Gas Prices and Pay Raises

The most consumer-visible commodity is down for the 67th consecutive day.

CNN Business senior writer Chris Isidore informs us “America just got a $100-a-month raise.”

Next time you stop at a gas station, think of it as a $100-a-month tax cut. Or a maybe $100-a-month raise.

The steady drop in gas prices over the last few months has turned into an unexpected form of economic stimulus, coming at a time when the Federal Reserve is trying to cool the economy and battle rising prices with higher interest rates.

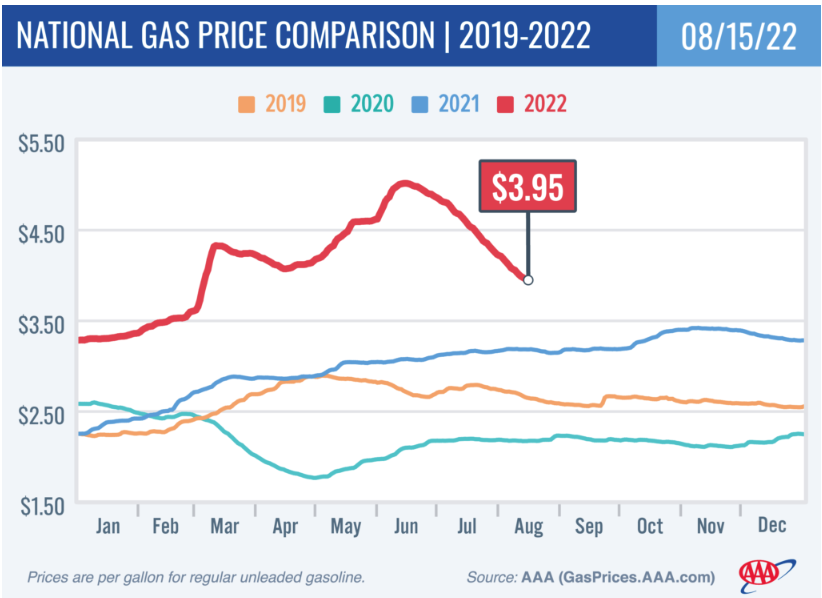

Since hitting a record of $5.02 a gallon on June 14, the national average price for regular gas is down $1.10, or 22%, to $3.92, according to AAA. That average has now fallen for 67 consecutive days.

Since the typical US household uses about 90 gallons of gas a month, the $1.10 drop in prices equals a savings of $98.82.

The impact of the extra cash could be a substantial boost to an economy that is showing signs of consumers pulling back on purchasing nonessential items, such as clothing, electronics and household goods.

This is all, of course, good news for Americans writ large and for President Biden and the Democratic Party’s prospects in the November midterms. And, sure, a drop in prices is tantamount to a pay increase (and, indeed, one that’s not subject to income taxes).

But it’s also a rather silly framing of the story. If one looks at the same AAA data, we see that, while the current $3.908 average for Regular is indeed lower than it was a week or a month ago, it’s still considerably higher than the $3.172 it was a year ago.

The site isn’t organized such that I can easily find longer-term data but a report from last week has this chart:

Let’s throw out 2020, given that demand dropped precipitously during the height of the COVID-19 pandemic and the lockdowns. But prices are considerably higher—indeed, by more than they were in the 2019 or 2021. It’s just ridiculous to say that, because they’re not as high as they were during this year’s spike, we should be grateful for a raise. Indeed, if anything, we’ve taken a pay cut of about the same amount as Isidore claims we’ve had a hike.

To make the obvious caveat: essentially none of this is President Biden’s fault. The energy market is global, after all. Of course, this also applies to the silly claim that the price hike was mostly about greedy oil companies. Did they suddenly stop being greedy?

Yes, this is a really silly framing of the story. Actual wages are up. Let’s talk about that. Because after decades of wage stagnation, this is actually new news. It’s just not advertised on big signs along the highway.

If I recall correctly, Biden asked the Saudis to pump more oil to prevent the big price spike, and they refused.

So, in that sense, it is about greedy oil … somethings.

@Jay L Gischer: That Kushner bribery money has to come from somewhere.

Reasoning here is a bit odd. Homicidal maniacs don’t have to commit murder every single day.

@DK: You mean it didn’t come from Yemen?

@DK: Absent some phenomenal level of undetected collusion, it’s really hard to manage large-scale price fixing. The oil companies always want to charge as much as they can get away with but station owners are naturally going to try to compete on price by undercutting competitors by at least a cent.

@James Joyner:

Isn’t the English language word for that “greedy?”

Oil company executives were exposed to all the same stories we were about the hurt that was put on the average American driver by $5 gas. The people in those positions have choice, so charging as much as they could get away with versus almost as much or even only as much as they needed to turn a decent profit wasn‘t beyond their control. In the second quarter this year, Exxon alone reported a profit of $17.9 billion – the highest quarterly profit reported by any oil company in history – while Chevron reported $11.6 billion, Shell reported $11.47 billion, and BP reported $8.45 billion.

I’m not saying that charging as much as possible isn’t natural in the commodities market, but it ain’t altruism.

@Scott F.: Greed is a constant, not a variable that’s useful in explaining wild variations in prices over a short period.

@James Joyner:

That is an abdication of personal agency that I’m not able to square with my aspirations for a moral universe that bends towards justice. YMMV

Oil powers and companies do not fix prices these days. They restrict supply. This is observable in California’s history. We used to have more oil refineries but some were closed for not being “efficient” enough. No new ones were opened.

And this is what the Saudis do, too. They can pump a lot more oil than they do, but they are very good at guessing how much will be best for them.

Nothing illegal about this, it seems.

@Jay L Gischer:

Irrespective of why an existing refinery closed, building a new one in Cali would be nigh on impossible.

{edit} They can’t even build middle class housing.

@James Joyner:

The energy industry is pretty consolidated, and there are a variety of choke points, so it’s not that hard to imagine.

Absent explanations for where capacity was restricted, and what caused that constriction to ease, I don’t see why we would rule out manipulation of the energy markets.

@Gustopher: We rule it out because, if energy companies could essentially double the price of gas overnight, they wouldn’t allow it to drop 67 days in a row.

Gonna be hard for me to get a $100 raise out of this when

1) Gas is still selling for about $4.69 9/10 per gallon here and

2) I didn’t spend $100 on gas during the previous month. But I admit to being an outlier.

(And I don’t lose 40 pounds in a year by cutting out one latte a week either 🙁 )

@James Joyner: Collusion breaks when one partner doesn’t play along. Regulators beginning to look to closely so they back off, or one party desiring to produce a little more at high prices causes a failure of the commons when everyone else decides to do the same, etc.

Who is producing or refining more oil, and why? Why were they not doing so before? Is this Russian oil working it’s way around sanctions? Has usage plummeted for some reason?

There’s a cause. And we know that it is human actions and decisions, rather than the Earth just spewing out more oil entirely spontaneously.

Why would you assume that these human decisions are entirely a free and fair market balancing supply, demand and production?

https://www.nytimes.com/2022/08/04/business/us-oil-prices.html

Oh, it’s collusion among the major oil producers, who have been limiting supply, and have decided to ease it.

But no reporting in the NYTimes as to why they decided to increase production.

(It does come after Biden’s trip to Saudi Arabia, if I am remembering correctly. Perhaps he gave MBS a bone saw?)

@James Joyner:

Not to mention energy companies had historic losses in 2020.

It’s almost like supply and demand might be the major factor when it comes to gas prices.

@Andy: That’s kinda my working theory.

@Jay L Gischer:

That’s at least partially spin.

If I understand the whole situation correctly (which is unlikely 🙂 ) Saudis agreed to increase current output to around max. but refused to put money into increasing capacity

1) Perhaps a snipe back at Biden re. MBS? Maybe, in part.

2) But also at reports of US during recent price trough of threatening Saudi’s if they didn’t restrict output.

Common American response: “but that was a different administration!”

Please note: rest of world does not, a lot of the time, care about admin. in DC: it’s just “the United States” and that’s that.

3) Saudis may actually have other things they want to spend money on right now.

If you look at the outputs, Arabia has increased production from existing capacity; and so has everybody else.

But not pouring money into new capacity.

Anyone with sense can see that fossil hydrocarbon investment has limited time horizon on returns.

But in any case, oil and petrol prices are edging down.

For now.

(I wonder how often Khamenei wakes up, has a morning cackle, and says: “Shall I push the button today? Hmm?”)

Anyway, in the larger picture oil/petrol prices are secondary.

Primary (sorry Americans) are natural gas and electricity prices in Europe over the next six months.

“Winter is coming!”