Another Round of QE3?

Will the Fed announce another round of Quantitative Easing?

The recent downgrading of the U.S. debt will lead to another round of quantitative easing according to Ken Rogoff.

“They certainly should do something right away,” said Rogoff, a former International Monetary Fund chief economist who attended graduate school with Fed Chairman Ben S. Bernanke. It’s “hard to know” if Bernanke would immediately be able to gain the support of Federal Open Market Committee members, Rogoff said in an interview today on Bloomberg Television.

The FOMC meets today in Washington a day after the worst day for U.S. stocks since December 2008. Bernanke last month outlined policy options including additional asset purchases or strengthening the commitment to low interest rates after the first two rounds of so-called quantitative easing failed to keep the unemployment rate below 9 percent.

“Out-of-the-box policies are called for, especially much more aggressive monetary policy, however unpopular that may be,” said Rogoff, 58, a former Fed economist who like Bernanke earned a Ph.D. from the Massachusetts Institute of Technology. The Fed is “going to move more decisively,” Rogoff said.

At 2:15 today (Eastern Time) the Fed will release a press release like it always does after the FMOC meets. This will be the first opportunity to signal such a policy.

Rogoff recommended the Fed say in “very clear statements” that it’s trying to create “moderate inflation.” “In the classic classroom QE, it’s open-ended,” Rogoff said. “You say, ‘I’m trying to create inflation of, let’s say 2 or 3 percent, and I’m going to do whatever it takes.'”

This fits with what Rogoff has said in the past about the recession which he is calling the second great contraction which applies not just to output and unemployment, but also debt and credit.

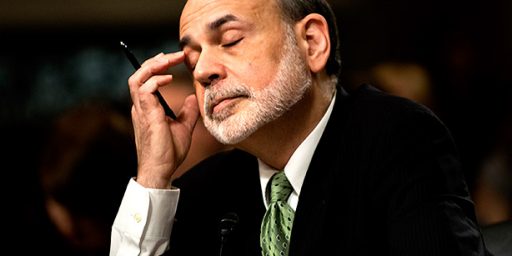

I’m thinking that right now Bernanke is worried about the economy heading into another recession. The data have been indicating we have been heading in that direction for a few months now. All the volatility in the markets related to the U.S. and European debt problems has only added to uncertainty making the situation even more untenable.

He may be right but I’ve expected that we’d need to see more threat of deflation before a QE3 was begun.

So Bernanke has finally caught up with what everyone else knew six months ago. And yet he still can’t recognize the combination of a liquidity trap and a totally insolvent banking system. I feel secure knowing the economy is in the hands of this man along with Tiny Tim. Together they might just be able to drive the developed world completely into neo-feudalism.

The announcement of “no interest for you!” through 2013 may accomplish the same thing. That is, it may hold equity markets up in the hope that the real economy will follow.

“no interest for you!” also reflects amazing confidence in the ability to borrow, in face of downgrade.

Abolish the Federal Reserve System – national banks are unconstitutional.

@Catfish: National banks are not unconstitutional, unless you’ve got one of those fill-in-the blank constitutions everyone seems to have these days.

@Ben Wolf: @Ben Wolf:

Correct, but fiat money is immoral.

@Pete: @Pete: Fiat money is not immoral. Have a nice day.

One problem with fiat has been that I can no longer buy a cup uf coffee with 5 cents as I could at age 25

RW age 80