Reports of the Death of Capitalism

have been greatly exaggerated.

Representatives from the countries with the twenty largest economies in the world met yesterday and, to what should be a surprise to no one, accomplished very little other than to agree that something should be done…maybe in the spring.

Expectations for the weekend summit of global leaders from the Group of 20 countries in Washington, D.C., were low. And they were fully met.

After a state dinner at the White House on Friday night, Nov. 14, and five hours of meetings on Saturday, Nov. 15, the heads of state from nearly two dozen countries agreed to continue working closely together to take the needed steps to bring stability back to the global financial system.

“Our nations agree that we must make the financial markets more transparent and accountable,” said President George W. Bush soon after the summit drew to a close. “We agree that we need to improve our regulation and to ensure that markets, firms, and financial products are subject to proper regulation and oversight.”

There had been any number of breathless forecasts of Bretton Woods II or the death of capitalism. Neither of those things happened.

“In advance of the summit, there had been much discussion [that] this was going to result in an assault on capitalism, or the death of capitalism, or the revamping of capitalism,” said one senior U.S. official after the summit ended. “Quite to the contrary.” Instead, he adds, there was a significant affirmation of free market principals; a “universal recognition” by all the leaders that the reform efforts would only be successful if they were grounded in a commitment to the rule of law, open trade and investment, and competitive markets.

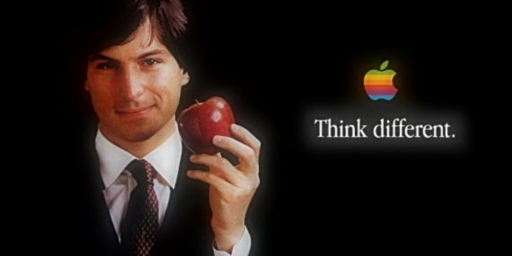

That left the leaders to signal their agreement on the broad principles to be studied, such as improving transparency, accountability, and disclosure, but with few specifics attached. As Kenneth Rogoff, the former head of research for the International Monetary Fund who now teaches economics at Harvard University, points out, those are hardly ideas anyone would disagree with: “It’s motherhood and apple pie, or whatever the European equivalent of motherhood and apple pie is.”

I think there are any number of reasons that it was unlikely that anything dramatic would result from this conference or will result from its successors. First, in the real Bretton Woods although 44 nations participated in the conference, basically anybody who was anybody at the time with the exception of the Axis countries (the conference took place during the dark days of WWII), the whip hand was held by the United States and the United Kingdom and the negotiators from these two countries, Harry Dexter White and John Maynard Keynes, were in a position to lay down the law for everyone else. No one has ever faulted either man for a lack of confidence.

The U. S. hand is nowhere near that strong today. Other countries, notably China and India, are tremendously more important to the world’s economy than they were nearly three quarters of a century ago.

Further, the U. S. is in the middle of what is certain to be a notable change of administrations. Even were President-Elect Obama to insist on the “one president at a time” rule of thumb, President Bush’s political clout is sufficiently low that it would make little difference.

I also think that the U. S. is suffering from a real lack of confidence and failure of bold leadership. We’re playing a relatively strong hand very poorly while China (for example) is playing a relatively weak one extremely well.

I expect that in coming months China will demand and get a stronger role in the governance of the largely European-dominated IMF in the hope that China’s participation in the funding of the IMF will increase. I think the signs that China’s economy is going into a downturn faster than we know are pretty strong and the country may hardly be in a position to fund the IMF.

If you’re wondering how the IMF is funded now and what its participants various shares are look here.

Bithead’s rule number 17:

Capitalism exists not because of government, but in spite of it.

How original…

Well Bit, you might need to define your terms. Markets and trading certainly predate and have existed without governments. On the other hand capitalism, in the sense of large concentrations of wealth and ownership, etc., probably do require rule of law.

If I recall correctly, IMF voting is based on quotas assigned that depend on various criteria like the size of contribution to the IMF and the size of the country’s economy. If China’s willing to fork over mucho money to the IMF to help it out, I’d be the first to offer them expanded voting rights.

Don’t forget, too, the two years of exhausting preparation for the original Bretton Woods conference.

Oh, I’m just waiting for someone to dispute the truth of it.

Certainly, yours is a definition often pushed by socialists, such as Obama, but it’s not true.

You want someone to dispute the truth of a platitude? Seriously?