Food Prices Under Biden and Trump

We shouldn't be surprised that Americans have noticed their grocery bill.

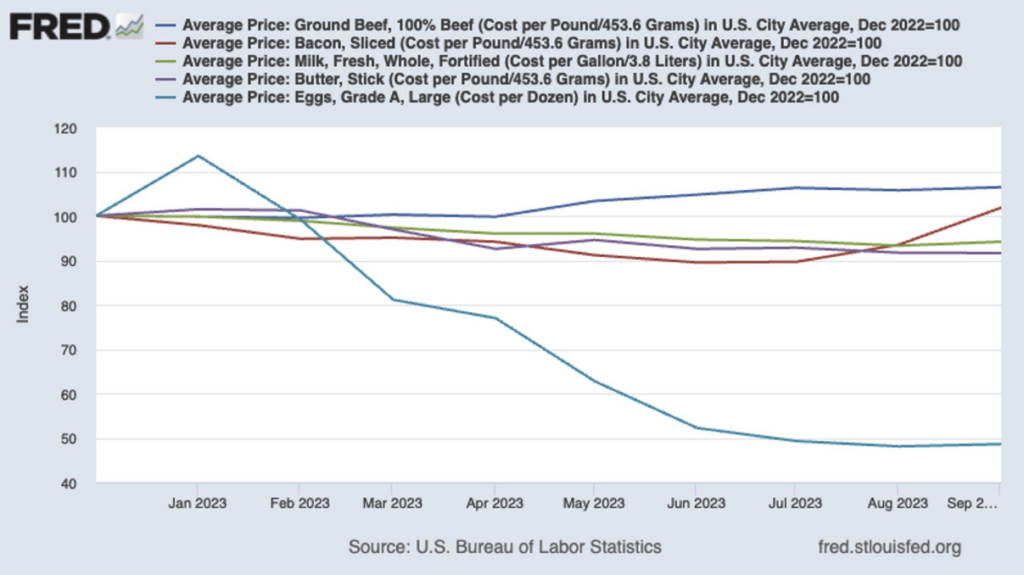

A weird post from Nobel laureate Paul Krugman at Bluesky Social this morning. He comments, “I’d be curious to see a survey asking people what they think has happened to the price of groceries this year (yes, they’re higher than 2020). They’ve actually been roughly flat — some up, some down. But I bet most people won’t believe that” above this chart:

As I responded, “December 2022 is a weird starting point for the graph if we’re looking at the perception that prices have gone up under Biden. They decidedly have!”

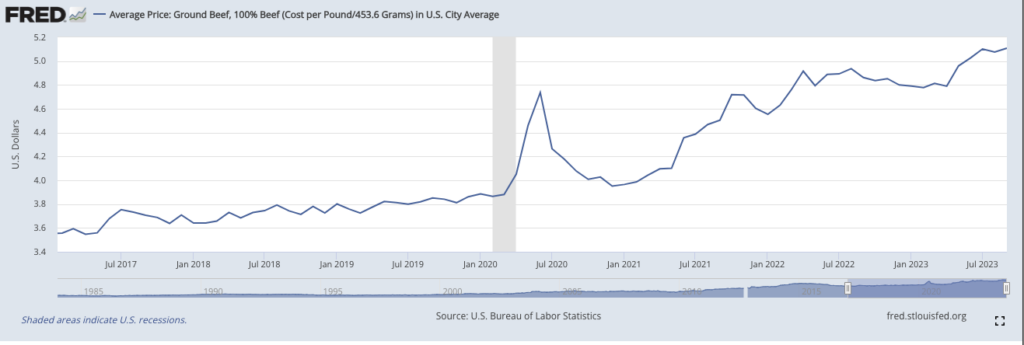

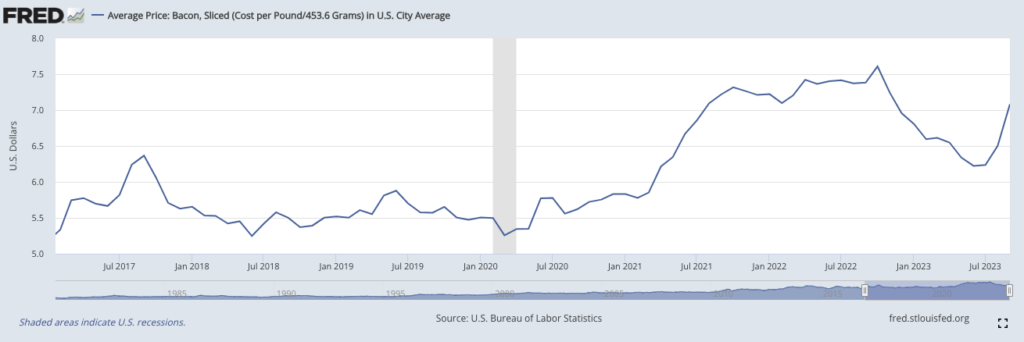

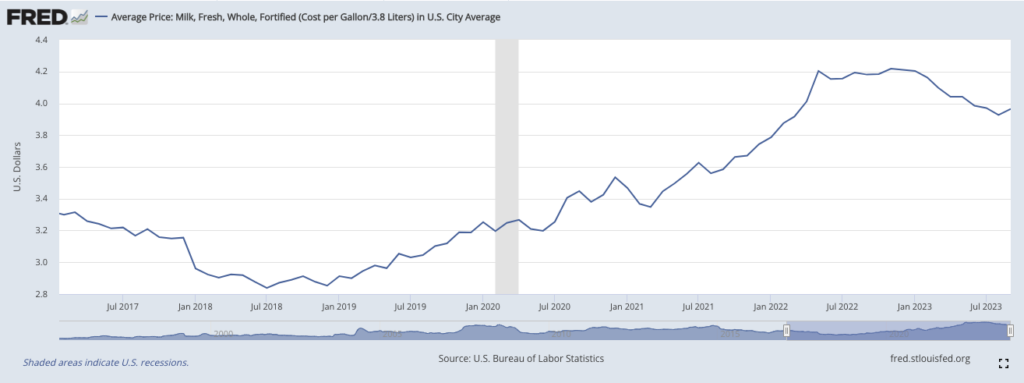

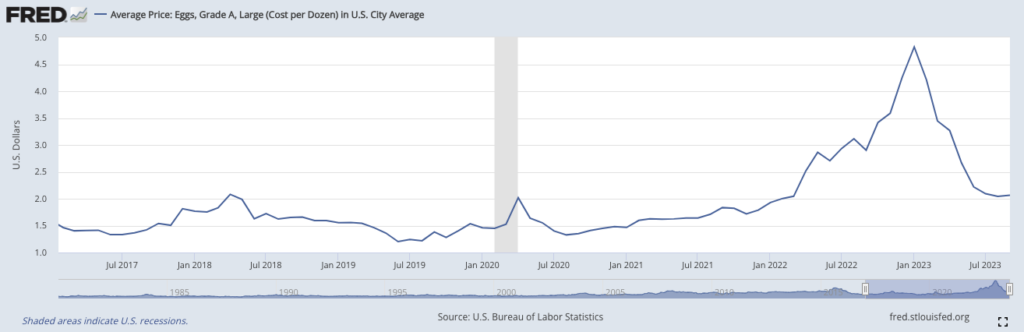

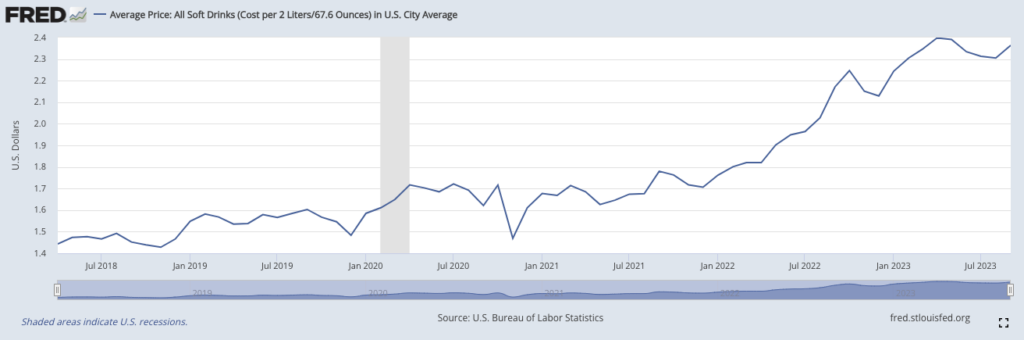

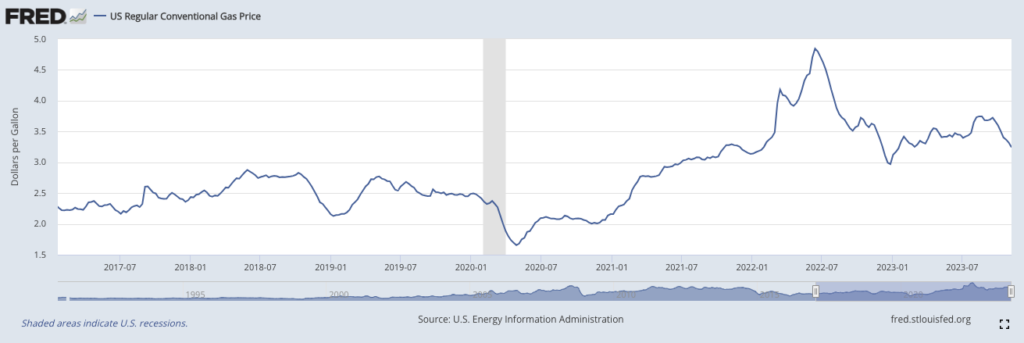

I haven’t figured out how to produce the five-product comparison graph so did it the hard way, looking at each of the five commodities in the list from January 20, 2017—the date of Trump’s inauguration—through September 1, 2023 (the max in the FRED dataset).

In the order of Krugman’s comparison . . .

Ground beef decidedly up both since January 2017 and since January 2021 (Biden’s inauguration).

Bacon way up in both time periods.

Ditto milk. (Who’s still buying whole milk, I don’t know.)

BLS apparently didn’t start tracking butter until June 2018. (Where one buys a single stick, I don’t know. 7-11 maybe?) But, yes, it’s more expensive now than when Trump took office and when Biden took office.

And ditto eggs, making it five for five. To be sure, they’re way down from the crisis point but they’re they’re still more expensive than they were during the Trump presidency.

Now, as I immediately noted in my Bluesky post, “That the President has next to nothing to do with the price of eggs and hamburger is, of course, noteworthy. But the public just knows things are considerably more expensive than they used to be.”

That was my intuitive sense and it was confirmed by checking the five items Krugman picked. And that’s to say nothing of the price of Diet Coke, which is through the roof.

(The data starts in April 2018.)

Again, I don’t think Biden has much to do with these price hikes. It’s likely that his two huge giveaway programs, ostensibly to provide COVID relief, contributed to overall inflation. That, indirectly, led the Fed to seriously jack up interest rates. Those all presumably had some marginal impact on food prices. His policies, especially the embargo on Russian energy (which I wholeheartedly endorse) also contributed to higher gas prices, which presumably impacted farming and delivery costs.

Now, as Kevin Drum continually reminds us, it’s not reasonable to look at prices in isolation—we really need to consider them in relation to people’s buying power which, in many cases, have gone up more than these prices. But people aren’t reasonable. Indeed, while I’m more analytical than probably 99% of people by both inclination and training, I don’t really do this. I still have “ought to cost” prices in my head that, for some items, are decades old and don’t adjust for inflation or my own increased affluence.

Further, as I’ve noted many times, we fixate on certain prices—gasoline, most especially, since the cost is generally in giant font visible from the road but also eggs, milk, bread, and ground beef—which have an outsized impact on our impression of cost. Anecdotally, while I think nothing of paying $9 for a glass of beer at a restaurant lunch, I plan my gasoline fill-ups around the lowest price stations that I expect to pass during the week. That’s true even though the 50 cents or so a gallon I save is less than the cost of that beer.

Regardless, prices of things people need have gone up considerably under Biden’s tenure and the people have noticed. They blame Biden for it. That’s a normal feature of politics in our abnormal political atmosphere.

That’s ALL we buy. We use it for coffee, and I use it for baking and things like sauces where the fat content of whole milk keeps the dish from curdling and/or splitting.

I’ve recently noticed that what we pay for groceries is coming down, but I haven’t done much analysis to see if it’s a result of me making different choices of what I buy, or if prices are moderating a bit.

Interesting. We buy 2% for milk and half and half for coffee. But my 14-year-old drinks it as a beverage, so whole milk would be too much.

Whole milk for morning cereal. Two percent is do-able, but barely, and skim is (little known fact) squeezed from the nipples of Satan.

You skip over that Biden’s action on his first day was to take direction against oil production and pipelines in the US. Sure there’s an embargo of Russian oil, but direct actions by Biden cut the US and Canadian oil available on the market.

I watch a farm channel. They just finished harvest (soybean/corn) and pointed out that they had used over 5000 gallons of off-road diesel through their fuel trailer, not counting direct fill up at the farm. Ironically, their corn goes to the ethanol plant to be made into transportation ethanol.

As I’ve pointed out, fog in the Houston Ship canal for a week will add at least 5 cents to fuel prices. But that was 20 years ago, and would be muted if North American oil production wasn’t being restricted so that investment in refineries that could processes it in North America was rational. That’s direct presidential executive orders.

I can buy an 18 egg carton for a $1.60 and free range, antibiotic-free eggs for about 3 bucks, up from $2.80 a dozen. During the global bird flu those prices skyrocketed.

As far as beef prices go, there are fewer cattle ranchers, not because ranchers are concerned about environmental damage or that demand is down, but drought and the corresponding high price of feed make raising livestock far less profitable. Prices are up because of scarcity.

Gas prices are down to less than $3.00 a gallon. People who use a large pickup truck or SUV as their main transportation, which includes a lot of southern suburbanites, that price may still be painful, but ignoring the volatility of oil prices has a cost. I had to laugh at the fools who rushed out to buy those monster trucks when oil prices came down after our wars calmed down.

@JKB:

Judge in Alaska upholds Biden administration’s approval of the massive Willow oil-drilling project

@JKB: We just can’t fry the planet quick enough for you, can we?

@JKB: U.S. oil production hits all-time high, conflicting with efforts to curb climate change

You’d have to run the numbers, but you could make whole milk when needed. Industrial milk production, strips the water (skim milk) from the milk fat (heavy cream) and then recombines them at packaging into the consistent “varieties”. No reason you can’t mix your own to get a higher/less milk fat content. Often unsalted butter is added when you can’t find a cream with enough fat content for making such things as your own clotted cream. I tried a recipe for the latter recently that used the microwave and took 20 minutes. Likely not as good as the traditional 8 hours in a low Devonshire oven, but tasty none the less.

@Jen:

@Steven L. Taylor:

Don’t bother him with facts, it’ll just confuse him, leading to denial.

@Steven L. Taylor:

And what would have been without:

Markets adapt, but as pointed out in James’ post, the starting point for the comparison matters. And then you have to look at what could have been without the bans. Biden is on record to ending fossil fuels, which naturally impedes investment in new fossil fuel production capacity since that infrastructure has a 30-40 year payback timeline.

Beef prices are going to go even higher. We “normally” get between $1.40 to $1.70/lb for our calves, depending on their weight. This year, the average is around $3.00/lb.

@JKB: Were the goalposts heavy?

I happened to mention here a day or two ago that I filled gas this week at $2.999. Your charts show four out of the five prices down lately. I’m waitlisted at Bluesky, but I expect Dr. K’s point was not that inflation didn’t happen but that that voters don’t recognize it’s basically over.

I see complaints that prices haven’t come down yet. I don’t expect the average voter to understand that’s not the way it works or that disinflation would be bad. Nor do I expect them to know inflation is largely over or that we came through it better than anyone else in the G7. But I don’t see anything wrong with Dr. K mentioning things like this.

It’s a year to the election. Most voters don’t react to anything over six months old. A lot can happen in the next six months to a year. Biden could die or have a serious health episode. IMO Trump’s more likely to. Trump may be appealing one or more convictions. One of the wars could go south or another break out. Inflation could restart. We could have a recession. That would be Jay Powell’s fault but voters would blame Biden. But with any luck, memory of inflation will have faded.

Bottom line, the electorate are a box of rocks and we almost always reelect the incumbent prez. Carter being the exception while H. W. is the exception that proofs the rule, being the third GOP term.

Ah, but imagine if that fifty cents was delivered in the form of a punch card.

18th punch = 1 beer, gratis.

(Bob’s Bail Bonds and DUI Lawyer, LLC branded paper bag available upon request. Please don’t drink and drive.)

@Steven L. Taylor:

You don’t understand how strong he’s gotten from the constant reps of moving them.

Also his sprinting skills have become legendary given how often he runs away when someone points out those types of flaws in his arguments.

@Jen: My wife drinks it as a palliative for her osteoporosis.

@mattbernius: Well, I do support exercise for good health!

@Steven L. Taylor:

Also, JKB fails to account for refinery capacity.

But hey I am sure it’s Joe Biden’s fault for not magically creating more refineries the moment he took office in order to increase production capacity.

Note: other reports suggest we are at slight under 100% capacity… In this case up to 92%… Slackers!

But also that is the highest it’s been at, including under the last administration.

Source: https://www.hydrocarbonengineering.com/refining/10072023/us-refinery-capacity-increased-at-the-start-of-2023-for-the-first-time-since-the-covid-19-pandemic/#:~:text=US%20operable%20atmospheric%20crude%20oil,at%20the%20start%20of%202022.

@JKB: While this will displease many commentators here, in this particular observation JKB is not wrong as such.

However where he is wrong is underlying implicit conclusion he has, that this is the policy error of Biden and the Democrats. It is not, as regardless of their leasing policy, the economic position of most hydrocarbons, ex low cost nat gas, is becoming increasingly weak in comparison with Renewables on a generalised levelised cost basis for utility scale (however, the key words are generalised and utility scale)

The policy error to date – which is shared with Europe in part although USA has a worse problem – is the lack of necessary level of action on the leading binding constraint for Renewables: grid infrastructure at Transmission level and at Distrubution level (or wholesale and retail). There needs to be massive expansion / upgrading of both levels, which needs a massive acceleration of permitting and over-riding particularly Anglo-Saxon world NIMBYism to allow investment to flow (even then the timing is quite fraught to meet targets, it is without a concetration on this issue utterly impossible).

Secondarily now with interest rates returning to historical normal levels, there is a need for government risk backstopping to bridge over the capital cost transition as markets reset – i.e. big government guarantees to pricing on projects to lower cost of capital up-front.

Third of course is the Base Load and Grid Frequency services problem and decarbnosing both of those, which is at once a grid modernisation problem in part, but as much a replacement of natural gas problem as the choices for no-carbon-emissions (direct) are either currently extremely expensive storage or nuclear (or a combination of the two, as not an either/or choice).

Without attention to this, the JKBs will inadvertantly have reason for their attacks on RE as it will become a cluster-fuck due to magical thinking and wooley headed lefty greeny NGO objectives not being aligned with engineering realities. An avoidable one as the medium term RE is excellent and should and must replace hydrocarbons. But without such attention, the “underinvestment” in fossil fuel / hydrocarbons will lose the quote marks and become an energy crisis.

With attention to the grid expansion issue and the Base/Frequency services, economies of scale will generally address the hand-wringing and have positive returns.

But this is an area where real government intervention is needed as market change from current quasi equilibrium to RE focused equilibrium will not happen without significant policy / government support.

@Lounsbury:

Honestly, this is a common issue with his posts in general.

Which gets to the challenge of motivated reasoning. Granted that is something we all need to work on.

This is a really important point. I have only a passing understanding of this, but our grid is in terrible shape and a huge vulnerability for us.

And to your point, I don’t think either party is particularly good when it comes to dealing with that issue.

While consumer prices for beef are up significantly, it’s interesting to note that the commodity prices for beef are about 30% less than they were at the peak in 2015.

So obviously the price of ground beef is the result of monetary policy and has nothing to do with the massive consolidation of the meat packing industry that has allowed a handful of companies to extort monopoly profits out of both consumers and producers

@James Joyner: That’s interesting. Where I shop, the difference between whole and 2% (house brands) is about 10 or 15 cents.

And I don’t know who buys whole milk either, but the store I shop at stocks about twice as much whole as 2%.

@mattbernius:

Sure, but if he acknowledges that, he won’t be able to criticize wooly-headed lefty greenies and their thinking, will he?

@Sleeping Dog: Yeah, thus my laziness of just dropping a link rather than adding any expository preamble… 😀

@Lounsbury: And you seriously think no one in DOE and their State counterparts are working transmission infrastructure.? This is the problem with 90% of the people posting ‘hot takes’ on the internet– They assume that things not in the media don’t exist.

Unfortunately, the nuts and bolts of technocracy, where shit actually has to get done (and work) is not entertaining enough for click-bait driven media. Do you think the gasoline delivery infrastructure appeared the year after the first horseless carriages took to the roads?

Put on Wheel of Fortune and let the experts handle the details.

The latest health research has been rather positive for full fat dairy.

Perhaps relatedly, at the finish line of a recent marathon, they had some cartons of full fat chocolate milk. This is a departure from the typical practice of only offering 1% (sometimes 2%).

I’ve only once seen strawberry milk on offer at the finish line. I would’ve been outraged if I hadn’t been knackered from having just run all the miles. That stuff is revolting in the best of times. What monster drinks it at the end of a marathon?

Interestingly, I just learned that while flavored milk is typically more expensive than the regular stuff, sometimes it is less expensive. Economics is interesting. In part because it **seems** so capricious.

@Mimai:

**unpack**

Many cases are not all cases.

Looking at averages hides a ton of variability – a point I’ve made before. The implication that people are stupid and don’t understand their own situation because someone posts a graph of averaged high-level statistics is missing the trees for the forest. Note that I’m not criticizing you for that, but that’s what Drum, Krugman, and many others on the left are doing.

There is a difference, for example, between “wages” and “incomes.”

Additionally, inflation is always very bad for people on fixed incomes, and this latest bout is no exception. Even with COLA adjustments, those adjustments only happen annually, which means people’s incomes effectively decrease over the course of a year while prices increase until the adjustment takes place. And those adjustments are often based on measures, like CPI, that are not a complete picture and are arguably insufficient to keep up.

Finally, things are not evenly distributed across geography either. The midwest, in particular, is underperforming compared to the rest of the country, which is also where several key battleground states are that will be crucial in determining who wins next year. This is another thing that averaged national statistics hide. And those who want to cheerlead “Bidenomics” should be cognizant of the actual economic realities with the key demographics in battleground states and not suggest that people are too stupid to understand how great the economy is.

@Andy:

Actually, it isn’t. Drum and Krugman, in particular, do not claim that people are wrong about being worse off than they were before the spike of inflation hit.

What they do claim is that people are clueless* about both the short-term causal factors behind inflation and the longer-term systemic factors behind increasing wealth disparity and blue collar wage stagnation. Noting that Biden’s necessary emergency intervention was only necessary because Republicans blocked the relevant preventive measures is… an oversimplification, but closer to reality than “Biden handouts trashed your buying power.”

@Michael Reynolds:

Whole milk tastes like milk, and is useful for drinking, sauces, and light-roast coffee.

2% tastes like watered milk, and is reasonable on very sugary cereals, or for making muesli.

Skim milk tastes like dirty water, and if it is useful for something I haven’t discovered it yet. My wife puts it in her coffee, which I literally cannot watch.

In Iceland, at least in 1992 when I was buying groceries there, whole milk was 8%. Heavenly. They also had a full range of yogurts and skyr, from thin enough to pour over cereal to thick enough that the knife would stand up in it.

@DrDaveT:

My great grandfather was born in Sweden and he only used or drank buttermilk. I thought it was foul.

He basically only drank buttermilk, beer, and aquavit.

@DrDaveT:

Well, yours is certainly a more nuanced take.

And I have been consistently clear that I think Presidents do not have much actual control of the economy, so I find arguments from the right that bad things are Biden’s fault, and arguments on the left about “Bidenomics” being this great success to be largely without merit. A President has no real control over prices, wages, or incomes.

But I think you are probably right my take is unfair to Krugman and Drum, but I do see a lot of commentary along the lines that I described.

Rub A Dub Dub, Thanks For The Grub

One of my staples is Kroger canned french cut green beans. The regular price of a single 14.5 oz can costs 89¢. I buy the four pack of 14.5 cans at the regular price of $3.29 that lowers the per can price to 82.25¢/can. The four pack regularly goes on sale for $2.99 (74.75¢/can). The four pack sale price usually lasts a week or two. Just the other day as I was grabbing an on sale four pack I noticed that the single 14.5 oz cans were on sale for 50¢! I’m in green bean heaven!

Another item I buy all the time is the Big K 2 liter diet cola. Wasn’t that long ago that it was 89¢ going on sale for 79¢. Those days are a memory. 99¢ then $1.09 to $1.25 and then $1.50 a week or so ago. Right after it topped out at $1.50 recently it went on sale for $1.25 and last week the sale price dropped to $1.00. Go figure.

The real bite in the ass that I just discovered today as I was reviewing my Medicare coverage is that the monthly premium for Part D (drugs that I do not take) has more than doubled for 2024. At least I have time to search for a hopefully lower cost plan.

I know that this is a thread about food cost but since @Jim Brown 32: brought up transmission infrastructure I will note that the local electric and gas utility where I live (AmerenIllinois) has been spending time and money repairing and replacing electric power facilities and natural gas lines recently.

It gets noticed on the local Facebook pages when residents gripe about the holes being dug. Usually but not always in easements and public right of way.

@Andy:

If people cannot be bothered to implement simple dollar cost averaging strategy for their Mac and Cheese purchases to protect themselves from price variability, I don’t think we can call them anything other than stupid.

@Kurtz:

**No thanks, I’ve got an early morning.**

I was referring to the tendency (my own in particular) to encounter some bit of economic data, be unable to make immediate sense of it, and then conclude that…

…this is random

…this is [convenient scapegoat]’s fault

…this is…

…this is…

…this is…

@Steven L. Taylor: Only one problem; A larger portion of that is being exported. Hence the higher prices where.

When I’m paying $5 a gallon for Diesel, trust me, you’re paying more for everything delivered by truck…. which is…. well…. EVERYTHING.@Steven L. Taylor:

@Andy:

I’ve been howling this into the void for most of my adult life.

@DrDaveT:

800 earthquakes in Iceland in 12 hours. Butter must churn itself.

@Jim Brown 32:

Quite the typical straw man, I suppose arising also from impoverished reading.

Working on grid and sufficient action on grid are not the same thing.

Yes there is action, it is deeply, deeply insufficient in respect to the need (capital, legal red tape cutting etc) – and rather too much is centred on the wrong things (although these are easier things which is partially explanatory).

Now of course you can have a silly superficial party political reaction, a tribalist howl (rather like the broad range of populist progressive reaction on the inflation subjecT), or realise there is a real issue which needs to be addressed in order to succeed the difficult challenge.

@mattbernius: I should note that Biden has taken action (albeit with dangerous blind spots) where his Repubican predecessors have not. Therefor points to the Biden side of Democrats.

@Andy: Krugman’s economic writing is not so simplistic as you rendered it. He is a very good economist, all politics aside.

“Looking at averages hides a ton of variability”

But it also gives you a lot of info. IIRC, wages have been running a bit ahead of inflation. That means, roughly, about 55% of people are ahead of inflation and 45% are behind. Yet in polls well more than 45% claim to have been hurt by inflation. So a lot of people are ignoring that they are better off. Then you have the people on fixed income. Some of them are behind, but the things that inflate faster than COLA are mostly things like health care, which COLA never catches, so they arent really any worse off now than they have been for the last 20-30 years.

Steve

@steve: It is questionable on a net basis if they are “better off” or not, but the reply shows exactly how partisan blinders leads to blindness.

Framing as ignoring how they are (possibly) better off is to commit a self-harming analytical misframing, they are reacting in quite predictable and structured ways to inflation. One that we see in every market where there is a spike in surprise inflation, humans hate it. Hate.

The cognitive framing – biases – for this are fairly well-known and one has to accept as fundamentally unchangeable. Engaging in egg-head intellectual argument on the point really is a dead end (this leaving aside if on a net-basis there has been enough net-cash catch-up that household really have recouped short-fall from inflationary spike – that requires more data than broad averages and by historical metrics I rather doubt that is yet the case, emphasis yet, although it will be if inflation is brought down).

Overall, behavioural economics (amongst other research, I just happen to read economics) has over past two decades detected in the end quite unsurprising structured cognitive bias on human side to loss-aversion and overweighting loss (in pure numeric terms) relative to gain – something like 5:1 as I recall (but that is mere memory and quite possibly wrong, misrecall or outdated).

When one thinks about how human cognition has evolved, I frankly find this unsurpising and sensible – until probably modern economies, as a biological heuristic for survival it is quite sensible as a risk management.

This is what you have to work with politically – strong bias to perceived loss aversion and an anchoring of those values. There is no way around it, so one has to massage it, not argue with it.

@Just nutha ignint cracker: Oh, the price difference is negligible—maybe 20 or 30 cents a gallon. It’s just too much fat and calories at the rate she drinks it.

Generally people use about only 10% of their budget for food. If food were to go up 2 of 5% it would still only affect their budget slightly

@Lounsbury:

And those need factors get to how each parties attentions and biases help create the problem in the US. My understanding is one party doesn’t want the government to invest in infrastructure (because many see it as the responsibility of private enterprise) and the other party focuses of maintaining heavy regulation of the work.

There are understandable reasons for both POV, but taken together it’s an expectation toxic mix.

Are there other key high level challenges on this?

@mattbernius: Of course the Republicans are in some nihilistic trap opposing any government action so the blame on lack of infrastructure action in USA must lay heavily with them.

Amongst the critical issues for both of RE investment and Grid upgrades are

(1) Cost of capital: given interest rate rises, there is a need for government guarantees to bring down

(2) Timing: NIMBYism, excessive red-tape, this for all aspects. Grid expansion (rights of way, interconnexions), grid connexions (the utter madness of decentralisation you have frankly causes my mind to hurt when I am exposed to it, really here Central Government badly needs to bang heads together on national),

— and additionally the sheer madness of short-term Left Greeny purity ponyism around permitting for such green enabling infra (see the idiot Greta and Norway) – where if one really understands climate as a genuine crisis, not merely a “crisis” for internet drama Llama declarations, one need to bite down as the clock is ticking at a speed that Lefty progressive stakeholder processes and time-to-decisions do not fit with*.

(3) Supply Chain and Industrial Scaling: as the Financial Times in as I recall September profiled the challenge of cabling alone, which is simply insufficient (ah yes here: https://www.ft.com/content/c88c0c6d-c4b2-4c16-9b51-7b8beed88d75) . I believe the Economist had similar this year as well. Grid expansion needs a massive industrial expansion of certain industrial equipment production – things one does not simply throw together like Apps.

Scaling up this kind of industrial investment needs solid lead times. I do invest in some of these things. It’s bloody hard and not enough is happening. Not by a long English mile. There is dangerous underestimation of how hard this is, how much investment is needed as we are starting to bump into capacity constraints and that is causing price rises that is eating away right now at RE price advantage – which is alarming to me at the level that the “Progressive” Left has latched on to some simplistic (and poorly understood by them) numbers that risk becoming false unless the challenge on the investment side is really grappled with.

*: as indeed something I work on where the bloody American side with Lefty NGOs wants us to generate a fucking report on whether the RE infra has taken into account fucking disabled people… no it hasn’t and it’s fucking irrelevant if you want to get it done at the forecast cost, timing.

the physics of Turbines, grid, economist April 23 to supply the link. It is to be noted journalistic technooptimism aside, the technology upgrades and grid changes are massive endeavours adding more system complexity. While certain modernisation is needed the danger is combination of cost to rate payers and lefty NGO engineering innumeracy underestimating up front transition cost and time and engaging in magical thinking that risks playing right into American climate denialism

proving that the Eco-Freaks want to end Farming we we would be forced to eat plant based junk and goo and with Gates buying up all that Farmland plus Swabe and the rest of the Globalists lowlifes

@Steven L. Taylor:

So… it takes three years for demand to push production?