corporations…after all they are people too.

Boeing gets over $7K in tax breaks for every $1 it spend lobbying.

http://www.followthemoney.org/blog/2014/03/boeing-breaks-record-for-biggest-state-subsidy/

Boeing made over $5B in profits last year and paid $0 in federal taxes. That’s right…ZERO.

Over the last 6 years Boeing has paid and average rate of -0.4%.

http://www.foreffectivegov.org/blog/boeing-second-largest-federal-contractor-pays-no-federal-income-tax-2013

I’m not sure how much further Florack wants to cut their taxes…but clearly Boeing is being treated unfairly.

@ Eric Florack

In fact (facts actually exist, you can look it up) the primary drivers of the Reagan deficits were the ’81 tax cuts, combined with a massive increase in defense spending. In 1987, when Reagan asked for one of the many debt ceiling increases we saw during his administration, the Democratic Congress tired to attach a provision that would eliminate the deficit over the next five years, starting with a 23 billion dollar spending reduction that fall.

For the last 35 years, Republicans have consistently blown up the deficit. Only under a Democrat – Bill Clinton – did we get it under control. Clinton handed Bush a strong hand in this area, which was promptly squandered.

@ C. Clavin

You have to keep in mind what sources Florack turns to for information:

Preaching to the Ignorant

@James Joyner:

The current capital gains tax structure doesn’t incentive investment:

1.) You only get the tax break when you sell the investment, so strictly speaking it incentives ending investments rather than starting them.

2.) You get the biggest break on investments that did really well (i.e. the ones least in need of incentivizing) and get nothing on something that had a slight loss (i.e. the marginal cases most deserving of government subsidy).

3.) It incentivizes “investments” that move lots of money around over ones that increase production or employment.

@Eric Florack:

Let’s by government fiat, take all the money from the so-called 1%. I mean, forget income. Let’s take it all. It doesn’t make a dent in the debt incurred by government spending, nor would it, if redistributed, amount to more than enough money to buy one meal for everyone else

The 1% own more than a third of total wealth in the US, or about $21-22 trillion. Divided among the entire population, that’s about $65-70,000 each. Where the hell do you buy your meals? Anyway, it would easily pay off all of the US debt, with trillions left over.

Oh, and that still leaves about $25 trillion in the hands of the 2-10%. The bottom 90% have only about a quarter of the wealth in this country.

You’re an idiot, bithead.

@Stormy Dragon:

This is a supply-side economy. Unfortunately the inevitable result of suppy-side economics is that capitalism no longer produces…it only consumes. Demand is rendered unnecessary. And here we are today…30 or so years in the making.

@James Joyner:

It could be argued that to the extent income is not being spent on consumption, it doesn’t create inequality in the sense people care about it and thus doesn’t need to be redistributed per se. That is, what creates resentment is seeing people with much nicer houses, better cars and clothes, taking fabulous vacations, etc. Not how much they have hoarded away in the bank but don’t ever use.

@C. Clavin:

What I meant with #3 is that if I, say, buy 100 shares of Apple from Guy A today and then next year sell them for twice as much next year to Guy B, Apple never got a dime from either the buying or the selling to increase the size of its business.

Meanwhile if I loan someone money to start a restaurant, capital gains breaks don’t benefit me a bit.

That’s not supply side at all, since the favored investments doesn’t nothing to increase supply.

@Stormy Dragon:

Right…but the tax code is currently written to benefit the first example. The Mitt Romneys of the world. They don’t produce bubkis. Yet they claim huge benefits. They are rewarded for producing nothing. It’s a supply-side economy.

@Eric Florack:

Eric, your “history” sucks. Reagan was lucky in that the biggest collapse of oil prices in the post war history started just shortly before he took office and continued, unabated well in to Bush I’s first term and the foundation for recovery had already been laid by Volcker. Also, women started to enter the workforce in droves during the 80’s which drove consumer spending and the good time rolled on despite a half a dozen tax increases later on. Further, after a short recession the good times continued unabated during the 90’s oil price collapse despite a big tax increase. Also Reagan’s “tax cuts” were balanced by a hefty round of middle class tax deductions (mainly the credit card interest deduction, one of the very few kinds of interest that didn’t get a deduction), and turned out to only reduced effective tax rates by about on percentage point. It only fooled idiots who are glamoured but the big numbers thrown around regarding the marginal rates which are mostly meaningless.

Your math and your history is for crap. Why is it people like you are so completely, unrepentantly, uniformed? I guess sometimes the examined life is it’s own reward.

@James Joyner: A system which allows for vastly greater incomes via capital market manipulation is one that disincentives the creation of real wealth, real products and real services. In other words society is poorer than it would otherwise be. By definition the more which accumulates to the top the less benefit to the country as a whole. This was, by the way, the reasoning we were given with the Reagan Revolution and the rise to dominance of neoclassical economics and monetarism: that by reducing capital gains, progressive taxation and regulation, society would reap greater gains. Notice that no one, not even on the right, makes this argument any more.

Thorstein Veblen called the .01% the leisure class, or “higher barbarians”, who do not create or produce but spend their time in pursuit of honors, status and social power so as to better prey upon the society from which they siphon their wealth.

@C. Clavin:

The Mitt Romney/Warren Buffets of the world are basically running a high-class three-card monty con, using their political connections to rig the markets in their favor. That’s not really supply-side or demand-side.

@Dave Schuler:

You make an excellent point. A hundred years ago when the Rockefellers and Carnegies and Vanderbilts dominated the economy the richest 1% of Americans earned roughly 18% of all income…by 2007 the top 1 percent account for 24% of all income…and now, as you mention, it’s grown closer to 40%. But in between their share fell below 10% for decades. This is shown in a chart also included in the article James hi-lighted.

http://houseofdebt.org/wp-content/uploads/houseofdebt_SaezZucman1.png

Or here…

http://upload.wikimedia.org/wikipedia/commons/0/0f/Share_top_1_percent.jpg

There’s an almost direct correlation between those graphs and historic tax rates.

http://taxfoundation.org/article/us-federal-individual-income-tax-rates-history-1913-2013-nominal-and-inflation-adjusted-brackets

It’s worth noting that those decades when their share dropped to around 10% is the period of time all Republicans pine for…but they always fail to mention the tax rates…which ranged from 63% in 1932 to 88% in 1942 to 92% in 1952 and 91% in 1962…just before Kennedy slashed them to 77%.

@Stormy Dragon:

Right…but the tax code is written to benefit them…that’s supply-side.

@Ben Wolf:

Sure they do…they might may it differently…but that’s what they are saying.

Now they talk about growing the economy and job creators…but they are still talking about progressive taxation and regulation.

My Modest Proposal:

Right now if I buy a $100 share of stock and sell it for $150 in two years, I will pay normal income tax on the $100 this year, and then get a preferential tax rate on $50 in two years.

My proposal would insted let me deduct the $100 from my income this year, and then charge me normal income tax on the $150 when I sell it.

1.) I get the incentive when I make the investment, so the actual investment act is incentivized

2.) My incentive is based on how much I invest, rather than how much I earn from it

3.) The process could be extended to debt investments as well as capital investment

4.) We reduce a lot of accounting costs both for the taxpayer and the government: we no longer have to track how long I owned something or what the cost basis was, we don’t need to distinguish retirement accounts from normal investments, estate transfers are greatly simplified, etc.

5.) People living off investment income still pay for their earnings.

@C. Clavin:

I realize that a lot of people call that “supply-side”, but that’s not what the term actually means.

@Stormy Dragon:

From Wikipedia:

Emphasis mine.

@C. Clavin:

The problem is you’re engaging an undistributed middle fallacy to jump from “People in Group A typically advocate for X” to “People who advocate for X are typically in Group A”.

@ mantis

I don’t think anything you or I can say will change bithead’s desire to grovel at the feet of the rich.

@Stormy Dragon: It seems to me that the tax treatment you would be describing is a form of tax shelter. Let’s say, I make a $250,000 per year. If I want to avoid higher taxation rates, I go ahead and put $150,000 in the bank. I significantly reduce my tax exposure, but still live as comfortably, if not more comfortably than someone making $100,000 per year.

That said, I probably prefer some sort of expenditure tax, that’s pretty similar.

@PD Shaw:

Simply putting it in the bank wouldn’t qualify as an investment, any more than I can get the capital gains rate on my savings account now.

@Stormy Dragon: Clavin is saying cutting taxes on the rich is supply side because that’s what supply siders advocate. You’re saying it’s not supply side because it doesn’t increase supply. Stop arguing, you’re both right. Republican supply side doesn’t support supply, OK, you’re right. But it was never meant to. It was a con from the day Laffer screwed up an otherwise useful napkin.

Reagan couldn’t come out and say, ” I want my rich buddies to pay lower taxes.” He had to have some rationalization. That’s all Republican supply side economics ever was, a rationalization for cutting taxes on the wealthy. There may be policies that would actually increase supply, but what’s that got to do with real world Republican policy proposals?

In our current situation there is only one way to increase supply – increase demand. In other words @James Joyner:, in the long run most economists would agree with you, but right now why would we wish to punish consumption and encourage savings?

@gVOR08:

My problem with C. Clavin is that blaming supply-side for Romney is like blaming demand-side for Pay-for-play. Any theory can be misused as an excuse for corruption. Supply-side would be a good idea if it meant actually trying to increase supply. Reclaiming the word to mean what it actually means is the first step to fixing that.

And here’s where I disagree. The only way to make society wealthier is to create more actual wealth; increase supply will lead to increased demand, whereas creating demand without increasing supply just creates inflation.

@mantis: Your math is off : wealth != liquid assets != income. The actual numbers are off by several orders of magnitude (though I can’t find them just yet).

Higher income taxes on the wealthy may make you feel better, but it won’t solve the US’ economic / debt problems. In fact, the only thing it will really do is change where they keep there money and how they spend it — or don’t as the case may be. The only ones really hurt by higher nominal tax rates are those who derive their wealth predominantly through Earned Income rather than investments: lawyers, engineers, doctors, and those [sarc]highly-overpaid university professors[/sarc].

In fact, the best argument I’m aware of for a high-nominal tax rate is that it forces the wealthy to keep their money in their businesses instead of withdrawing it. Ironically, this doesn’t change their lifestyle very much.

@Stormy Dragon:

In a world full of great examples, you picked two of the worst. Mitt Romney doesn’t even manage his own money (though I can’t say there’s not a con-job on the part of his managers); and Warren Buffet is a classical Value-Based Investor (q.v.), which is hardly a con job. In fact, the latter really helps the economy.

Now if you had mentioned Goldman-Sacks or 3/4 of the portfolio managers out there, I might have been able to agree with you.

I have always felt that it was crazy to have a tax on savings account interest. The government should be encouraging savings, not penalizing it. That is not my main concern though. My main concern is paying almost $5 for a box of cereal. Three years ago the same cereal was $2. That is what we had better be concerned about.

If you thought the flat tax was regressive wait until you try a consumption tax or national sales tax of 15% or something. It would be a radical shift.

I wish there were estimates on how much we’d really be talking about if there were a small wealth tax in lieu of an income tax because even though that would be just as radical a change it would more accurately apportion the costs of civil society to those who most clearly benefit from the civil society.

@John D’Geek:

Your math is off : wealth != liquid assets != income.

I was responding to a comment that was explicitly about wealth and not income. My math is fine. Your reading comprehension sucks.

@John D’Geek: They question is not why taxes should be raised, but why they shouldn’t.

@C. Clavin: Then let me rephrase: No one respectable in the field of economics makes supply-side arguments any more. Even its most depraved members like Mankiw now attach a plethora of conditions; the argument invariably resorts to moral sentiment. The conservative movement had a lot of intellectual heft behind it when it initially moved to “market oriented” reforms, intellectual heft that collapsed when its prognostications failed to materialize.

@rudderpedals:

The problem with wealth taxes is that it incentivizes irresponsible behavior. If you blow all your money on hookers and booze, you’ve got no wealth left at the end of the year to tax, while the guy responsibly saving for retirement gets whacked with a huge tax bill.

@Stormy Dragon:

Well…you’re half-right.

Increasing supply does not necessarily increase demand. It can. Or it can’t. Say’s Law isn’t so much a law as a suggestion. I mean, look around you. We don’t have a supply problem. We have a demand problem. If you (and Say) were right then unemployment caused by inadequate demand wouldn’t occur. Allegedly Say himself was in favor of public works spending to relieve unemployment.

On the other hand…Increasing demand without adequate supply is exactly what is happening in Argentina. So you are spot-on about that…demand chasing a fixed supply is causing inflation there.

@Ben Wolf:

Agreed. Thanks.

@C. Clavin: @Stormy Dragon:

Under normal conditions, yes Under current conditions in Argentina, yes. Under current conditions in the US, which are far from normal, no. We have huge underutilized productive capacity. Economists want a little more inflation, the Fed wants a little more inflation, but they keep being unable to hit their inflation targets because of slack demand.

@Tyrell:

My main concern is paying almost $5 for a box of cereal. Three years ago the same cereal was $2. That is what we had better be concerned about.

You’ve been beating this grocery prices drum for quite a while now, and it’s nonsense. Food has risen at about a 2% compound annual rate since 2009. If your food costs have increased 150% in three years, that problem is unique to you.

@C. Clavin:

You’re confusing output with supply here. If I start a “hitting people on the head with a hammer” business, the fact I was able to hammer twice as many people this year as I was last year doesn’t represent an increase in supply, because there’s no marginal utility in increased output of head-hammerings. Because of the aforementioned high-class three-card monty game most of recent economic growth has been in areas where increased output doesn’t translate into increased supply.

Let’s stop tweaking around with the tax code and treat earned income the same way we treat return on investments.

There is something mindboggingly stupid about a world where a trustafarian can get $100K in long-term capital gains from his inherited portfolio while doing nothing more than sitting on his ass drinking beer and pay a lower tax rate than someone who earns $100K as earned income for an 80-hour work week.

@Tyrell: I suggest you change over to oatmeal.

@Tyrell:

What cereal was that? The cereals in the stores here were certainly not $2 a box 3 years ago unless it was a store brand on sale. The same is true now.

@Tyrell:

The Government Is Always After Me Lucky Charms!

@Stormy Dragon: Granted that hookers and likker are attractive. A tax benefit would be extraordinary. But maybe the number is only like a dollar per ten thousand dollars of assets? I have no idea what the income tax replacement millage rate would need to be. Wouldn’t it be good to know?

@grumpy realist: I think there needs to be more than just tweaking. In another week or so the American people (some of them) will go before the powerful judgement throne of the IRS at the annual, dreaded April 15 tax day. Millions are spent every year to pay someone else to fill out tax forms that resemble a Byzantine maze of complexity. This is ridiculous. There are several reform proposals. Imagine if the tax base was doubled or even more. The deficit could be paid off and there would a surplus. Any reform must bring in as many people as possible. The tax rate could then be decreased. No loopholes, everyone from ages 21-65 should have to pay something. And the form should be the size of a postcard and can be filled out by a fifth grader. This makes sense, instead of going through the dreaded annual trip through the torture chambers of the tax code and form 1040. Tax overhaul is needed now.

What on earth are you carrying on about? I’ve been paying taxes for decades. I sit down with my accountant for an hour, I write a few checks and I am done. There have been a few years I came up short on April 15, and I had no problem setting up a payment plan. I am beyond sick of listening to people whining about taxes. You live in an advanced, stable society. It costs money. Millions have risked everything to try and get here. If you don’t like it, you can always leave. PS, take the “taxation is theft” crowd with you.

@Stormy Dragon: “The problem with wealth taxes is that it incentivizes irresponsible behavior. If you blow all your money on hookers and booze, you’ve got no wealth left at the end of the year to tax, while the guy responsibly saving for retirement gets whacked with a huge tax bill.”

You know, I’d go for this just for the spectacle of watching the Koch Brothers and Sheldon Adelson trying to blow their entire fortunes on hookers and booze.

@Stormy Dragon:

No.

What you’re saying is making a bunch of widgets creates demand for widgets.

I’m saying no, that’s not necessarily so. It might. It might not.

We are exactly the opposite of Argentina. We have slack demand. So there is no reason to make widgets.

If you were correct somebody would simply make widgets which would create demand…and voila…mass employment.

Tell me what sector of the economy is experiencing a supply shortage?

@C. Clavin:

Or a capacity shortage.

@C. Clavin:

Healthcare, Education, Housing, Water, Cybersecurity, Online Digital Media, Virtual Reality Gaming….

Now conversely, what sector of the economy is experiencing a demand shortage?

@Stormy Dragon:

That’s nonsense…none of those things is lacking capacity. Except maybe water in drought ravaged California.

Demand? Name it. Consumer spending only returned to 2008 levels this past December.

http://www.gallup.com/poll/166742/consumer-spending-december-highest-2008.aspx

Construction, which typically leads us out if recessions, is still weak.

And of course a net loss of 2M Publuc Sector jobs due to mis-guided austerity doesn’t help.

This is old…but a good synopsis.

http://mediamatters.org/mobile/research/2012/06/08/the-main-problem-with-jobs-growth-is-lack-of-de/185857

bottom line; rich people suck….until you become one?! i wonder if the smarmy crowd will adapt their bumper stickers and go after the .001 crowd now? nah, not enough of them to sate their hate on- and they’re still worshiping buffett for acting like he was a democrat.

@bill:

Excellent job repeating the Fox News talking points.

Ever had an original thought?

@C. Clavin:

Yes, but that’s not due to a lack of demand. People want things, but they’re not affordably available. That’s a supply problem.

@Stormy Dragon:

Now you’re just making shit up.

@ bill

Yet more lame BS from you. The fact that someone does not want to vacuum weld their lips to the rear end of rich folks does not make them a “hater”

This is simply an attempt to deflect an important discussion about wealth inequity in this country. Some people, such as yourself, are simple enough to fall for it.

John D’Geek:

You are wrong. If we wanted to completely eliminate the deficit and the debt we could, just by raising taxes on the top 1%. 100% of the current deficit would be eliminated if the top 1% resumed paying the effective tax rate they used to pay in the period 1942-1981. Link.

If we wanted to tax the rich in ways that are effective and unavoidable, we could do so. We simply lack the will to do so. This has to do with politics, not economics or mathematics.

And I think you implying that the rich will leave. So what? If money means more to you than your American citizenship, then good riddance. This country will be a much better place when it contains fewer people who love money more than they love their country.

And the rich who leave will take with them only the money that the law allows them to take.

Also, please tell me about all the rich people who left when the top rate was 92% under Ike.

Stormy Dragon:

This might interest you (link):

anjin-san:

Correct. The 17 largest deficits (as a % of GDP) in the period 1947-2009 were all produced by Republican presidents. Reagan, Bush and Bush were in power for 20 years, and 15 of those 20 years are on this list. The GOP now whining about debt and deficits is like a bunch of arsonists returning to the scene dressed as firefighters (as Biden has said).

In the 20 years of Reagan-Bush-Bush, the average deficit was 3.9% of GDP. The deficit is currently 3% of GDP. Number of times Reagan did worse than that: 7. Reagan’s average: 4.3%. Next year the number will be 2.6%. Number of times Reagan did better than that: zero.

The GOP loves debt. When the GOP is in power it explodes the debt. Then when it’s not in power it uses the debt as an excuse to try to kill programs that it’s been trying to kill since forever. This strategy is effective only with people who suffer from severe Romnesia.

Don’t you remember “the flight of the millionaires” in the 50’s and how it crashed our economy?

That’s why we remember the Ike era as a time of great economic hardship.

Since “taxation is theft”, so called conservatives must think that General of the Army/President Eishenhower is one of the greatest criminals in history…

@C. Clavin:

No, I’m not. Corporate profits are at an all time high, so there’s plenty of room for prices to drop, which would make things more affordable. If that happened, the demand is already there. Why aren’t prices dropping? Because supply is constrained (as seen by the historically low inventory/sale ratios), meaning corporations don’t have to fear losing business to competitors if they don’t reduce prices.

There’s also a variety of factors making it so that companies face little opportunity cost for sitting on large piles of cash rather than increasing production. Again, this is a supply side issue.

@jukeboxgrad:

Hate to be a killjoy but under our system of constitutional governance, it is impossible for a president, Dem or GOP, to produce a deficit. Only Congress can do that. You could say that they were produced while Republicans were presidents. You might be able to say they were produced with Republican leadership, but even then Reagan had some help from Tip, and Bush the Elder had Foley and Wright in the House and Mitchell in the Senate.* This is of course an oversimplification, but it serves to illustrate that the issue is a whole lot more complex than “were all produced by Republican presidents”.

* source , source

@Stormy Dragon:

Supply is absolutely not constrained. There is plenty of capacity. According to you they could just make the fridges and demand would appear. That’s silly. Absent demand for refrigerators there is no reason for GE to make refrigerators or to stock the materials to make them.

Corporate profits are up because productivity is up…wages are flat so workers are keeping a lesser share of the benefits from that productivity and the corporations are keeping moremore…and corporations are paying nothing in taxes. Again…Boeing paid a -0.4% tax rate over the last 6 years. 26 of the largest corporations paid no taxes from ’08 to ’12. None.

Profits for Proprietors remain flat. These are the small businesses that cannot game the system like Boeing can. If prices were high their profits would be up too.

Contrary to your claim, prices are not high…inflation is near zero and has been forever.

Supply side is a pipe dream that was long ago debunked along with that other Republican fantasy – uncertainty.

The prescription is to stop this nonsensical austerity program and stop slashing the social safety net. To do that taxes on the wealthiest have to go up. Even Reagan realized he had cut taxes too far and raised them back up again. When Bush and then Clinton raised them again we had the longest period without a recession in recent history. This despite all the supply-siders saying it would destroy the economy.

This is why we need a proper inheritance tax. What we actually have is a joke, and furthermore structured all wrong (we should tax individual inheritance, not estates, thus incentiving spreading the wealth around).

And James, seriously, the American Aristocracy is already here. It’s a little late in the game to be pretending that we don’t have a problem.

This is also why taxes on (inflation adjusted*) capital income should be taxed just like labor income. The recent increase from 15% to 20% was a good start, but I’d rather we simply applied an inflation adjustment and called it income.

Regarding the income tax, I’m of the opinion that we could use some more marginal rates at much higher income levels. Or better yet, use a function to get a smooth progressive curve from 0% to, say, 55% (this leaves some room for state & local taxes so that you wouuld get a high-end marginal rate of ~70%, which is, based on recent research, the optimal top rate). This would work best in conjunction with my proposal to treat capital gains as regular income. If that isn’t done, then we’d have an even larger disparity between taxation of labor and capital income, which IMO is a bad thing.

* – in case it’s not obvious, this is to prevent privileging pump & dump “investing” over a long-term buy & hold approach.

@OzarkHillbilly:

“This is of course an oversimplification, but it serves to illustrate that the issue is a whole lot more complex than “were all produced by Republican presidents”.”

However, over the last 50 years, every time a Democrat has succeeded a Republican as President, the deficit was reduced in his first term and over the life of his Presidency in nominal terms (not merely adjusted for inflation, or as a percentage of GDP). And every time a Republican succeeds a Democrat as President, the deficit was increased in his first term and over the life of his Presidency as a percentage of GDP (not merely adjusted for inflation, and especially not nominally). This applies independent of which party controls either or both houses of Congress.

So, while correlation is not causation, it provides a starting point for analyzing this complex issue.

@Moosebreath: Whole heartedly agree, I just want to point out that the deficit is a bi-partisan problem. More than anything else about the Iraq war, the cowardly rush by most Dems to vote in favor of it pi$$ed me off. The same can be said of the Bush the Younger tax cuts. Dems could not wait to vote in favor of them no matter what happened to the budget. At the time I laughed/cried about the $600 bribe sent to each taxpayer. What a joke the phrase “fiscal conservative” is.

@OzarkHillbilly:

@Moosebreath:

I’d love to see a graphic that showed Presidency, Senate and House Leadership, and Economic Indicators like GDP, Deficit, and UE across a historical timeline.

I agree that it’s a bi-partisan thing. But that can cut both ways.

Certainly today’s reflexive obstructionists have held down spending levels…which has helped reduce the deficit faster than any time since WW2…but that has been to the detriment of the economy in general.

Ozark:

As Moosebreath pointed out, history shows that Congress is not the issue. Here’s an expanded version of my original statement, which shows that more clearly.

The 17 largest deficits (as a % of GDP) in the period 1947-2009 were all produced by Republican presidents, and they did that with both D Congress and R Congress. During this period, both R presidents and D presidents had both R Congress and D Congress, but the 17 worst deficits were all R presidents. Why?

Reagan, Bush and Bush were in power for 20 years, and 15 of those 20 years are on this list (of the 17 highest deficits in the period 1947-2009). In 15 of their 20 years in office, those three ran a deficit of at least 3%. Number of times any Democrat did that in the period 1947-2009: zero. That is, those three R presidents did 15 times what no D president (in the period 1947-2009) did even once, even though those D presidents usually had a D Congress.

In the period 1947-2009, there have been this many years when Democrats controlled the White House and both Houses of Congress: 18. In those 18 years, there was a deficit exceeding 3% of GDP this many times: zero.

In the period 1947-2009, there have been this many years when Republicans controlled the White House and both Houses of Congress: 4. In those 4 years, there was a deficit exceeding 3% of GDP this many times: 2 (and of course those are both Bush).

What does this data tell you about which party is more likely to produce a deficit?

In the period 1947 to 2009, every time Democrats controlled both Houses of Congress and also the White House, there was never a deficit greater than 3% of GDP. But when the GOP controlled the White House, there were 17 years when the deficit was greater than 3% of GDP. Why?

Even though Congress is nominally in control of spending (and taxation), history shows that the president has a great deal of influence, and that R presidents (at least since 1980) tend to produce large deficits, regardless of who is running Congress.

@C. Clavin:

Unused capacity is a supply-side problem, not a demand side problem. Consumers don’t control capacity, suppliers do.

If demand is so weak, why are inventory levels so low? There should be all these unbought refrigerators hanging around. But there’s no glut of unsold inventory; what they make sells. They’re just choosing not to make more so they can maintain monopoly profits, secure in the knowledge no one is going to come in and undercut them with a cheaper refrigerator.

@Stormy Dragon:

Gee..maybe you should think about that for a while and get back to me.

Going off topic for a moment – this seems like it would be a good time for some Obamacare posts…

@anjin-san:

No…the news out of Obamacare is good…so you won’t see anything here at OTB.

@anjin-san:

However there will be a Jobs post on Friday, when the BLS numbers come out, that will completely ignore the effects of Public Sector austerity.

@Stormy Dragon:

Maybe because businesses have gotten better/smarter about building up inventory, so nowadays you don’t have a bunch of excess lying around if there’s no one to buy it? Walmart, Amazon, etc. Just a guess.

Your argument appears to be that there needs to be deflation, so products are cheaper and folks can buy them. But this risks a deflationary spiral.

What we’ve had is very low inflation combined with basically zero wage growth and persistently high unemployment. Sorta like stagflation, but with low inflation/low wage growth instead of high inflation & wage growth. Same result though: malaise.

I’m not seeing how this is a supply problem. Debt overhang & job losses reduced demand. Government stepped into the breach briefly, and then pulled back. Result: depressed demand.

@Stormy Dragon:

Their supply is in cash not in widgets thanks to things such as Just-In-Time inventory management that Walmart and others have pioneered.

Check it out (Wikipedia)

@ C. Clavin

Since Obamacare crashed our economy, I’m afraid I can’t make any comments without the permission of our Chinese overlords…

@anjin-san:

I hate it when that happens.

Stormy,

Going with the example of major appliances (fridge, range, washer, dryer, dishwasher)… I don’t find the prices to be high (for the low-to-midrange stuff. Obviously you can spend stupid money on high-end appliances, but hasn’t that always been true?). But I only need one of each of these things. Mine are still working, so I don’t buy more.

Meanwhile, if you’ve lost your job and/or already have a bunch of debt, you’re not buying a new fridge regardless of whether it’s $800 or $1200. It’s money you don’t have either way.

@anjin-san:

This is hilarious…

http://www.motherjones.com/politics/2014/04/hobby-lobby-retirement-plan-invested-emergency-contraception-and-abortion-drug-makers

@C. Clavin:

Just like you’re not likely to see any Bridgegate / Christie stories…..

@Rafer Janders:

Or the Rogoff/Reinhart kerfuffle…in which the very basis of the austerity program was debunked.

@Stormy Dragon:

Not to belabor the obvious, but this is a self-correcting problem. That aside, so what? Conservatives talk about taxes as if they fundamentally change your standard of living, but that is simply untrue. The vast majority of Americans have essentially the same lifestyle after taxes that they would have if they got to keep it all (at least until the roads fell apart and the Canadians invaded).

This holds at almost all levels of income — except the middle. The poor pay no taxes, so they aren’t affected. The laboring classes pay little tax, and so aren’t affected. The well-to-do pay their 30%+ (fed, state, and local) but are still well-to-do. The rich, who don’t depend on income anyway, could be paying 100% tax and never really notice it day to day. (No, I am not advocating this.)

The one group that suffers disproportionately is the lower middle class. They don’t have enough to be comfortable, and the amount they give back in taxes (under current law) is a tangible barrier to becoming comfortable.

This is why wealth is so much more important than income. Only the poor, who have no wealth, live off their income; everyone else lives off their wealth. Wealth generates both income and more wealth. Wealth is security. Wealth is independence. Employment (by others or by yourself) is transient; wealth persists. Every conversation about income inequality is distracting everyone from the real problem and the real solution mechanisms.

Note that the above is only vaguely true if we’re talking about federal income taxes (and, to a lesser extent, state income taxes in states that have them and have progressive rates). The poor pay sales taxes, for instance, which hit them a lot harder than they hit me.

The lower middle class has a similar problem. Sales taxes might bite a bit less, but they either owe some income taxes instead, or they lose access to means-tested benefits (most likely EITC?).

I disagree. The stats on this are clear: real income at the bottom hasn’t risen in a long time (depending on how exactly you slice the population, you could say it’s fallen). More income at the bottom would lead to more saving, which leads to more wealth.

That said, sure, wealth matters as well as income, and we should talk about that too.

@Rob in CT:

Yes, but you can’t fix that with income tax policy, because you’re already not taxing the bottom. (EITC is not a tax policy; it’s a transfer payment.) Similarly for sales tax — I agree completely, but we were talking specifically about income taxes.

No, he argues that it obscures the WEALTH inequality picture. James keeps trying to make this about income for some reason (maybe just typos), but it isn’t.

@DrDaveT: You’re right that that’s what the meat of the post is actually about. But both the general debate and the lede of Thompson’s post is about income inequality:

@anjin-san: Next week I will try your idea and have a professional fill out my taxes. Maybe they can save me some money. I will let you know.

@C. Clavin: you watch a lot of fox i guess? i don’t watch tv all that much but if fox is repeating that then it’s all good.

@bill: “you watch a lot of fox i guess? i don’t watch tv ”

I love the way every idiot right winger slavishly repeats every Fox talking point, then claims not to watch Fox, just as they lift entire passages from Limbaugh, down to his adorable pet names for people he hates, and then claims never to listen to the radio.

I don’t know if they’re ashamed of how they spend their time, or simply desperate to be thought of as original thinkers despite their lifelong inability to have an original thought.

@wr:

This is the thing – RW media is very coordinated (LW blogs often pass stuff around too, but aren’t quite as synched up). Bill might actually not watch FOX. It’s not necessary, if he instead reads, say, NewsMax or Free Republic or whatever.

@DrDaveT:

Ok, it doesn’t seem we have much of a disagreement. I do think that income tax policy matters in this, because 1) if you bring in more revenue from the top you can use it on things like the EITC; and 2) much more abstract, I know, but I think that if you can tamp down on excessive fortunes you bend other things indirectly… positional goods don’t get bid up so much (is a college degree from one of the best institutions a positional good? Seems that way…), politicians have to focus more on less wealthy people rather than chasing small numbers of ultra rich folks, and generally you have less concentrated power. Tax policy may be secondary, but it’s still important.

@Rob in CT:

I agree completely — but that too is about wealth, not income.

Milton Friedman argues that people consume on the basis of their “permanent income” — their anticipated lifetime average income — rather than on their current income. If he’s right, it follows immediately that wealthy people are wholly insensitive to high income tax rates, because income tax doesn’t touch their wealth and their permanent income is wealth-derived. That’s not the conclusion Friedman was aiming for, I’m sure — but it means that both the libertarian Chicago economists and the neo-Keynesians agree that whopping high income tax rates on the wealthy have almost no downside and lots of upside.