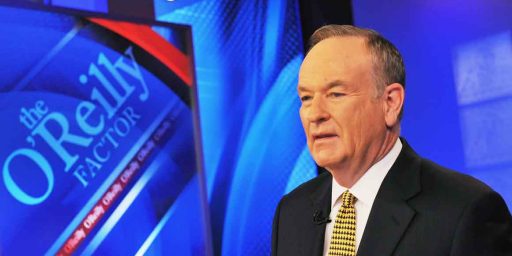

Bill O’Reilly: Price Gouger

I was listening to Bill O’Reilly on my way to work and he was ranting about the price of oil and how oil companies are price gouging. This got me thinking…what does O’Reilly mean by price gouging?

If we define price gouging as O’Reilly does: profits increasing as prices increase, then any and all firms are likely price gougers. After all, even for a perfectly competitive firm profits are increasing in the price. If we define price gouging as exercising market power, then in this situation most firms are going to be price gougers. Every firm exercises whatever market power it has. A perfectly competitive firm has very, very little market power, while a monopolist has quite a bit of market power. Since O’Reilly (who sells himself to the public) is a monopolistic competitor he has significant market power and is thus a price gouger.

The only way out is to restrict the term price gouging to a state of emergency such as things like food, water, and shelter right after a disaster such as a hurricane, earthquake or even a war. However, this would not apply to oil companies at the moment as there has been no such disasters here in the U.S. that woud restrict supplies to the current stock of gasoline in the tanks at gas stations and cars. So, this definition cannot be the one O’Reilly is using and we are left with either of the two above and that O’Reilly is himself a price gouger.

Well, I define it kinda like this:

Let’s say oil goes up $2/barrel right now. That’s the trading cost of a barrel purchased today on the open market, but _not_ a barrel in anyone’s (except possibly the original country’s) hands… that oil needs to be pumped out of the ground, sent to a port, put on a tanker, shipped to a refinery, and then transported to the gas station. In other words, gas price may go up as oil price goes up, but there’s a significant lag time. If oil goes up _today_, and gas goes up _tomorrow_ in response, _that’s_ what I call gouging.

Tho I expect most economists (and all oil industry types) would disagree…

Then, Shall we say that the Oil Companies are “Pillaging” the American People.

Any way one puts it, Big Oil is getting filthy rich at the expense of Every American and they love having those who “understand” ? by providing them with “Excuses” for their greedy behavior.

One more thing, Whatever happened to the old standby Excuse,

SUPPLY and DEMAND

Flash News:

BP has just posted a profit of over 7 (Seven) Billion, 30% increase over the same period last year.

If that don’t P everybody off, then the oil companies are successful in their PR with those who provide them with the excuses for this Obscene Profit.