Troubled Times? Compared to What?

In response to my comment about Barack Obama taking office during “troubled times,” Charles Austin retorts:

In response to my comment about Barack Obama taking office during “troubled times,” Charles Austin retorts:

Not to diminish or belittle the very real problems for folks who find themselves on the wrong side of the various bubbles out there, but if these are troubled times, then we really do have it pretty good. Has everyone forgotten the late sixties and seventies? Does Iraq really look like Vietnam? Does George Bush remind you of Jimmy Carter? This doesn’t feel anything like those days at all. The difference now is that our Oprahfied populace’s first reflex is to claim victimhood and seek an ever larger government to insulate them from being responsible for themselves.

If you are old enough to remember compare the evening newscasts of 1969 and 1979 to those of 2008. Which has changed more, the times or the reporting of the times?

I’ve said much the same thing in previous posts. I fully agree that Iraq is not Vietnam, our much-bemoaned political polarization is tepid, indeed, compared to the 1960s, and my own sense of the current economic mess is that it’s not as bad as the stagflation of the 1970s.

Having heard it said, repeatedly, by people with credibility on the subject that this is The Worst Economic Downtown Since the Great DepressionTM, I’ve reluctantly come to accept that as true. It certainly looks to be a bigger systemic calamity. Still, inflation is under control, interest rates are at historic lows, and even unemployment is reasonably low.

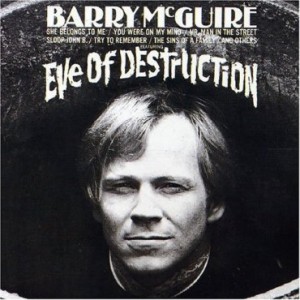

Perhaps some perspective is in order, then. As the great social commentator Barry McGuire described the situation in July 1965, mere months before I was born, it was quite grim. We were, quite literally, on the eve of destruction:

The eastern world, it is exploding

Violence flarin’, bullets loadin’

This remains the case today. Tie.

You’re old enough to kill, but not for votin’

You don’t believe in war, but what’s that gun you’re totin’

Now, not only are the age for killin’ and votin’ the same (18) but we have an all-volunteer force and even allow for conscientious objectors to get out of fightin’ after they’ve volunteered.

And even the Jordan River has bodies floatin’

I’ve seen no reports of this, so presume it’s no longer the case. Advantage: Now.

If the button is pushed, there’s no runnin’ away

There’ll be no one to save, with the world in a grave

This remains true. However, the demise of the Soviet Union and end of the Cold War has markedly decreased the likelihood of such an eventuality. Advantage: Now.

Handful of senators don’t pass legislation

Still true and more frequent. Advantage: Then

And marches alone can’t bring integration

McGuire misapprehended the situation. Integration was indeed achieved. Advantage: Now.

This whole crazy world is just too frustratin’

So true. Tie.

Overall, you’d have to agree, we’re in much better shape now.

Yeah, but they still can’t have a beer.

While it is better than 2 yrs ago, the streets of Baghdad still become rivers of blood from time to time.

But now we have non-state actors trying to get the bomb, and they don’t care how many of their brethren die… as long as we do.

While I agree that we are better off now than we were then, I am not so sure that it is quite so clear a winner, especially because

3 months after the crash of ’29, I am quite sure most people were walking around going, “So what?” I feel like that is what we are doing now. Considering that housing starts are now at their lowest since 1959 when they first started tracking them, I feel it is safe to say that we are just beginning to feel the pain.

I know it is going to rougher for me than it was in ’81.

If people have sense they are not worried about what has happened, they are worried about what is baked-in.

Nope. Bush would have had to have done quite a bit better than he did to rise to the level of failure achieved by Carter.

The Kingston Trio wasn’t far off either:

Houston! You are a Trio fan… great stuff.

Maybe, but this recession is 12 months old. And unemployment is very low by historic standards for being 12 months into a recession. In the begining of the Great Depression unemployment went from 3% to almost 8.7% which is nearly triple. Another problem with the Great Depression was deflation.

Uhhhmmm no. Interest rates have been cut, money has been pumped into the economy unlike the Great Depression, and nobody is serioulsy talking about protectionism. This is not 1929.

Regarding housing starts, that is completely normal when you have a glut of available housing on the market. Chances are this market will remain sluggish at best for sometime. So this shouldn’t be the only series of data one should look at when assessing the state of the economy.

As for feeling the pain, yeah we likely have some time to go before things start to look up, and probably even longer before we know it. Still I don’t think we’ll have the same protracted period of economic contraction that was seen in 1929 to 1933. The average duration of an economic downturn since WWII has been 10 months, with the longest being 16 months. I don’t think it will be 43 months.

Thank you Mr Austin and Mr Joyner for some sanity. In the circles I travel in I have been attempting to make these very points…..with little success. Politics, you know.

I am in the private equity business and therefore am keenly interested in general economic prospects. Personally, I think a full year 2009 GDP wipeout and peak unemployment of 10-11% are squarely within reasonable expectations. A severe recession indeed. But have we lost all perspective….??

I came of (business) age in 1981-1982 – in the steel industry of all things – now THAT! was a recession. But see how quickly we see the world through our own prism? An awful lot of people have never experienced a 1982 style downturn. For me, I observe that current conditions are clearly bad, but not catastrophic. For newbies, life as we know it is over. I say: “C’mon, newbies, wake up.”

I saw a Fortune article titled “8 Really, Really Scary Predictions.” Not one “scary prediction” had the recession producing more than 9% unemployment. Terrible for the unemployed, to be sure. But let’s have perspective. By objective measures, this is not the end of the world – 1982 saw 10.5%.

(BTW – political comment. The major media ran non-stop gloom and doom for two years in advance of Obama’s election, for obvious political reasons. Economy. Iraq. Middle class angst. Blah, blah blah……Careful what you wish for, Barry. Sentiment and expectations are important. And don’t you wish your propagandist minions at MSNBC etc, having gotten you elected, would now shut the FXXXX up?” Its your deal now.)

Our country is basically in sound shape. I understand the politics of painting GWB as the devil, but that is just juvenile BS. The “financial crisis” will be resolved. And in fact, liberal policies will ultimately be judged the cause. Can we reverse the near term misguided policy reactions……I don’t know. There is probably a near term (next 10 years) hit.

But 10 years from now, I’m hopeful. Unless Obama gets his way……..that is…..

Steve, I largely agree with you (I do not think this is 1929 revisited), but 3 months ago, John McCain was still saying “The fundamentals of the economy are sound.” which we now know to be false.

I did not say it was like ’29… just that in early ’30 I am sure most were still saying “So what?” (meaning that we had/have no idea what is coming down the road, or how bad it will be)

Absolutely, agreed… but not since before 1959 has there been a time as bad as this, which at the very least bodes ill for me, a union carpenter. As I said,

. I remember ’81, I was eating popcorn, stealing beans to eat, and drinking coffee out of thrice brewed grounds.

My point was, and is, only this: Hard times are a’comin’. If you have a job, keep it. Things are going to be rougher than we have ever known.

And Mr Verdon…..

I should have put “we” in bold… because I mean “we” as in those who are personally here in the here and now, not my father, or grandfather… they went thru far worse than we face.

James, great minds and all that… 🙂

Careful though, you’ll get a bad rep agreeing with me in the comment threads.

The words are by Sheldon Harnick. Yeah, the same guy who was the lyricist for Fiddler on the Roof.

tom p,

Couple of things, 3 months ago nobody was sure we were in a recession. It was likely, but nobody was sure. A politician affiliated with the current party in power is going to say that because bad economic news is bad for the party in power. So I’m not terribly impressed by this.

Make it three things, I don’t see that simply because John McCain says something it has to be the general consensus. For sometime I’ve been pessimistic on the economy and taking heat from those on the right, FWIW.

The Trio used material from a wide variety of writers. Dave Guard found all kinds of cool stuff. (Scotch & Soda is credited to Tom Seaver’s parents, though they learned it from a now unknown pianist in Reno). The Trio and Harry Belafonte were doing world music long before it was a recognized concept.

The Trio started to get more original material when John Stewart joined the group after Guard’s departure.

And your painting Obama as the devil before he has even taken office is not?

I see…

Whether things are better or worse today is purely subjective.

Everything that is, is wrought at the expense of what was.

The pseudo-iconoclasm of today, with it’s persistent rejection of all tradition, is certainly a mixed bag.

From the semi-sublime to the utterly ridiculous: The Spokesmen sing the answer to “Eve of Destruction.”

“Dawn of Correction”

Drew, you piece started out pretty reasonably, but this?

If by “basically good shape” you mean that we still have a moderate regulated capitalism, that might be true … but “good shape” would probably not include the desperation implied by the ZIRP.

Maybe there is some middle ground where GWB isn’t the devil, but just a bad captain of a ship off course. Now we are almost literally running all pumps to stay afloat.

(I’m working basically in the auto business right now, and it’s pretty ugly across the board.)

You guys should probably read this Naked Capitalism piece. It is about how government action contributed to this mess, yes, but it is also about the mess was made possible by a chink in the Bush era regulatory philosophy.

“Free markets” were believed to be self-correcting, even as crony capitalism allowed large scale looting.

Weren’t some of us talking about the Enroning of America a few years ago?

More: Bush’s SEC let Madoff walk

You know, “crony capitalism” is something we used to hear from the crazed left … until it REALLY happened.

We are in the middle of a bad recession, please don’t over dramatize the situation.

Only problem is the situation Akerlof and Romer describe is not a free market. Let me point to some key indicators that Akerlof and Romer gave you,

Which is pretty much the entire quote from Akerlof and Romer. It isn’t the market that ist he problem here, but the government bailouts, the notion of too big to fail, and so forth. It sets up a system of perverse incentives you’d not find in a market without such government guarantees.

The author of that blog completely missed the obvious. It wasn’t investment firms going public. It was the government’s willingness to step in and bail these guys out.

IIRC, the SEC under both Bush and Clinton gave Madoff a pass. It isn’t like Madoff started up as soon as Bush got in office.

By the way, the Akerlof and Romer argument is one I’ve been making for awhile here. I’ve argued that a bailout is bad becuase it simply reinforces the belief that when the fit hits the shan, the government will bail out those “too big to fail firms” thus setting us up for the next round of a financial crisis down the road.

Tell me again about my “chops” Odograph.

OK, explain how a ZIRP is not desperate. How many times have we resorted to it here in the US?

I misunderstood the “Akerlof and Romer” reference. If you’ve been on that, kudos!

Although it wasn’t *just* that. We would have had the wreckage without the bailout. Profit by bankruptcy depends on getting yours and getting out while the getting is good. Bailouts are about mitigating damage (or not). They by themselves say nothing about clawbacks etc.

Never, but we came close last recession and Japan has used it before. It isn’t the end of the world though as some might have us think. I’ll get really worried when we have ZIRP and deflation.

Sorry you are wrong. The government has demonstrated at least twice before that it will step in and bailout companies/guarnatee deposits, insurance plans, pensions, etc.:

Chrysler,

S&L Crisis.

The latter, the S&L crisis was the U.S. example noted specifically by Akerlof and Romer. They also looked at banking crises in other countries as well.

While we can point to the introduction of new financial instruments and changing the rules of the game (lets not call it deregulation please) as contributing factors, the problems we see today are also due, in significant part, to government’s willingness to guarantee/bailout firms.

Oh and add the airlines immediately after 9/11 to the list of bailouts.

The problem is we have no certainty of how long this recession will last.

The “Great Depression” surprised people, not by how sharp the contraction was, but by how long it lasted–13+ years. Every one of the nine prior US “Banking Panics” had lasted only from six to eleven months.

The 1921 contraction, which washed $50 billion out of the economy to pay for World War One, only lasted nine months. A similarly sized Monetary Inflation, to prop up the British Pound after the war by the New York Federal Reserve Bank, caused the ’29 crash.

The difference, between the ’21 and the ’29 crashes, was that President Hoover was an interventionist who stepped in to prop up wages and prices. This caused unemployment to reach 18.7% by 1932. He also closed down a third of the banks by 1931 causing a liquidity crisis.

FDR continued Hoover’s interventions and added ones of his own. His unemployment figures reached 24.9% by 1937. He vastly increased the power of the Trade Unions and cartelized American businesses. Also, the Smoot/ Hawley Tariff Act shut down world trade as other countries retaliated to our trade barriers.

Is President Obama likely to intervene in the economy as much as Hoover, or even George W. Bush? Yes, that is so. Every intervention will delay recovery. Moreover, as the length of the recession extends, this will undermine the other structural flaws in our system: Social Security, Medicare and pensions. As the economy shrinks, its ability to pay for our huge government will vanish.

If Obama increases taxes, or if he allows the Bush Tax Cuts to phase out in 2010, he will learn that America is on the wrong side of the Laffer Curve where any tax rate INCREASE will produce a tax revenue DECREASE because it destroys the incentives to be in business. Many small business owners will sit out this recession. Unfortunately, when they do, the people they employ will lose their jobs–20 to 25% of the labor force.

Obama will be forced to the printing press to pay for his programs, causing high price inflation. His advisors are Keynesians or interventionists. They believe there are no consequences for increasing the money supply. They will learn that this is not so.

Currently, this recession is worse in the rest of the world, than here. Oil is likely to drop below $30 a barrel. Most of the Muslim tyrannies need oil to be two to three times that to pay for their welfare states. Civil unrest and a lack of world liquidity is a breeding ground for revolution and war, but much of this depends on the incoming US administration. Countries in high stress often go to war to divert attention from revolution.

Many people will be blaming this contraction on America. I’ve already seen this contention in print in France.

Odo-

First, let me say my condolences for being dependent on auto right now. I came out of college into the steel industry in 1981-1982 when it soon was flat damn on its back. Ugly.

But my comment stands. The country still has sound fundamentals, and unless those fundamentals are destroyed, we will be fine. (A heavy dose of increased tax burden, regulatory burden and wasteful green legislation and wasteful bailout would do the trick, but I digress.) Business cycles and asset bubbles simply do happen. This current cycle is just another one. All estimates I have seen for the current recession do not even have the unemployment rate breaching the 10%+ of 1982……yet somehow we survived then.

I understand the politics of blaming GWB for everything, that’s fine. But its just BS. Bill Clinton bequeathed a bursting dot.com bubble and a crashing equity market to GWB. But we don’t acknowledge that. (“We” being the popular press, which means the general population, your sophisticated dinner party mates notwithstanding.) Look at the top to bottom of the broad based Wilshire 5000. 35% down. Ugly. Thanks, Bill.

Further, the current housing bubble bust has its roots in long term easy credit, CRA, and a 1990’s HUD that went berserk pushing leftist social policy. You can throw in derivatives if you like, but even that financial tool predates Bush’s watch. Further, the 2003 regulatory reforms Bush sponsored were vociferously shouted down with claims of elitism and racism by the likes of Chris Dodd, Barney Frank, Maxine Walters etc. As I’ve said before, the C-Span tapes are readily available if you want to watch that spectacle. I don’t think that was a mirage I saw as Dem after Dem excoriated the regulators.

Blaming things on Bush is nice for the barber shop, sewing circle and dinner parties. But if one’s interest is truly understanding the economic, regulatory and political policy mistakes made you have quite a different conversation than the simplistic “Bush is an idiot and provided poor stewardship.”

People going down that path need to use the word ‘idiot’ carefully.