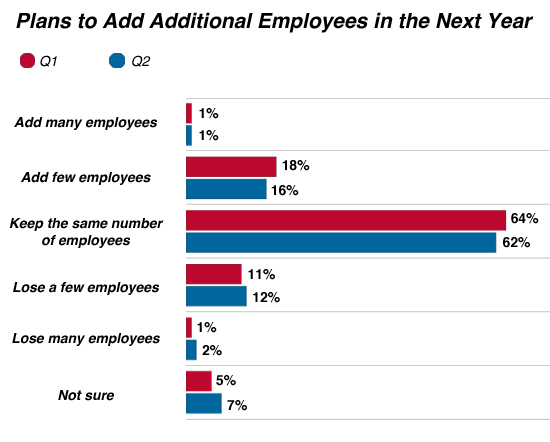

Most Small Businesses Don’t Expect To Hire New Employees Next Year

Somber news from a survey conducted by the U.S. Chamber of Commerce:

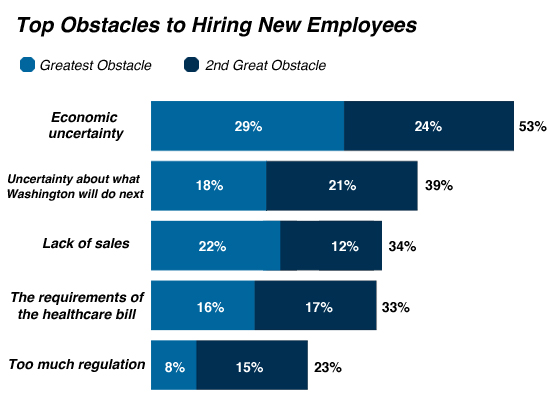

And, not surprisingly, these same business owners list economic uncertainty, and uncertainty over what Washington is going to do, as the primary reasons they are holding back on expansion:

And, not surprisingly, these same business owners list economic uncertainty, and uncertainty over what Washington is going to do, as the primary reasons they are holding back on expansion:

Republicans are probably disappointed to see “too much regulation” so far down the list since it’s a meme they’ve been pushing lately. On the same account, Democrats are likely disappointed that “Lack Of Sales,” the traditional Keynesian mantra is only listed third.

I think Keynes himself was all about item number 1, economic uncertainty. Animal spirits and all that.

What do you think “economic uncertainty” is Doug?

It’s worry about future sales.

I’d like to see a baseline…given nothing to compare it to…this is meaningless to me.

Oh wait…I just noticed it’s from the U.S. Chamber of Commerce.

Really? We’re supposed to take anything they say seriously?

@Hey Norm:

I could say the same thing about anything from Think Progress, the AFL-CIO, or SEIU

You do.

Often.

But you’re not a Republican, so it’s okay.

Nevermind. This is pointless.

I would submit that it’s far more complicated than you’re making out to be. It’s not just about sales, it’s about the cost of materials, productivity, the safety of investments, and economic stability of the medium and long term. There are entire textbooks written about this stuff, so trying to just lump it all under the category of “sales” is pretty silly

Well, that can’t be right. I mean, according to Cain, the reason folks aren’t employed is because of personal moral failings. Right?

@Doug Mataconis:

I think you just reversed yourself. A minute ago “Keynesian mantra” was all about sales. But of course those “entire textbooks” say it’s not.

In related news the Sun rises in the east and bears shit in the woods.

Hello, Obamacare anyone? The economy?

Incidentally, without fundamental regulatory reforms there won’t be an end to the “economic uncertainty” cited in that survey. Small businesses in that event won’t be hiring all that much in 2013, 2014, 2015, etc., although truth be told if Obama is ousted next year there’ll be a pickup in net hiring on that basis alone, for the reason that small businesses in that case will have a lot more confidence, largely because the crushing regulatory burdens couldn’t possibly get worse. All these items are flip sides of the same coins.

@ Doug…well of course. If you posted a survey from any of theose organizations I would be just as incredulous. Interesting to note, however, that you haven’t. I’m just sayin’

@Tsar Nicholas:

“Economic Uncertainty” is not the same as “Regime Uncertainty.”

Watch out for people who swap “uncertainties” on you. They may start with the Regime type, but then grasp the Economic type as proof. Improperly.

Stop dancing on the head of a pin, people. As the resident multiple business owner and conversant with same, this is exactly correct.

And for those trying to parse things, what the hell do you think the difference between “economic uncertainty” and “what will Washington do next is?”

We have an administration openly hostile to business. Would you hire?

@Drew: I would hire if I thought my sales and revenues could support additional staff…. but hey, I’m worried about potential consequences 3, 5, 10 years down the road and my future discount rate is abnormally high….

For your argument to work you have to assume that there is sufficient demand to support added staff and have a very high discount rate for future cash flows. Right now with government bonds trading at sub 3% levels, and AAA corporate bonds at very low yields as well, the aggregate future discount rate is very low, not very high. And then we know that the American consumer is deleveraging and thus spending less, so demand is not there for anything beyond the essentials unless you are selling to the top couple of % of the income distribution whose income has easily recovered from the market crash that they as a class caused and benefited from.

Funny that corporate profits are at an all time high during an

Funny that huge banks had their risk nationalized but not their profits during an

Funny that the Auto Industry and all their myriad suppliers and millions of employees survived during an

Funny that Wall Streeters are back to huge bonuses during an

Reality and Drew’s statement don’t seem to jive. I wonder which is correct?

@Dave Anderson:

You were going in a good direction……..then crash landed.

I’m completely with you in discounting future business related cash flows, and with a need to apply a heavy discount rate.

However, the discount rate for bonds, currently engineered by Helicopter Ben to be artificially low, has little to do with the discount rate for business cash flows, and their attendant risks.

As for this: “unless you are selling to the top couple of % of the income distribution whose income has easily recovered from the market crash that they as a class caused and benefited from.”

This is just inane babble.

Logical connections, as opposed to partisan babble, don’t seem to be Hey Norm’s strong suit.

Drew…what logical connections? What are you uncertain about? There is always uncertainty about the future…to expect otherwise is illogical. To think anyone is going to hire anyone absent demand is illogical. To think that someone with sufficient demand is not going to hire someone because they don’t know everything about the future is illogical.

This survey, from the most partisan lobbying organization in the country is bunk. And so is the uncertainty canard.

http://economix.blogs.nytimes.com/2011/10/04/regulation-and-unemployment/

@Drew:

So much assertion, so little backup.

But Rob…Drew is THE resident business owner. So if he says the Administration is openly hostile to business we should believe him. Or her.

Sigh. Oh, for the glory days of OTB………..before the trolls arrived.

@Drew:

That’s because high demand for U.S. bonds is the market signalling building deflationary pressure, and the Federal government is the only sure bet left for sheltering investments from it unless one simply holds it as cash.

The current problem with flows is a consumer debt crisis. The private sector wishes to save, so the proper response in order to meet its needs is for the public sector to spend. The worst thing we can do for those businesses is attempt to balance the budget, as doing so will drain net financial assets from the private sector. This will, ironically, create the very “crowding out” effect conservatives so worry about.

Problems with the “survey”:

1) They do not provide the actual questions asked or how the questions were phrased, making it impossible to separate “uncertainty” from anything else.

2). They provide no methodology

For all we know this came from someone’s laptop just last night.

And, not surprisingly, these same business owners list economic uncertainty, and uncertainty over what Washington is going to do, as the primary reasons they are holding back on expansion.

One wonders how we ever settled this country at all.

Wagon Train Futures Down Amidst Uncertainty Over “What’s Out There”

New York, October 10, 1873

Owners of the largest wagon train companies in the United States report business is off by 50% or more. “Seems folks now are just plumb scared of going off into the unknown,” said Caleb Cornshoot of Westward Ho Industries. “It’s not like it used to be. Folks were willing to take a chance. Not so much anymore.”

His thoughts were echoed by Ezra Tackler of New Start Enterprises. “Time was, people would say, ‘Yes, there’s a risk that we could starve to death or die of thirst or of disease. Not to mention getting attacked on the trail out. But, dang it, we going to take the chance. We’re afraid, but we’re going to take the chance. We don’t know what’s going to happen. It’s all uncertain. But we’re going try and make it anyway.’ ”

“You don’t see much of that now,” Tackler said. “I guess the pioneer spirit is going away. I’m afraid we’re becoming a nation of folks just too scared to take a risk. I know the risk is great. I mean, it’s not like losing some money in a business. They could die. Many, many have. But was a time when folks would risk all that for the chance. Times past, I’m afraid.”

“However, the discount rate for bonds, currently engineered by Helicopter Ben to be artificially low, has little to do with the discount rate for business cash flows, and their attendant risks.”

Benjamin: “That’s because high demand for U.S. bonds is the market signalling building deflationary pressure, and the Federal government is the only sure bet left for sheltering investments from it unless one simply holds it as cash.”

Uh, Ben, you may have heard of quantitative easing: I and II. That was an explicit attempt to reduce interest rates. Yes, demand for US bonds is driven, but its by a “flight to quality,” a credit consideration, not a yield consideration. You do understand the distinction, right?? As for a deflationary concern: see – commodities, high dividend blue chips, utilities etc.

Take another deep swig on the vodka bottle, Ben.

@Drew: QE’s purpose was not to lower interest rates, its purpose was to boost bank reserves in order to spur lending. You do understand how bank lending works in relation to reserves, don’t you?

Also, perhaps you may have noticed commodities across the board are showing price growth. Where do you think that QE money went? Right into speculative measures by investment banks which is exactly why Bernanke, in an unusual show of wisdom, refrained from QE3.

Don’t panic just yet. Most small businesses will remain small, you know, Ma, Pa, a couple other people. Also, I’m not sure many small businesses with low capital will ever face “economic certainty,” if that’s what they’re looking for.

@Drew:

“Economic Uncertainty” also has an established meaning. It is about the fear of recession (or the prospect of growth, etc.). It predates the election of your favorite President, as this 2008 article shows:

Economic Uncertainty Spreads

That article begins:

That’s a big clue about when the uncertainty is “economic,” because it often also “international”

Kind of like now, right?

lolz. I get why rightists would like to pretend that all “uncertainty” is “regime” but they should be able to see the game as counter-productive. You can take a stupid and extreme position. It may fly, or you may just look stupid.

Shorter: These businessmen were asked about “economic uncertainty” and we can hope that at least half were smart enough to know what those words mean.

Drew pretends to be brilliant businesman, makes all sorts of ludicrous claims about how the economy is bad because evil Obama hates business.

Multiple posters demonstrate with actual facts what absurd nonsense this is.

Drew whines about “trolls.”

And the day is complete.

Drew,

Hey Norm cleaned your clock…you look like chuck Wepner after the ali fight.

If Obama is so hostile to business, please refute Norm’s recitation of the record profits/low tax reality.

You haven’t done it simply because you can’t.

“Economic Uncertainty” is indeed a problem. What lies beyond it is instability, which is much worse. So one has to wonder why the GOP willfully opened that door by holding the economy hostage over the debt ceiling.

Could it be that they are willfully taking us onto the rocks for political purposes? That does not sound very pro business to me.