Jobs News

A good jobs report.

Via the NYT: March Jobs Report Shows Strong Gains: Live Updates

U.S. employers added 431,000 jobs in March on a seasonally adjusted basis, the Labor Department said Friday. The figure was just shy of forecasts, and there was an upward revision of 95,000 for the previous two months of this year.

The unemployment rate was 3.6 percent, down from 3.8 percent a month earlier and just a touch higher than its levels right before the pandemic.

Among the industries with gains were leisure and hospitality (112,000), retailing (49,000) and manufacturing (38,000).

One of the reasons I resist people trying to use the term “stagflation” for the current period is that one of the elements of that concept is persistent unemployment to go along with inflation and poor growth. We only have one of those elements the moment, inflation.

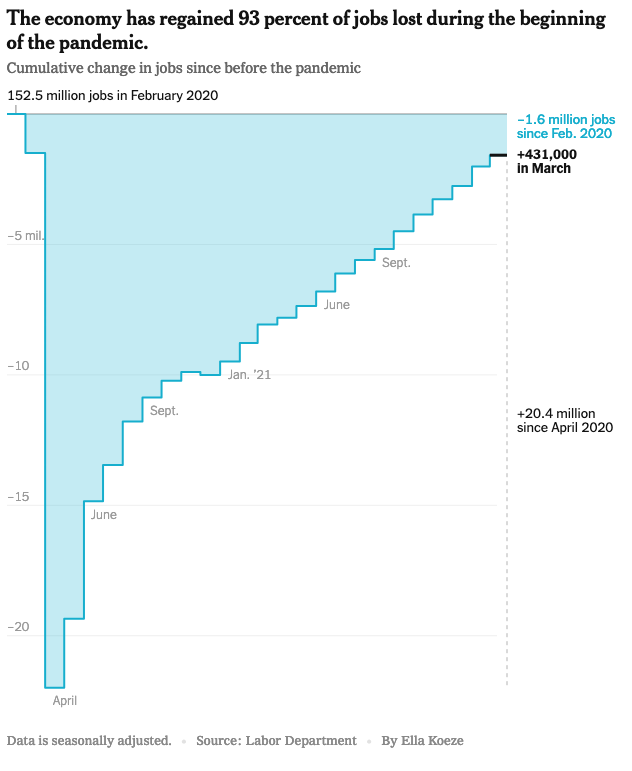

The good news is that the effects of the pandemic on the overall job market seem to have been almost erased:

Hard to believe that the Fed used to deliberately manage interest rates with the goal of keeping unemployment at 5% or above. In their minds this kept wages low, which in turn kept inflation low.

There are 14 states that have unemployment rates of 3% or less. Interestingly, most are R states, and most are fairly small. The states with the highest unemployment lean to being large and Dem.

I’ll suggest that size has a greater correlation to unemployment than does political party, but there is clear evidence of a mismatch in available jobs and available workers.

As well you should.

Inflation is bad, but the economy is doing great. Most of our “supply chain” problems aren’t supply chain problems. They’re demand exceeding supply problems.

@Sleeping Dog: I’d also note that minorities tend to be the last hired and small, Red states tend to have few minorities.

@MarkedMan: Part of keeping unemployment at 5% was that someone from Nixon’s CEA or the Fed was saying that the equilibrium level for unemployment was something like 7%, IIRC. The pessimists of the era were saying that level would go down (ie 7% was a permanent acceptable level of unemployment).

@gVOR08:

The southeast would like to have a word. 🙂

MS, LA, GA all have Black populations over 30%

AL, SC, and NC have Black populations over 20%

Not to mention that TX and AZ have hispanic populations over 30%.

@just nutha: Last sentence should read “would not go down.” Sorry.

Is there any news on the labor force participation front?

And I’m starting to think much of the negative economic attitude is about housing unaffordability and rising debts. There seems to be little acknowledgement of housing costs, let alone political plans to address it.

We’ll see if that is reflected in gas prices anytime soon.

Meanwhile EU is also seeing inflation. And Canada’s inflation hit a 30 year high.

@Steven L. Taylor: You’re right, and I should have phrased that more carefully. The 14 states with lowest unemployment in order are (BLS February ’22): NE (2.1), UT, IN, KS, MT, OK, SD, MN, NH,ID (2.8), .

MS (4.5), LA (4.3), GA (3.2) rank 33rd, 35th, and 16th

AL (3.0), SC, and NC do better, ranking 14 20, and 23

TX (4.7, 39th) and AZ (3.6, 22nd)

I’ll stand by low minority population having as much to do with it as small and Red.

@gVOR08:

I see this a lot, but I have no idea what it’s supposed to mean. Every manufacturing and sales operation has as many supply chains as they have products. When you cannot get the inputs necessary to fulfill your order demands then that product has a supply chain problem. That’s different than a capacity problem, where your production line doesn’t have the capacity to produce enough to fulfill the demands.

My company has the production capacity to fulfill our orders but we have severe problems getting the quantity and quality of components we need in a timely fashion and so have to devote huge amounts of buyer and engineer time to find substitutes and workarounds. That is the exact definition of a supply chain problem. Every company I talk to is in the same boat. That is the definition of a world wide supply chain problem.

I suppose that in a war you could say, “we don’t have a problem with their guys shooting us, we have a problem with our guys stopping bullets with their bodies”, but I don’t really understand the point.

@gVOR08:

Yeah… that’s known as a “supply chain problem”.

Our company is looking at lead times for components that stretch into the months–sometimes over a year. These are components that we never had issues getting before. Lead times used to be a few weeks–and we had that built into our process. It’s not like we’re suddenly asking for 30 times the number of chips.

Are you suggesting that there’s suddenly a world-wide super-increased demand for packing foam, and that’s why we’re having problems sourcing it?

We had a trailer full of materials sitting in a lot in Chicago (3 hour drive from here), but there wasn’t anyone to drive it up here. That’s not “over-demand”, that’s lack of drivers. i.e., a “supply chain issue”.

@Mu Yixiao:

The entire world had, pre-pandemic, evolved into just-in-time supply chains.

Which makes sense. Why pay for storage, etc. if you don’t have to?

But now the system is unable to catch up. It’s getting better by most accounts, but there is still a supply problem.

Add to that the fact that the pandemic changed a lot of lifestyles and people are spending more on goods than they used to, and less on services, and you have a demand problem.

@MarkedMan:

And they were not entirely wrong. There are a lot of pressures on prices, and when wages go up, demand for products and services goes up — and if that is faster than supply you get inflation, which can strip away any wage gains.

If it all happens at the same rate, it could be fine — long-held debts are effectively reduced, which can be good — but that never happens and so it hits some people harder than others (the usual suspects — the minorities, the working poor, etc)

There’s a sweet spot where anyone looking for work will be able to find it relatively quickly, the labor market is just tight enough that wages will rise slightly, and those rises are low enough that it doesn’t create the spike in demand.

If you think it’s immoral that the fed is trying to use inflation rates to ensure a certain amount of unemployment to keep wages down, I think you’re looking in the wrong place — the tax system is frequently regressive (hello Washington state!) and does way more to affect the working class than an additional 1-2% in the unemployment numbers does.

And housing policies, where we just don’t build enough housing in the areas people want to live in and which can consume massive amounts of people’s wages. Don’t underestimate this.

Also, a better metric than unemployment rate would be “how long does someone look for work?” — that’s what affects people, and isn’t as closely tied to unemployment rates as you might think, and incredibly variable on who that someone is.

@MarkedMan: I think that the point that is trying to be made is that there are two options:

1. Demand is outpacing supply.

2. Supply exists, but transit is slower than normal and therefore existing inventory is not making it to distributors.

@Daryl and his brother Darryl:

Lololololololol

When a gas stations is being sued by competitors for not price gouging customers? Fat chance.

Oh, wait, we’re supposed to pretend that the market is magic and no human beings are making pricing decisions at any point in the process. Otherwise, we’re in denial.

Not so true. Several red states have sizable minority populations: Mississippi, Florida, Georgia, S Carolina, Texas, and Louisiana come to mind.

I was a little surprised that Hawaii has the highest percentage of minorities at 77% but I’ve never been there, so why wouldn’t I be ignorant?

eta: and I see Steven beat me to it.

@Steven L. Taylor: Actually, I think we are back to our old nemesis: different definitions for the same words. Taking your first example:

Inability to meet demand can be due to either supply chain issues or insufficient capacity. If my factory can produce 100 widgets a day and I have a demand for 80, but can only get components to make 50, then the demand/supply imbalance is due to the widget’s supply chain. If I have a demand for 120 and can get all the components I can use, I still can only produce 100 per day, so my demand/supply imbalance is due to lack of capacity.

Your second example:

…is simply an example of a post-manufacturing link in the supply chain being the problem. It is the nature of a supply chain that any broken link causes an issue.

“Supply chain” is well defined and universally understood in manufacturing and manufacturers are having supply chain issues up and down the chain at a rate I’ve never seen in my whole life. Not even close. Industry after industry after industry.

People outside of manufacturing are defining “supply chain” in a way I don’t even understand and think they have some kind of gotcha moment because of it.

“We have a tomato shortage!”

“Well, a tomato is actually a fruit so we don’t have a tomato shortage!”

Makes no sense.

@MarkedMan: Here’s the thing I am going to do that often is not done in these conversations: I am perfectly happy to state that whatever the prevailing definition of “supply chain” is the one that should be used, especially if there is an industry-specific usage.

I have no particular dog in the fight over the term.

Which can be quite frustrating/annoying, no doubt.