GREEDY GERIATRICS

Steve Chapman has an amusing piece on Social Security in Slate.

When Social Security was founded, offering a federal pension at age 65, most of the people born 65 years earlier couldn’t take advantage of it. They were dead. For the lucky ones who lived long enough to collect, the new pension system, founded in 1935, was meant as a modest support in the brief span before they passed on to glory. No more. Since then, life expectancy at birth in America has increased to more than 77 years. For the majority of people, that means lots of time being supported by the government. A working life is now just a tedious interregnum between two long periods of comfortable dependence.

America’s elderly have never had it so good. They enjoy better health than any previous generation of old people, high incomes and ample assets, access to a host of medical treatments that not only keep them alive but let them enjoy their extra years, and a riotous multitude of ways to spoil their grandchildren. Still they are not content. From gratefully accepting a basic level of assistance back in the early decades of Social Security, America’s elderly have come to expect everything their durable little hearts desire.

Retirement benefits used to be just one of the federal government’s many maternal functions. But in recent years, the federal government has begun to look like an appendage of Social Security. In 2000, 35 percent of all federal spending dollars went to Social Security and Medicare. By 2040, barring an increase in total federal outlays, they’ll account for more than 60 percent of the budget. And that’s before you add in the prescription drug benefit. Most of the projected growth is due to rising health-care costs, not to the aging of the population, according to the Congressional Budget Office. Retirees eyeing this bounty feel no pangs of guilt, thanks to their unshakable conviction that they earned every dime by sweat and toil. In fact, economists Laurence Kotlikoff and Jagadeesh Gokhale say that a typical man reaching age 65 today will get a net windfall of more than $70,000 over his remaining years. A luckless 25-year-old, by contrast, can count on paying $322,000 more in payroll taxes than he will ever get back in benefits.

Why do we keep indulging the grizzled ones? The most obvious reason is that they are so tireless and well-organized in demanding alms. No politician ever lost an election because he was too generous to little old ladies. A lot of people are suckered by the image of financially strapped seniors, even though the poverty rate among those 65 and over has been lower than that for the population as a whole since 1974. But it’s not just the interests of old coots that are being served here. Young and middle-aged adults tend to look kindly upon lavish federal generosity to Grandma because it means she won’t be hitting them up for help. Paying taxes may be onerous, but it’s nothing compared to the cost, financial and otherwise, of adding a mother-in-law suite to the house. Working-age folks also assume that whatever they bestow upon today’s seniors will be likewise bestowed on them, and in the not too distant future. It’s not really fair to blame the greatest generation for this extravagance. They are guilty, but they have an accomplice.

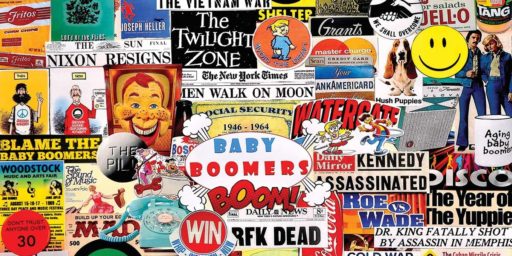

It’s surely no coincidence that the new drug benefit is being enacted just as the first baby boomers are nearing retirement age. Nor can it be forgotten that the organization formerly known as the American Association of Retired People–it’s now just AARP–has lately broadened its membership to include all the boomers it can get its wrinkled hands on. AARP, to the surprise of many, endorsed the plan. And what a surprise it is that the prescription drug program, which will cost some $400 billion over the next 10 years, could balloon to $2 trillion in the 10 years following that–when guess-who will be collecting. You would expect taxpayers in their peak earning years to recoil in horror from a program that will vastly increase Washington’s fiscal obligations for decades to come. In fact, they–make that we–can see that the time to lock in a prosperous old age is now, before twentysomethings know what’s hit them.

We already knew most of this, of course. Indeed, we have known this for 20 years or more but really haven’t done anything about it.

Sadly, we’re actually in far better shape than our European and Canadian brethren, since our retirement benefits are less generous and we have more young people as a percentage of our population.

America (especially the left) talks a good game about “the children,” but apparently it doesn’t mind enslaving them. I see an old guy in a dog sled: “On You Huskies! (whip crack).

—