Peak Energy: A Reply to Kevin Drum, Part 2

This is the second part of the my response to Kevin’s Peak Oil posts. This looks at Part 2 of Kevin’s series.

In this part of his series Kevin looks at the work of M. King Hubbert and his Hubbert curve and why Hubbert has it, basically right. Hubbert’s idea, which later became known as the Hubbert curve, was first outlined in this paper.

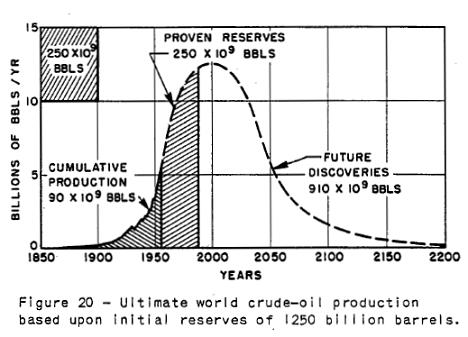

I am not going to dispute Kevin’s statements on the problems/issues with extracting oil, but what I am going to take some exceptions to are his portrayal of Hubbert’s article and ideas. First it Hubbert’s successful forecast of oil production for the lower continental U.S. One of Hubbert’s forecasts (there were two) was that oil production would peak in 1970. That prediction was correct. However, Hubbert’s other forecast was obviously wrong, and another interesting bit of information in the article is Hubbert’s prediction for world wide oil production. That peak was to be in 2000. You don’t usually hear to many people talk about this.

Now, the problem is noted by Hubbert himself. If the ultimate world production in greater than 1,250 billion barrels then the peak is moved back. So this does not disprove Hubbert in the sense that his model is wrong, but that he didn’t use the best guess/estimate when constructing it. But it does raise a number of possible problems with using the Hubbert curve as a predictive tool, IMO.

The first is that as the price for an exhaustable resource goes up, there will be more exploration to find new sources of the exhaustable resource. Granted this cannot go on indefinitely, but it does make using the Hubbert curve as a predictive tool problematic. Second, Hubbert himself noted this one, is that new recovery processes might improve the situation also pushing back the date of the peak. Third, there is the economics that is overlooked. Another thing that many Hubbert enthusiasts wont tell you about is that they often have to use more than one curve (i.e., more than one local maxima) to get a good fit to the data. You see, there was a problem around 1980 or so when production peaked and then declined for a number of years (you can see it here). So how many peaks will we actually go through before we get to the last one? Hubbert is silent on that point since he and all of those who have followed him have no way of actually knowing this. Right now, the number of peaks is two, but it could be three or even four. Granted the more peaks the less likely the scenario, but it isn’t impossible.

Now, this does not make Hubbert and his curve incorrect in theory. Let me repeat that; this does not make Hubbert and his curve incorrect in theory. However, it does make the Hubbert curve questionable tool for policy analysis. It strikes me alot like the Laffer curve in economics and many, Kevin included, love to heap scorn on that idea. The theory behind the Laffer curve is 100% sound and correct. The problem is in empirical/practical application. We know that at a 0% tax rate there is zero tax revenue. We also know that at a 100% tax rate there is zero tax revenue. Thus, our domain is what a mathematician calls a compact set. The function (tax revenues as a function of tax rates) is continuous, and any continuous function on a closed and bounded set has a maximum (see corollary 6.7.3 in Lewin and Lewin, An Introduction to Real Analysis, Random House, 1988 p 119). If we move away from that maximum then the value of the function (in this case tax revenue falls). The problem is that nobody knows what the Laffer curve looks like other than at the end points. So its use for policy purposes is problematic.

Further, Hubbert himself was not a pessimist when it came to energy outlook, which is really what the topic should be (after all we don’t like oil because it is oil, but because is a cheap and useful source of energy). Hubbert himself suggested a switch over to nuclear as a solution to the eventual decline in the production/availability of oil. And we are now seeing some companies starting to look towards that option. As I noted some firms are testing the NRC’s new permitting policy.

Finally let me address yet again this common complaint.

I just love these guys’ arguments. “Something’s always come along in time…†OK. What?

So, what will Rueben be doing in 10 years? Don’t know, well he must be dead in 10 years. What job will he have in 5 years? Not sure? Then he must be unemployed. Will he be in the same living quarters he is now? Oh, he must be homeless then. I hope the point is clear, simply because the solution is not obvious years before a change takes place does not mean there is no solution. It semed inexorable that Malthus’ numbers were going to lead to massive world wide starvation and misery…didn’t happen. Did anybody see the solution (improvements in technology) when Malthus put forth is theory? My guess is no. Many people thought Ehrlichs views on feeding humanity were inescapable, but he was totally and completely wrong. The Club of Rome figured millions would die as we ran out of resources, but they too were wrong. Now none of this means that the Hubbert/Peak Oil/End of the World believers have to be wrong. But do you want to bet they are right? The doom-n-gloomers have a poor track record, but hey, maybe this will be the big success for them.

Steve, I appreciate your comments. About a month ago I stumbled upon the works of Deffeyes/Kunstler/Heinberg and had a good many sleepless nights. How would I take care of my family? What about my mortgage, if I couldn’t make my commute and lost my job? However, as a UU, I’m perpetually interested in hearing the other side of the story. As I read your post, I do have one question. I am serious and not being snarky. What about ExxonMobil’s recent report predicting peak oil in 5 years? Are they simply misinterpreting the data, as per the above? Their report gives me some pause because it seems they must have reviewed it very carefully, and pondered whether to even publish such a prediction.

Looking forward to what you think.

Hey, maybe of you can snark the facts enough, peak oil won’t come! Have you studied the rate of depletion from peak in the North Sea? Do you really suppose there is a conservative vs. liberal perspective when it comes to peak oil?

There are a million things coming down the pike to replace in-ground oil. First of all, hydrocarbon fluids can be created through a wide range of organic processes, including themal hydrolization from waste organics, as well as bacteriological processes such as fermentation. Tthe latter can be sped up with genetic engineering, as we have seen fermentation expanded from sugar feedstocks to cellulose feedstocks using genetically engineered cellulase. Then there are the oil sands. And biodiesel.

And that is just hydrocarbon fluids. Nuclear fission and nuclear fusion are the dense energy sources of the future, but electical power from them needs to be stored more densely in batteries for vehicular use.

Cellodon,

Actually I’ve been reading and re-reading that ExxonMobil link Kevin places so much value in and I think you might want to re-read it too. I’m pretty sure it doesn’t say oil production is going to peak in 5 years, but that Non-OPEC production will peak in 5 years.

Uncle Al,

That wouldn’t be Uncle Albert Bartlett would it? If so, could you please answer my question?

Oh and just what facts am I snarking? I admit I’m a bit dismissive of some of the predictions, but then predictions aren’t facts. Maybe you could work at being a bit more coherent?

Thank you, I will take another look. Facts do get twisted. On May 31 the Cleveland Plain Dealer reported that the DOE wants American homes to generate most of their own energy, via solar panels & proper insulation, by 2020. (See “Struggling to Keep a Lid on the Oil Crisis” at their site.) I hunted all over the DOE & couldn’t find any such thing. I called the reporter who wrote the article. Turns out it is sort of true: the EERE initiative called “Building America” wants that — in all cases of *new construction.* See how a slightly different interpretation can be kind of misleading? Anyway, thanks for the dialogue. It is much appreciated. I love WGN, but you sure don’t hear this on the standard AM dial.

I read that peak oil is a scam. Oil is abiotic and not a fossil fuel. There weren’t enough dinosaurs to make such large pools of petroleum even if it were a fossil fuel. Oil seems to be produced in the mantle of the earth with gases under pressure. it is a continual process which means oil is a renewable resource. Oil is the breath of society. It is needed for most synthetic materials, energy and food production. Without oil, we die. There are a couple of theories out:

Peak oil is an attempt at depopulation.

Peak oil artificially lowers supply to increase profits.

Peak oil is real and abiotic oil is farce.

I want feedback and elaborate.

I think we’ll see some economic disruption as oil production starts to lag oil demand, but I agree that we’ll make adjustments.

The thing is, those adjustments are going to involve some businesses dying and others being born. It will be “creative distruction” on a fairly wide scale. It might be fun to watch the creation side, but hard being on the receiving end of job distruction.

In the article above you talk about the foolish predictions of the Club of Rome, etc. I agree that they were foolish, and did not take account of price-feedback loops, new technologies, etc. The thing is, they were publishing at a time of recession, largely driven by an energy price shock. It wasn’t all roses.

Sure, we will probably adjust without too much trouble to post-oil technologies, but that doen’t mean that it will be painless for everyone.

I think the best thing we can do to reduce the pain is to get real about all this as soon as possible. Nail down the EROEI on ethanol and see if it is really worth our subsidies. Check out the real engineering status of hydrogen fuel cell cars, and see if we should really be building filling stations.

And consider if the “silver bullets” aren’t that promising, that we should be pushing much harder for increased efficiencies in our factories, homes, and automobiles.

Don’t trust me too far though, I can’t even spell destruction!

First of all, oil is not abiotic. OK, there may be a very small amount of oil that is abiotic, but the vast majority of it comes from the breakdown and “cooking” of organic material laid down millions of years ago (plants not dinosaurs). Source rock laden with tons of partly degraded plants was pressed down into the earth’s crust between 7,000 and 15,000 feet, where it cooked into oil. Any deeper and it breaks fully down into gas, shallower and it is “shale oil” (lots of it in Colorado and Wyoming). There is a plethora of information about the source of oil. It is well understood. You can find any old crap on the internet. Do your homework from reputable sources.

Second, the alternatives to oil are truly great and will constitute a larger and larger share of our energy mix in the coming years. However they will fail to supply AS MUCH energy as we currently extract from oil. Declining gross energy consumption (as opposed to expanding) will have consequences for industrial civilizations. Efficiency, conservation, and new sources of oil will buy us a few years. Shifting to cellulose based fuels, even if they could ramp up to the volumes of fuel we use today (I have my doubts), would just result in Peak Topsoil in a number of years. Which brings me to my third point.

Third, the Club of Rome was derided in the above comments as “wrong”. Their predictions were for NOW – 2050. If limits to growth are still totally invisible in 25 years I will gladly eat a huge serving of humble pie, but I’m afraid they will be proven right in the next two or three decades. We live in a finite world with finite resources and finite pollution sinks. There is a very solid body of multidisciplinary science from meterology (global warming), to geology (peak oil), to ecology (where to start?), that supports the understanding that we humans are “living beyond our means”. Peak Oil is just the first manifestation of a limit being imposed on our current growth based economic system. We may be able to ramp up Fischer-Tropsch processes, LNG, and nuclear electricity in time to substitute for the coming declines in oil production, but as long as growth is the goal we will hit limits.

All natural resources hit a peak. Oil has been declining since it was first pumped. It doesn’t matter when we run out of oil or how much it costs since it is not renewable. If billions of people in this world can live without oil, it shouldn’t be hard for a few hundred million americans and europeans.

Oh, what a great deal. You blow your first set of predictions by a freaking million miles and all they do is change the prediction date. What a bunch of pathetic twits.

No, no, no! Haven’t you learned anything? Just move back the catastrophe date by 25 years. Or even better claim that since you brought up the problems people responded accordingly and through your sage advice disaster was avoided.

Yes, I’m sure Malthus mad a very similar point. Say…didn’t Ehrlich make this point too?

I find it so interesting that this concept of Peak Oil has taken on political overtones. If you believe in Peak Oil you must be a Liberal. If you don’t you must be a Republican.

I look at this stuff from the inside of a major oil company and from a position where I get to see a lot of the upstream investment opportunities throughout the world. What I see is not encouraging. The price of oil has doubled in 3 years, but industry activity is only up slightly. The big oil companies produced less oil last year than the year before – despite the big runup in prices.

Peak Oil is reality. Hell, the Oil and Gas Journal, the mouthpiece of the International Oil Industry has had at least 3 major articles about this in the last 6 months.

When it will happen, no one can say for sure. Moreover, we all hope that the grand genius of mankind will find a solution out of this predicatment. But I for one am starting protect my assets for the probability that there will be some problem years before we find a way out of this predicament.

Steve,

I’m a little disappointed in your response to Edmund Brown. He’s raised three points and you’ve only chosen to address one, the one dealing with the “Club of Rome.”

Are you trying to debate the merits of prognostication in general? Or are you interested in debating the specifics of “Peak Oil” prediction?

I’d assumed the latter considering the title of your article and our previous deliberations.

With that in mind, I’d be interested in your take on at least one of his other two points.

I know some of your positioning on new or alternative fuel sources and I agree with the notion that alternatives will play a much greater role in providing energy in the future if the “dooms-dayers” happen to be correct in their peak oil predictions.

Do you agree though that,

Personally, I think that’ll be the case, and I also have to agree with him when he says,

After that it could be one peak after the other until we encounter some disaster or discover a viable, long term alternative.

I think we need to consider any option that will buy us the time to reach that discovery. In other words, we need to start planning and introducing the alternatives immediately rather than wait for the discoveries to appear.

What do you think?

In either case, disaster or discovery, I’m afraid we’ll be in for some tough economic times ahead as we adjust.

As to the theory of oil being abiotic, I think we can all agree that its validity is about as remote as is the theory of Earth being struck by an unknown comet anytime soon.

This is a pleasant diversion, thanks for giving me a chance to participate.

We may argue and dicker over the exact point at which world Peak Oil may take place but it seems pretty clear it will take place within a the next 25-50 years. In other words World Peak oil will take place in our generation. Looking at real data, the number of new oil fields to come on line in the next 5-10 years and the demand that India and China will have on oil, we have at best hit a plateau in the curve. The only way oil prices go down significantly from this point on is to have a down turn in the world economy. It appears that world oil production will not be able to keep up with the current economic growth rates of China, India and the US. The way I view the situation it’s a Catch-22.

Geo,

I see no reason to reply to the abiotic theory of oil since I don’t hold that belief.

I’m also unimpressed with the cellulose argument as well. I thought it was not worthy of a serious response or a joke.

Well I’m interested in both, but focusing on the latter is fine with me.

With current technology, sure that is a given. Solar, wind, biomass are all rather inefficient right now. Nuclear could go a long ways towards solving the problem, but I don’t think the U.S. is ready for such a move…yet.

Well without trying to give away too much of the punchline here, I think our biggest worry is that the government is going to “solve this problem”. I think this is what will actually lead to a crisis, not a solution.

So let me guess, Todd you are long on oil futures right? I mean afterall if you really, really believe the above you should be buying up oil like crazy. In 10-15 years you’ll make Bill Gates look like a penny-ante chump! It is inevitable right, so its pretty much a sure path to riches and hot chicks.

Steve, I think we’ll keep electricity going, even if we have to bulid quick and dirty (literally) coal plants.

My concern (as a science/engineering realist) is that people seem to invoke “magic” (as we engineers say, when we are being critical) to solve the transportation issue.

FWIW, I could be happy with a current-production electric, like the GEM neighborhood vehcile … but if everybody steps down that far in mobility we are looking at some serious disruption.

I am a Republican and a geologist who believes that light oil will peak at some point (can we all agree on that?). The question is how many years from now. I find it interesting how some opponents of the Peak oil theory dismiss the idea that it will happen in the next few years, and are indifferent to its occurence in lets say 2037 (the date chosen by the USGS). 32 years from now is not that long! 32 years ago was 1970.

As a beliver in the free market I think things will work out in the end as we develop alternatives to cheap oil. However the invisible hand of the free market will not keep a roof over my head! Each individual needs to prepare for some bumpy roads ahead. Buy coal stocks! Buy windpower stocks! The US has 27 percent of the worlds coal reserves!

I think the situation is both better and worse than most people assume.

Better, because the march of technology has led to improvements that we couldn’t have imagined during the last energy crisis. The Japanese are buying refrigerators that use 160 kWh a year; that’s less than 20 watts average! People are hacking their Priuses to run them on somewhere between zero and 1/100 gallon per mile, using electricity to make up the difference. We know how to make buildings which need next to nothing for heat and light. We can get large amounts of electricity as an industrial byproduct and we can solve the nitrogen fertilizer problem by extracting hydrogen from the syngas in coal-fired IGCC powerplants. Solar PV from micron-thick silicon is touted at 1 euro/watt by 2008, and quantum dots are claimed to offer PV at up to 65% efficiency (imagine a McMansion roof that puts out 100 kilowatts in full sun, or an electric car that recharges itself); closer to today, 5 megawatt wind turbines are highly competitive and can take pressure off natural gas supplies. If we moved on these and other advances in a big way, the wave of this problem would be left behind so fast it would never catch up to us.

Worse, because I expect people in the USA are going to continue business as usual until it’s too late to avoid serious pain or worse.

(Ahem. This blog software edits escape characters to their targets INCLUDING IN THE EDIT WINDOW so you cannot post what was in the preview. Will someone fix this?)

Read a good summary re abiotic oil at: http://www.museletter.com/archive/150b.html.

I have been following the peak oil/natural gas issue for some years and am convinced we are headed for serious near term problems. Our debt-based economic system, agricultural productivity, population explosion and other growth areas have been enabled by cheap energy. When global energy production begins to fall below demand growth by 4-5% per year, watch the bombs begin to fall.

The US media has been irresponsibly negligent in discussing the issue. Go to Google/…more/Alerts and request alerts for ‘peak oil,’ ‘oil depletion,’ saudi reserves,’ and related topics to see what the larger world thinks of the problem.

Read the report to the DOE on Peak Oil at: http://www.hilltoplancers.org/stories/hirsch0502.pdf, or the newletters and links from the web site of the Association for the Study of Peak Oil (www.peakoil.net) for more detailed information.

The Richard Heinberg book: The Party’s Over also gives a sobering perspective on the issue. Try to put wind or nuke power into the fuel tank of a truck, train or car. Hydrogen is a political distraction that will not arrive in time to solve our problem.

The oil problem is a BIG problem and the “invisible hand” of the market is blind. Look at the mess GM is in. Who wants to pay $70 for a tank of gas? When it goes over $100 you will be able to buy the big butt vehicles really cheap. They will make great crappie habitat. Why doesn’t GM offer a car that can generate a 12-24 month order backlog? Duh!

Watch for the brownouts and rolling blackouts as our natural gas supplies dry up and gas line pressures drop. The combustion turbines our utilities bought over the last decade or two were relatively cheap, but may be useless when needed the most. Biogas anyone?

So long as we remain in denial and continue to be led by delusional hypocrites we will continue our rush to the cliff.

Read a good summary re abiotic oil at: http://www.museletter.com/archive/150b.html.

I have been following the peak oil/natural gas issue for some years and am convinced we are headed for serious near term problems. Our debt-based economic system, agricultural productivity, population explosion and other growth areas have been enabled by cheap energy. When global energy production begins to fall below demand growth by 4-5% per year, watch the bombs begin to fall.

The US media has been irresponsibly negligent in discussing the issue. Go to Google home page, more then Alerts and set up Alerts for peak oil, oil depletion, saudi reserves, and related topics to see what the larger world thinks of the problem.

Read the report to the DOE on Peak Oil at: http://www.hilltoplancers.org/stories/hirsch0502.pdf, or the newletters and links from the web site of the Association for the Study of Peak Oil (www.peakoil.net) for more detailed information.

The Richard Heinberg book: The Party’s Over also gives a sobering perspective on the issue. Try to put wind or nuke power into the fuel tank of a truck, train or car. Hydrogen is a political distraction that will not arrive in time to solve our problem.

The oil problem is a BIG problem and the “invisible hand” of the market is blind. Look at the mess GM is in. Who wants to pay $70 for a tank of gas? When it goes over $100 you will be able to buy the big butt vehicles really cheap. They will make great crappie habitat. Why doesn’t GM offer a car that can generate a 12-24 month order backlog? Duh!

Watch for the brownouts and rolling blackouts as our natural gas supplies dry up and gas line pressures drop. The combustion turbines our utilities bought over the last decade or two were relatively cheap, but may be useless when needed the most. Biogas anyone?

So long as we remain in denial and continue to be led by delusional hypocrites we will continue our rush to the cliff.

Of course the “invisible hand” will not keep a roof over your head, and maybe that is what you are saying, but to be pedantic there really is no “purpose” to the market.

As for bumpy road, I’m sure there will be bumpy roads in the future. We have had them in the past and most likely will in the future. Planning accordingly is wise.

Norm E: What do you mean, you can’t put nuclear or wind in your “tank”? It’s happening. What we really need is to re-start the PNGV program so partial-battery vehicles are built by more than just Toyota.

“Person who claims something is impossible should not get in the way of person who is doing it.”

The most recent price I’ve heard for the Prius-mod is $10,000, and that is pretty much the battery cost.

It doesn’t surprise me that adding $10,000 worth of batteries can increase the electricity a car can carry …

I don’t know, a lot of the popular-press articles seem to think this is some kind of fundimental breakthrough and that the quoted “100 mpg” is the result of a cheap tweak.

In terms of transforming the fleet, I’m not sure how many people want to commit to $10,000 more in batteries … the charging cost may be low, but the “container” cost is quite high.

We need battery research,

Another way to say it is that I suspect Toyota made the right engineering decision when they sized their batteries, given: range, price, life, and eventual replacement costs.

The $10,000 figure is for the version using Valence Technology’s Saphion batteries; these appear to be very early models and are probably closer to the cost of prototypes than production units.

The list message quotes the battery-pack capacity as 9 kWh. The retail quantity 50 price of Li-ion cells appears to be about $720/kWh, or $6500 for the battery pack; bulk discounts and automated assembly would probably reduce that. We can also expect the price to come down fairly rapidly with time.

Or we could start with lead-acid batteries and buy up as the relative cost of fuel and high-performance batteries permits. This message mentions a string of 18 PbSO4 electric bicycle batteries, nominal 12 V, 2.4 kWh total capacity at vehicle discharge rates, 240 pounds. They claim 58-105 MPG over a 14-mile hilly round trip. At the same per-AH cost as the deep-discharge batteries I’ve got, such a battery would run a mere $144.

Quadruple it if you like. That’s still not a bad place to start.

(test comment – my substantive comment has not appeared despite 3 attempts to post it.)

Actually Steve, it depends on where you are looking. Malthus made the observation that populations increase geometrically while food production increases linearly. If you sift through the history of human beings on this planet you can find examples of this being right as well as your correct observation that in our own era, in our own countries it was wrong. Many civilizations have flourished only to perish due to Malthus’ law. I suggest Diamond’s latest book on this subject.

Ethiopia and Rawanda are both modern examples of Malthus, Ehrlich and the Club of Rome being right. There is over-population in regions of the planet right now. The world produces enough food to feed everyone, so why are a significant portion of the world going hungry? What about the massive destruction to ecosystems and bio-deversity that has occurred since Ehrlich wrote his book? Oh, I guess you don’t care about that. Your vision and experience of the world is obviously narrowed to your own first world rich life. Do I have to point out that you and I are of an elite in this world, with freedom, money, and access to advanced technology taken for granted while the majority of the earth’s population doesn’t even have access to a private telephone?

You are making the same mistake as Ehrlich. You assume that current trends happening now will continue forever into the future.

Actually I’ve already heard this one before… many times. The reduction in oil use due to the recessions caused by the OPEC oil shocks could account for this. Which leads into this point:

This drop in production was a result of the OPEC oil embargoes. So yes pricey oil causes conservation and diversification in energy use, which is a fancy way of saying RECESSION. Hopefully this will smooth the peak out into more of a plateau, this would provide breathing space for policy on a power-down to be implemented. OTOH If new technology comes along that allows us to get the oil out faster the crash happens sooner.

You are not looking at the other side of Hubbert’s theory – that production must mirror discovery. The data on discovery is pretty dire, it peaked in the 1960’s. Expensive oil isn’t helping discovery now, as this theory suggests it should. More money was spent on exploration last year than the value of the discoveries. Does that sound like good business to you?

They thought that was the case in the 50’s when Hubbert presented his paper. He was right, the USGS’s ridiculously large estimates of U.S. oil was wrong. So guess what, history repeats and econmists like yourself are doomed to relive the mistakes of your predecessors. Unfortunately, the religion of neo-classical economics rules, and so dooms the plebeians with it.

If the Hubbert curve was used to create policy leading up to 1970 world history would be very different. The U.S. could of been a world leader in alternative energy technology, carbon emmisions would of been significantly lower perhaps mitigating global warming and the Middle-East would not be the clusterfuck it is now.

Show me any economic theory that can make a successful prediction decades into the future. You can’t, because economics is not a science. So should policy be created on a previously tested geophysical theory or more economic wishful thinking?

Engineer-Poet, I’m open to things that work. My concern was that they are currently charging (checking their site) $10,000-$12,000 for a system that will carry a buck or two worth of electricity around (I think I read that was the charging cost).

Paying $10,000 to carry $1-2 is interesting economics.

It is probably important to emphasize that I love technology (I’m a semi-retired engineer myself), but that one of the things we’ve got to do is look at what “breaks” an idea early, and then see what can really be done about it.

Better batteries will help us in all kinds of ways, as we move from the truly excellent liquid petroleum fuels.

It may also be that lead-acid batteries will work in a plug-in hybrid. I’d love to see what the real-world range and mileage are (given the weight penalty).

Oh, and given tight battery supplies, I suspect that it would be better to build more prius-level hybrids, rather than fewer plug-ins.

(as batteries become plentiful (and cheap) that changes, of course)

I must say Rowan that’s the spirit! When the initial prediction is flawed you change the prediction around so that you can justify the hypothesis. Goal post moving though does get a tad boring though.

Let us recap, the prediction is that the world wide effort to feed humanity was/is over. Not that there are regional problems (usually political) than can bring about famine. The claims of Malthus and Ehrlich are false. That there is not a distribution system in place or that the distribution system in place is not allowed to work to eliminate famine was not the issue. The claim was that we simply could not grow enough food. We can grow enough food, we do grow enough food, but for other reasons (again usually political) in some places famine does occur.

And Zimbabwe! Don’t forget the idiotic policies of a madman causing famine! Of course, these examples don’t work either. The claim by Ehrlich et. al. wasn’t that for political reasons famine might be used as a weapon. Or that war might disrupt local food distribution. No, it was that worldwide famine and resource exhaustion was inevitable. Local examples do not support the claim.

Congratulations on disproving your own claims. Good work.

Which of course discounts the role the Federal Reserve played in the recession. Interest rates were sky high because inflation was sky high. Now some might suggest that inflation was high because of oil, and to some degree they’d be right. But also a problem was a complete break down of the Phillips curve inflation-unemployment trade off. Basically the curve went veritcal implying that increases in the inflation rate would not reduce unemployment, not that the government didn’t try. So you had higher inflation mainly because people figured out the governments gimmick for increasing inflation to lower unemployment. Along comes Paul Volcker who breaks the cycle and sends the country into a severe recession.

So sorry, this explanation just doesn’t wash with me.

Ahhh yes, the old conventional wisdom. Oil prices rose, and the economy went into recession. Lets forget that interest rates were around 20% at the time! Very convienent of you to omit such facts.

Beat that strawman! Beat his ass!

Did I say that new discoveries could solve the problem? No. In fact, I claim the opposite. I note that new discoveries doesn’t make Hubbert or his curve wrong, but that it makes its use as a predictive tool problematic.

Yeah, if we all had 20/20 foresight like we do with hindsight we’d all be billionaires. Big deal. I see this as irrelevant.

It is my contention you wouldn’t know what neo-classical economics is if it came up and bit you on your ass. You have not argued in the least against any of my criticisms other than to hurl logical fallacies.

Let me see. We have and have had a cheap reliable source of energy: oil. But Rowan here thinks it is smart business sense to spend money on alternative technologies. And this is good business sense because…we’d spend lots of money on more expensive alternatives. Sheer genius.

As already noted, Hubbert’s prediction of a world wide peak was wrong. So much for your “previously tested geophysical theory”.

You might be interested in this collaboration between ecologists and economists. Don’t be put off too soon, it gets good (everythign that follows is a quote):

On the one hand, economists tend to believe that, if we run out of some environmental resources or find better or cheaper substitutes, we will simply switch — from horsepower to gasoline, for example, or from gasoline to hydrogen. The economic argument is typically that “increases in knowledge and in manufactured and human capital will enable societies to substitute their way out of economic problems,†says Dasgupta.

Ecologists, on the other hand, tend to believe that “we are running out of environmental resources†and some environmental resources cannot be replaced, like the dodo or the passenger pigeon.

“Much of what is generally published on the question is an outburst of the personal emotions of the writer,†Dasgupta says. But the Askö group, as they decided to call themselves after their Swedish getaway, came to believe that it just might be possible “to go way beyond mere hand-waving.â€Â

They began to think, quite audaciously, that they could figure out a mathematical formula for sustainability that would satisfy both economists and ecologists. There were two crucial things that made this possible.

odograph writes:

Bad analogy. I think the proper one is what it would cost to get the same energy from fuel, including disruption costs.

If the car is carrying electricity for 30 miles, that’s worth about $2.25 at current gas prices for a car getting 30 MPG ($3.00 for a vehicle getting 22.5 MPG); the battery would pay for itself in about 4,400 cycles (132,000 miles). If the price of fuel goes up to $3.60, the electricity replaces fuel costing $3.60 ($4.80 for the 22.5 MPG case) and the battery pays off in < 2800 cycles (84,000 miles). Things get better and better as the cost of fuel goes up.

If you can make the battery for $5000, payoff distance is halved. A $500 lead-acid battery providing 10 all-electric miles would pay off very quickly for drivers making mostly short trips.

Whatever is built should be convertible at a later date, and allow different battery technologies. A Prius built today can be converted to GO-HEV tomorrow, or three years from now; being able to re-power large parts of the vehicle fleet long after manufacture would provide the flexibility required to deal with price and supply fluctuations.

Steve,

I think you’ve hit the nail on the head with your last reply to me,

In my mind there is no question that the government will create the biggest problems in many ways.

Unfortunately, as Bubba the real one pointed out, this seems to boil down to a “liberal” vs. “conservative” argument.

I’m not sure what side you butter your bread on, but I guess I’d fall into the “liberal,” peak oil camp.

It seems to me that one of the results of peaking oil would be that those governments with the military power to do so, would certainly engage in resource wars to protect or steal as much of the remaining oil reserves by force as possible before the peak.

I think this is exactly what our government is doing in Iraq right now.

If I recall correctly, Iraq is supposed to have reserves only slightly less massive than those of Saudi Arabia.

By trying to control those reserves the government is clearly acting to preserve its power and “solve” the problem.

All this, included with much of the other information presented on this site recently, clearly indicate to me that peak oil is not just a dooms dayers nightmare, but rather something we’re all witnessing as the beginning of a very painful slide into chaos.

Thanks again.

I thought the prius+ could do all-electric for only 10 miles, making the total overnight charge worth 1/4 gallon (at the prius mpg).

There are two versions of the Prius+. One has the 18-unit array of electric bicycle batteries (lead-acid) and has an electric range of about 10 miles, and the other has the Valence Tech. Li-ion battery which gives an electric range of up to 30 miles.

Sigh

No. It. Does. Not.

It means we are only over our “carrying capacity” if there is no replacement for oil and we actually go through a complete Hubbert cycle.

Really…what is so hard to grasp about this.

Oh, I see you’re an engineer. Now don’t get me wrong, but engineers are not the best people for understanding the market. The market is generally an undirected process, as I have been trying to point out in comments here. The market doesn’t care about much of anything. Now sometimes that is bad, but generally I think that is good.

So the market didn’t help you come up with finding replacement material, but the market didn’t help you. Okay, why didn’t it help you? Was it too expensive? If that is the case, it isn’t a failure of the market more than of your checkbook.

As for your examples such as Easter Island, I didn’t realize that was a market economy. Was the economy more of a command-n-control economy. Silly me not to realize it was an economy just like we have today. Tired of carving monoliths, just go switch and become a fisherman, or farmer. Or was the economy one where certain commodities were “open-access” and hence there were no institutional mechanisms (i.e., the price mechanism via the market and property rights) to preent over-use?

Re. the Prius+, I’ll watch more closely, and give it a chance.

Re. “engineers are not the best people for understanding the market” … that makes me laugh, and not only from my perch in decades-early retirement. I’m afraid the flip side is that management and marketing can pres-release anything. A tremendous number of companies go tits-up when they finally figure out what those dumb engineers were trying to tell them.

Actually, lots of companies go Tango Uniform because they refused to believe what “those dumb engineers” were trying to tell them, or never understood it; the ones who get it late may still have a chance if their competition doesn’t.

One of the reasons I’m big on GO-HEVs is because I want a reak market in energy for transportation. That doesn’t just mean that oil from different places should be fungible, but energy from oil, wind, nuclear, solar and cogeneration should all be usable and competing against each other. Vehicles which can make use of electricity from the grid accomplish that with no further effort.

Unfortunately, our options are in no small part determined for the nation as a whole, and are constrained by the decisions of Congress. Is it safe to say that this Congress refuses to even listen?

Bruce writes:

In this case, there is .5 orders of magnitude or more between our current energy consumption and what’s available from various resources we are barely touching. Here’s a list off the top of my head:Human energy consumption: 400 quad/year (~13 terawatts)NASA estimate of available wind energy worldwide: 72 terawatts.Solar energy received over the Earth’s disc: 174 THOUSAND terawatts.We can fail in our attempts to find ways to capture this energy for our use, but we sure can’t run out.

We don’t need to. Our mobile systems are among our least efficient users of fossil fuels; batteries weigh a lot more per kWh stored, but the difference per kWh delivered is about 1/5 as big after you compare a 90% efficient battery to a 17% efficient engine. The issue is whether you can get rough functional equivalence, and when electric cars running on Li-ion batteries are already getting ~300 miles of range it’s hard to argue that replacement isn’t feasible; it may be right around the corner.

Dammit, that was a nicely bulleted list in the preview! Will you blog-dummies quit double-interpreting HTML?

No bullets for you!

Anyway, I think I’m slightly more pessimistic than the Engineer-Poet, but not by that much. I think we have technologies which if widely deployed today could give us a nice, but slightly different, lifestyle. I think incremental improvements will be made, but given the decades of hard work already applied to many of these technogies, we’ll have few revolutions. As a stake in the ground, I’d expect currently-known transportation technologies to improve no more than 100% from current best-of-breed.

But that’s still good. If we moved to 70 mpg cars (our current best-of-breed) now, we’d get tremendously more life out of the resource. We’d get more years for engineers to chip away at “known” and “hard” problems.

You want to give me something out of left fiedl? Great, that is where you can see >100% improvement … but left fields are a bit rare in personal transportation technologies … it is a valueable and well-researched field.

… all this adds up to something quite a bit more negative than the original article, but then I think the original article is out at an extreme, and not at all the centrist, reasonable, position. The other extreme would be “die-off” and I’m certainly no where near there either.

Maybe to make it clear where I’m coming from:

“The second Model A was the second major success for the Ford Motor Co. First produced Oct. 20, 1927 but not sold until December 2, it replaced the venerable Model T, which had been produced for 18 years. The Model A was available in four standard colors, but not black.

Prices ranged from $385 for a roadster to $570 for the top-of-the-line Fordor. The engine was an L-head 4-cylinder with a displacement of 200.5 cubic inch (3.3 L). Typical fuel consumption was between 20 and 30 mpg (US) (9 and 12 L/100 km) using a Zenith one barrel carburetor, with a top speed of around 65 mph (104 km/h). It had a 103.5 inch (2.6 m) wheelbase with a gear ratio of 3.77:1. The transmission was a 3 speed sliding gear unit with 1 speed reverse. The Model A had 4-wheel mechanical brakes.”

http://www.answers.com/topic/ford-model-a

… a 1927 Model A got basically the same mileage as my current model Subaru. Sure, my Subaru is nicer .. we’ve heard that before. But where is the best of breed? The current best MPG car in America is the Honda Insight which barely provides that 100% improvement over the 1927 Model A.

That’s what wires are for, Bruce. And various technologies, from microturbines to solar panels, allow the equivalent of “electricity wells” all over the place.

odograph: Very interesting, but compare vehicle weights (Google shows several repeats of 2155 pounds for the roadster). My ’04 Passat delivers 38 MPG at a speed the Model A could not reach, and weighs more than half a ton more. Your Subaru is many times cleaner than the L-head Ford. There HAS been progress.

I am enjoying the progress, I assure you. At the same time, I think it is important to note the character of progress in fields populated by many companies and many engineers over many decades.

Again, looking at best of breeds for fuel economy … the Insight makes that 100% improvement, as does the Smart, but they both drop two passengers off the Model A … and I’d suspect drop some cargo capacity. I believe they both weigh less. This, more than 75 years later.

And so I think I’m being optimisitc when I say that we can get another 100%. As I mentioned before, I think that will take a change to safety (and possibly emissions) rules.

Yes, it does matter because in a culture with property rights and a market mechanism the price of the good will go up as it is used up. This does not have to be the case in a command economy. That you don’t understand this implies strongly that you don’t understand this issue. At all.

In some cases maybe, but generally I doubt it. You are the guy who will implement the solution, not invent it.

As for the societies collapsing, lets not put the cart before the horse here. Our society hasn’t collapsed despite repeated erroneous claims to the contrary. Hell there was supposed to be a nuclear war in the 1980s. Fortunately most policy makers ignored the Club of Rome, Ehrlich and their ilk.

So you are an archaeologist too? Is that your weekend gig? How about many ancient civilizations developed rigid social structures and that often prevented change, innovation, and progress? No, you don’t like that? Too bad.

Also, different methods of allocating resources have different outcomes. Most people know this. This is why the Soviet Union collapsed despite an abundance of natural resources. Institutions and processes matter. That you can’t see this also strongly implies you don’t understand the topic. At all.

Don’t worry Bruce, I’ve already grasped that you aren’t up to speed on this issue. Aside from drawing crude analogies that when examined at a more detailed level fall apart I don’t see anything else you’ve brought up for me to consider.

By the way, have you read any research on the collapse of the Easter Island economy? Well if you had you’d note that one thing that tends to fit the data well is that an open-access to resources. I’m sure most people here are familiar with the free-rider problem and tragedy of the commons. Well, one way around the latter is via property rights. It isn’t the only solution, but it is one. So ignoring property rights in this specific case is what is leading you astray.

Ahhh the strawman tango continues. I didn’t say Engineers were dumb, but that generally they don’t seem to have a good grasp of undirected processes. For some reason you find engineers who tend to be fascinated by intelligent design over evolution.

Should a company listen to its engineers? Sure on engineering issues. But should an engineer offer advice on marketing, accounting, or how to run the cafeteria I think listening politely, then turning to the accountants, cook and marketing guy would probably be the wise strategy.

Right now 2.8 billion people live on $2 a day and 1.2 billon of those live on $1 (www.worldbank.org). No problem, it is quite possible to live on $2 a day, maybe you should go out and try it Steve. Just don’t count on eating three healthy meals a day… or feeding your six kids with three healthy meals a day. I guess if you haven’t actually starved to death there is no overpopulation.

Auther Russ Finley writes on this subject…

The exact predictions of Malthus (an economist) and Ehrlich were wrong, yes I freely admit that (again). The problem they were raising-overpopulation-has however proven to be real. So if by your reckoning these theories should be junked because they made some false predictions, then economics should also be junked, it’s track record is about the same as astrology.

The problem is, as Finlay puts it:

So no, I haven’t destroyed my claims, you have misinterpreted them. By the way, you really need to get over using the straw-man argument, you are starting to look like a one trick pony.

Please explain why another economic theory (ie the Phillips Curve) being proved to have no empirical underpinnings, has to do with anything? First you must prove why high oil prices were not the fundamental cause of high inflation. It sounds like you are trying to make history fit your favorite economic theory! Really I’m intrigued, please tell me more…

Either way you define inflation (an increase in price of goods and services or an increase in money relative to goods) oil seems to be the culprit. If you can prove otherwise I’d be grateful. To your credit, bungling on the parts of Government and the FED must have played a major hand in the ensuing recessions.

I’m sorry I’m using plain old conventional wisdom mate, but I didn’t realise that higher oil prices doesn’t cause the cost of transport, farming, petrochemical manufacturing, mining, etc, ad nauseam, to increase and I didn’t realise those cost would be passed onto consumers… who would have less money to spend on fewer goods… who would demand higher salaries… causing higher inflation… hmmm?

And then this little gem:

No, you had a reliable and cheap source of energy then, as Hubbert predicted, your domestic production peaked and you were at the mercy of an international Cartel who disagreed with your policies in regard to Israel. Really smart? Really smart, to think that alternative supply to the middle east would last forever when the vast majority of reserves are located in that region of the world. Really smart to have to spend billions of dollars and more importantly the blood of your children to ensure a major source of that oil makes it to the market (unsuccessfully I’m afraid).

Adieu.

Unless you have reason to suspect this of present company, how about you stop using this issue as a smokescreen?

Steve, I’d like to see you address the issue of progress in mature industries, and how the hope for “something” is different that a “hail mary pass” downfield.

I see the concept of logic escapes you Rowan. The above in no-way rebuts what I wrote. Sure its sad people have to live on $1/day. But that does not dispute the fact, one you admitted by the way, that we grow enough food to feed everybody. The problem is not growing food, but the distribution of food. You are wrong, get over it.

Sure, so says the guy who refutes his own arguments. Malthus wasn’t saying over-population is bad because food distribution systems aren’t good enough. Neither did Ehrlich. Further, it isn’t clear there are too many people vs. really rotten institutions in places like Africa that really fuck things up.

Coming from a guy who

1. Misrepresents my position.

2. Discredits his own.

3. Can’t seem to come up with a valid response

I don’t find the above all that impressive.

I already did. It isn’t my fault that you

1. Don’t understand the topic

2. Aren’t willing to learn.

The bottomline, once more, is that based on the Phillips curve the government would try to lower unemployment by increasing inflation. When people figured that trick out, the relationship between unemployment and inflation went verticl (i.e., no matter how high inflation got, unemployment wouldn’t go down). Thus, we wound up with high inflation. The higher oil prices probably didn’t help, as I noted, since many people look at the CPI as an indicator of inflation and high oil prices would result in an increase in the CPI (never mind that the CPI overstates both inflation and the cost of living). But to reduce inflation the Federal Reserve basically brought about a sharp recession in 1980. The idea it was only oil is dubious at best.

Are you stupid or what? Where did I write anything that indicated the above? Hint: I didn’t. Sure, higher oil prices would drive up prices, which in turn would drive up the CPI. Is it the only factor? No. Which has a bigger effect, loose monetary policy or oil?

Granted oil was probably a factor, but was it the pivotal factor or a combination of things. Bad policy for years, higher oil prices, tightening of credit by the Fed, or just oil. Notice that right now, oil prices have risen quite a bit and economists in general are revising upwards their estimates as to what oil price would lead to recession.

Oil is still cheap. It is cheaper than its high point back in the last oil shock.

I think it is most adequate to describe Bruce.

As I’ve noted, one should approach this in a probabilistic way, IMO. That is

Prob(bad|peak oil,other historical information)

or

Prob(not bad|peak oil,other historical information).

My contention is that the second probability is larger. I don’t deny that Hubbert is right in theory. I do question some of the conclusions and forecasts. Also, are all “hail mary passes” the same? Doesn’t it depend on the QB and reciever? 1,000 years ago with the insitutions and social norms at the time running out of an important resource could have been devastating. Nowadays with different social norms and instiutions it might not be a big deal?

Well, I’ve tried to relate my experience as an engineer and watching many players in competition in the engineering space – an example of “undirected processes” quite fiercely faught.

My caution would be that established industries iterate. Once you have, say, a dozen companies, in a few countries, working on something for twenty years … you know the growth curve. For some things the curve is steep (semi-conductors) but for others it is gentle (automobiles).

You know, there used to be a saying … ah, here it is:

“Gordon Moore, one of the early integrated circuit pioneers and founders of Intel once said, “If the auto industry advanced as rapidly as the semiconductor industry, a Rolls Royce would get a half a million miles per gallon, and it would be cheaper to throw it away than to park it.”

http://nobelprize.org/physics/educational/integrated_circuit/history/

The thing to ask yourself, as you count on a long shot, is why Rolls Royce didn’t build that amazing disposable luxury car.

My answer is that the personal transportation industry has a difference set of fundimental constraints.

And I think this thread is too abusive for me … bye bye.

Between Steve being abusive and Bruce adhering to a bunch of nonsense pushed by bare-faced liars who claim their theory is scientific while explaining nothing and hiding a religious agenda, I think I’ll take a powder too.

I’ll bet we could have used the energy we’ve wasted on criticizing and sniping at eachother to find a solution to the potential oil depletion problem had we chosen to.

Instead, we’ve simply proven that if a crisis does begin, we’ll probably just argue ourselves into oblivion.

So, why worry?

Let’s build some stone heads instead…they’re always good for a laugh.

Good luck boys and girls.

I’m outa here too.