What Happened to the Surplus?

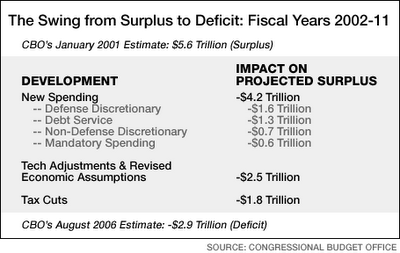

Back in 2000 and 2001 everybody was predicting budget surpluses for years to come. Bush and Gore argued over how to “spend” it. Now the convetional wisdom is that the surupluses disappeared in an orgy of tax cuts by the Bush Administration for the rich. Greg Mankiw points out that this is not entirely accurate.

So the idea that the tax cuts were to sole “culprit” in turning the surplus into deficits is not really accurate. To be sure, they were a contributing factor.

Also, there was that little issue of the recession. In the above graph, that falls under the part called Tech (Technical) Adjustments and Revised Economic Assumptions. That alone “cost” $2.5 trillion, and while it is sometimes fashionable to blame the recession on Bush, the reality is that the seeds of recession had germinated during 2000, well before Bush was President.

Now this doesn’t mean that Bush is “off the hook”. There were indeed large increases in discretionary spending (using the above chart and back of the envelop calculations) of about $2.7 trillion dollars. Add in the tax cuts, and we are talking $4.1 trillion. So if there were no tax cuts and no increases in discretionary spending we’d still have a surplus…a small one, but no deficits.

Mankiw does bring up the issue of dynamic analysis of the tax cuts and how positive feedbacks might have lowered the impact of the tax cuts. Still, I think it is fair to say that the tax cuts did play a significant role in the current bleak fiscal outlook. But they are not the entire story by a long shot.

I never cease to be amazed by those who claim the defecit is caused by a reduction in tax revenues. No matter how you try to explain it, a defecit is caused by one simple fact: spending more than is collected as income. It’s not the tax cuts that have created a defecit, it’s spending too damn much.

To try to claim otherwise would be the same as me saying that my personal defecit (credit card balances) is caused by my employer not paying me enough. And the argument of tax cuts for the rich would equate to me having a defecit because my employer pays my boss more than me.

This is just common sense and yet so many people believe that tax cuts “cost” us an increased defecit. I suppose the real question is why are there so many people willing to buy into this fairy tale.

Steve, I always assumed that the projections of a surplus contained an expectation that the huge run up in capital gains taxes would continue. Does the Technical Adjustments and Revised … remove those false expectations completely?

I can’t help it, but I just thought that the politicians were too dumb, or too venal, to get past pretending that the exceptional tax revenues were anything but normal.

I don’t understand how the $5.6T surplus estimate was calculated, if it didn’t take mandatory spending ($0.6T) or debt service ($1.3T) into account. But then, I don’t understand 95% of economics anyway.

More commentary from a real economist

Plus, the added benefit of finding out that the person who wrote this works for the Department of Labor, as the article now points out

Hal,

What, Mankiw isn’t a real economist, or me?

In any event Thoma’s post is sort of a “Yeah, so?” for me. After all, his point is that the tax cuts played “a significant role in the current bleak fiscal outlook,” which is right in line with what I wrote…in fact that is what I wrote.

As for the full disclosure thing, I don’t see any point to that. A full time bureaucrat for the Labor Department is usually a career person–i.e. who has usually been there for several years. Now if he were a political appointee then you might have something.

Oh and regarding this,

Actually, it does, it reduces its relative size. As an economist Thoma is more than aware of this.

Well, math for one thing.