Obama Trying to Block AIG Bonuses

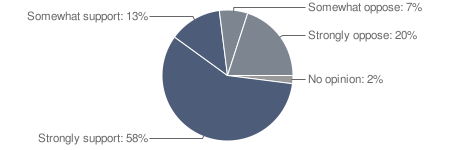

Responding to understandable public outrage, President Obama is vowing to figure out a way to get back the money AIG paid to the people who ran the company into the ground.

Responding to understandable public outrage, President Obama is vowing to figure out a way to get back the money AIG paid to the people who ran the company into the ground.

President Barack Obama declared Monday that insurance giant American International Group is in financial straits because of “recklessness and greed” and said he intends to stop it from paying out millions in executive bonuses.”It’s hard to understand how derivative traders at AIG warranted any bonuses, much less $165 million in extra pay,” Obama said at the outset of an appearance to announce help for small businesses hurt by the deep recession. “How do they justify this outrage to the taxpayers who are keeping the company afloat,” the president said.

Obama spoke out in the wake of reports that surfaced over the weekend saying that financially strapped American International Group Inc. was paying substantial bonuses to executives.

Noting that AIG has “received substantial sums” of federal aid from the federal government, Obama said he has asked Treasury Secretary Timothy Geithner “to use that leverage and pursue every legal avenue to block these bonuses and make the American taxpayers whole.”

The public is right to be mad at the bonuses and Obama is right to want to recoup the money. It’s indeed hard to fathom how a company that’s taking millions in bailout money from the taxpayer can in turn transfer some of that money to reward the people who caused the problem in the first place.

Glenn Greenwald who, as noted previously, is outraged that the administration didn’t head this off before it happened, argues rather persuasively that AIG’s chief defense — that they were contractually obligated to pay these bonuses and had no choice — is bunk. He points out, for example, that the administration insisted that UAW workers tear up their contracts as a precondition for bailing out Chrysler and GM.

As any lawyer knows, there are few things more common — or easier — than finding legal arguments that call into question the meaning and validity of contracts. Every day, commercial courts are filled with litigations between parties to seemingly clear-cut agreements. Particularly in circumstances as extreme as these, there are a litany of arguments and legal strategies that any lawyer would immediately recognize to bestow AIG with leverage either to be able to avoid these sleazy payments or force substantial concessions.

I think that’s right. To be sure, the AIG and UAW cases are different, in that the UAW was a second party to the bailout and the terms of the Big 3’s labor agreements were considered by many to be a major contributing factor to the pickle they were in. But, surely, the AIW bailout negotiations could have stipulated that certain contractual obligations be renegotiated as a condition of receiving taxpayer dollars.

Lawrence Cunningham, a GW lawprof and “leading authority on law and accounting, particularly in corporate governance and securities regulation” provides a whole list of plausible legal loopholes off the top of his (expertly trained) head.

Megan McArdle, an MBA rather than an attorney, tackles a different question entirely: Is it good public policy to kill said bonuses?

But the AIG retention bonuses raise a question the government is going to have to ask again and again before all this is over: do we want to make a point, or do we want to make money?

[…]

Why not just say “no bonuses for anyone at AIG”? To hell with the bums! Well, we now own the company. If we hasten the flight of quality employees out of the company, that will cost us money. The answer might be some kind of performance bond. But as in other financial firms, traders often take as bonus what should be salary, which means that they need at least part of their bonuses to maintain their lifestyle. If they’re faced with bankruptcy, the traders who are talented will go elsewhere–the financial market is shrinking, but the top traders still have other opportunities. AIG has a lot of positions to unwind. Do we want to leave the job to the dregs of the organization?

A tricky issue, indeed. One could be flip and note that, since the division in question screwed the pooch so impressively, that it must have been entirely comprised of said dregs. But, alas, that’s likely not true. As Megan notes, we have no way to know from the outside who the good people and the bad people are.

That said, it’s hard to imagine that anyone in AIG’s Financial Products subsidiary earned $6 million in bonus money last year.

It was reported on CNBC this morning that the Treasury Department had agreed that AIG was obligated to pay the bonuses. The bonuses started at $1k, and IIRC the largest were employees in Britain where it was believed that litigating the bonuses would cost more in lawyer’s fees than the bonuses themselves.

There is also a retroactive versus prospective difference here.

Via Josh Marshall,

http://www.talkingpointsmemo.com/archives/2009/03/squeeze.php

The WSJ reports that the Treasury is delaying the most recent $30 billion infusion into AIG while some of this is resolved. Nice.

I double-checked the CNBC story (audio link below) and it was reported that a majority of the bonuses are for employees based in London and the belief was that it would cost twice as much in legal fees as could be saved in bonuses to attempt to rescind the bonuses because of intricacies in British law.

LINK

As to Megan’s response: pfui. Where are they going to go? It’s a buyer’s market for labor in the financial services industry right now and I see no reason we shouldn’t capitalize on it. Further, the problem that AIG faces today is survival and whatever they might wish that survival depends on the good will of the electorate. Taking that into consideration the argument that AIG’s survival at some point in the future in which they’re not wholly dependent on tax dollars depends on paying these bonuses, the argument made by AIG’s CEO, falls pretty flat.

Unlike the auto companies, there’s like no agent equivalent the the UAW that can make such an agreement on behalf of all employees. And trying to get each and every employee effected to individually sign off on the bailout wasn’t feasible.

The real issue here is that the fact AIG was locked into this perverse salary structure is just another reason the government should have let them go bankrupt to begin with.

If the government was worried about ripple effects, then have the government agree to honor AIG’s outstanding policies, but that can be done without saving AIG itself.

Haven’t many of these bonuses already been paid? So the issue is getting the money back, not paying it out in the future? Clicking through the link PD Shaw posted above, it sounds like they were paid out on Friday.

If that’s the case, it’s not a matter of the employees suing AIG, it’s a matter of AIG suing the employees. Good luck with that.

In any event I’d be surprised if the contracts were not in fact pretty clear and pretty bulletproof. Employment contracts, even for highly paid employees, are not really that complicated. AIG is a big company with all the HR and legal bureaucracy that entails – so I’d assume that basically the contracts are solid.

I’d also, before going too far down this road, ask whether it’s a problem if none of these guys ever shows up for work again? E.g. is there a tangled mess of stuff we need them to clean up, or can we just cut them loose? If the former… hardball may prove unproductive…

Dr. Schuler, without knowing who was getting how much for what services, it is tough to be too specific, but how do youi know it was just traders ingetting bonuses? AIG is a very large company employing people in lots of different capacities. It is likely that at least some of their employees did perform well enough to earn significant bonuses in things other than financial services. Even in a buyer’s market, you reward and hang on to talent whenever and however you can. The idea that all these financial services people are interchangeable ought to make them really excited about card check if that were true.

Of course, I would have let AIG fail, but nobody asked me.

As I posted earlier this month, I think, the rationale for the financial services dudes and dudettes is probably: “Gee, if they hadn’t done such a stellar job, we’d be more effed up than we are now.” As hard as that might be to believe.

If by ‘dregs of the organization’ she means ‘the millionaire idiots at the top who bankrupted the company, then no, we don’t want to leave the job to them.

Thinking that you have to pay million-dollar salaries to get good businesspeople is incredibly stupid. For $100,000 a year you can find thousands of people smart enough to figure out that economic variables aren’t all uncorrelated, and that sliced-and-diced pools of crap are still in fact crap.

Just in my state alone, Florida, you can find hundreds of bankers who make less than a half million a year, and whose banks are not in trouble because they didn’t do incredibly risky BS. While the multi-millionaire heads of Bear Sterns, Lehman Bros, AIG, not only blew their institutions to pieces but damaged the *global* economy. Fire those romanticized ‘top talent’ geniuses at AIG and replace them with these cheaper, typical bankers who will make responsible loans, who won’t sit around dreaming up opaque SIVs, and in general won’t jeopardize the entire system. Is it too much to ask for some responsible, boring people to run insurance companies and banks?

I’m for hire, I haven’t f*ck*d up the entire economy of the world, and a $100k/yr sounds pretty good to me.

While I probably wouldn’t do any better than any of these *ssh*l*s, I would do the same job for a whole lot less. A good deal for the taxpayers? I doubt it. A better deal than the one they are getting? Without a doubt.

Who are the bonuses actually going to in the company? I think we need to remember that while the AIG leadership was utterly incompetent, that doesn’t mean the whole company was incompetent and failing from top to bottom in terms of personnel. There could still be a bunch of people within the company who did their jobs quite well.

These weren’t merit-based bonuses, they were part of a retention plan to encourage the employees to stay. Imagine a building contractor who is paid during work, but ten percent of the price is retained to make sure the job is finished. The building contractor is still owed his ten percent at the end of the job.