About that 4.1% GDP Growth….

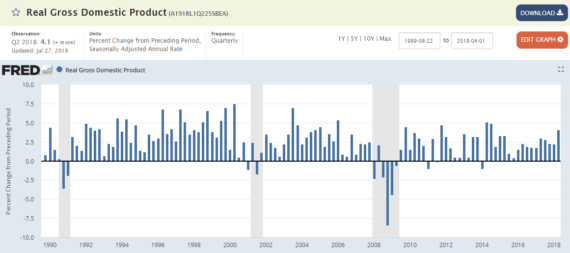

The recent report of 4.1% GDP growth over the previous quarter is indeed welcome news. However, taking a look at the data both recent and in the past and there are some reasons to be concerned about GDP growth in general.

Yes, it is pretty good growth. Definitely above average. And well above average for the post 2000 period. And yes, it is quite likely that Trump’s tax cuts are a big part of the reason. After all, that legislation changed the withholding tables so that more money is showing up in each person’s paychecks. More money implying more consumption spending. Sure, let’s give Trump credit where credit is due.

However, this is one quarter of above average growth. Maintaining such growth in the post 2000 period has been quite challenging. See the following chart. Growth past 2000 has been markedly lower. And post the Great Recession it has been noticeably lower. Growth during the 1990’s averaged 3.4% whereas post 2000 growth has averaged 2.0%. Even if we remove the Great Recession years it is not all that much better with growth clocking in at an average of 2.4%. This is not good. This is not a partisan issue. This is something that should be of concern to everyone. After all these percentages tell us about the doubling time for GDP. With an average growth rate of 2.4% GDP doubles every 30 years. With 3.4% GDP will double about every 21.2 years. So if you are 20 now and GDP is say, $17 trillion dollars by the time you are 80 GDP with 2.4% growth will be $68 trillion. But with 3.4% growth you’d see that $68 trillion by the time you were 65. Given that GDP is distributed (if unevenly) across the population where would you rather be? I’d rather be in the second scenario.

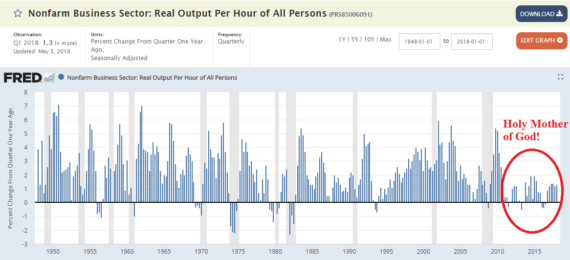

What is causing this? Good question, in fact it is the question. Nobody really knows. They have been looking for an explanation but there really isn’t much to go on. There has been a drop in the growth rate of productivity, but that drop is also a mystery.

A recent paper by Nathan Goldschlag and Alex Tabarrok looked at federal regulation to see if that was the culprit and shocking the answer was, “No!” Here is the summary,

Mounting evidence suggests that economic dynamism and entrepreneurial activity are declining in the United States. Over the past 30 years, the annual number of new business startups and the pace of job reallocation have declined significantly. We ask whether this decline in dynamism can be explained by federal regulation. We combine measures of dynamism with RegData, a novel dataset leveraging the text of the Code of Federal Regulations to create annual measures of the total quantity of regulation by industry. We find that rising federal regulation cannot explain secular trends in economic dynamism.

And the data set they are using, RegData, is quite interesting.

Our primary source of information on regulation is RegData, a database built upon the CFR.6 The CFR captures the stock of all federal regulations in effect in a given year. RegData builds on prior studies of regulation that use page counts or other size measures from the CFR or the FR. RegData improves upon earlier measures in two ways. First, not every page in the CFR is equally impactful so rather than a simple page count RegData counts the number of restrictive words or phrases such as ‘shall’, ‘must’, ‘may not’, ‘prohibited’, and ‘required’ in each section of text. Restrictive word counts are likely to better measure the regulations that influence choice, binding regulations, than will simple page counts.

The second way that RegData improves upon previous measures is by disaggregating the measure of regulation to the industry level. The CFR is divided into sections, including titles, chapters, subchapters, parts, and subparts. Although the titles of the CFR often have suggestive names such as ‘Energy’, ‘Banks and Banking’, and ‘Agriculture’, a single regulation in any CFR section can affect many industries so there is no simple way to connect the number of regulatory restrictions by section to an industry. To solve this problem, Al-Ubaydli and McLaughlin (2015) draw on developments in machine learning and natural language processing techniques.

The CFR acronym refers to the Code of Federal Regulations. Basically, this is a more comprehensive and disaggregated to the industry level. Further, the machine learning aspect of the algorithm does try to account for “stringency” of the regulations.

But the shocking finding is that federal regulation appear to have little impact on dynamism in the economy. And they tried really hard. They tried all sorts of different models with their data and found…pretty much nothing.

Both the authors expected to find a large role for federal regulation in reducing dynamism. After working with the data, however, our view is that if the effect of federal regulation on dynamism was strong then it would show up more consistently and clearly. As noted earlier, the question we examine is not whether regulation influences dynamism, it surely does in both positive and negative directions. The question is whether regulation on net has been an important cause of the large, secular, and widespread decline in dynamism in the United States. While other measures of industry-level regulation and other techniques are to be encouraged we suspect that the main message of our paper – we should be looking elsewhere than Federal regulation for the cause of declining dynamism – is robust. Thus, it is appropriate to briefly consider other possible causes of declining dynamism.

So what could it be? Goldschlager and Tabarrok suggest the following places/things to consider for future research:

- State level regulations (note one could even look at interaction effects here with federal regulations).

- A decline in the rate of technological growth.

- Improvements in information technology may allow firms to internalize “creative destruction” that is large firms are better able to adapt to shocks and thus there are less bankruptcies, unemployment and periods of worker reallocation.

- The authors also note that it is possible that dynamism is being mis-measured.

Another possibility is a cultural shift. Perhaps Americans are becoming less entrepreneurial than in the past. If so, then this could explain the decline we are seeing in productivity and thus growth. One potential solution to this is greater immigration. Immigrants tend to start businesses at a higher rate that natives.

In the end this is a great big mystery.

So, yes the recent GDP numbers are good. They could have been better without Trump’s blinkered trade antics. But it is just one quarter’s worth of higher than average growth and we saw similar growth under Obama and Bush. To act like this is something unprecedented is just downright ridiculous. Gloat if you want too but you’ll just look stupid.

Please correct me if I’m wrong:

The actual real GDP 2018Q2 change is estimated by BEA at 1%. (and some small change). Even this (the so-called “advance” estimate) is subject to revision after more data is collected.

If that 1% growth is annualized (aka expected to be consistent over the next two quarters) … that when you have a ~4% growth for the year.

That looks more like a drop in the growth of productivity, if I am reading the graphs correctly.

Either way, I think the cause is obvious —

millennials with their f.cking avocado toastwages haven’t caught up with the productivity gains of the past, and people just don’t see a value in doing a better job.@Gustopher:

Whoops yes. I will change it. Thanks.

And your second comment is actually post worthy.

I wouldn’t completely write off regulation as a factor. While I respect Goldschlag and Tabarrok’s approach, I think are two caveats to their conclusion:

1) It’s possible we are getting to a “straw that broke the camel’s back” situation, esp with the intersection of state and federal regulation — that a certain amount of regulation was fine, but once it gets to a certain point, it creates an impediment that startup business find difficult to overcome. There’s no law of nature that says the effect of regulation has to be linear.

2) Not all regulations are created equal. A lot of people (Bainbridge for example) have written that Sarbanes-Oxley was uniquely bad in terms of hampering startups and entrepreneurship. I find it difficult to believe the impact would be that dramatic. But then again, if you’re choking off innovation at an early stage. And it would correspond to that drop (modulo correlation ≠ causation).

I suspect we have a confluence of multiple factors — aging population, rising prosperity in the rest of the world, etc. But I will agree that the picture of more regulation = bad economy is a bit too simplistic. I think a smarter approach — looking at what good a regulation does versus how much it’s hurting the economy — would be better (e.g., lead abatement doesn’t cost much and has gigantic benefits, so it’s fine).

There is an aging population all over the world, that’s putting pressure on growth. Entrepreneurs need demand to be entrepreneurs, people simply opening business if there is no demand for their services won’t create jobs. Disproportional numbers of people opening business in retail or services sector never end well.

I think that inequality in income and wealth also probably plays a part. Start ups have generally been funded out of personal savings and by borrowing from family and friends. Much more of our money is concentrated into the hands of very few people. So if Johnny Middle Class comes up with a great idea for a new product, he just can’t fund it.

Steve

@steve:

In tech if you have a brilliant new idea there’s about a 90% chance Apple or Samsung is about to do it better and for free, or Google will just buy you out and absorb you. No entrepreneur worth her salt wants to be in either situation. When Jeff Bezos started Amazon he was not just hoping to be bought up by Wal-Mart. Entrepreneurs are not managers, they’re closer in temperament to creatives than they are to money managers and efficiency experts. They want to create something of their own.

I had a revelation attending the last (IIRC) Mac World in SF. This big convention floor full of little guys with great ideas. My kid and I walked around thinking, “Ooooh, that’s a cool product!” only to go into the keynote presentation and learn that Apple had already bundled all those cool ideas into its system. It was a blood bath of entrepreneurs. All those people mortgaging their homes, maxing out their credit cards, working 90 hours a week. . . and Apple just calmly fired a bullet into every single one.

An aging population, a failure of entrepreneurship in a market crushed under the weight of monopolies and well-financed chains, and, I believe, a lull in technological creativity yielding no world-beating new products. 11 years ago the iPhone changed the world. The internet/computer/iPhone system has had a huge effect, but that revolution is aging into increasingly meaningless refinements.

Finally, a factor I’ve been harping on for a while only to be dismissed: newer generations are less materialistic than Boomers were. The notion of a big house and German car as status indicators isn’t chiseled in stone, it was just a fashion. Now that fashion has changed. Status now can come from the number of Instagram followers you have, and adding Instagram or Twitter followers is not the sort of good or service that shows up in the GDP. The vast numbers of people who thought it terribly, terribly important to have a million dollar McMansion in order to signal their value, now wants 1000 Twitter followers, price tag: $0.

All things being equal, I would agree, but all other things are never equal. How much debt are we bringing on to boost our GDP? Are we increasing income inequality? Are we getting anything for the GDP rise, or are we simply moving money back and forth (if I pay you $20 to eat dog poo, and then you pay me $20 to eat dog poo, the GDP is $40 higher, but all that happened was a bill got passed back and forth)?

We should be looking at other statistics, like personal savings and debt.

Trump is very pleased with his entirely precedented 4.1% growth data spike that comes with massive increases in debt, and a massive payout to the richest. He is optimizing the wrong metrics.

@Lava Land: Please tell us what industry you are in. The US is very large and diverse, and something that is good for some might not be good for many others. For example, a company near me provides airdrops of retardants for wildfires; I wish that their business was not booming. Also, I fear the government having too much power to pick winners and losers; it is not just a theoretical concern that enrichment of the rulers often becomes a goal in such situations.

Steve

A few observations.

Politicians and their minions engaging in hyperbole isn’t novel. Bill Clinton: the worst economy in 50 years. Obama: I saved the economy. (Snicker). And so it goes. The bottom line is that the TTM GDP has advanced 3%, a 50% increase over Obama’s long term 2%. And he told us that was all there is.

You may place more credence in academic studies than I do. But as a practicing serial business owner I will tell you regulation has absolutely strangled tangible and gleam in the eye business expansion. Guar-on-teed.

The notion of suddenly ball-less businessmen has been a topic at Schuler’s place. I totally disagree. The business environment has simply sucked. “You didn’t create that” my ass. It’s different now. Give it time.

Drew

@Guarneri: “But as a practicing serial business owner”

My goodness, somehow that one never gets old! Thanks for starting my day off with a big laugh!

Good piece, however, the fact is that most real economists not named Kudlow believe the trade antics BOOSTED the GDP by ~.6%…so the actual GDP number should have been ~3.5%. Not as impressive as the sort-of-impressive 4.1% (ranked 5th amongst Obama’s best months).

@Guarneri:

Maybe if you practiced even more you wouldn’t fail so often. But then maybe that’s the source of your infatuation with your dear leader…

Trump Vodka

Trump Wine

Trump Steaks

Trump Magazine

Trump Airlines

Trump University

Trump Casinos (how do you go bankrupt in a business where the house always wins???)

Serial, indeed.

Poor Drew…

I don’t know if anyone is still following this thread, but…

The bigger questions here is, after a $Trillion giveaway to corporations and the rich, and regulations being slashed;

Why is real GDP not stronger, and why is Dennisons best month only ranking with Obama’s 5th best?

Why has wage growth has gone flat in the last two months and is lagging behind that under Obama.

Why is employment growth in Dennison’s first 18 months behind the last 18 months of Obama?

Dennison is running the Republican playbook…cut taxes on the rich, and de-regulate. And it ain’t working like they promised.

@Daryl and his brother Darryl: Also don’t forget where all that cutting-of-taxes ended up: higher salaries for CEOs and money getting plowed back into the stock market….which went up.

At least until we get the Brexit crash…..

@Daryl and his brother Darryl: You may be looking at the wage element from a false perspective; this is Drew we’re talking about. Based on all we can surmise based on how he presents himself, flat wage growth is just as likely to be a feature as a bug.

Don’t you get tired of being wrong Steve?