Bloomberg: Don’t Blame Banks for Mortgage Crisis

Did Congress cause the mortgage crisis by mandating loans to poor people? No.

New York City mayor and media mogul Michael Bloomberg says Congress, not the banks, is responsible for our current mess.

Speaking at a business breakfast in midtown featuring Bloomberg and two former New York City mayors, Bloomberg was asked what he thought of the Occupy Wall Street protesters.

“I hear your complaints,” Bloomberg said. “Some of them are totally unfounded. It was not the banks that created the mortgage crisis. It was, plain and simple, Congress who forced everybody to go and give mortgages to people who were on the cusp. Now, I’m not saying I’m sure that was terrible policy, because a lot of those people who got homes still have them and they wouldn’t have gotten them without that.

“But they were the ones who pushed Fannie and Freddie to make a bunch of loans that were imprudent, if you will. They were the ones that pushed the banks to loan to everybody. And now we want to go vilify the banks because it’s one target, it’s easy to blame them and congress certainly isn’t going to blame themselves. At the same time, Congress is trying to pressure banks to loosen their lending standards to make more loans. This is exactly the same speech they criticized them for.”

This was a popular and perfectly plausible argument a year or so ago. I joined many in making it. It was a perfectly understandable mistake for informed laymen to make, since it starts from a true premise: there was indeed pressure on lenders to make loans to disadvantaged people and communities seeking to become homeowners.

But, as Paul Krugman notes, it has long since been debunked in the popular debate and therefore “for any public figure to go with the Congress-did-it argument at this stage is for him to reveal both that he is grossly ignorant about the central policy issue of the day and that he gets his ‘analysis’ from right-wing flacks.”

Krugman points to a May essay by the Roosevelt Institute’s Mike Konczal which debunks a piece by Peter Wallison ironically titled “The True Story of the Financial Crisis.” I actually find that post rather in the weeds. But a brand new piece by Konczal written in direct response to Bloomberg’s remarks is more illuminating:

1. The first thing to point out is that the both the subprime mortgage boom and the subsequent crash are very much concentrated in the private market, especially the private label securitization channel (PLS) market. The GSEs were not behind them. That whole fly-by-night lending boom, slicing and dicing mortgage bonds, derivatives and CDOs, and all the other shadiness of the 2000s mortgage market was a Wall Street creation, and that is what drove all those risky mortgages.

For some data, start here: ”More than 84 percent of the subprime mortgages in 2006 were issued by private lending institutions….Private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year.”

As Center For American Progress’ David Min pointed out to me, the timing doesn’t work at all: “But from 2002-2005, [GSEs] saw a fairly precipitous drop in market share, going from about 50% to just under 30% of all mortgage originations. Conversely, private label securitization [PLS] shot up from about 10% to about 40% over the same period. This is, to state the obvious, a very radical shift in mortgage originations that overlapped neatly with the origination of the most toxic home loans.”

2. The next thing to mention is that the “affordability goals” of the GSEs, as well as the Community Reinvestment Act (CRA), didn’t cause the problems. Randy Krozner summarized one of the better studies on this so far, finding that “the very small share of all higher-priced loan originations that can reasonably be attributed to the CRA makes it hard to imagine how this law could have contributed in any meaningful way to the current subprime crisis.” The CRA wasn’t big enough to remotely cause these problems.

For the GSE’s, I’d recommend checking out Jason Thomas and Robert Van Order, A Closer Look at Fannie Mae and Freddie Mac: What We Know, What We Think We Know and What We Don’t Know, which, in addition to explaining how their affordability mission is a distraction, argues that subprime was only 5% of the GSEs losses and the GSEs bought the highly-rated tranches of mortgage bonds for which there was already a ton of demand.

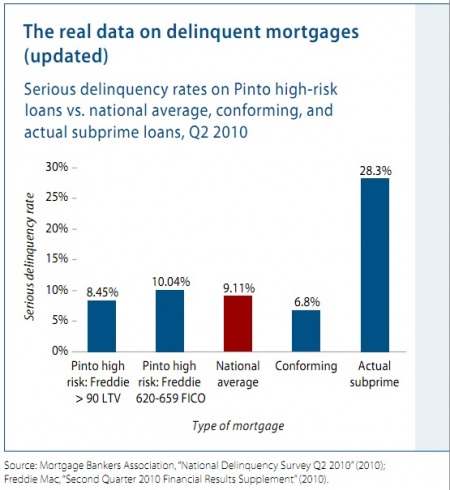

There’s much more but those are the salient points for a lay audience (of which I’m decidedly a part). This chart, which appears in both of the Konczal posts, is also worth a gander:

Conservatives were right to be skeptical of the Community Reinvestment Act, which did indeed lead to riskier loans being made. The default rates on those were indeed higher than on conventional loans. But simple logic would tell you that an act passed in 1977 is unlikely to be the proximate cause of something that happened in 2007–three decades later.

In fact, the vast majority of subprime loans (around 80% of them) were issued by private institutions not covered by the CRA at all. Here’s Krugman again from three years ago:

Fannie and Freddie had nothing to do with the explosion of high-risk lending a few years ago, an explosion that dwarfed the S.& L. fiasco. In fact, Fannie and Freddie, after growing rapidly in the 1990s, largely faded from the scene during the height of the housing bubble.

Partly that’s because regulators, responding to accounting scandals at the companies, placed temporary restraints on both Fannie and Freddie that curtailed their lending just as housing prices were really taking off. Also, they didn’t do any subprime lending, because they can’t: the definition of a subprime loan is precisely a loan that doesn’t meet the requirement, imposed by law, that Fannie and Freddie buy only mortgages issued to borrowers who made substantial down payments and carefully documented their income.

[…]

In that case, however, how did they end up in trouble?

Part of the answer is the sheer scale of the housing bubble, and the size of the price declines taking place now that the bubble has burst. In Los Angeles, Miami and other places, anyone who borrowed to buy a house at the peak of the market probably has negative equity at this point, even if he or she originally put 20 percent down. The result is a rising rate of delinquency even on loans that meet Fannie-Freddie guidelines.

Also, Fannie and Freddie, while tightly regulated in terms of their lending, haven’t been required to put up enough capital — that is, money raised by selling stock rather than borrowing. This means that even a small decline in the value of their assets can leave them underwater, owing more than they own.

And yes, there is a real political scandal here: there have been repeated warnings that Fannie’s and Freddie’s thin capitalization posed risks to taxpayers, but the companies’ management bought off the political process, systematically hiring influential figures from both parties. While they were ugly, however, Fannie’s and Freddie’s political machinations didn’t play a significant role in causing our current problems.

High finance is outside my expertise and so I’ve had to learn about most of this on the fly as the crisis unfolded. Plausible arguments based on half truths that fit into my pre-existing worldview were naturally attractive to me. But, at some point, facts ought to prevail in honest debate.

Bloomberg, frankly, doesn’t have that excuse. Not only was he mayor of New York City–otherwise known as the financial capitol of Planet Earth–at the time all this was going down but he’s a mega gazillionaire who made his mega gazillions (okay, around $19 billion) in the financial sector. He’s got an MBA from Harvard Business School and was a general partner at Salomon Brothers, where he headed equity trading, way back in 1973. Let’s just say that, contrary to Krugman’s charitable interpretation, he’s no ignoramus on these matters.

Good post, though you worried me with the headline 😉

My synopsis is that the government backed mortgage system had other problems, principally graft and rent-seeking, before the bubble, but those problems should not be conflated with the problem of NINJA loans, malicious securitization, and corrupt ratings agencies.

In related news:

So … the Fed is going to help out again … by buying some of those MBS off Wall Street.

Kinda like having a rich (and forgiving) uncle.

(LOLZ, though you could have used fewer Krugman references, and provided less red meat for the deniers. They’ll be all “Krugman! Of course we can’t believe Krugman.”)

Ah, I see you miss the long view. That is that the CRA was the catalyst to the crisis. But the dissembling by Bloomberg and others has a purpose, if the CRA didn’t do it, then all those Harvard Business and other Ivy league grads on Wall Street aren’t as smart as they like to think they are.

The CRA pushed for loans to risky borrowers. The old guys resisted for a couple decades but finally the government’s threats caused the loans to be made near the edge in significant numbers. Well, as we know, you can play on the edge of a cliff if you do it with care and diligence. So that, along with a booming economy, kept the losses reasonable compared to the profits. Along come the young and dumb. They see this golden opportunity being passed up by the old guys. So they start pushing more and more of the loans without catastrophe. The refrain against those who’ve seen a bad market is “It hasn’t crashed yet”. Which adults know, has nothing to do with the risks of tomorrow. But it went a long, good money was being made, those betting against the practice were ignored, banks even started buying their own blends thinking it was a good investment. Till, one day, it changed.

It’s an old story, it’s sadly an oft repeated story. Subprime mortgages, junk bonds, Russian roulette, etc. If you don’t die in the first few rounds, there comes the idea that you are invincible. And the more elite your education, the easier it is for you to fall for such fallacies.

@JKB:

Simple question: Who packaged MBS designed to fail and bought AAA ratings for them?

(Who just settled with the SEC, for doing that.)

Ha…a Wall Street guy is defending Wall Street. I’m shocked.

And JKB carries their water like a dutiful little minion.

It’d be one thing for someone who spent the 90s living under a rock to imagine that Congress took down Glass-Steagall all on its own & pressured banks to offer loans to anyone with a pulse for the last decade, even though it’s beyond clear that that was all done at the behest of Wall Street money to begin with. But for Bloomberg to make such a statement is a laughably transparent lie. The K-Thug quotes are useful here because – like him or not – he assaults those lies with the facts that directly contradict them – it’s not a case of “no one could have predicted”, because lots of knowledgeable people did predict exactly this. There was just too much money being waved around for people in power to make good, responsible decisions. Surprise!

Trying to pin the blame for something as complicated as the housing bubble and resulting mortgage crisis on a single entity or factor strikes me as mistaken. As with most cluster-f**ks, there are a number of guilty parties, all acting for their own reasons, who combined to create a disaster that now seems inevitable.

Yes, the banks share some degree of responsibility, for the reasons James notes as well as others.

The government also holds some share of the responsibility, not so much because of the CRA, which played a minor role at best, but due to loose monetary policy from the Fed and tax policies that created incentives for homebuyers to buy ever more expensive homes.

And, finally, home buyers are responsible. In the end, we got caught up in a classic speculative bubble made worse by the fact that it was financed almost entirely by debt. It’s no surprise we are where we are, and it’s going to take time to work through the consequences.

I barely understand any of this mumbo-jumbo, but the only thing I wonder is whether the CRA made some ‘unnatural’ competition for high-risk loans. In other words, I’m asking if the private banks went riskier in order to compete with the CRA-mandated loans.

Regardless, I’m pretty sure this doesn’t excuse re-selling these packaged up loans as low-risk or any of the other mistakes Wall Street made.

@john personna: @Hey Norm:

First off, the MBS weren’t designed to fail, they were the product of years of Ivy League arrogance and what was thought to be a brilliant idea, if you don’t examine the boundary conditions. They were simply pate, where you take diseased geese liver, blend it, mix it up with some spices, mold it and then sell it to those who think they are brilliant for a huge profit.

Now, to the point, how is what I wrote, @JKB: , a defense of Wall Street?

The Monster: How a gang of predatory lenders and Wall Street bankers fleeced America – and spawned a global crisis by Michael W. Hudson

JJ agreeing with Krugman…. It is the end times. 😉

@JKB:

Uh, aren’t you overlooking the fact that the huge profits were made by shorting the instruments they were selling? Or was that just a case of negligence on the part of the banks who did the selling?

@OzarkHillbilly:

Don’t worry, Doug is here to carry the glibertarians’ water.

@Doug Mataconis: “Trying to pin the blame for something as complicated as the housing bubble and resulting mortgage crisis on a single entity or factor strikes me as mistaken.”

That’s true. However, the financial crisis caused by taking those bad mortgages and monetizing them as mortgage-backed securities? That was all Wall Street.

Mike

@sam: No, it’s just a complete coincidence that of all the parties that people like Doug and JKB like to say share the blame equally, the homeowners end up foreclosed and out of work, the government is saddled with the blame and the bankers profited in the billions. Whatever you do, don’t let that fact sway you — clearly the blame must be spread equally.

I doubt that Mayor Bloomberg is a conservative. If I had to assign him an ideology it would be opportunist.

Note how desperate financiers are to point the finger somewhere else. You might think that they were afraid that somebody might figure out that their seven, eight, or more figure incomes weren’t due to hard work, brains, and acumen but to high risk-taking (with other people’s money) and a roll of the dice.

That´s more complicated. I´m a foreigner and I find worrying that most Americans that I know sees houses as a way of profiting, not as a way of living there.

@André Kenji de Sousa:

That ship has sailed (and sunk at the harbor mouth).

@Dave Schuler: Hell, I’d settle for them taking outrageous risks with other people’s money. As it is, they’re taking no risks at all since they’re Too Big To Fail.

I think Doug’s point about easy money from the Fed helping to blow the bubble makes sense. That doesn’t in any way excuse what the banks did.

Regarding putting blame on the people taking out the loans, well to me it depends on which loans we’re talking about. There seem to be a lot of folks who took out loans they probably could have afforded, but then the economy tanked and they lost their jobs. Subprime may have been the trigger, but then a bunch of regular mortgages ended up in trouble, didn’t they?

A house-flipper taking out a crazy subprime loan who couldn’t find a chair when the music stopped? Ok, sure – blame away. Still, I’d put more of the blame on the bank that loaned the money (and then bundled it up, got Moodys or whoever to slap a AAA rating on a piece of crap, and sold it to somebody else, giggling all the way. The somebody else in question also deserves some blame, for a lack of due diligence. Not to mention the ratings agencies!).

The CRA narrative is an excellent dog whistle, though. I can tell you that my father hears that whistle loud and clear. Jesse Jackson, you see, caused all our problems. *sigh*

@sam:

Outside of some hedging, the guys shorting the MBS were putting money where mouth was. They’d told everyone that it was all going to end in tears but they wouldn’t listen. So they sent the brightest alert on Wall Street, shorting. Shorting is a signal that someone believes the investment will collapse. And it did, so they made money because it happened before the shorts expired.

That’s how it works. Two sides to a contract. One believes the investment will go up, one believes it will do down.

The lie that that our current international financial crisis was all the fault of a few poor black families getting government backed mortgages proved to be irresistible to most Republicans.

No surprise there.

Some guys are natural born water boys…

Every time I try to make these points I take a barrage of arrows. I think its because people reflexively think I’m trying to absolve “Wall Street” (whatever that really means). Nothing could be further from the truth. But I’ll try once more.

First, I think Doug has the most sober view, noting that there are a number of people with blood on their hands.

Second, the points made in “1” and “2” aren’t really responsive to the issue. There is loan origination, and there is loan syndication. It occurs in many markets. LBO’s, mortgages, credit lines for Fortune 500 companies etc.

The proposition is that since most of the loan origination volume came from private institutions the problem comes from greedy Wall Streeters. That’s garbled logic.

I watched first hand (I was a lender at the time) government regulators putting pressure on private institutions to extend suspect credit. They threatened you with portfolio quality downgrades (which means more reserve requirements) or (and at the time a lot of consolidation was going on) refusal to approve a merger. Hence, these institutions made the loans. They were both business and consumer loans.

Here is what no one seems to understand or appreciate. If you are senior officer of a bank you have a fiduciary duty to manage your balance sheet. They knew these loans were no good. They knew that their loss experience would rise. So what do you do? You offload the loans to reduce your risk. You syndicate them.

They were offloaded to GSE’s, and then as MBS’s. It was a perfectly rational reaction to pressure to make substandard loans. This really started in the late 90’s, accelerated in the early aughts and then went on steriods in the mid-aughts.

Now here is the point. Yes, “Wall Street” knew they were packaging a mess. The Countrywides of the world knew they were originating a mess. But this occurred after the ball got rolling. And “greed” has existed in the financial services industry (and Main Street) forever. What those who just want to truncate their “analysis” and simplistically assign blame to “Wall Street greed” refuse to acknowledge is that this engine just didn’t arise out of nowhere. “Wall Street” has never originated a mortgage in their lives. It was fostered by government social policy goals to cause origination of poor credit quality loans. People often like to quip “how could CRA, implemented in 1977, be to blame.” Turn that around. Why did we not have a housing bubble in the 40’s? The 50’s? The 60’s? The 70’s? etc No greed then? Bull. Because there was no catalyst. You needed a pot of bad mortgages before you could syndicate them about and create this mess.

Now of course what happened was once this whole process became recognized and “legitimized” was that people do what people do: pursue their own self interest. And the whole thing gained a destructive momentum. But I always know I’m not dealing with the brightest bulb when they invoke “Wall Street greed,” as if greed hasn’t been around forever, as if unions don’t bargain for the best deal, as if consumers don’t comparison shop etc. Get real.

A couple parting points. Those who want to cite “predatory lenders” are just knuckleheads. People wanted a seat at the casino. People were perfectly capable of not buying Mercedes Benz’s because they knew they couldn’t afford them. Somehow they lost their risk compass because a “predatory lender” wanted them to buy a house? C’mon. They voluntarily rolled the dice. They wanted in on the game. Second, the issues in the housing market were well understood by the early aughts. Those so motivated can go to C-Span archives and watch Congressional testimont with the likes of Barney Frank, Maxine Walters etc absolutely denying a problem, in fact calling regulatory mechanisms racist. If you want to criticize the Bush Administration, the other convenient whipping boy with Wall Street, then criticize them for not vigorously pursung this issue because they had political capital to spend on the Iraq War. That’s a legitimate criticicm.

@Drew:

So your argument boils down to “hey, you knew we were greedy, so its really your fault!”

@JKB:

This of course ignores the fact that the people shorting the MBS were also the ones selling them.

This is akin to a drug dealer, saying out loud, as he sells, that this crap is going to destroy you and your community, but since you’re willing to buy, I’m willing to sell. Perhaps its legal (the at once selling and shorting of MBS), but it sure isn’t moral in any Western Judeo/Christian sense.

And as Dave and others point out, the issue is that this was largely done with other peoples money and little risk to the sellers. And also note that the gains from those dealings — if I understand correctly — are exactly the type of profit that the “Buffet” rule has been focused on.

And if you still think the above was ok — which you are entitled to — atleast be good enough not to show the utter lack of awareness/imagination/empathy to ask what is driving OWS (or for that matter the early tea party).

Thanks for the post James… I look forward to diving into that content to be able to better understand those issues…

I should mention,btw, that I think it’s entirely possible that we, via our government, took the whole “ownership society” thing too far. I’m pretty sure the concept of a “quasi governmental” entity like Fannie/Freddie is a bad idea, or at least a potentially dangerous one. I think the CRA linkage is a blatant dog whistle, but debunking that doesn’t in turn mean that Fannie/Freddie weren’t screwing up. I think they played a role in the bubble, along with the Fed.

…

The argument isn’t “greed” Drew. It’s *unchecked* greed. Unregulated greed. The greed is a constant, but History shows us it must be regulated. Finance has a clear history of cluster-effs. The greedy individuals who took out the “liar loans” – hey, their greed is a constant too, right? It’s about setting up conditions that result in that greed being particularly harmful. I think we agree on that. The hard part is coming to agreement on root causes.

I have no problem with the idea that various Democrats played a part in avoiding proper regulation of Fannie/Freddie (and Wall St). I think it’s pretty clear those entities had a highly incestuous relationship with Congress. Those representatives screwed up (or were simply corrupt) and should be voted out (in Chris Dodd’s case, he’ll just ride off into the sunset). A problem like this is rather unlikely to be the sole handiwork of one political party. That said, I think the constant deregulation efforts of the GOP (whether direct repeal of laws or just lax enforcement) are an important factor too. Yet the GOP hasn’t skipped a beat with their deregulation mantra.

@Liberty60:

Not quite. Drew does have a worthwhile point about greed. It’s always there. It becomes a problem when it is allowed to become a problem.

I think it is more that the American rich have divided us plebs into two teams and we fight each other while they sit back and sell both sides machetes and bandages.

@JKB:

And you don’t think there was something just a tad amiss about the guys selling the CDO shorting the CDO they were selling (and not telling the marks they were shorting it)? You’re cool with that?

@matt b:

Not even legal. See, Judge Rakoff Questions S.E.C. Accord With Citigroup

@Matt b

Using your example, it would be like the government going in and telling the alcohol businesses that they have to sell Meth also or they will shut down their alcohol business. Once problems arise the politicians turn around and blame the alcohol businesses for selling Meth. The argument of “well it was the alcohol businesses selling Meth not the Government” falls flat.

As I typed above…I am amused by the Bloomberg who makes his money off Wall Street defending Wall Street.

But I’m more interested in what has barely been touched on here…and that is what to do about the problem.

Too big to fail banks are still too big to fail. Attempts to regulate them have been stymied by lobbyists and their water carriers on both sides of the aisle.

And of course there is the constant, mindless, delusional, drum-drum-drum-beat for even more de-regulation no matter the result from the wingnuts on the right.

We are just being set up for this to happen again.

The first thing I would like to see is the re-institution of the Glass-Steagall provision that idiot Phil Gramm worked to repeal…and which, yes, Clinton signed.

James Joyner: A well-written, honest assessment. I admire the fact that you follow evidence rather than ideology. That makes you one of about six people on the internets. It’s a standard I aspire to myself, though we all fail at times.

Doug Mataconis: Just the opposite.

@Wayne:

What the hell are you talking about?

“People were perfectly capable of not buying Mercedes Benz’s because they knew they couldn’t afford them. ”

False comparison. No one has ever created liars loans so that people can buy a Mercedes. No one has ever claimed that the Mercedes you buy will only appreciate in price. No one ever hired appraisers to give falsely elevated values on a Mercedes so the seller could make more money.

I still view the crisis as mulitfactorial. You needed low rates, left over money from the prior bubble, securitization, ratings agencies giving AAA ratings and a switch to hedging risk rather than careful underwriting. You also needed a fair amount of control fraud. Can any finance person tell us with a straight face that they did not know that liars loans would fail?

Steve

Here’s a clue, Wayne:

GS settled the suit for $550 million. In the settlement, GS, while not admitting guilt, did allow that its marketing materials were “incomplete”. Yeah, right, “incomplete”. Here’s what complete marketing materials might have looked like:

@Liberty60:

Your simple minded response has been duly noted.

But does it make him a Democrat yet?

OT: Gallup has Obama’s approval at 45% today, up 7 points in 3 weeks:

http://www.gallup.com/poll/113980/Gallup-Daily-Obama-Job-Approval.aspx

@JKB:

You simply don’t know the history. Sam got it. I was thinking of the Abacus deal and the Goldman settlement.

It is actually really appalling that you’ll argue your theory of the crash without tracking what we actually learn about it, as the story unfolds.

@ Ponce…

For all the “Obama is doomed” posts Mataconis has done based on poll numbers…you would think he would jump right on this news…Quinnipiac also has Obama improving across the board, including groups he was having trouble with.

I guess OTB is only interested in bad news for the Prez.

Rob / CT –

“The argument isn’t “greed” Drew. It’s *unchecked* greed. Unregulated greed.”

That’s fine. But it doesn’t change my point. Lehman and Bear didn’t go out to mortgage originators and say “see, we invented this thing called a MBS, so go out and make bad loans and we’ll just package and sell them off.” It happened the other way around. The originators needed a way to offload to protect their balance sheets.

“It’s about setting up conditions that result in that greed being particularly harmful. I think we agree on that.”

We completely agree. Hence my point. Anyone who doesn’t just want to traffic in convenient ideology ought to go watch those CSpan tapes. Dodd, Frank, Waters and many more absolutely scorched regulators (it was truly abusive inquiry) who dared insinuate that there was trouble. Absolute denial.

“The hard part is coming to agreement on root causes.”

Yes. But call me crazy. You can’t syndicate a bad loan until you make a bad loan. Lehman and Bear didn’t make loans.

“That said, I think the constant deregulation efforts of the GOP (whether direct repeal of laws or just lax enforcement) are an important factor too.”

This is a popular position. Care to actually name a regulation stripped by the GOP that caused the mortgage meltdown? The biggest “deregulation” that was part of the problem was of course GS. It enabled large commercial banks to “play with the big boys” and get into investment banking activities. It was signed into law by William Jefferson Clinton.

“Yet the GOP hasn’t skipped a beat with their deregulation mantra.”

Not wrt housing. They were the ones on the other side of the hearings. Go watch the CSpan tapes. Your eyes and ears won’t lie to you.

BTW, Goldman and Abacus were hardly alone. Google “SEC MBS settlement” just for fun. I dare you.

You’ll find more, like:

Overall, people who used to take the BS “it was all CRA” line are having to walk back their arguments (as Drew does above). Now it is “hey there are lots of dirty hands.” Well, yes there were, but the old line that it was all in the governmental sector is totally shot.

The smoking gun is out there in the form of SEC settlements, and still more investigations in progress.

steve –

“False comparison. No one has ever created liars loans so that people can buy a Mercedes. No one has ever claimed that the Mercedes you buy will only appreciate in price. No one ever hired appraisers to give falsely elevated values on a Mercedes so the seller could make more money.”

Not at all. You want us to believe that the Average Joe has enough common sense to avoid ridiculous claims about cars, fridges and any number of other significant time financed purchases and their attendant come ons (No money down!! Zero % financing!! No payments until January!!)……………….but become mind numbed zombies who will believe anything when it comes to the single greatest purchase/financing of their lives? Not a chance. They were suckered not by predatory lenders, but by cocktail circuit talk, the guy down the street bragging at the cookout etc. You want to talk about greed? Look at the people who bought when they shouldn’t have. Its stamped on their foreheads.

Drew- Did the investment banks believe their own models which showed that housing prices could not drop across the whole nation at the same time? If the answer is yes, then why would you expect average Joe to think otherwise. If the answer is no, why were they committing fraud? To be clear, I think there were a lot of peopel who should have known better. Some were gambling, just like the folks on Wall Street. However, an awful lot of people believed the advertising. Those guys get paid a lot to get people to buy stuff. They are pretty good at it. Quite a few people also bought houses they could afford, but got stuck with underwater houses when the market collapsed.

Steve

Drew,

It was signed into law by William Jefferson Clinton.

I’m well aware of that. Clinton agreed to it, unfortunately, and he shares blame. But wasn’t it Lindsay Graham’s baby?

Ah, I remember well the corporate all-employee email we all got encouraging us all to contact our representatives and express support for repeal (at the time, my co. was part of CitiGroup. A certain Mr. Weill was a big fan of G-S repeal).

I seem to recall that it was primarily GOP politicos who made it happen. Clinton shares blame, certainly.

Not wrt housing. They were the ones on the other side of the hearings. Go watch the CSpan tapes. Your eyes and ears won’t lie to you.

Certainly wrt Wall St. though, so I’m not reassured. I’ll check out those hearings at some point, sure, though I’ve already conceded the point (Dem culpability on GSE regulation).

@Wayne:

This absolute nonsense which clearly demonstrates that you didn’t understand the slightest bit of what I posted.

Further, as you do with so many other brainless rightwing talking points, you continue to push a select (and false) version of things when the actual facts (which contradict your first point) were cover by JJ in the very article above.

Given those two facts, there’s only one rational response to this utter inanity…

as Drew does above

Nice try. Never said that. Never deal in absolutism. But your blatent dishonesty is noted.

@ Rob…

No…even worse…it was Phil Gramm’s baby.

Gramm responded in March 2008 to criticism by stating that he saw “no evidence whatsoever” that the sub-prime mortgage crisis was caused in any way “by allowing banks and securities companies and insurance companies to compete against each other.”

Look up epistemic closure.

Norm,

“Look up epistemic closure. ”

To be fair, Phil Gramm has been wrong about everything for as I long as I can remember. I still recall him predicting that Clinton’s 1993 tax increases were going to kill the economy stone dead. There’s no reason for him to ruin his track record by being right about this.

Rob / CT –

I don’t think it was Lindsey Graham, but the GOP guy in TX. I want to say Phil Gramm.

You know, I do mostly drive by here, between calls, in airports and such. So I don’t write “completely.” And it allows shallow thinkers like J Personna, for example, to jump on trite issues and aha!! claim the general thrust of a position to be incorrect while he nibbles around the edges. I don’t have time to write tomes. And if small minds want to capitalize on it, so be it.

I have no quarrel with your point, Rob. Mine was not to say that “its all Clinton’s fault.” It was a play/poke in the eye on all the intellectual lightweights on the left currently infesting this site with their usual “its all Bush’s fault” or “the Republicans only care about the rich” or other such brainless tripe. The fact of the matter is that Clinton worked for the bill, and signed it. After all, he got campaign contributions……..

I wonder how many leftist commenters would acknowledge that, and give up their “its all Bush’s fault and deregulation” chanting. I won’t hold my breath. There are only a handful of intellectually honest commenters here. Willing to call it as it is, rather than just reflexively put on the knee pads. Given our exchange, I think you have a good idea who they are.

@Drew:

You did briefly hand-wave “other factors,” in the midst of your CRA spiel.

Your comment from April 30, 2011:

That’s what you are now walking back. The “CRA made us do it” bullshit.

BTW, my own comment from that same thread better stands the test of time:

Well, as I was typing you can see what happened. All Republican Phil Gramm’s fault, right?

You guys spit, or swallow?

Here’s another of your “personal expertise” pieces, Drew. It does begin charmingly:

To bad it fails the test of time.

News! Bank of America to reconsider debit fees! OWS wins! Oops, not! The MCT (middle class

taxpayers) win: here’s how. We decided to vote on the debit fees with our feet – two simple moves: sign a form withdrawing our money. Take the money down the street to another bank that doesn’t charge the fees. How easy! That is how problems are solved. Not with hanging around in tents and beating on drums. Next fall, I will fire leaders who have not done anything except take tax money and give it away. This is how the real 99% get things done in this country.

That’s a patently dishonest interpretation and conclusion, jp. No surprise.

CRA coercion was real. Real as a heart attack. You have no basis to dispute it. Only one of us was a lender. Only one of us was in the room. And its also widely understood and documented.

It is only you who are taking that to mean it was the sole cause of the mortgage mess, because it fits your meme.

My point is, and always has been, that there was a catalyst. CRA is a piece. General pressure on private lenders to do subprime a piece. GSE’s a piece. “Wall Street greed” and the whole syndication effort came later. Originators had to offload their crappy balance sheets. And then a godawful mess was set into motion. Its not rocket science, although all matters financial have never impressed me as your strong suit..

I’ve always known you have a dishonest posting style. But I’ve always though you bright. I’m questioning the latter now.

“I tend not to “pull rank.” But in a prior business life I was a lender at a bank. I can tell you unequivocally that subtle pressure was put on banks by regulators to meet CRA requirements. However, it was subtle. That changed under Andrew Cuomo’s stewardship of HUD in the nineties.”

I defy you to prove otherwise, jp. You are just flapping your lips now.

This one size fits all argument is, to say the least, a massive over simplification of a complex phenomena. If you are going to call others out for being “simple minded”, you might want to do a little better yourself.

@Drew:

Widely understood and documented? That’s a laugh riot there, as the CRA is and always has been a red herring. It’s a sign the person is primarily interested in making government/liberals/Democrats look bad. It’s quite telling that anytime the CRA is brought up as a cause of the mortgage meltdown, there are never any links to actual evidence. I will note Joyner’s original post even debunks the idea that the CRA played a meaningful role, so it’s pretty entertaining to see people try and defend the idea.

As I said earlier, I always get a barrage of arrows when I make these points.

Anyone noticed that the arrows come with no data or argument, but just “that’s absurd, professor so and so says so.” Great. I love my Groucho Marks line, because I was there: (paraphrased) “who you gonna believe, a politically motivated professor/commentator, or your lyin’ eyes and ears?”

Its sort of like the global warming debate – just shout them down: “the science is settled, no need to deal with ten years of no increase in temperatures.”

But despite all the denials about public policy considerations, anyone looked at what is happening right under your eyes today? More uncreditworthy loans. But of course, back in 1999 there is only one possible explanation, it was greedy bankers and George Bush……..oh, wait……

David M –

See above.

Did you ever work at a bank? Have you ever made a loan? Have you ever attended a bank credit policy meeting? Have you ever dealt with a loan regulator?

You were saying someting about evidence? Are you calling me a liar?

@Drew: No, it sounds like your bank definitely needed the CRA enforcement. However, your personal experiences don’t mean much when looking at the big picture.

Really, complaining about evidence? Did you not even bother to read the original post and see the links? I notice you don’t have any actual evidence other than “I worked at a bank” (that apparently got the attention of some regulatory agency) and “this is just like global warming” (in that right wingers lie and make stuff up).

@Drew:

Please link as much of this documentation as possible. Thank you.

“subtle pressure was put on banks by regulators to meet CRA requirements. ”

What about the aborted subprime crisis in California in the early 90s? Also, I have looked but failed to find evidence of charges being brought against anyone fo rnot complying with the CRA.

Steve

The ludicrous argument that sub-prime was responsible for the crash rests on the faulty premise that the economy was doing perfectly fine in the first place. 100% losses on sub-prime loans were insufficient to come anywhere near the total wealth and national income destroyed during the financial crisis. There was too much debt in the private sector period, and that applied to the financial firms as much as to any individual borrower. All the big banks were heavily indebted and technically insolvent before 2008 rolled in, the result of years spent accumulating ficticious capital at the expense of productive investment.

Sigh.

You are all correct. I’m wrong. You got me. Its those meanie Wall Streeters all along. BTW – since they are so greedy and all powerful, what’s the next scam? Or have they retired from the greed business?

And this is credible, why? What has that moron ever gotten right? Even Enron, he got wrong.

@Drew:

What do you expect when your entire argument is one gigantic appeal to authority? Perhaps if you weren’t consistently so belligerent and passive-aggressive you might make some headway.

Your stated reason is corrrect but your conclusion isn’t.

Best way to describe why is to ask you if you understand how a avalanche starts with a few small rocks.

@Eric Florack:

He called the crash before it happened, and he correctly identified the Fed’s post-crash policies as non-inflationary, despite tripling the monetary base. He also understands the difference between stocks and flows which you, Mataconis and Bastiat clearly do not.

@Eric Florack:

If the banks had been properly leveraged they would have weathered sub-prime adequately on their own. You conveniently ignore that CDS, synthetic bonds and OTC derivatives represented unsustainable debt levels vastly in excess of the sub-prime market. What Bill Black calls the Systemically Dangerous Institutions were operating by a single thread because the profit margins were so high. When the thread snapped they couldn’t pay the debts they owed on their bad bets; AIG for example knew it couldn’t possibly honor the amount of CDS it had sold if things went bad, but it kept selling anyway.

@Eric Florack:

Best analogy ever, assuming the CRA is the small rocks.

The small rocks falling are not the reason there is an avalanche, as small rocks fall all the time and don’t cause avalanches. Avalanches result from unstable snow packs, and avalanche prevention isn’t focused on preventing small rocks from falling as the large unstable snow pack is a much bigger concern.

Even if we stipulate that CRA played its part, I don’t hear a lot of discussion about the professional responsibilities or lack thereof on the part of lenders. Something that a friend’s wife said at the height of the boom sticks in my mind.

She had just quit a nice administrative job with a very successful mortgage brokerage in Napa. Close to home, good money, nice office. When I asked her why she quit, she replied, “the people I work for lie so often, they don’t know what a lie is anymore”.

I don’t think anyone from the government was putting a gun to their head to force them to make loans they knew would fail, lying to customers in the process. I think they decided that they had a chance to make a lot of money and they did not give a crap about the details.

@Drew:

Drew, your simple minded response has been noted. Question: Do you have any other kind of response?

@anjin-san: There’s also the fact that everyone has the potential to get greedy; it’s human nature. A multi-million bonus check is a powerful incentive for any of us to do stupid, short-sighted things in its pursuit. When you live entirely within such a culture it becomes exponentially more difficult to resist.

You have yet to prove that governmetal maipulation didn’t cause the crash.

Sorry, you simply havent.

“If you don’t loan money to people who cant pay you back, we’ll put you in jail” doesnt soundlike the lenders were given a whole bunch of room.

You have yet to prove that any mortgage brokers were threatened with jail. Sorry, you simply havent. Not surprising that you don’t live up to the standard you expect from others.

This is pretty weak tea even by your anemic standards. During the boom, I used to hear mortgage brokers laughing about the loans they were making, loans that they knew were a joke. “Let’s see, you are a maid, you have been in the country 18 months, and you make 100K a year. Your husband is a busboy. How much does he make? 65K, you say? Great, you are qualified up to 500K”. I never, ever heard them say “Damn, these loans are going to fail! But what can I do? It’s this or prison. I have a family to think about”.

Well, these guys were making 20K a month and buying Porsches and homes in Blackhawk, and vacationing in Tuscany. They seemed to be quite pleased with the situation.

In reality, people like WAMU CEO Kerry Killinger exerted a great deal of pressure on their mortgage divisions to make more predatory loans. Why? Simple, they were very profitable.

Well, Killinger walked away from the disaster he helped create with over 100 million in his pocket. Others made much more. But Fox told you it is all Fanny and Freddie and Barney Frank and Jimmy Carter, and like a dutiful little water boy you repeat your lines over and over…

And if the government was FORCING lenders to do all this, why the lying? Why assure people that they had nothing to worry about with that ARM, prices would go up forever? We were in the market, briefly, in 2006. I could not find a lender who I could meet with and not laugh in his face, they were spinning so much BS. We rented a house and sat it out until last year, when prices returned to sanity.

Again, even if we stipulate that CRA played its part, even if we accept your claim, for the sake of argument, that lenders were facing jail if they did not make these loans avaiable, why all the lies? Why not be professional and lay out the possible risks and rewards of getting into that market? Or are you now going to claim they faced jail if they did not become serial liars?

Goldman Pays $550 Million to Settle Fraud Case

Goldman Sachs has agreed to pay $550 million to settle federal claims that it misled investors in a subprime mortgage product as the housing market began to collapse, officials said Thursday.

http://www.nytimes.com/2010/07/16/business/16goldman.html

@anjin-san: You’re putting too much thought into it. My opinion is that pointing to the CRA is equal parts assigning blame to liberals and making it harder to argue for more regulation going forward. It was a massive market failure that showed the need for more and better regulation, and today’s

conservativesradicals can’t have any of that, so they blame the CRA.In 2009, I bought a used car. The used car salesman told me he used to work in the financial services business, but quit to be a used car salesman – a far more ethical profession. I laughed. He said it was no joke.

Obviously that’s stayed with me.

It’s but one little story. I’d give it the same weight as anjin-san’s friend’s comment and Drew’s personal experience wrt to governmental pressure to make loans (Drew – if you had more evidence, of course, it would strengthen your claim quite a bit).

A whole lot of people were lying (or, perhaps more accurately, bullshitting – simply not caring about truth) I think.

I’m willing to accept the possibility that banks were pressured to comply with the CRA (it is the law, after all) in ways that contributed to making bad loans. The thing that I have to wonder, however, is why said bankers couldn’t have simply gathered the evidence that the people they wanted to reject were unacceptable risks, and made their case to the regulators.

The other thing I question is the linkage between the CRA and subprime. I was under the impression that a lot (most?) subprime loans were not given to poor people at all, but rather to middle class folks stretching to buy McMansions.

Wasn’t the CRA all about “redlining?”

And wouldn’t it, even if it was pushed, have had most effect in those areas?

The bubble and crash were not about blighted areas and forced loans to minorities. It was about a transformation of the entire industry to sub-prime or sub-prime-ish. The whole sales machine was about offering good risk clients the most highly leveraged options available. No one made banks offer HELOCs.

Here’s my CRA analogy:

I was walking downtown and I saw a car parked illegally. Later I heard a bank was robbed on the same street. Obviously, illegal parking is the problem … because I saw it with my own eyes.

@john personna:

Exactly the issue I was trying to raise. I thought the CRA was all about prohibiting a bank from looking at a map, saying “that’s a shitty neighborhood” and decided it wouldn’t lend to anyone there regardless of their qualifications.

I’ve heard claims that there were changes made in the mid-90s that made the CRA dangerous, but I’ve never seen that claim fleshed out.

…

My apologies, all, for my Lindsay Graham/Phil Gramm mix up.

@Eric Florack: Government didn’t create the derivatives market, didn’t force AIG to defraud customers and didn’t develop securitization. Government didn’t force banks to make a single loan. Anywhere.

@Rob in CT:

It didn’t force them to make loans. It simply made it illegal for banks to write off whole segments of the population regardless of their credit-worthiness, and it absolutely did not require them to over-leverage. In fact if you look at the CRA page the regulations specifically state banks are required to use best judgement on whether to make a loan.

There’s actually a way we can empirically test which sector is responsible for the crash.

1) A national law requiring 20% down in order to obtain a mortgage.

2) Make derivatives a regulated market with caps on leverage.

Does anyone seriously think that the meltdown would have happened if these had been in place? Government was asleep at the wheel and the banks stomped on the gas.

So, too, a lot of bankers and a lot of Repulicans, and other conservatives. Funny how they don’t get credit…

That’s what we were told, yes.

If it had been so written, yes. It wasn’t.

And by the way, no evidence of “redlining” exists, past there were some low income areas of cities that tended not to get loans…. but that also tended to have peple who couldn’t afford loans.

Ah, but poor folk don’t HAVE 20% down. That’s redlining. Profiling. Whatever.

It;s also common sense.

Oh, please. You mean the idiot who raves for the Huff and Puff?

The cheerleader for everything Leftist and Big Government?

Laughable.

@Eric Florack:

While I would agree with you that a lot of crazy things happened when the Republicans ran all 3 branches of government this strikes me as paranoia..

Still waiting for some proof of this. Or on you already on to the next rant?

Please prove this statement.