Bernanke Turns On His Turn Signal

One theme in the monetary theory literature is that central bankers can signal their intentions in regards to inflation. The ideal is that the central banker will set the inflation rate very low or at zero. Today in a Congressional hearing Bernanke tried to send a signal.

One theme in the monetary theory literature is that central bankers can signal their intentions in regards to inflation. The ideal is that the central banker will set the inflation rate very low or at zero. Today in a Congressional hearing Bernanke tried to send a signal.

“In recent weeks, yields on longer-term Treasury securities and fixed-rate mortgages have risen,” Bernanke said. “These increases appear to reflect concerns about large federal deficits but also other causes, including greater optimism about the economic outlook, a reversal of flight-to-quality flows and technical factors related to the hedging of mortgage holdings.”

The budget deficit this year is projected to reach $1.85 trillion, equivalent to 13 percent of the nation’s economy, according to the nonpartisan Congressional Budget Office.

“Either cuts in spending or increases in taxes will be necessary to stabilize the fiscal situation,” Bernanke said in response to a question. “The Federal Reserve will not monetize the debt.”

What Bernanke is doing is trying to send a signal to the bond market that their fears that the U.S. monetary and fiscal policy will lead to excessive inflation are unfounded.

“Bernanke knows that fiscal financing problems are already complicating monetary policy and are in danger of undermining Fed credibility,” said Alan Ruskin, chief international strategist at RBS Securities Inc. in Stamford, Connecticut. “He knows that there is only so much quantitative-easing financing that can be done.”

What this is saying is that Bernanke can talk all he wants, but the ultimate signal will come via actions. What actions the Fed take in the coming weeks will be the most important. If Bernanke continues to rely on quantitative easing and continues to buy up U.S. government debt then the bond market participants will likely dismiss his comments in hearings today as “cheap talk”—i.e. the signal is not real and to expect higher rates of inflation.

President Barack Obama has pledged to halve the deficit by the end of his term. Even if successful, his administration anticipates the government will still run what would be, by historical standards, large deficits for the foreseeable future. Bernanke said the debt-to-gross domestic product ratio is set to reach the highest since the 1950s.

And what isn’t noted here is that the reason the national debt was that high was because the U.S. had recently finished fighting a world war and the debt had run up past 100% of GDP. Of course, during that time period there was also a strong consensus that such a debt-to-GDP ratio had to be reduced to a more manageable level. Debt-to-GDP steadily declined in the post-WWII years. I’m not sure that consensus/conviction holds today. I think Dick Cheney’s statement, “Deficits don’t matter,” applies to both parties.

And while it is all well and good for President Obama to reduce the deficit by 50% by the end of his first term it will start to rise again the next year if CBO projections hold. Granted that is somewhat of a heroic assumption, but it does undermine confidence in the bond market. The President’s very own budget projections out to 2019 show almost no improvement in the budget deficit for the long term.1

The central bank is buying as much as $1.75 trillion of housing debt and Treasuries this year to lower borrowing costs across the economy after reducing the benchmark interest rate almost to zero in December. Fed officials hold their next policy meeting June 23-24 in Washington.

What isn’t mentioned here is that a chunk of that $1.75 trillion in housing debt is still government debt in that it is Fannie Mae or Freddie Mac debt (I think). Add on the $300 billion in U.S. Treasury debt and you have lots of money the Fed is simply printing up and either putting in the government’s hand or propping up government policies. So now the question is, when does it stop? Will Bernanke stop with the quantitative easing and possibly cause problems with the Administration, or will the Administration reduce some of its grandiose spending proposals and reduce deficit projections, or some combination of the two?

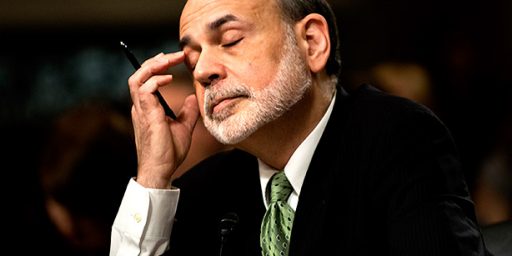

Image via Flickr user ZeroOne under the Creative Commons license.

_____

1In absolute terms, from a debt-to-GDP perspective the picture is improved, but the trend is of continued deterioration from 2013 onwards with the national debt going past the 80% mark.

That was a good balanced piece. One footnote to this:

Cheney (and Bush) did finance another war on debt. The claim made at the time was that war spending added 1:1 to debt, and was not financed at all from current receipts.

I don’t think I would call it government debt. The debtors are the home buyers. The government does have various degrees of commitment for various instruments when those home buyers default. Ah, here we go: