93% of America’s Counties Still Haven’t Recovered from Great Recession

The economy is booming. Except where it's not.

In his valedictory State of the Union address, President Obama declared that, “Anyone claiming that America’s economy is in decline is peddling fiction.” By almost any standard, he’s right. Aside from the silliness of taking credit for “gas under two bucks a gallon,” all the indicators he points to, especially job growth, are moving in the right direction.

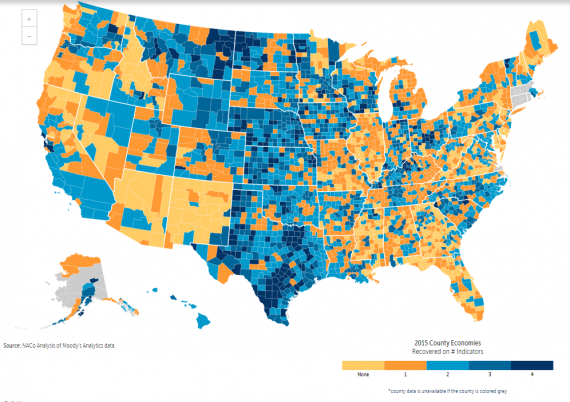

It’s worth noting, though, that the recovery from the Great Recession is far from complete and, more importantly, highly uneven. Indeed, a new study finds, “93% of counties in the U.S. have failed to fully recover.” Eric Morath summarizes for the WSJ:

Nationwide, 214 counties, or 7% of 3,069, had recovered last year to prerecession levels on four indicators: total employment, the unemployment rate, size of the economy and home values, a study from the National Association of Counties released Tuesday found.

The reality is slowing population growth and industry shifts mean some parts of the country will likely never fully recover. But by the end of last year, more counties had not recovered on any one of the four indicators, 16%, than had recovered on all of them.

“Americans don’t live in a single economic place,” said Emilia Istrate, the association’s director of research and outreach and one of the study’s authors. “It tells you why many Americans don’t feel the good economic numbers they see on TV.”

As was the case in 2014, when just 65 counties had fully recovered, most of those that bounced back are in states benefiting from the energy boom. Last year, 72 of the recovered counties were in Texas, the most of any state. Nebraska followed with 22. Minnesota, Kentucky, North Dakota, Montana and Kansas each had at least 10 fully recovered counties.

Meanwhile, in 27 states, not a single county had fully recovered.

Some of the nation’s largest counties finally recovered from the recession in 2015, including the counties containing Denver, San Francisco, San Jose, Dallas and Columbus, Ohio. In 2014, no county with more than 500,000 residents had fully recovered. Last year, 17 of 126 had.

The recovery is spreading out from the energy-rich center of the country—in part because a massive drop in oil prices is reversing job creation there while providing an economic benefit to larger metro areas near the coasts.

Numerous counties on the West Coast, Nevada, New York, Florida and the Carolinas recorded better than 4% economic growth last year, the NACo study found. (The entire country appears to be growing at about a 2% rate.) But a large swath of counties in Texas, Illinois and other states in the middle of the country suffered economic contractions last year.

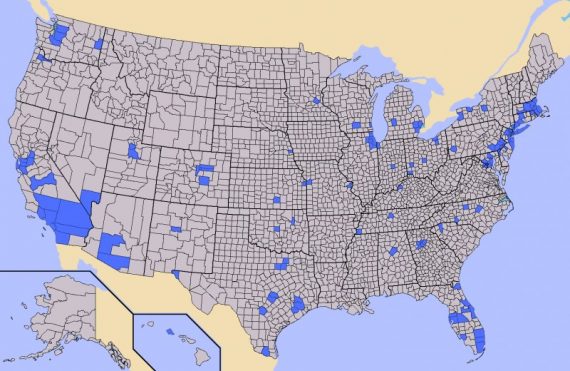

Now, on the one hand, this is highly misleading. As has been repeatedly noted since the county-by-county voting maps gained popularity during the bitter dispute over the 2000 presidential election results, looking at the country in that way can be very misleading. After all, most counties have very few people living in them while others are highly concentrated. Los Angeles County, California has slightly more than 10 million residents. That’s more people than live in 41 of the 50 states. Cook County, Illinois has over 5 million residents, more than all but 22 of the states. A Business Insider piece from a couple years ago noted that half the population of the United States lived in 146 counties out of more than 3000 in the country. Visually, it’s even more stark:

Still, the localized data gives us information lost at the macro level. People living in all but 7% of the land mass still haven’t made it back to where they were eight years ago. To them, the sense that the economy is booming is simply crazy talk. Everyone they know is still below water.

In 2007 did you hear anyone say, “Oh dear, 90% of our counties haven’t fully recovered from the Second Bush Recession.”? In 2009 did you hear anyone say, “OMG, 99% of our counties are down on at at least three measures of their economy.”? WSJ managed to find and cherry pick a made up statistic in their ongoing effort to make Obama look bad. Whoopee. The story here isn’t that the recovery isn’t complete, or that the economy is uneven, or that oil boom areas were doing well; the story is WSJ’s bias. Long standing, but worse under Murdoch.

Sick to death of Republicans complaining that the Democrats have not cleaned up their mess fast enough.

A relatively stable middle east is a yyyuuuuggge factor in $30/bbl oil.

If McCain or Romney were in the WH the middle east wouldn’t be relatively stable.

Obama gets credit for that.

I’m sure it sucks to blindly support a party that has Donald Trump as it’s intellectual leader. But that doesn’t mean you can ignore facts.

I’ll just note that home value as a measure of recovery is misleading since the soaring prices of real estate prior to the crash, and of the factors contributing to it, meant that a lot of property was over-priced and should not return to those levels …unless we want to invite that boom/bust to repeat.

As an example, my home has not returned to it’s 2007 estimated value. However, I bought it in 1998 at less than half of that price. Now, I realize this is hard on the folks who found themselves underwater on mortgages they took out shortly before the crash, but the fact that a 50 year old suburban ‘cookie-cutter’ house is ‘only’ worth 175% of what we paid for it instead of 225% is not a sign of economic weakness, but sanity.

Yup.

@James Joyner:

No. There are plenty of people in the 7% of the land mass who haven’t made it back and there is plenty of people in the 93% who have made it back…

Also, if we really should use land mass, shouldn’t that also be used when deciding on how many refugees from {Syria, South America, etc} should be allowed into the country? Most of the land mass doesn’t contain any refugees at all!

@C. Clavin: Also, while Sarah Palin was running around saying “Drill, baby, drill!” Obama was quietly drilling.

“all the indicators he points to, especially job growth, are moving in the right direction.”

Jobs are a lagging indicator, it amazes me that no one pays much attention to that fact ,or simply doesn’t care. Initial claims for unemployment, non-farm payrolls, the unemployment rate, and the duration of unemployment typically turn well after the economy does. If one wants to look at leading economic indicators then that data suggests that we’re headed into a recession. On the fed national surveys order backlogs have dried up and inventories have expanded, the Baltic Dry Index is near 2009 levels, and rail traffic is just as bad. The yield curve is flattening (with short tern rates essentially zero-bound it probably won’t invert) and credit spreads are blowing out. None of these suggest positive things for the economy. All this happened in 2011-2012 and we avoided a recession so it’s possible we avoid one this time as well. I’ll continue to monitor the relevant data and revise my opinion accordingly.

This is somewhat misleading. Here in Oregon the Portland area has certainly recovered. Housing prices are actually above where they were in 2007. There is a housing shortage here and it’s not unusual for a home to sell for more than the asking price within hours of going on the market. Much of this recovery is the result of Intel’s massive plant and other hi-tech companies.

The rest of the state not so much but this is nothing new. It’s been the case for 2 or 3 decades when the logging industry all but died.

You have to throw out home values as well as UE rate. Here is a good local example of why reading into this (like the WSJ did) is stupid

County Economies, 2015

Recovered on # Indicators: 2 indicator(s)

Jobs Recovered: Yes

Unemployment Rate Recovered: No

GDP Recovered: No Recession

Home Prices Recovered: No

According to your assumed summary of this report, Loudoun is light blue and just not doing too hot….Uh, yeah right. Everytime I drive through Loudoun County and see all those homeless people in their BMW’s, I sit there and ponder, man, when will Loudoun recover? Same with Fairfax, Prince William and Arlington – all have 2 out of 4 – Man, this area is really bad compared to those 4 for 4 counties… Really?! Then toss in the fact that if your county’s UE rate just happens to be .01% off of what it was at the start of the recession, well another negative indicator, when in actuality it is likely back to normal.

It’s not that surprising that most of the areas in blue are urban areas. Phoenix, Vegas, and Albuquerque are islands of blue surrounded by orange.

But look at Texas. I know it’s easy to hate on Texas, but I try to resist that urge. Dallas, Fort Worth, Austin, San Antonio, these are all awesome cities. I’ve never been to Houston, but it’s proximity to the Gulf and it being in Texas leads me to believe that it, too, is awesome.

Texas is so awesome that I-35 takes it’s “economic recovery” all the way up through Kansas and into Iowa.

Not sure what’s up in Missouri and Illinois though. Almost all of the neighboring counties in other states have recovered. But step over the state line… What gives?

Just curious….when was the data compiled for the top map?. It looks like it was published in 2015 (maybe…I can’t read it) but is the data from before or after the drop in oil?.

@James Pearce: What people forget about Texas is that there really wasn’t much of a housing price boom. As a result there wasn’t much of a bust. Therefore, recovery home values was quite easy. The irony was that while Texas brags that it is a low regulation state, the fact of the matter is that banking and mortgages had a few regulations (left over from the depression) that put a damper on wild home price swings. Example were limits on home equity loans. They were allowed only in recent years and you are still just limited to one loan.

@Scott:

While housing policy may be a factor, I think there’s more going on in Texas. 1 in 10 Americans live there, most of them in the urban cores, and they have the resources and infrastructure and the desire to fully participate in the globalized economy we have now. Not only do they have an international border with one of our more significant trading partners, but they also have a seaport.

If I had to put forth a theory, without a shred of evidence to back it up, I would say that the reason Texas is recovering better than IL, MO, the rust belt, and the bible belt is because they’re more committed to shared prosperity, and less concerned with sorting the haves from the have nots.

For all the cowboy backwardness that bubbles up from Texas, it’s this quality that I appreciate most from 21st Century Texas.

I’m old enough to remember when cheap gas was a big problem for global warming. You can’t simultaneously say that we need to address global warming and take credit for cheap gas. I mean, you *can*, I guess. Obama did. But these are contradictory goals. Any real attack on global warming is going to mean much higher gas prices.

@Hal_10000: True. But a lot of the drop is due to low demand, so on net we’re reducing carbon. It is an opportunity to impose higher gas taxes, preferably on a percentage basis, against future demand increases.

A question for the group. Anyone read Naomi Klein’s book on global warming, This Changes Everything? I’m two chapters in. Can I finish it without becoming suicidally depressed? 6 deg C, maybe 8. Gawd.

@bookdragon: Well said! Thank you from a person in whose hometown the median price of a home “plummeted” during the downturn to $395,000 (and whose parents sold said “median home” for a whopping $75,000 in 1990).

@Hal_10000:

You can’t? That’s a bit of an oversimplification, isn’t it?

Gas is cheap right now because the oil supply is high and the demand for oil is low. The supply is high because of an increase in domestic production, which is “greener” than importing it, and demand is low due to alternative energy sources and improvements in fuel efficiency.

That’s not to say that tackling global warming inevitably leads to cheap gas prices, but this result would have been easy to predict, provided you ignore the politics and look at the economics.

Or, as the corporations of America would say:

When Herr Trump inadvertently spoke the GOP truth and stated that US wages were too high to compete internationally, it made clear the view of the Oligarchy.

There is money to be made, but not by YOU.

Next time you hear someone parroting Fox and Limbaugh talking points, railing against Unions, they are just letting you know that they have a strong desire to earn far less money than they earn today.

Oligarchs have the collective bargaining power of dark money and Super Pacs.

You have…. bubkis.

I think our area is somewhat worse off in the last few years. Mills stand empty. The few businesses that have moved in are a flea market, discount flooring store, and an indoor carpet golf/video game place. High tech industry would be desirable. A lot of people have gone back to work at jobs paying not even half of what they were making before they got laid off or the mills shut down. Many cannot afford health insurance. The schools have laid off.

Too many areas have got left behind.

@Tyrell:

Just curious, where are you from? “Things haven’t been the same since the mill shut down” seems like a very old complaint that’s at least two generations out of date.

@James Pearce:

He is from 1967.

@Grewgills:

Too early.

Jimmy Carter is president in whatever timeline he’s stuck in.

@Tyrell:

Today we set the bar for “recovery” at the economy which existed during the time the derivatives scam was effectively fire-hosing stolen money on the nation. We rightly damn the bankers for their ruthlessness but they actually took but a small percentage of the booty for themselves. They lacked this guy’s integrity…but…

https://www.youtube.com/watch?v=abI8cdLvJp8

Anyway, it masked the fundamental problem of off-shored manufacturing. What we have now may be as about as recovered as it gets until we address the fundamentals.

Here in the People’s Republic of the San Francisco Bay Area unemployment has dropped to below 5% and the housing market for both home buyers and rentals is rocketing along. Our current round of prosperity is fueled by the Silicon Valley complex of tech and social media, as well as biotech, medical research, healthcare and a variety of technological based service companies.

@al-Ameda:

I think the jig us up. Conservatives in the prosperous red states know that the bay area is really a scorched wasteland/socialist hellhole. I am planning a trip to the People’s Republic of Malibu, perhaps they will have food and electricity there…

@gVOR08: Baloney! Most, if not all the drilling was done on private land. Obama has put a stranglehold on drilling on public land.

@John430:

… and, as the current glut in petroleum based energy supply shows us, drilling on public lands is currently unnecessary and unprofitable. Oil prices are depressed.

@anjin-san:

I’ve been to Santa Monica and the Palisades area recently and I can assure you that those ‘gun grabbing’ commies have both electricity and food, and both are gluten free.

Seriously, how can it be that the immoral “lifestyle” cities on the west coast – from San Diego up to Seattle, socialist high tax hell holes that they are – are experiencing strong job growth, robust housing markets, and strong government financial positions? How can this be?