Some Tax Breaks Are Middle Class Welfare

Do people who take advantage of tax breaks get a "government benefit"?

Alex Tabarok takes exception to an argument raised by Catherine Rampell, Bruce Bartlett, and Matt Yglesias that Americans who take advantage of government polices such as the home mortgage interest deduction or the 529 college savings program are unaware of how they benefit from government programs. Before examining Tabborok’s argument, lets take a look at what he’s argument against.

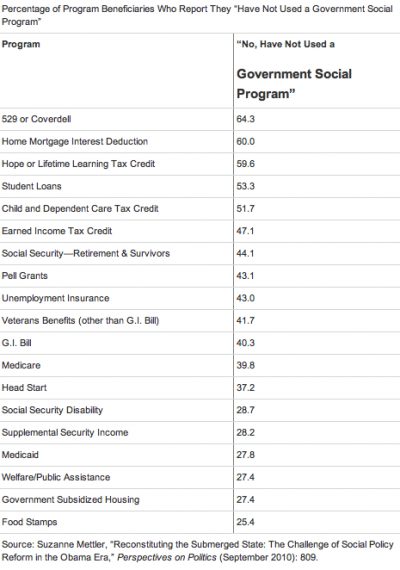

Bartlett started the ball rolling back in February in a column about the GOP’s budget cutting strategy where he reproduced the chart below, which comes the chart below from a paper by Suzanne Mettler:

Matthew Yglesias comments:

The tax credits and deductions that lead this list are actually designed so as to obscure their government program nature. But it’s pretty amazing that 44.1 percent of Social Security beneficiaries seem to have convinced themselves that the single largest government social program—a program that consists of the government mailing checks to people—is not a government social program. And then there’s Medicare, the largest forward-looking source of budget deficits. This is all especially galling since in the Obama Era the over-65 demographic has become by far the most conservative group in America, even as it’s the group that gets the lion’s share of the benefits from big government.

One is reminded of the signs frequently seen at protests against the health care reform law while it was being debated that said, in one form or another, Keep the government’s hands off my Medicare. The fundamental lack of logic in that position is fairly apparent, but perhaps it is easy to understand why someone who benefits from the Home Mortgage Interest Deduction or participates in a program that gives preferential tax treatment to money saved for college expenses might not see themselves as benefiting from a government program.

That doesn’t mean they are aren’t, however. Both of those programs in particular are changes made to the tax code designed to specifically benefit a select group of people–homeowners in one case, parents in the other. There is no natural right to be able to deduct the interest from your mortgage from your taxable income, or to avoid paying taxes on the gains from money kept in a special account that with the intention that the money won’t be used until ones child goes to college. They are both government programs designed to benefit a select class of people. There may be good policy arguments in favor of both of them, but that doesn’t mean that they aren’t government programs.

Tabarok, however, isn’t buying any of it:

What Rampell et al. want to do is to make people believe in this great fiction. But there are always taxpayers and taxeaters, even though government has so wormed its way into every organ of the body politic that it is sometimes difficult to tell which are which. (Indeed, part of Mettler’s point is that the government shell game of ‘hide the subsidy, hide the tax’ is often designed to obscure taxpayers and taxeaters.)

Nevertheless, there are dividing lines. In a laissez-faire world we don’t get rid of 529 programs, instead all savings, not just savings for college, become tax-free. A 529 program is not a government program like food stamps, it is the absence of a government tax. (N.B. I am not taking a position here on the best tax structure.)

People who use 529 programs and who think that they have not used a government social program are not willfully ignorant, they are demonstrating a healthy if fading appreciation of the distinction between civil society and government. What Rampell et al. implicitly imagine is that the natural state is slavery and any departure from that state a government benefit. Thus, if the government taxes your saving for a college education less than your other savings, you should be grateful for how government has benefited you and your children.

And if the government doesn’t jail you today, you should be grateful for how government has granted you the benefit of liberty.

This is the attitude of a serf not an American.

Tabarok has a point at some level, but where I think it falls apart is that we don’t live in a lasseiz faire world, and we never really have. Tabarok is making a moral argument, and it’s one that I’m sympathetic to, but I’m not sure that it’s particularly helpful in a debate over our tax system and how its used to provide benefits to favored groups.

Ever since the income tax became a part of American life, it has been used as a back door way to regulate American life and business by means of defining what is and isn’t income, how different forms of income shall be taxed, what may be deducted from Total Income to determine Adjusted Gross Income, what may be deduced from Adjusted Gross Income to determine Taxable Income, what tax rate will be applied to Taxable Income, and what tax credits a taxpayer may be entitled to in order to reduce their tax liability. These are all policy choices, not moral ones, and the reason that millions of people benefit from things like the mortgage interest deduction or the 529 program are receiving a government benefit, and they’re receiving it because someone in Washington decided it would be a good idea to bribe the middle class with another tax break. These tax breaks are government programs just as much as Medicare and Head Start.

H/T: Professor Bainbridge

True, but it goes back much further than that. All governments have used the power to tax or exempt as a tool of policy- this is one reason why churches were exempt from taxation, since the Founders wisely understood that the temptation to tax some more than others would lead to government control of religion.

Even more true. Highways are the classic example of the government favoring one method of transportation (autos) over others (trains), and interfering in the workings of the marketplace to establish a favored policy.

Moreover, this is the failure of the free-market fundamentalists- they want to enjoy the benefits that a mixed economy brings- public infrastructure, public education, common defense, social safety net- yet pretend that they can somehow stand apart from it, to live on their own little island exempt from the taxes we all have to pay to support them.

In effect, they become the dreaded “Free Riders” we hear about.

The word “program” is confusing here, “subsidy” is more appropriate I think. Regardless, it is a bending of the world in what may or may not be a better direction.

By that definition there isn’t a single person in the country not on the dole.

Yglesias appears to disingenously miss the point that SS and Medicare are deisnged with the use of conspicuous payroll tax deductions tied to one’s social security number to give every appearance of ownership. This is a design; not something beneficiaries have without reason “convinced” themselves of. And everytime, reformers talk about means-testing entitlements, liberals will worry that the program will be stigmatized and reduced if it’s not seen as a return on investment.

I’m not sure about “willfully ignorant”. You link then links to an abstract.

The point of the paper and the subsequent online discussion was that a huge number of Americans who assume “other people” are on the dole are actually on the dole themselves. At the time I believe the discussion revolved around insurance subsidies, and the number of people actually receiving insurance subsidy, by virtue of their employer getting a tax break. Call it ignorance, or denial, or simply not thinking in those terms…it still goes back to this silly people with the tea bag dangling from their hats wanting the government out of their Medicare.

Obama today said he’s willing to talk about tax reform as long as it is not regressive. Let’s see if the so-called conservatives take him up on it or just keep holding their breathe an stomping their feet.

The 529 focus seems odd. One popular type of 529 is pre-paid tuition. In many states, you can pay a semester or more tuition at a public university today to be used in later years. Since you are writing a check to the state in order to pre-pay, there is government involvement, but it’s not really any more involvement than writing checks to a public university at the time of attendance.

Are public universities a government social program?

They are subsidized by state gov’ts.

This was an excellent essay. In particular two insights people frequently miss:

” it is easy to understand why someone who benefits from the Home Mortgage Interest Deduction or participates in a program that gives preferential tax treatment to money saved for college expenses might not see themselves as benefiting from a government program.

That doesn’t mean they are aren’t, however. Both of those programs in particular are changes made to the tax code designed to specifically benefit a select group of people – homeowners in one case, parents in the other.”

And:

“Ever since the income tax became a part of American life, it has been used as a back door way to regulate American life…” Remember the line from the Temptations Ball of Confusion song? “….vote for me and I’ll set you free…”

And it persists to today with Obama’s crass come on: “…these tax increases will only affect 3% of the taxpayers…” In other words, vote for me an bofo your neighbor.

Separately, PD’s observation is spot on, and Wolf’s ridiculous. Wolf, if the top x% are paying the overwhelming proportion f the taxes, and receiving a less than average benefit then we are back at subsidy and wealth transfer, or “vote for me and I’ll set you free…”

@Hey Norm: The withholding tax is the most regressive tax we have. Why isn’t there a reform idea to eliminate it? Wait, there is. The Fair Tax!

Most of the Welfare goes to big companies and the rich. So I don’t want to hear it. We have lots of problems, lots of talk, but no one has solutions. If you’re an An American you have to read “Common Sense 3.1”. This is our future. All this other garbage is just noise.

WAKE UP!

The people who receive government benefits know perfectly well they’re receiving government benefits.

They simply lie to themselves (and others) so they can continue to lead a life that is so contrary to their stated beliefs.

Government not taking your money is not welfare. The government forces one to pay FICA taxes as a way to supposedly force people into a retirement fund. Receiving payment from that retirement fund is again not welfare.

Unless you are a socialist and believe everything you own actually belongs to the government then tax breaks is not the same as being on the dole. Just receiving government dollars or them not taking more of your money doesn’t put you on the government dole. There is a big difference between keeping more of what you earn and being paid for services or products than receiving money for basically existing.

By your definition a person receiving payment for selling a computer or delivering that computer to a government agency would be on the Government dole. Military personnel working 7 days a week would be on the dole and\or welfare. That is not what most people consider as being on welfare or the Government dole.

Liberty60, it is a mistake to imagine that the choices we have are between either accepting the Left’s arguments for an ever larger governemnt or that we must have what you imagine to be a libertarian hellhole where there is no role for government at all. Saying we have gone too far isn’t the same thing as saying we need to eliminate the government, though that is clearly an easier strawman to argue against.

Wayne, what’s really bad is all that money collected in FICA taxes has already been spent. Ther eis no Social Security “fund” or “lockbox” to pay the benefits from. Everything now going out is paid either from general revenue or more debt. Best to end the facade now and start over. If the rules of the game are changed now so that benefits are means tested then it is effectively a retoractive welfare scheme to redistribute wealth. Oh well.

Social Security, in theory, is “insurance” that we pay into during our working lives, then collect back when we retire. It’s as much as “handout” as income tax refunds are “money from the government.”

At least, that’s how it’s sold.

I’m in my 40’s, and I don’t expect to get back one cent of what I’ve paid in. And a local talk show host has a standing offer: he will waive any future claims for Social Security if he can only be excused from paying any more in (he’s in his mid-50’s.) In other words, the government can keep all he’s paid in, as long as he doesn’t have to give them any more.

If the system is honest, it’s a sucker bet. They should jump on his offer in a heartbeat.

On the other hand, if the system is as corrupt and empty as he (and I) think it is, then they need him to keep giving them more money, then find some way to weasel out of paying him when he retires — maybe by “means testing,” or some other scam.

J.

@Drew:They are receiving a benefit you fool. It’s called “capital gains” and means the majority of their income is taxed at less than have the official rate for their income block.

They also receive the benefit of $14 trillion in government bailouts when their malinvestment blows up in their faces. They receive the benefit of government policies which enabled their wealth to double while everyone else is right back where they were in 1979. They receive the benefits of hundreds of billions in subsidies to their businesses, and they receive the subsidy of a system which allows buying and selling of elected officials if the price is right.

Open your damned mind and realize your stone-age simple model of how the world works doesn’t match up with the empirical evidence.

Nexr thing you know Drew will be arguing that if we aren’t nice to the oligarchs they might move away and take all our jobs with them.

Let me ask Drew and Charles a question. Would either of you avail yourselves of the services of the Ex-Im bank in the course of your business affairs if such use would advance your businesses?

Nevermind. Of course you would. (As Steve Verdon and Dave Schuler forcefully told me one time, to not avail oneself of rentseeking opportunities beneficial to a business when they are presented would be a dereliction of fiduciary duty.) And who would criticize you for that? Not me.

Let’s review the mission of the bank:

Needless to say, the activities of the bank depend on the US taxpayer. But can anyone argue that the bank is not engaged in subsidizing the businesses that use it services? And that this is not a good thing?

sam, please note my above comment to Liberty60. That strawman is getting kinda ragged. Time to find a new one.

@charles austin: Do you have money in the bank? You should know that the money isn’t actually there. Go ahead, march down to the bank and demand to see every penny. By your reasoning, you’re broke. Better just give it up now.

“And a local talk show host has a standing offer: he will waive any future claims for Social Security if he can only be excused from paying any more in (he’s in his mid-50′s.) In other words, the government can keep all he’s paid in, as long as he doesn’t have to give them any more.”

Heh. Nothing like calling the liar’s bluff. Its become an income transfer program that will not ultimately operate in any way shape or form like its advertised. It will be a fraud on the implicit contract.

“Do you have money in the bank? You should know that the money isn’t actually there. Go ahead, march down to the bank and demand to see every penny. By your reasoning, you’re broke. Better just give it up now.”

I have a couple posts to respond to but I just saw this. Gold medal for just plain dumb.

@Charles-

The notion of a purely free market, “every man is an island” mentality may sound like a straw man to you, but it is actually the explicit theory of Libertarians, many of whom make up the brain trust of the conservative movement.

But OK, lets say you are not one of the “free market fundamentalists” that I referred to- lets say that you merely want to alter the balance between the public and private sector.

If so, we could probably have a worthwhile discussion.

The most worthwhile impact of the original article is to get people to recognize how much value the public sector creates in their lives- how it is the government that creates the playing field upon which private enterprise operates.

If we say that “welfare” is simply receiving a benefit from government, then every single person in America receives some form of “welfare”;

If we say that “welfare” is receiving unearned compensation- that is, receiving a benefit without a corresponding input of work- then we can narrow it down.

But this still leads to the conclusion that the biggest and richest people and corporations also receive many benefits, which are received without a corresponding input of work- agricultural subsidies, passive loss carry forward, and accelerated depreciation come to mind.

@WR:

There’s a difference between checking account deposits and Social Security payments. By law the bank is required to disburse to you the funds you have deposited in your checking account, pursuant to applicable laws on timing, etc. That isn’t the case with Social Security. You have legal demand neither on the payments made to Social Security nor to the benefits.

So much ignorance……so little time.

“They are receiving a benefit you fool. It’s called “capital gains” and means the majority of their income is taxed at less than have the official rate for their income block.”

No, zero, it means they are being taxed a second time on income already taxed at ordinary income rates and, having been recycled and placed at risk, is now taxed twice. Second, do you think it sound social policy to enforce high tax rates on capital formation and investment?

“They also receive the benefit of $14 trillion in government bailouts….”

Who is “they?” Please be specific, not embarassingly superficial. And I would note that the primary recipients you cite are the beneficiaries of regulatory capture. That is, from your beloved government and their policies and inherent dynamics. Do you even understand the term??

“Open your damned mind and realize your stone-age simple model of how the world works doesn’t match up with the empirical evidence.”

No, you grow up, and realize how an increasingly government dominated economy and all that you rail about derives from your voting proclivities – then look in the mirror and ask for forgiveness from your fellow Americans.

OK Dave, I am an idiot (I know I know, half the commentariot here is going, “Well duuhhhh!!!!”) please explain “legal demand” and why it does not apply to SS.

“Let me ask Drew and Charles a question. Would either of you avail yourselves of the services of the Ex-Im bank in the course of your business affairs if such use would advance your businesses?

Nevermind. Of course you would.”

As I’m fond of saying, you gotta teach me that mind reading trick sometime. Could be pretty useful.

In any event, the answers are, no, never have. No, anticipate will never happen and can only deal with the hypothetical with “let you know if it happens.”

And you are talking to a guy who looked at a deal in the worldwide dredging business – supported by an international financing entity (think financing Nigeria etc) – and passed because I don’t believe in artificial support for diseconomic activities. (Unlike our useless president….Chevy Volts and sech)

You might have come to a different conclusion, but methinks you would have taken the bucks. You good guy, you. But thank you for playing.

So much stupidity, so little time. Drew, capital gains is the profit on the sale of an asset. That is NOT double taxation.

OK, I’ll bite and say, “Yes.” Now I want you to actually make an argument w/ facts to back it up asserting your point of view, not that BS question you asked in a way that means only either “I don’t know what I am talking about” in which case you are an idiot, or “You, poor peon, could not possibly understand the finer nuances of the financial arts.” in which case you are an elitist snob in need of knee-capping (figuratively, of couse).

Right after you Drew, Right after you.

Ozark, well we know the rest…..

“So much stupidity, so little time. Drew, capital gains is the profit on the sale of an asset. That is NOT double taxation.”

Yes it is. Last time I looked assets did not have a purchase price of zero, the cash was converted to another asset, which is not risk free. They are bought with previously taxed income, they could decline in value to zero, or have a gain. It is a longstanding piece of public policy to promote the general welfare that such investments be taxed advantaged. We’ve arrived at the current rate. I’d advocate zero. Of course we could all put the money in a mattress, have no taxes, and then everything would be all fine and well. Right?

Maybe they do things differently in the backwoods of Mizzou, or maybe they don’t live by the Code. BTW. Can I buy a still for zero, and pay no taxes?? Or is that “different.?

I am taxed on my income; I take part of that income and invest it in a slot machine;

the slot machine pays a profit, and I am then taxed on my gains.

Am I getting the concept of double taxation correctly?

@OzarkHillbilly

Because you can’t legally demand not to pay your FICA tax and you can’t legally demand the “promise” benefits if the Government decides to cut part or even all of your benefits.

So you are force to pay into the Government retirement program without any guarantee on receiving any benefits.

The Social Security trust fund consists of intra-governmental securities that are a debt to be paid (somehow, somewhen) by the US Treasury, not piles of cash or gold doubloons. This debt is included in the $14+ trillion US debt figure that people frequently mention.

No. Most of the Social Security benefits that are currently going out are paid for from payroll taxes, though the ratio of money paid from direct taxes vs “withdrawals” from the trust fund via the US treasury will change over time. Unless you believe that the government will stop collecting payroll taxes, Social Security is going to continue collecting money from which benefits could “potentially” be paid. “Potentially”, because what is actually done with payroll tax money and the trust fund is a matter of politics. Though, Social Security has an influential enough constituency that it’s unlikely to vanish anytime soon.

By the way, when I claim two exemptions for raising my children, plus whatever tax credit I get for raising them, does my raising children become part of

A) A government social program;

B) A government welfare program;

C) A government subsidy;

D) All of the above;

E) None of the above?

If spending is fixed, reducing taxes on one group requires increasing taxes on another group if you are going to achieve the same level of revenue. Alex is usually pretty bright, so not sure how he missed the obvious.

Steve

OK Drew, either you are REALLY stupid…. or You think I am. Capital gains taxes ONLY apply to the PROFIT.

And if they DID decline to zero…. THAT is a tax right off!!! wow, heads I win, tails you lose….

Sorry Drew, your BS does not add up. Not a single fact posited in support of your assertion, not even a coherent arguement….

But of course, because even tho you make 17 times what I do (I have no idea how much you actually make, I only know you write 7 figure quartarly checks to the IRS) it is entirely possible that you pay less taxes (by percentage) than I do. (I read recently that some pay as little as 18-19%)

Oh, we live by the code (little “c”) down here, but you would not begin to understand.

Thanx Wayne, I think I get it now.

@Liberty60: Anyone making $30,000 and who’s ever bought a pop-tart has been double taxed. No sympathy for you.

Am I getting the concept of double taxation correctly?

No, actually you aren’t even close.

@PD Shaw:

Yes. In the same way that if the government gave a tax break to ethanol producers, the producers could be described as benefiting from a government energy program.

No, The word “welfare” has enough baggage attached to it that applying it to this situation doesn’t seem right unless you want to start an argument (e.g. you are a blogger or blog commentator).

Depends on how you look at it. If you save $1000 dollars in taxes because of a government tax credit based on your behavior, you could argue that you are “keeping your own money”. If, instead of a tax credit, the government sends you a check for $1000 because of your behavior , then it looks pretty much like a subsidy (e.g. cash for clunkers). Since the financial result is the same in both cases, this seems like a pointless definitional argument. But, whatever you want to call it, both cases involve market-distorting behavior by the government.

ratufa… just feeling the need to point out that we elect our gov’t…. just sayin’

@OzarkHillbilly:

What point are you trying to make?

“OK Drew, either you are REALLY stupid…. or You think I am.”

Actually, neither. You are just uninformed, and without proper experience or perspective on these matters. You simply do not understand the concept of risk capital, or the attendant issues considered by those who employ it. That’s fine.

If you go over to a wonderful sister site – Glittering Eye – you can fish around and see a somewhat similar exchange with a quite accomplished individual, Michael Reynolds, who is similarly out of his sphere of competance on this issue.

Best.

@ratufa: That we, in the agregate, get what we deserve. That is all.

Ohhhh, I am just ignorant. FU Drew. You are a chicken sh*t gutless weasel who can not answer the simplest of statements:

I repeat:

A simple response to my statement would go a long way…

By Drew’s definition of double taxation any tax beyond an initial income tax would be considered double taxation. I’ve seen plenty of arguments why the capital gains tax should be eliminated due to double taxation, but his is way out of the mainstream.

and for the record, this is your response: “You, poor peon, could not possibly understand the finer nuances of the financial arts.” in which case you are an elitist snob in need of knee-capping (figuratively, of couse).

Drew; Come down to my level.. please explaine it all to me…. please…. I dare you.

I dare you.

@Drew: Thanks, Drew. I agree — anyone who says “there is no money in Social Security — it’s all in government bonds so it’s gone” really has no idea what he’s talking about.

You are trying to separate things which are mostly inextricable. Only the truly nefarious don’t base their policies upon moral grounds. Now people may disagree with the policy promoted, and hence, the underlying morality, but it is fruitless to project an immoral motive. One of the reasons that both the mortgage interest and dedicated college savings deductions have both been so successful and so hidden as a subsidy, is that both comport well with most ideological (moral) bents.

Yes, but the difference is that the latter two have morphed into a party specific morals based subsidy.

@Pug:

well then, if I have to pay taxes on my slot machine winnings, why shouldn’t I also pay taxes on my investment winnings?

You are forgetting your history. Throughout the 19th century and well into the 20th century, it was the railroads that were the favored means of transportation. It wasn’t till Dwight Eisenhower was president that the federal government started really promoting a national highway system. Prior to that, it was primarily in the purview of the state, county and/or city.

Given that kind of statement, you know nothing of the mind of the Libertarian, the neo-libertarian, nor the conservative. But perhaps it is just crass and partisan driven hyperbole. It is much easier to build a caricature of ones ideological opponents than to address their arguments head on.

Doug Mataconis said,

For decades politicians and their sycophantic supporters in the media have propagated the myth that entitlements like medicare and social security were not inter-generational wealth transfers and these entitlement were paid for by senior citizens payments into them.

Every year the social security administration sends out a document called “your social security statement” That helpfully points out how much you have paid into your social security and medicare “accounts”.

For some reason the inside the beltway response to decades worth of political lies and misinformation about the nature of entitlements is to slag senior citizens for being confused by decades of lies and misinformation.

Someone needs to tell Matt Taibbi that Medicare isn’t a voluntary program

@bains:

I’m not sure I understand your point here. You’re not arguing that the federal government did not play a significant, even determinative, role in the creation of the transcontinental railroad system, are you? Because such an assertion would be flat wrong. See, First Transcontinental Railroad and Pacific Railway Acts.

Drew, this thread gives you an idea of just how f*cked we are, doesn’t it?