Britain Ending Checks

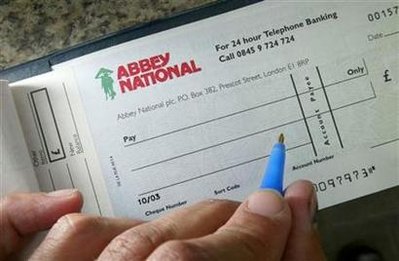

England is phasing out the bank check.

After more than three centuries, the humble check is set to become a historic relic after British banks voted to phase it out in favor of more modern payment methods.

The board of the UK Payments Council, the body for setting payment strategy in Britain, agreed on Wednesday to set a target date of October 31, 2018 for winding up the check clearing system. The board is largely made up of Britain’s leading banks.

“There are many more efficient ways of making payments than by paper in the 21st century, and the time is ripe for the economy as a whole to reap the benefits of its replacement,” Paul Smee, the council chief executive, said in a statement.

The use of checks has fallen drastically in the past 10 years as more consumers transfer money electronically, by direct debit or with debit and credit cards. Last year, around 3.8 million checks were written every day in Britain, compared to a peak of 10.9 million in 1990, the council said.

It costs about one pound to process every check.

“The next generation probably won’t even have a checkbook,” said Addy Frederick, a spokeswoman at the payments council.

But while many UK supermarkets, high street retailers and petrol stations have stopped accepting checks, they are still a popular form of payment among elderly people, many of whom find the idea of using automated cash machines intimidating. “Chip and pin is problematic for many older and housebound people and we know 6.4 million over 65s have never used the internet,” said Vicky Smith, a spokeswoman for the charity Age Concern. “Without checks, we are very concerned people will be forced to keep large amounts of cash in their home, leaving them vulnerable to theft and financial abuse.”

Well, they’ve got nine years to adapt. I mean, really, how hard is it to swipe a debit card?

My guess is that the UK’s action will be moot by 2018. The real question is whether we’ll still be carrying cash by then. My wife and I have long done most of our banking electronically and write perhaps two or three checks a month, usually for household services. And we mostly use cash for very small purchases. Once a convenient, secure, and efficient means of interpersonal electronic transfer is developed — likely through the nearly ubiquitous smart phones — the rationale for all of the old school financial instruments will be gone.

“The real question is whether we’ll still be carrying cash by then.”

It is an interesting issue. Aside from my poor who don’t have bank accounts, you also have the whole illicit economy — drugs, prostitution, gambling, etc. If there were no cash, it would lead to some pretty significant societal changes, I think.

If a society doesn’t have checks or cash, then it needs a mechanism to transfer funds from one person to another. Any suggestions?

Personally, I don’t think the phaseout of cash would ever happen in the US. Too many libertarians want to be able to spend anonymously.

Basically, a smartphone-to-smartphone variant of Paypal.

And, as Bernard notes, a whole lot more criminals. But cash is expensive to produce and manage compared to digits.

No cash, no checks. Nice idea but suffers one fatal flaw, at least. That is system failure. Namely, how will you buy what you require to live when the network is down? Can’t happen? Well, Blackberry was down today wasn’t it?

But more importantly, disaster strikes and the banking system stops for days if not weeks. Can’t happen? Hurricane Katrina. Many people found themselves in dire straits when they failed to get cash before the storm. I gave or loaned more than a few dollars to those who found the local cash machines to be cold hunks of metal after the storm. That piece of plastic is worthless without the network. That smartphone is pretty dumb without the network. A person to person transfer still needs to verify via the network that the money is there. If you didn’t have cash, you couldn’t buy ice, food, water or anything else. Sure you could depend on the efficiency and good graces of the government but in a disaster my money is on Walmart to provide at a good price.

Just because you haven’t experienced the failure doesn’t mean that the failure won’t be catastrophic when it happens.

Maybe when Microsoft puts out an OS that doesn’t crash or can’t be arbitrarily cut off, the people will trust a world with out a physical exchange medium. But when with a few key strokes you can be rendered penniless and starving, whether by error or malice, it is foolish to put all your dollars in one exchange medium.

I’m almost more concerned about having records of the transaction (for tax and business purposes) as whether the transaction goes forward itself.

JKB thinks like an American, what will we do when it all breaks down?

Basically, a smartphone-to-smartphone variant of Paypal.

Yeah, but these transactions cost money. How will the economy respond to the notion that every time you buy anything from anybody, you have to pay a transaction fee?

But cash is expensive to produce and manage compared to digits.

Producing and managing digits costs money, too. The thing is that right now it’s banks that are absorbing the cost. They do so because their customers are profitable. Who is going to monitor the accounts of those that are not profitable? How is someone that cannot get someone to manage their accounts going to buy or sell anything?

Given the sheer number of transactions that occur at present without any direct transactional cost, I am not sure that the printing of money that makes it all possible is more expensive than would be a system that had to be tapped in to any time anyone buys anything.

I do not want the government to be able to track every purchase I make. There cannot be enough safeguards to protect privacy when dealing with electronic transfers. That “criminals” need it is BS. Criminals us electronics. That is the same BS they use to attack gun rights. If I work for you and you try to pay me in something other than coin of the realm, you will understand why I value my gun rights.

I don’t see a phase out of cash, and in the US at least I think it will be a while before we see a phase out of checks, but I think it will happen.

Right now the only two methods I can pay my bills to the city (taxes, registration and water/sewage) is by cash or check. They do not accept credit cards or debit cards. Going checkless would make paying these bills a real pain in the tush.

I do think older people are the most resistant to ATMs and even online bill paying. I know my own mother before she passed refused to use an ATM and wouldn’t do any kind of monetary transactions online, because she didn’t trust them.

I work with an older teacher (she is in her early 60’s) who refuses to do direct deposit for her checks (even though the district offers them) and she won’t use ATM’s. She also doesn’t really use her computer.

I think people like her and my mother would protest this move, but like everything else they would adapt.

Eliminating checks is a classic 80-20 solution. It is a good solution for 80%+ of transactions. For the technorati, it works for the other 20% with a smartphone type solution. But it doesn’t work for large portions of the population (yes including the illegal and libertarian). I suspect that the banks will solve the problem with a marketplace solution. Already more people use credit/debit cards, on line bill paying, auto draft/deposit, etc. The use of checks will evolve to requiring a higher balance, monthly fees or per use fees. The poor will bear an outside cost (just as the poor tend to pay more to cash their pay check than the rich).

It is a big deal who pays the transaction costs. If banks unload the costs on to me, what do I get out of it? If the answer is nothing, then no thanks, I’m totally opposed.

ATM and credit card transactions are pretty expensive for the small business or individual. Not only a percentage is taken, but a flat fee of around 59 cents the last time I checked is also charged. Right now, checks costs nothing to write and I just don’t see how the cost of clearing a check could be one British pound, that’s ridiculous. With the US E-check system, the checks are scanned and then money moves electronically, the physical checks no longer have to be sent to a clearinghouse. That greatly reduces costs to the point where it doesn’t confer any more advantages to go to a card type system.

As for the poor, many don’t have bank accounts because they hate the fees and charges that they end up having to pay. Many simply walk away with a small negative balance. When you live paycheck to paycheck, and don’t keep minute by minute trak of every penny, it is easy to overdraft your account. And each time you do that a bunch of fees have to be paid so it’s better just to use cash and not run into that problem. You can’t be charged with overdraft fees and NSF fees if you use cash.

Cash or some untraceable method of payment will always exist because it is needed and demanded. The Black Market is as ancient as government and no regime has been able to totally destroy it. Foolish to think it’ll just go away.

I agree with Zelsdorf completely. Which I’m pretty sure means that this is the correct position.

I don’t see checks becoming obsolete. There will always be a distinct need for personal checks in some rare interpersonal circumstances, vide the laws of negotiable instruments, e.g., the maker’s marking a check for payment in full (re a disputed transaction) amounts legally to payment in full & trumps all oralities between the parties~~a swiped & signed card receipt simply can’t do such a job ; such circumstances are rare, but not unimportant, in commerce.

Another objection to discontinuing personal checks is the Federal Reserve/private banks/customers nexus: abolish private banks’ role & you’re left with the customer playing a usually losing & invariably frustrating game of ping-pong & telephone tag with some well-meaning credit-card-company outsourced functionary~~wannabee if not soi-disant English speaker~~in a Third World outpost somewhere beyond the seas!

A third objection~~according to my feeble lights~~ is that credit cards are tools of the bourgeoisie & the petite bourgeoisie, not of the poor & the humble, bless their hearts, to whose best interests in my opinion cash or personal checks are better suited than are credit cards!

Most shops in the UK stopped accepting cheques a few years ago. I write at most 2 a year now. Most of my major transactions are either electronic payment initiated by me from my bank account, or automatic Direct Debits where regular amounts are collected e.g. electric bill. Debit card covers most of the rest.

Cash is disappearing too – look at the contactless payment cards Barclays issue for example. Whilst still in their early days, they look promising – and can be integrated with mobile phones.