Why Cutting Gasoline Taxes Won’t Help

Prof. Hamilton has the answer. But for those of you who are too lazy to click through here is the short version.

Let’s say that the market clearing price with taxes is $3/gallon and that taxes are $0.5/gallon. So the initial view is that cutting taxes would cut lower the price by $0.5/gallon. The problem is that there is currently a shortage. So short of rationing, once the gas tax is removed prices would rise to their pre tax market clearing level. In then end there’d be little if any price relief and all that would happen is various government entities would wind up short on revenue. The added profits might provide greater impetus over a slightly longer period to bring capacity back online faster, but that is about all the benefit you’d get.

Plus, add in the fact that my oil in the Pacific Northwest, further refined to gas, comes from Alaska (80-90%). It is slightly fungible. My local refineries are all operating fine. Their output cannot reasonably be sent to the sections of the country without massive transportation costs (like tankers through the Panama Canal).

Therefore, my gas prices have gone up $1. OK, I’m still paying about $3/gallon, much less than some (Atlanta $6). Something isn’t making sense here, I do not understand it, and so I am getting out of oil stocks on Tuesday (getting out because I do not understand what is going on – not because I think they are going down, just the uncertainty is too great for me now, I’ll probably be buying oil stocks on the next dip).

You (and the linked article) fail to mention the reason that prices would likely stay the same: anti “price gouging” laws.

There is effectively a cap on gas prices in many states (LA included) that is exacerbating the supply problem. If prices were allowed to rise naturally, demand would taper off, and the supply would last longer.

But because there is a price cap, many gas stations are looking at narrowing profit margins (or in some cases, negative profit margins), and so they wouldn’t be able to pass the savings on to consumers… they’re barely staying in business as it is!

Atlanta $6? Do what now? Where’d you get that?

I live in metro Atlanta. The highest price I ever saw with my own eyes was $3.499, and that was at stations that were being rationed by their suppliers at a critical juncture just before a major holiday weekend.

That was on the same day that some stations in the area were charging at or near $6 a gallon, but those were aberrations caused by panic buying and a gouging impulse that was quickly stomped that same day when the governor promised to prosecute price gougers. The next day he suspended all state taxes on gasoline.

The panic buying had run its course that day. The pipelines were back online. Gas prices in my area are uniformly at $2.999 — but even at the worst of the panic, the gougers were always being undersold. To me that indicates a clear dividing line between a genuine market price for gasoline, and gouging. It also made the gouging unsustainable even without the threat of prosecution.

If I may gently suggest, that may be because your information is incomplete. Panic-selling of stocks is no more sensible than panic-buying of a commodity such as gasoline.

Spoted in West Haven,CT 2 days ago- and all on the same short street. $2.89, $3.09, $3.58 – You takes your pick gentlemen! Foolishly there were cars (SUVS?) filling up at the one with $3.58 a gallon. Now is the time to shop carefully – the pricing is rather arbitrary and will respond to competition.

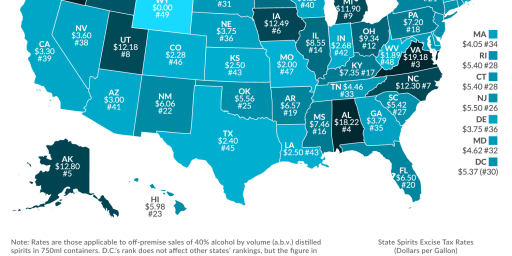

You also neglected to mention the many states that apply state sales tax on gasoline. I found a survey dated 2002 that shows that total taxes on gasoline range from .26.4 cents per gallon in Alaska to .50.4 cents per gallon in California. That is a lot more than the .05 cents per gallon you mentioned. Perhaps Prof. Hamilton needs to do a bit more research before spreading the doom and gloom.

Herb,

I assumed a tax rate of $.5, or about 50 cents, not $0.05 (or 5 cents).