Raising Taxes on Other People Very Popular

President Biden's pollster has made an amazing discovery.

Axios (“Biden pollster urges blunt tax talk“):

The top pollster for Joe Biden’s presidential campaign is advising the White House to do something that often makes Democrats nervous: Talk loudly and proudly about raising taxes on the rich.

Why it matters: John Anzalone tells Axios his extensive polling and research has found that few issues receive broader support than raising taxes on corporations and people earning more than $400,000 a year. Anzalone’s view — which he pushed during the campaign, and which the new president’s inner circle seems to share — is that Biden should go on offense on tax hikes. He should make raising taxes on the wealthy and corporations a standout feature of his messaging, rather than a necessary evil to fund his $3 trillion-plus spending plans, Anzalone argues.

[…]

Anzalone says Republicans will brand Democrats as “tax increasers” regardless of what they do, so they would be best served by framing the tax debate themselves. “The middle class is tired of carrying the tax burden for the country,” he said. “They are pissed off. They aren’t anti-rich or anti-corporate. They are anti-not paying your fair share.” He said voters “know the rich and big corporations have the power, accountants, lawyers and tax law on their side to avoid paying their fair share” and “they just want those holes plugged and a fair rate so the country can make investments in the economy, health care and education.”

By the numbers: Poll after poll after poll after poll support Anzalone’s analysis. A November New York Times / Survey Monkey poll found “two-thirds of Americans (67%) support raising taxes on those making $400,000 or more,” including “70% of independents and nearly half of Republicans and GOP leaners (45%).”

That raising taxes on other people is popular is hardly surprising. George Bernard Shaw told nearly eighty years ago that “A government which robs Peter to pay Paul, can always count on the support of Paul.” By defining “the rich” as those making more than 98 percent of people, it’s not shocking that 67 percent agree with taxing them more; indeed, the shock is the 21 percent below that threshold who don’t.

Beyond that, I don’t recall Democrats being afraid to talk about taxing the rich. Indeed, it’s been a central message as long as I can remember. They’ve just been careful to make sure “the rich” are defined in a way that the average voter can’t imagine themselves joining the cohort.

The silliness of the popularity argument aside, most Americans at least vaguely understand the law of diminishing marginal utility. A hundred dollars is a windfall to a very poor person and meaningless to a billionaire. While what constitutes a “fair share” is, of course, debatable, our tax system is and always has been progressive, taxing those with means at a higher rate and excusing those who earn very little from paying federal income taxes altogether.

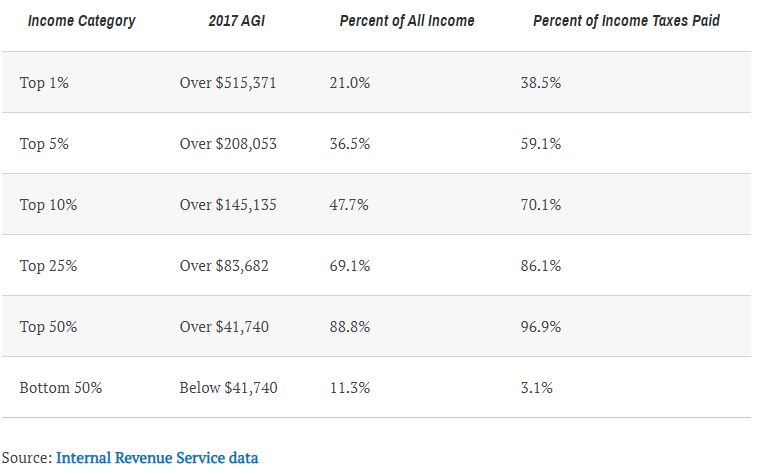

The nonpartisan Tax Foundation looks at 2017, the most recent year data is available, and reports:

*In 2017, 143.3 million taxpayers reported earning $10.9 trillion in adjusted gross income and paid $1.6 trillion in individual income taxes.

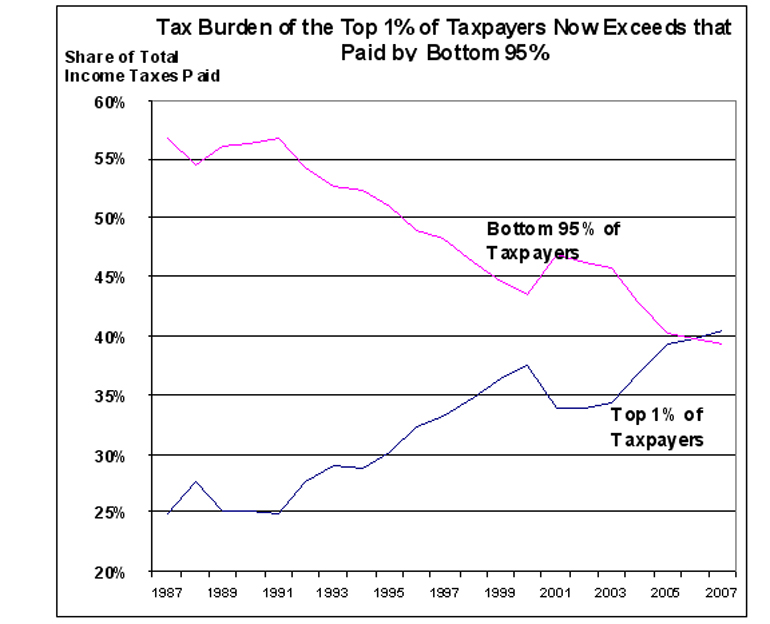

*The share of reported income earned by the top 1 percent of taxpayers rose to 21 percent, from 19.7 percent in 2016. Their share of federal individual income taxes rose to 38.5 percent, from to 37.3 percent in 2016.

*In 2017, the top 50 percent of all taxpayers paid 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

*The top 1 percent paid a greater share of individual income taxes (38.5 percent) than the bottom 90 percent combined (29.9 percent).

*The top 1 percent of taxpayers paid a 26.8 percent average individual income tax rate, which is more than six times higher than taxpayers in the bottom 50 percent (4.0 percent).

A Kiplinger report puts the same data into tabular form:

Now, this was the last year of the Obama-era tax code, so things likely skewed somewhat in the other direction after the Trump tax reforms that went into effect the following year. They radically reduced the corporate tax rate but also eliminated or capped loopholes, notably the state and local tax write-off, that mostly benefitted the well-off.

Also, as the Intercept‘s Jon Walsh rightly notes, federal income taxes are only part of the picture. State and local taxes tend to be less progressive, especially given their reliance on sales taxes. That’s relevant when talking about the overall tax burden—but not when talking about the federal tax code.

More to the point, as Walsh and Brookings’ David Wessel note, even at the federal level, the cap on Social Security payroll taxes (currently $142,800) exempts most of the income of truly high earners. Because we treat Social Security as a separate account—and cap monthly Social Security benefits at $3,148 a month—it’s perfectly reasonable to also cap the taxes. But, given that Social Security is simply an entitlement paid for out of the general Treasury, we could simply eliminate separate payroll taxes for it and Medicare altogether in favor of a higher income tax, all of which would be subject to collection.

Regardless, the claim that “the rich” are evading taxes because they have armies of lawyers and accountants—and that “the middle class” is carrying the burden for them—is mostly a lie. Its true of massive corporations, who can make hide their profits such that appear to be made in tax havens like Ireland and, to a lesser extent, the ultra-rich whose income is mostly from the financial sector. But the lawyer, physician, or entrepreneur pulling in $500,000 a year is likely paying what he owes.

I’m not sure that is actually true. Republicans and the wealthy like to define our tax system as the marginal rate on income taxes. In reality it is the actual percentage of income paid by real people to get services normally considered government services. Fees, fines, property taxes, sales taxes and so forth constitute a much larger percentage of income for poor and middle class folks than it does for the rich.

Focusing on the income tax rate is a game the rich pay to avoid talking about the real costs to citizens. The states that don’t have income taxes instead fund their government functions by other means that fall disproportionately on the lower income people. For example, in many states a registration fee on a $120K Mercedes is the same as for a $3K beater. And the “no-tax” states have also privatized many government functions like trash collection and electric utilities, almost always raising the price and sowing chaos. And many state and local governments have kept their no-tax pledge by relentlessly harassing poorer folk and especially people of color and issuing ticket after ticket to heap up fines and late fees.

Bottom line, the focus on income tax is meaningless unless the rich actually pay that tax, including on capital gains.

Yes, yes, no.

Taxes on actual salary is pretty straightforward – no matter your salary.

A business owner or entrepreneur has many, many ways of changing what their “income” actually is. It can get very, very grey.

The more complicated the business enterprise, the more ability there is to be creative.

Raising taxes is simply responsible governing in an environment where all parties want to increase spending. The alternative is operating from a deficit.

I can’t fathom why we spend so much time figuring out who to bill for the excessive spending, rather than having a conversation about reducing military spending (in particular) or other huge categories that actually cause the problem.

Taxation is a symptom, an outcome — not the problem itself.

Then there is this hopeful sign:

Biden budget would beef up IRS tax enforcement -Yellen

This is a good return on investment.

What is the “tax gap”? From the CBO(July 8, 2020) report:

@MarkedMan:

Acknowledged in the OP. But almost all of that is on the states and localities. Biden has zero say over that.

The historical “justification for a lower tax rate on capital gains relative to ordinary income is threefold: it is not indexed for inflation, it is a double tax, and it encourages present consumption over future consumption.” But I agree that it’s harder to justify when the financial sector constitutes such a disproportionate share of the uber-wealthy.

@SKI: Yes, that’s fair. Your average small business owner has more write-off opportunities.

@Scott: Yes, I’ve addressed that in multiple previous posts. But almost none of that is the low-grade rich. Even though $400k is a lot of income, putting one in the top 1.8% nationally, it’s really those in the top fraction of the top 1% who have those tools.

@SKI: Exactly. Bill gates famously only got $100K/year in “salary”, but billions in stock options. These are taxed at the very low capital gains rate. I can vouch for the fact that the large company I worked for structured payment the same way, with C level salaries in the 100’s of K, but total compensation well into the millions. When the company was sold the C level execs received 10’s of millions in payout, all of which was taxed at half the rate I was paying on my salary. And none of which was subject to any of other taxes and fees that my salary was subject to.

@James Joyner:

The fact that this is still a talking point just shows the dishonesty of the wealthy and their errand-boys in congress. They still pretend that the capital gains are because of decades long investment in a brick and mortar enterprise instead of stock options, deferred earnings and rapid turnover in stock trading. The fact that the lobbying firms like the Heritage Foundation and other Billionaire funded organizations haven’t acknowledged this basic truth is all the proof you need to discount anything they say.

@MarkedMan: That’s why I referred to it as “the traditional justification.” That’s why the divergence exists and I think it’s perfectly reasonable to treat true investment income differently than wage income. What’s unreasonable are things like “carried interest” or options in lieu of cash and the like. The rules were based on a 1950s model and need to be adjusted for a financialized economy.

@James Joyner: I agree whole heartedly. My real gripe is the continued gullibility of the MSM in accepting that income tax is the most meaningful measure of how much someone pays to the government(s). It’s not, and never has been. And amongst large corporations and the wealthy, the nominal tax rate has virtually no effect on what they pay.

I don’t find that table terrifically useful. What matter is how much tax people are paying as a percentage of that income. There are various ways of calculating this but the gist is that the poorest pay about 5% federal, 10-15% state and local; the richest about 25-30% federal, about 8-10% state.

As I’ve argued many times, countries with big welfare states fund themselves with heavily regressive taxes: VAT, sales tax, more regressive income taxes (e.g., the UK’s second highest tax rate kicks in at 50,000 pounds). It’s also the only way it works politically: most people don’t want to “take from the rich”. But programs where everyone kicks in and everyone takes out (Social Security/Medicare in our country; the NHS in the UK, etc.) are popular.

We’re going to have to raise taxes on the middle class at some point. The longer we deny that, the worst the budget situation is going to get. We’ve gone from where that was a bipartisan agreement — Reagan, Bush and Clinton all raised taxes — to the point where its bipartisan denial (and in the case of Republicans, paired with the belief that we can somehow raise revenue by cutting taxes).

GBS was on to something true when he penned, “A government which robs Peter to pay Paul, can always count on the support of Paul.” But, when I consider who has the lion’s share of political influence/access in our Congress and reference the 50 year trends in income and wealth inequality in the US, I think I may have a different idea of who Paul is than you do.

I can’t speak for Amazon et al, but I pay a fukton of taxes. My corporate rate dropped under Trump, but my personal rate stayed pretty much the same. No, there is no fabled army of lawyers and accountants. No, I don’t have some magic way of deceiving the IRS. I sit down, take a deep breath, and write very large checks to the IRS and the FTB (Franchise Tax Board of CA). I also pay about a grand a month in property taxes. (And a shocking amount in marijuana taxes, but I suspect that won’t earn much sympathy.)

I’m not complaining (much) but I do get annoyed when people casually assume that I’m not paying. In fact, I have repeatedly voted to raise my own taxes, and when I do that it’s not kabuki, I really do have to write big fukkin checks as a direct consequence of my votes.

@Hal_10000:

Amen. Despite paying some of the lowest effective tax rates in the industrialized world, the US middle and lower classes inexplicably consider themselves to be grossly overtaxed, while also unilaterally considering themselves to be net payers who are entitled to a level of government services their contribution does not even begin to cover the cost of funding.

I did some quick and dirty back of the envelope calculations, and determined that the “fair” share of the federal budget amounts to around 80 grand for every man, woman, and child in the country. So, family of 4, “fair” share comes in around 240 grand, which obviously they aren’t paying. The vast, vast, vast majority of citizens are net burdens to the state (and to the small minority of taxpayers tasked with carrying them as well as carrying themselves).

At some point, the only viable alternatives will become raising tax rates or slashing services to the bone. It’s as certain as the sun rising.

@Tony W:

Be careful there. Another term for “military spending” is “utterly massive jobs program”. Cutting it involves rising unemployment. There is no free lunch.

About a year ago, the stock market tanked hard with the onset of covid. I bought a portfolio of stocks I thought would do particularly well. I don’t normally pick individual stocks, I think it’s kind of a fools game. But the world was panicking.

In the last couple of weeks, I sold them after making sure I’d held them for a year, so I could qualify for long-term capital gains. They did well, thank you.

The thing is, I don’t see any particular increase to the common weal that resulted from this. Specifically, I likely would have bought them just the same, and maybe held them a month or two less, but not a lot different. So I don’t really see what the justification for granting this transaction, and the many others like it that I’m sure are out there, a lower tax rate might be.

@Michael Reynolds: Speaking for myself, I didn’t assume this applied to you. And there are many honest people of significant means that are in the same boat. But you and I both know that, say, the Walton’s or Koch’s probably spend a lot more money on lobbyists, accountants and lawyers to avoid taxes then they actually spend on the taxes themselves.

@Michael Reynolds: But Michael, if you did have that army of accountants and tax lawyers, you’d incorporate differently and have several “working offices” scattered around the globe in “inspiring locations” (aka 4 star resorts) as business expenses (plus travel costs, etc.). You just aren’t being creative enough…

😉

@HarvardLaw92: the federal budget for 2020 was $4.79 trillion. Divided by 328 million people, that’s $14,603.66. Maybe you meant the debt?

($14,600 if you want to follow the rules of Significant Figures, but I Do What I Want 😛 )

@HarvardLaw92:

You’re 4-5x too high.

This is a lazy headline. There’s a desire to raise taxes on the wealthy, not other people in general.

For some of us, the wealthy aren’t even other people. (I would claim to be upper middle class, since I have to work, but I meet the definition of “wealthy” being talked about).

@Gustopher: The headline is largely a joke, a reaction to a predictable survey result. Yes, “the rich” are a specific subset of “other people” and, as noted in the post, there’s a good reason to tax them more. But politicians are very careful to define “the rich” in a way that they’re other people for just about everyone.

@Michael Reynolds: Is it possible that among your economic peers that your situation is called “an outlier?”

@HarvardLaw92:

This is SO SO accurate.

I’ve lived overseas, and prior to covid we would travel internationally 1-3 times a year. We pay fairly low taxes in this country, and it is maddening to hear people complain about it.

Right now a lobbyist friend in Missouri is complaining about the proposed gas tax measure there. We pay some of the lowest fuel taxes, and yet constant complaining.

I tend to drop into these conversations with anecdotes of what we paid per gallon for fuel the last time we visited the UK (around $9.25/gallon).

Apparently, we’d MUCH rather have crumbling roads and infrastructure than consider paying more in taxes.

Dr. Joyner is also suspicious that “apple pie” is a cynical ploy by politicians who carefully define “apple” in a way that it’s a different type of pie for just about every other fruit.

@HarvardLaw92: @Jen: Our founding mythology is partly based on aversion to taxes. Ostensibly, the objection was to being taxed by the UK without a voice in Parliament. But, frankly, almost all of the levies were perfectly reasonable.

Beyond the cultural issues, though, I think we do a piss-poor job of communicating what it is the taxes are going for. In Europe, free health care, free childcare, university education, highly subsidized mass transit, and the like make it more obvious.

Additionally, even though things like the fuel tax are comparatively low here, we do a poor job of actually spending that money on what we’re supposed to spend it on. Anecdotally, at least, we seem to tear up perfectly good roads to replace them and leave others with giant potholes seemingly indefinitely.

@James Joyner:

Oh, I know. I live in New Hampshire. 😀

@Jen:

And the infrastructure reflects the tax base.

@Teve:

No, I was in a hurry and wasn’t paying attention.

That having been said, actual projected outlays in FY 2021 are about 5.8 trillion, which comes to $17,682.93 for every man, woman, and child, bringing the “fair share” federal tax bill to $70,731.71 for that family of four. They each also owe another $2,642.28 per year for the next 30 years if we assume that debt elimination is a goal, so the fair share for our family of four including debt elimination comes to around $81,300.

The point (which you blew right past in your effort to be pedantic) remains that under either scenario, the vast, vast, vast majority of them aren’t paying anywhere even remotely close to that in federal taxes. They’re net burdens, not net payers, who have to be carried by those of us who do pay our fair share and theirs as well.

But they inexplicably consider themselves to be overtaxed and complain that those of us who are carrying them should pay our fair share.

I am paying my fair share, and the fair shares of several other people as well. I’m doing (more than) my part. It’s past time that they did theirs.

@Jen:

“Live free or die” takes on new dimensions, doesn’t it?

@CSK: Yes, that and the Free State movement. Our influx of libertarians has had…mixed results. Thank g_d for the Massachusetts transplants to balance them out.

@Just nutha ignint cracker:

No, I don’t think so. It’s not that I don’t have accountants and lawyers, it’s that all that fun stuff is for the 1% of the 1%, not the regular 1%. I get 1099’s, the IRS gets a copy, and despite being somewhat loose with my notions of ‘research’, ‘travel’ and ‘marketing’ expenses, my expenses don’t amount to that much. And this year it’ll be next to nothing.

Also, I have to be led by reason, not by unreasoning hostility to taxes. IOW, if some clever accountant says, ‘look, if you pay me 50 grand I can cut your taxes by 52 grand, but maybe the IRS will disallow and you’ll get fucked five years from now,’ I would say, ‘no thanks.’

Maybe I could do more but I’d rather spend an hour earning than an hour avoiding taxes. And I’ve decided to put a cap on my greed so I’ll know when enough is enough. I don’t have that open-ended, I must have more, more, MORE mentality. I want enough to sustain my lifestyle (which is not exactly a bare bones existence) til I’m dead, and some extra for my kids. I drive the car I want, I travel when I want, I eat out when I want, and if I could add one more room to my house and get rid of the goddamned telephone pole that obstructs my view, I’d have everything I want. It’s crazy that I have this life, and if I sat around eating myself up over taxes I’d have to be an even bigger asshole than I am.

@Michael Reynolds: The question is whether Scotch and weed are legitimate business expenses in your line of work.

@HarvardLaw92:

Except we don’t tax people, we tax income.

If we had a flat tax — Republican pipe dream that is is — the “fair” tax for the median family of 4 would be far less. The kids don’t make squat, for instance.

Your $80k figure is just nonsense.

And if you want to argue that services are about the same, regardless of wealth or income, I would invite you to look at our legal system, which certainly benefits the wealthy more than the poor. Or state enforced property rights — the value of the state enforcement goes up with the value of the property.

@Michael Reynolds:

One of my coworkers has recently travelled to South Dakota to set up a legal residence (a P.O. Box), so he can buy and register a car there, to avoid taxes in Washington State.

After he buys the car, I intend to turn him in. I really need to look up how.

Sure, “snitches get stitches” and all that, but fuck this guy.

@Gustopher: A friend of my husband’s told him that a mutual acquaintance of theirs had applied for and received a PPP loan that he used to pay off a bunch of personal credit card debt. He’s a big Trump supporter. If the information wasn’t second-hand, I’d be inclined to report it…

@Gustopher:

We tax income unequitably.

The rest is a wordy way of rationalizing the fact that the vast majority of US citizens are freeloaders who believe themselves to be contributors. They’re being carried while complaining that the people carrying them don’t do enough. No joy, sorry.

I don’t even really challenge the existing system, because it’s the only way it can really work. Of course I’ll have to pay more on a relative basis, but I don’t get 27 votes on election day. The water doesn’t come out of my tap 27 times cleaner and the fire department doesn’t arrive 27 times faster. I tend to take umbrage at being told by the net parasites I’m carrying that I’m not doing enough and should pay more so they can enjoy a better standard of living. They’re not doing enough. I’m already doing more than I should be expected to. I’m carrying them, so maybe bashing me while they have their hands out isn’t the best optics.

@HarvardLaw92: You are free to expatriate to some oligarchy if that’s what you would prefer. Not trying to put words into your mouth*, but if you want your wealth to give you more power, that seems to be what you want.

If you’re not doing better than the local oligarchs, though, you might find the situation unpleasant. Also, a lot of the oligarchies have issues with the Jewish folks.

Anyway, higher marginal tax rates are the price the wealthy pay to avoid pitchfork wielding mobs. The government functions only so long as it maintains the consent of the governed, and progressive tax rates are the wealthy paying off the masses so their heads aren’t on pikes.

(And the growing income inequality suggests that heads might get affixed to pikes at some point, when left-wing economic populism and right-wing economic populism combine.)

——

*: I suspect the words coming out are simply not clear.

@HarvardLaw92: Freeloaders. Hmmm. The rich and powerful have been relentless since Reagan in ensuring that every dollar of increased productivity has gone into their pockets. Every single dollar. The benefit from the systems in place, of laws and enforcement and an entire infrastructure of bridges, electrical generation, airports, air traffic controls, radar systems, satellite GPS systems, and on and on and on that were all built by the sweat of those “freeloaders”. The rich did nothing, no work, while the poor did it all – but the rich took all the profits for themselves.

The reason the US changed in the 1920’s was because the rich and powerful saw their compatriots in Russia and China stood up against the wall and shot, and their wealth taken away, because the freeloaders there got sick of being taken advantage of. And so the wealthy here thought, hmmm, maybe we might have to give a little something up if we want to stay sipping expensive booze in our expensive mansions. In the end, the rich and the poor in Russia and China both got f*cked, while the rich and the poor in the US did immeasurably better. At least until Reagan and his execrable “revolution”.

@HarvardLaw92: I will guarantee that fire and police response to your ‘hood is quicker than to any low income area. Just want to point out a gaping hole in your whine

So as wages stagnate and people lose purchasing power, they pay less in taxes?

Hoocoodanode!

@HarvardLaw92:

Haha. Okay. You should go back and read your “no free lunch” post. You get a free lunch. White shoe law firms are hardly essential to society.

If 2020 was an 80s sitcom, at the end, people like you would have realized that the people who had to continue working in public are actually essential and those who didn’t are not. Yet the big salaries are almost all in the former category.

At least have the decency to admit it. You once wrote here that you successfully weathered “the rigors of law school.” Guess what? The vast majority of people have jobs that present rigors that never pass; it’s their life, not a gale to weather.

But go ahead and act like you’re over-paying you deluded vampire–you’re not sucking fruit punch out of the rest of us.

If a white shoe law firm collapses in a forest, does it make a sound? Nope. Nor should it.

People like you confuse your credentials with value. Some of us aren’t willing to be conned. GFY.

@Thomm: I believe he’s in France right now, so he’s likely paying taxes in both the US and France.

@Kurtz:

I’m literally rolling my eyes. If you’re dissatisfied with how your labor, or anyone else’s, is valued, blame the market, not me. You’re whining about the circumstance of dependency, not denying the fact of it. You didn’t say that what I said was incorrect, which leads me to believe that you’re angry at it being right.

Life isn’t fair, which I think I’ve come to the conclusion is the wellspring of liberal angst. You seem to believe that it should be and rail in frustration that it isn’t. People like me pay the surfeit of taxes that make society possible. If you’re waiting for me to express some sort of sense of guilt in the bargain while doing it that you seem to believe I should feel, you should pack a lunch.

@MarkedMan:

I’m pretty sure that every single worker you’ve listed in your screed got paid for their work – at a rate of compensation they agreed to accept – unless we’ve somehow revived indentured servitude that I’m unaware of . Then they got to enjoy the benefit of having their portion of responsibility for funding the society they benefit from reduced or eliminated entirely. So who is to blame for their situation?

@Jen:

He is, and he does, voluntarily (despite being well capable of avoiding it) – at rates which would make Che there wet his pants. Apparently I’m supposed to feel guilty about it.

@HarvardLaw92:

OK buddy. Teve out. 😀

@HarvardLaw92:

Actually, I told you exactly how you are incorrect. If you put that amount of effort into reading the documents for your job, you should be fired.

This isn’t the first time you have done that. In a conversation about the incestuous nature of the ivy-to-federal-judgeships pipeline, your initial response was to defend your firm’s hiring practices. Oops. That reveals quite a bit about you, now doesn’t it?

You tell me to “blame the market.” Please. If you’re half as smart as your handle implies, you would understand that you were being used as an example of how the market is flawed.

But you are that smart, right? So which is it? Smart enough to get into Harvard Law but too dumb to read an internet post from someone who you look down upon or someone whose self-respect is so tied up in their credentials and salary that the only way to enjoy life is to deny reality? (Get it? Or do I need to be even more direct?)

The only way to defend yourself is to appeal to the authority of the market. But I guess they didn’t cover common fallacies in education.

Recruiting from the Ivies isn’t about hiring the best, it’s about something else. And you know it.

“Life isn’t fair” is the last refuge of someone who knows their bullshit isn’t working in a conversation.

Oh, by the way, one more thing: those liberals that you seem to think you know so well are the reason Harvard would accept you.

It wasn’t that long ago, probably right around when your family immigrated, that people with your background weren’t allowed. So maybe you should thank the liberals for your success, because had it been up to the conservatives, you wouldn’t be here. The fact that you carry their water for their descendants reveals more about your character than anything else.

@HarvardLaw92: I assume you’re just pulling my chain here? I’ve read enough of your posts to know you couldn’t be this clueless.

@James Joyner:

Sometimes when I’m high I get a cool idea. And I write it down. So. . .

@James Joyner:

Yeah, and the historical justification for racism is the inherent inferiority of brown people. What’s your point?

“Not indexed for inflation” doesn’t pass the straight face test — the profits are in deflated dollars, so the point is moot. “It’s a double tax” is a flat-out lie — the investment is entirely independent of how you earned the money you invested. And the idea that present consumption is not taxed is both false (since we all pay sales tax) and irrelevant (since present consumption is better for the economy than hoarding by the wealthy).

These “justifications” are bafflegab, at best. The bottom line is that the people with the capital gains have the lobbying leverage, and so get the law to treat capital gains kindly. There is no actual public policy rationale; it’s pure influence.

As we gripe over our progressive tax system, how progressive is it? If top 5% income has grown more than any other bucket in past 40 years, how progressive is it? Look at tax revenue to GDP as well, not exactly going in right direction you would expect. And you do have to look at overall tax burden, payroll taxes, property taxes, sales taxes, gas taxes etc… a true progressive tax system would have a upward slope curve. Ours does do that but also flattens and and sometimes goes back down depending on the makeup of all of ones income. The gas tax is a great fair tax, people who drive the most pay the most and the funds go to those same roads/traffic they are driving, yet it’s impossible to raise politically. If the US system is so great a fair progressive tax system, then why is income inequality still such a big issue in the US? And why do the rich get richer faster than the middle class over say the past 40 years?

@MarkedMan:

Let’s just say I’ve had my fill of far left paternalism. There has to be a point where we say “you know, your shitty life stems at least to an appreciable degree from your own shitty choices, and at some point that has to be your problem to resolve”. The endless excuses for and redirection of responsibility for failure that are proferred up instead by the left have begun to nauseate me.

@Kurtz:

More too disinterested in what you have to say to take it seriously, if we’re being honest.

Spare me that ridiculous bullshit. You really do see oppression hiding under every rock, don’t you?

Nope, it’s just speaking the simple truth. It offends you because you don’t want for it to be true, I suspect, but that’s your issue, not mine. Speaking for my people, who you bizarrely seem to have co-opted into your argument, it’s one of the first things we are taught as children.

Again, utter bullshit. Harvard’s Jewish enrollment stood at a whopping 21.5% – in 1922 …. If you are fooling anyone with this tripe of yours, it is only yourself.

Really? Paul, Weiss, Rifkind, Wharton & Garrison. Weil, Gotshal & Manges. Skadden, Arps, Slate, Meagher & Flom. Just to name a few. Goldman Sachs, Kuhn Loeb, Lehman Brothers, Salomon Brothers, Bache & Co. Just to name a few. Benjamin Cardozo, nominated by a GD conservative Republican to the Supreme Court. Before I was born, by the late 1950’s 6 of the 20 largest law firms in New York were “Jewish”. Before I finished high school, that figure had grown to include 4 of the largest 10. If you legitimately think that was the result of liberal politics, instead of the building of practice areas in fields historically eschewed by “WASP” firms which suddenly became the center of the business universe beginning in the 1950s, then I have a bridge you might want to consider buying.

The absolute worst thing about your politics is that you’re so busy falling over yourself being paternalistic to failures and generating endless excuses for their failure that you’ve failed to recognize that the one thing we as Jews tend not to engage in – indeed the one thing I’d proffer is basically verboten in our culture – is self-pity. So, I’d kindly suggest that you show yourself out of a history and a culture you have badly misread and clearly know nothing at all about. We don’t need your paternalism, so go draft some other minority into your argument. Thanks.

@HarvardLaw92:

“If you’re dissatisfied with how your labor, or anyone else’s, is valued, blame the market, not me.”

-HarvardLaw92

Whatever helps you sleep at night, mijo.

Your cute attempt at a trap may work with people whose intellect has to be enhanced by credentialism, but those of us who actually read to comprehend and strengthen our thought processes look at it and laugh.

Do you see now? By criticizing you, I am criticizing the market. And your response, dripping with unearned self-regard, makes it fun to push the stake into you. You couldn’t even go one day without a glaring inconsistency once the spotlight was on you.

@MarkedMan may not want to go this route, but I will continue to do it. You mistake my ire for an attempt to draw from you shame and guilt. If I thought you were capable of either of those responses, I would take a different approach. But you’re not.

You’re way past the point when heeding Hawthorne’s warning about faces would do any good. Your self-worth is contingent upon your value as measured by a paystub; your intellect validated not by understanding, but by a sheepskin with a particular institution on it. Indeed, why else would you choose such an on-the-nose handle unless your identity relied upon it?

So stop blaming me (the Left) for your fucking nausea, because your own choices are the source. You’re in France, right? I’m sure they have a copy or two of Sartre around somewhere.

P.S. If the Left you bitch about was like Che, you would have been against the wall long ago. And I’m guessing you would have wet your pants the moment you got grabbed. I’m also pretty confident you would go out like Elena rather than Nicolae. It wouldn’t be justice in the moral sense, but damn would it be poetic.

@HarvardLaw92:

Oh, I know that they enrolled Jewish people. You spent so much time listing all of them you didn’t realize why I said it. What was the quota advocated by Lowell? Something like maximum 15%, right? And what was the reasoning for it? The quote I remember involved something like making sure they can mingle and blend with the rest of the students. But if they were to let too many in, they would lose…was it prestige? I can’t remember, help me out.

He also said it would be good for the Jews because they wouldn’t be subject to as much antisemitism. Lovely guy to name a building after.

I will admit to not being able to remember whether you are first or second generation born in the US. But it doesn’t matter, because the point is you carry water for the same ideology that tolerates antisemitism in its ranks and then bitch about me for making your tummy hurt.

Read this and then defend your beloved alma mater. I’m sure they’re touched by one of their graduates defending a legacy of exclusion with such passion. I’m pretty sure there are a couple accurate words and phrases here… Useful idiot? Token? Apologist?

Now, that’s how you run a trap when in a debate. And I’m not drafting anybody, because my politics is informed by the oppressed, including the Jewish Left.

Paternalism, really? You were the one who decided to say that people should have made better choices and then lay it off on “the market.” Take some responsibility, little boy.

The difference between you and I is that I came about my politics through listening and thought rather than what it would gives me. So maybe, before you speak a word about my viewpoint, you understand it better. But I never claimed to understand all of Jewish culture. And I pity no one, by the way. The fact that’s how you see it shows just how closed off you are. Let me break it you, you ain’t that fucking smart.

GFY you empty husk of a human being. You’re a waste of a sharp mind, you POS.

@Kurtz:

Whatever gave you the impression that wasn’t blindingly obvious from the outset? Of course I got your point – those slighted by the market or those who feel it should give greater value to intangibles they feel it ignores will always rail against it. Your shtick isn’t anything new; it isn’t even original. History is littered with tortured souls who sang the same tired, threadbare chorus. Boo fk’ing hoo, I suppose. Have some hot chocolate and maybe you’ll feel better.

@Kurtz:

You’re still missing the point. You’re so busy railing about anti-semitism that you’re failing to ask the one pertinent question which seems to escape you:

Why is it that, in the existence of such supposedly overarching opposition to us, this imagined cabal that wants to somehow keep us in our place, that we as a demographic so disproportionately succeed while others do not? Chew on that question for a while.

I do find it a tad touching that a Gentile is presuming to lecture a Jew about anti-semitism, but it is what it is. We’re used to that too. You’re the flipside, you see. On the one hand, we have members of the extant power structure determined to “keep us in our place”, as it were, and on the other, we have other members of the same who somehow think it their dual duty to act as penitents for it and help its perceived victims (who of course, in this little drama, are presumed to be incapable of helping themselves …). I assure you that I am well familiar with, and equally disdain, both.

Know how we deal with anti-Semitism? We do the same thing we’ve done for thousands of years in the face of adversity and exclusion – we get on with the business of succeeding anyway. It’s by far the best revenge, I assure you. You evidently want to change the market to make it fair for everyone (which, I assure you, is a fool’s errand). We’d rather just take that market for ourselves instead of waiting for someone to dole out our share. Looking around me at the moment, I’d say we have the better strategy, but keep tilting at your windmills if it makes you happy.

(and yeah, I’m familiar with Karabel and his scribblings about an institution that is so anti-Semitic that it admitted him – twice. No surprise that he ended up where he is. No surprise at all …)

@HarvardLaw92: “You seem to believe that it should be and rail in frustration that it isn’t.”

Actually, the only one here whining about how unfair the world is happens to be the guy complaining about how he has to carry all these freeloaders out of the income which should be entirely his.

@DrDaveT: ““It’s a double tax” is a flat-out lie ”

From what I understand, a double tax is the single most evil thing ever invented, unless it refers to people in liberal states having to pay federal taxes on money they’ve already paid to the state, in which case it’s good because liberal tears.

@HarvardLaw92: @Kurtz:

I pay high taxes and I also only get one vote. Everyone who thinks that means I have no more power in the system than some random Wal-Mart greeter who votes, raise your hand. And now let me introduce you to a thing called campaign donations. A surprisingly large number of politicians desperately want ‘my views’ on any number of issues. Money is access, money is power. I am confident that despite having no exalted credentials I have ten times the political power (adjusted for state of residence) of my fictional Wal-Mart greeter.

That said, I think the Left too often assumes that all the evil in the world comes either from the rich, or in the international context, just from Americans. There is a distinct tendency to infantilize minorities and women and even entire countries, to deny them agency, to dismiss any notion of responsibility lest it diminish the need for our hair shirts. This is arrogance, and it is also often ‘soft racism.’

But it’s also silly to dismiss the effect of culture, or to imagine that culture is entirely sui generis, or to imagine that culture is easily adapted. We Jews succeeded in the US because by the time we got here every two-bit king, bishop or jealous merchant in Europe had done their level best to destroy us. We didn’t create a culture of survival, that was forced on us. It took thousands of years of Jews being attacked for Jews to acquire the skills to prosper in the context of western civilization. And as recently as the 1940’s, we still weren’t great at surviving. We lost our homeland for 2000 years, FFS, which is not testament to some innate talent.

Blacks can’t suddenly acquire all the survival skills of Jews overnight – it took us millennia, and as recently as 75 years ago, we still kind of sucked at it. And the fact that we succeeded disproportionately does not somehow excuse the millions of murders it took to train us up. The story goes that after we escaped slavery in Egypt* we cleverly took 40 years to cross a few miles of desert, at which point we set about massacring people. 40 years after Blacks escaped slavery they were busily creating basically every form of modern music.

*Almost certainly a myth, BTW. The Egyptians were pretty good record-keepers and there is zero evidence of some pretty harsh biblical plagues you’d think they might have noted. OK, I’ve chiseled all the data from the harvest, was there anything else of significance I. . . what, all the first-born males were killed? Nah, that isn’t worth the waste of chisel points or even papyrus.

@Michael Reynolds:

This is a good point, but not my position. This risk certainly exists. But I make the same argument about working-class Trump voters as I do about socially marginalized groups. It’s not infantilization, it is a critique of the system that attempts to account for different observations about relationships between social sciences and tracing the connections between historical political movements.

Some of the arguments I’ve had with you are about differences in how we got to a similar conclusion. When I have criticized you, it’s not because we disagree at the end as much as the mechanics of how we got there. In most cases, it doesn’t matter all that much, unless it also opens the door to a criticism that can only be justified by a specific, unshared internal linkage. But in very specific contexts–public tactics of the ‘woke’ left as one example–the difference becomes much clearer. We agree that that approach is counter-productive. But how we criticize it is very much different.

But HL doesn’t even make an attempt to understand the position, because to him his experience and socioeconomic position is a license to claim authority on how life should be. That is the arrogance that draws my ire. It’s distinct from the paternalism you highlight.

His position is solipsistic and myopic. It’s easier for him to make stupid invectives about Che and cabals than it is to understand someone else’s position. Those remarks reveal a juvenile understanding of the Enlightenment or expose him as a profoundly dishonest interlocutor. To him, his views are fully formed, but their quality is on par with a TV pundit pushing an agenda. He behaves as if he’s better than that and his educational attainment would suggest he is. But those are facts not in evidence based on the bullshit he spews here.

Challenge him with nuance and you get accused of being a pedant. The irony of that is lost on him, considering that practicing and adjudicating law are exercises in extreme pedantry. He may work a white collar, brainy job, but the lack of depth in his politics reveals him to be a scoundrel deserving of ridicule.