Income Mobility in the United States

Defying every rule in the bloggers’ code, commenter Hal has taken it upon himself to conduct some actual research into the various assertions about income mobility bandied about here and elsewhere in response to a recent Thomas Sowell column. In so doing, he unearthed an interesting Treasury Department report from November 13, entitled “INCOME MOBILITY IN THE U.S. FROM 1996 TO 2005,” whcih largely mirrors — indeed, was likely the basis for — Sowell’s column. It’s available here in PDF format.

Defying every rule in the bloggers’ code, commenter Hal has taken it upon himself to conduct some actual research into the various assertions about income mobility bandied about here and elsewhere in response to a recent Thomas Sowell column. In so doing, he unearthed an interesting Treasury Department report from November 13, entitled “INCOME MOBILITY IN THE U.S. FROM 1996 TO 2005,” whcih largely mirrors — indeed, was likely the basis for — Sowell’s column. It’s available here in PDF format.

The key findings highlighted in the executive summary:

- There was considerable income mobility of individuals in the U.S. economy during the 1996 through 2005 period with roughly half of taxpayers who began in the bottom quintile moving up to a higher income group within 10 years.

- About 55 percent of taxpayers moved to a different income quintile within 10 years.

- Among those with the very highest incomes in 1996 — the top 1/100 of 1 percent — only 25 percent remained in this group in 2005. Moreover, the median real income of these taxpayers declined over this period.

- The degree of mobility among income groups is unchanged from the prior decade (1987 through 1996).

- Economic growth resulted in rising incomes for most taxpayers over the period from 1996 to 2005. Median incomes of all taxpayers increased by 24 percent after adjusting for inflation. The real incomes of two-thirds of all taxpayers increased over this period. In addition, the median incomes of those initially in the lower income groups increased more than the median incomes of those initially in the higher income groups.

While the larger trends cited by Sowell would seem to have an empirical basis, what about the discussion about the infamous “top one percent”? That remains somewhat elusive. These excerpts are somewhat helpful, though:

Nearly 58 percent of households (i.e., 57.6 = 100 — 42.4) in the lowest income quintile in 1996 had moved to a higher quintile by 2005. While 29 percent moved up to the second quintile, the same percentage moved up at least two quintiles, and about 5 percent moved all the way to the top quintile.

[…]

The mobility of the top 1 percent of the income distribution is also important. More than half (57.4 percent = 100 — 42.6) of the top 1 percent of households in 1996 had dropped to a lower income group by 2005. This statistic illustrates that the top income groups as measured by a single year of income (i.e., cross-sectional analysis) often include a large share of individuals or households whose income is only temporarily high. Put differently, more than half of the households in the top 1 percent in 2005 were not there nine years earlier. Thus, while the share of income of the top 1 percent is higher than in prior years, it is not a fixed group of households receiving this larger share of income.

Now, of course, many of those people could have moved out of the top 1 percent to merely the top 2 percent or top 5 percent. As best I can tell, the report doesn’t answer that question. It does, however, say this:

[R]eal incomes increased for about 35 percent (35.2 = 8.6 + 6.0 +7.6 + 13.0) of taxpayers in the top .01 percent in 1996. On the other hand, about 59 percent of taxpayers in the top 0.01 percent experienced declines in real income of at least 50 percent. Similarly, 52 percent of those in the top 0.1 percent, but below the top 0.01 percent, experienced income declines of at least 50 percent. These results illustrate that the incomes of a significant portion of those in the very highest income classes in a given year are highly transitory and not maintained over time.

That said,

The pattern was similar, if less dramatic, for the other subgroups of the top 1 percent in 1996. The basic result is that the income of many of the highest-income taxpayers is transitory. Thus, for the majority of this group at least, the rich do not get richer. Instead, their income drops to a lower level, albeit generally to a level well above average.

The report has a bevy of charts and tables that may be more useful to some than the text.

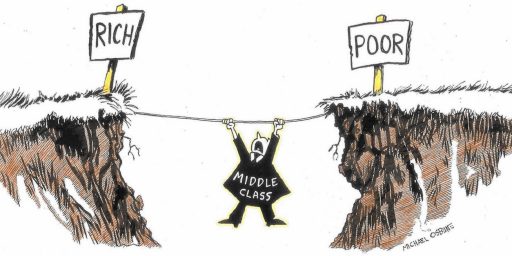

Image source: Brian Dennert

Further, half of the nation is in the bottom 50% of income. These numbers should make it clear that we need to nationalize income distribution to provide true equity and stability.

I recall the notice when this came out and taking a quick glance at it. My reaction at the time was that the info on the top .01 percent was probably misleading. Deaths and inheritance probably have something to do with what’s seen in that group. I also wonder if the decline in the median income of that group has something to do with the equities market.

The statistic that I’d be interested in is the breakdown of the top 1% by occupation. My guess is that an astounding proportion are medical doctors and lawyers.

The statistic that I’d be interested in is the breakdown of the top 1% by occupation. My guess is that an astounding proportion are medical doctors and lawyers.

I would also be interested in seeing how many in this group are professional and created some kind of retirement type account-or invested money.

If you have a fairly decent income-where you are able to invest well, and the majority of the wealth is tied up in markets and property, there can be huge fluctuations.

Great. Let’s make public policy based upon the wild pertubations experienced by the extreme outliers in the distribution.

People earning salaries do not make it to the top 0.o1% and probably rarely into the top 0.1% or even the top 1%. Such huge income amounts to qualify for this rarefied air can only be generated by movie stars, professional athletes, and those cashing in on significant capital appreciation. Noting how the market fluctuates annually, should it really be a surprise that the members of this group change with such frequency? Especially since someone who cashes out of a significant positionone year probably isn’t going to be able to keep doing that year after year after year. They may still have a lot of the money, but it doesn’t count the next year, since we are only counting income.

Wealth still isn’t about income, it’s about assets. As someone with a nice income but without sizeable assets, I really do resent people like Warren Buffett saying I need to be taxed more while he can continue to live rather better than I off the interest of the interest of the interest of his holdings.

Whatever else is true about these income statistics, it is also true that redistribution of wealth by taxation is theft by the government and it should be stopped cold.

mannning, tell that to yestanotherjohn lol!

While yestanotherjohn may be merely joking, I think that these numbers are way above the level of understanding by liberal democrats (aka thieves, as mannning might put it). And if they spend too much time trying to understand it, their heads might explode!!!

Seems that Krugman already dealt with this issue in 2002, as he points out in a blog post today about Sowell’s article

And Krugman finishes that post up rather nicely by noting Remember, this was back when 100K was a lot of money.

When the government and the people realize that they can continue to vote themselves an ever larger share of other people’s money and get away with it, that will be the end of the American republic.

A billionaire or a corporation can maneuver out from under the US tax system, and base somewhere else in the world, instead of paying a larger and larger share of money to re-distributive taxes. Poland, for example. With that kind of money, he or the corp can exist quite nicely elsewhere. Then, where does the government find another source to feed the mouths of the needful and wantful?

The unions in Holland made a serious attempt in about 1978 to require corporations to level their salary structures such that a CEO would make only three times what a janitor makes. So you were either a One, a Two, or a Three!

The ten top corporations responded to this threat with a letter to the government. They included Royal Dutch Shell, Ahold, Philips, AMRO, Unilever, and others, saying that if this idea became law, all of these corporations would move their operations to other countries. These ten corporations had the majority of well-paying jobs in the nation… The unions backed down and the government was voted out of office soon after.

There is a lesson here for those who would try leveling of income here in the US.

I don’t know who your source of Dutch history is, but this is nonsense.

Unions don’t make laws, government does. Unions can only negotiate with companies so a response to an Unionmade demand would not be a letter to the government.

Political parties have more influence and there may have been a political party that would aim for a ratio between the income of the highest and lowest earners in a company. But even those would never go for a three-to-one ratio.

In 1978 the Netherlands had a ChristenDemocrat/Liberals government; not a very fertile ground for such marxist idea’s anyway. AFAIK the most radical union idea (never made it to policy though) was to negotiate for absolute increases, not relative ones, to ensure the biggest benefit would be for the lower incomes.

The unions *were* involved in general policies about wages though. Most famously in our ‘akkoord van Wassenaar’ in 1982. The government asked the trade union movement and the employers to negotiate a formal agreement on pay restraint and the prevention of unemployment. It was agreed to put jobs above income and workers were given the option of trading pay increases for cuts in working hours. As a result, the working week in many sectors shrank from 40 hours to 38.

Since that agreement wage increases have been much more moderate – except for the CEO’s and such. Average union-negotiated wage increases have all been below 5%, whilst top-incomes these past years have been 10-20% on average (not counting the bonus, options and other finacial benefits in the package).

When the government and the people realize that they can continue to vote themselves an ever larger share of other people’s money and get away with it, that will be the end of the American republic.

Mannning, do you even know what the income distribution is? C’mon. Let’s see if you know how much percentage of total income is garnered by the top 0.1%. Top 1%? Top 2%? How big of a percentage of those on bottom does it take to equal that percentage garnered by a small sliver at the very top?

It’s completely absurd to think that people are voting themselves an ever larger share of other people’s money. Well, I guess that’s technically true in the red states, which get more money back from the federal government than they pay in – that money coming from the blue states, of course.

Wish y’all would walk the walk instead of just babbling incoherently.

You mean like the $9 trillion in debt we have laid on kids and the unborn?

Before the highest income brackets can complain that they are paying more than their fair share, we need to come to grips with the fact that collectively none of us are.

Before the highest income brackets can complain that they are paying more than their fair share, we need to come to grips with the fact that collectively none of us are.

With all due respect, the problem isn’t what we’re paying but what we’re spending. Until spending is brought under control no amount of taxation will ever be enough.

Until spending is brought under control no amount of taxation will ever be enough.

Well, considering that the military budget dwarfs anything domestically, pray tell us how you would like to see it cut?

With all due respect, the reason why people rob banks is that’s where the money is. You want to bring spending under control? That’s where you’ll find the money needed to do that.

I do not care what the percentage in the top .1% pays or makes, because it is not relevant. The point is that redistribution of wealth by the government is still theft of rightful earnings.

Well, Mr. Dutchman, I personally read the letter I referred to, and it named the companies participating, and spelled out that they would react if such a 3:1 salary limit was imposed. Since I worked for one of the companies involved, I have no reason to think it was a false letter handed to me to read by the then Director in one of those green executive signing folders. I was not allowed to copy it.

I will admit that the addressee might have been the union, but the government was also addressed or copied. Sorry that my exact memory has faded since the late 70s, but the fundamental facts are as I stated them. I suspect the whole matter was deliberately covered up rather quickly so as not to get the public too aroused by the thought of a general evacuation of their major corporations from Holland. As I recall some of the conversations surrounding that time, it was pointed out to me that many of the corporations had significant management units already in place in the UK(RDS) and US(Philips, Ahold)etc..

The basic statement I made was a paraphrase from Ben Franklin, who was very well known for his “senseless blather”. Let the Congress or the people loose on the funds, unencumbered by any restrictions, and it will be our end.

Hal, come on. Entitlements dwarf military spending and constitute virtually all of the real growth in Federal spending since at least, say, 1980. Since you asked, and as you noted, that’s where the money is so I’d be happy to start there.

Perhaps Sigmund Freud could explain why you casually provided an analogy involving robbery to justify your apparent greed for other people’s money — albeit for the public good, of course.

Entitlements dwarf military spending and constitute virtually all of the real growth in Federal spending since at least, say, 1980

See, this is why I keep coming back. The comedy. You guys just crack me up. Here’s the federal budget. Show us where you’re going to start slashing.

[Long post deleted] Why bother. Now I remember why I went away.

Well, Mr. Dutchman, I personally read the letter I referred to, and it named the companies participating, and spelled out that they would react if such a 3:1 salary limit was imposed. Since I worked for one of the companies involved, I have no reason to think it was a false letter handed to me to read by the then Director in one of those green executive signing folders. I was not allowed to copy it.

Oh, well, than of course it must all be taken as absolute proof, if you read the letter 35 years ago yourself. I am amazed at your knowledge of Dutch though; it is not often that Americans are so fluent that they even understand Dutch officialese. And if it was a letter from Dutch companies to Dutch unions cc-ing the Dutch government (but adressing the government of last year) it must have been Dutch.

In trying to pin down the date of that letter more closely, I was promoted to a level in 1976 where it would have been normal to be included in certain company communications such as this one. So the period involved was most likely from 1976 to 1978, after I had already been there for 4 years. I favored the latter date, but can’t be absolutely sure.

And yes, by that time I was able to read Dutch rather well, especially technical Dutch, and the newspapers/TV I could understand. (In my industry, which was defense systems, the official language was English, as it was for the Dutch Army, Navy, Air Force and NATO.)

The hardest was to speak the language in multiple situations where the vocabulary shifted with the domain: electronics; military systems and tactics; auto repair; politics; food; religion; everyday chat; and so on, plus the inevitable idiomatic expressions that floored me, and the startlingly differing manners or dialogs of speech in almost every town (Twense, for example). But that was, as you say, 35 years ago.

If this situation is of real interest to you, I can have it researched, since I have excellent public, Dutch resources. If it was suppressed, I guess there is no solid proof to be had, so my word will have to suffice. Your call.

I do not post lies.

Ah, if you have lived in the Netherlands that you’ll at least know why I was to busy to reply till now 😉

(For others: Sint Nicholas is a bigger and more demanding holiday than X-mas for the Dutch, especially those with kids)

Lies would mean that there is intent to misinform and afaics I blamed your source, not you. Yes, I would be interested in links/pointers because I couldn’t find anything myself and I still cannot believe that there would be a serious attempt and implementing such an impractical policy.