Poll: Americans Want Free Stuff

A shocking new polls shows that most Americans would like to receive Social Security and not pay for it.

A shocking new polls shows that most Americans would like to receive Social Security and not pay for it.

AP (“Poll: Most Americans want payroll tax extension“):

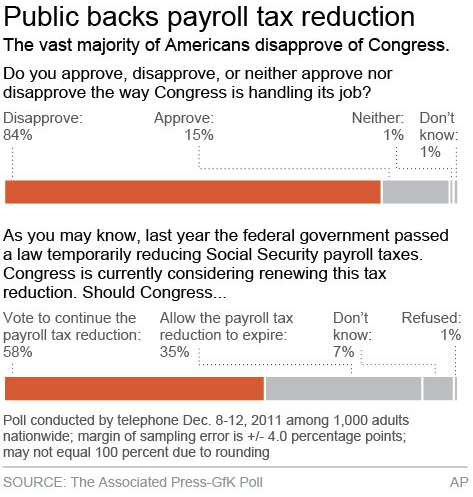

Most Americans want Congress to vote to continue the payroll tax reduction, according to a new Associated Press-GfK poll that comes as Democrats and Republicans wrestle over whether to extend the cut through 2012.

[…]

Nearly 6 in 10 respondents say they want Congress to pass the extension, according to the poll. Letting the payroll tax break expire would cost a family making $50,000 about $1,000.

[…]

On the payroll tax deduction, 58 percent of respondents said they want Congress to extend the break, while 35 percent want it to expire.

Democrats and independents are the strongest supporters of continuing the tax cut, while Republicans were evenly divided. But the difference is more partisan than ideological: Conservatives supported an extension, 54 percent to the 42 percent who prefer to let the reduction expire.

Those with annual incomes below $50,000 more strongly support the extension compared with higher-income respondents, and seniors were more likely than younger adults to back the extension.

In news that is actually news, it seems that, if getting free stuff is not an option, people would rather not get the stuff than pay for it.

As for how to balance the federal budget, more now favor cutting government services as the best means to bring federal spending into balance. Sixty percent think lawmakers should focus on budget cuts over tax increases. That figure had been as low as 53 percent in August, during the showdown over raising the country’s debt limit.

The biggest shift on that question has come from independents. In the August poll, 37 percent said lawmakers should focus on increasing taxes and 42 percent said cutting services. Now, that divide stands at 28 percent for raising taxes and 59 percent for cutting services.

This is very interesting, in that it reverses recent trends in which people preferred to pay for services by raising taxes on other people. Presumably, it reflects the fact that Republicans have been hammering spending cuts for two years and the Obama administration has largely relented.

This willingness to cut services will, to a large extent, vanish when you start mentioning specific services, in particular the budget items (Medicare, Medicaid, Social Security, Defense, Education) that make up the vast majority of Federal spending. And, the reluctance to raise taxes will, to a large extent, remain.

Republicans and Democrats are perfectly aware of this and have encouraged these beliefs in their own particular ways, which is one reason why our budget is such a mess (though, I don’t mean to imply that both parties are equally culpable).

Aside from your inflammatory lead in (“A shocking new polls shows that most Americans would like to receive Social Security and not pay for it.”)…I can not see how this approach to reduce payroll taxes doesn’t align with the Laffer curve….

If more people who spend money on common goods increase their available resource to spend (ie, lower income people are reputed to spend more of their disposable income than invest is stock or save it), then that increases the money in circulation in the economy…

More spending = more demand = more work = more hiring or raises based on increased demand = increase in payroll tax revenues to the pool….

So why does a temporary tax reduction (not elimination, as your lead-in implies) not fall right into the Republic party’s ?

@Robert in SF: The current Republican orthodoxy is that we have to pay for things. We’ll still be sending out Social Security checks, but not collecting the money to pay for it.

In terms of stimulus policy, though, this strikes me as perfectly rational. It goes directly to those who will spend and can be done with next to zero administrative overhead.

Lower tax rates can and do lead to higher tax revenues, but only when the reduction in the tax burden obviates a binding constraint. Job creation has been pitiful not because of payroll taxes. Consumers also have been spending throughout the recession. The extra money from the temporary payroll tax exemption largely is going towards catching up on late or absent mortgage payments or to fill up gas tanks. Not too much in the way of job creation there. To observe a real world example of the Laffer curve in action, as applied to jobs, it would require a major cut in the corporate income tax rate.

James:

Again, I think you are using some sort of intentional misrepresentation here on the issue. The current question is about extending payroll tax rates…not eliminating them. And yet, you seem to be phrasing it as though a temporary decrease in income somehow dissolves savings, as it were, available for payments.

If the Republic party was so interested in paying for things, why did they vote down PAYGO? Political reasons, of course, but still….the same concept. [citation needed]

@Tsar

Demand drives job creation…not supply. Just because a company has more money doesn’t mean they will hire, if there are no need for the jobs. Jobs are not an asset, they are a liability, as far as my laymen view of accounting goes. Demand is tempered by availability of spending resources (credit or income)…so why not a reasonable injection of income into the market via this continued tax reduction?

And I would think I should find a citation for your claim: Lower tax rates can and do lead to higher tax revenues….let me search via Google to find it, unless you can post it before I get back.

@Tsar:

Nope.. Apparently the concept that tax cuts automatically increase revenues isn’t a given.

All I found were these references to actual analyses and opinion leader comments:

Tax Cuts Don’t Boost Revenues

http://www.time.com/time/magazine/article/0,9171,1692027,00.html

http://www.factcheck.org/taxes/supply-side_spin.html

Tax Cuts: Myths and Realities

http://www.cbpp.org/cms/?fa=view&id=692

@James Joyner: James, you said, “The current Republican orthodoxy is that we have to pay for things.” We could pay for things by raising taxes, but Republicans will not currently allow that. I get the impression that this is more about cutting social programs than a newfound concern for deficits and debt.

@James Joyner:

How is it that some tax reductions on income need to be paid for and others don’t?