Americans Giving Up Citizenship Over Taxes

A small but growing number of Americans are renouncing their citizenship because the tax burden outweighs their perceived benefit:

A small but growing number of Americans are renouncing their citizenship because the tax burden outweighs their perceived benefit:

According to government records, 502 expats renounced U.S. citizenship or permanent residency in the fourth quarter of 2009 — more than double the number of expatriations in all of 2008. And these figures don’t include the hundreds — some experts say thousands — of applications languishing in various U.S. consulates and embassies around the world, waiting to be processed. While a small number of Americans hand in their passports each year for political reasons, the new surge in permanent expatriations is mainly due to taxes.

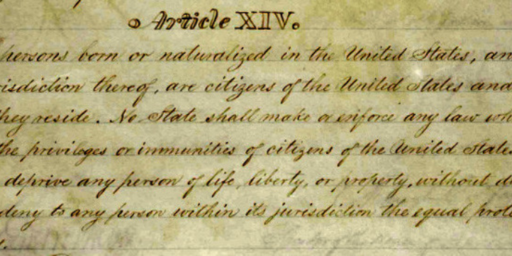

Considering that an estimated 3 to 6 million Americans currently reside abroad, the number of renouncements is small. But expatriate organizations say the recent increase reflects a growing dissatisfaction with the way the U.S. government treats its expats and their money: The U.S. is the only industrialized nation that taxes its overseas citizens, subjecting them to taxation in both their country of citizenship and their country of residence.

“Their income and wealth are generated largely outside the U.S., so why does the U.S. get a slice of that?” says Phil Hodgen, a California-based international tax attorney who helps Americans in the expatriation process. “More and more people see no long-term benefit to retaining U.S. citizenship.”

Apparently, measures put in place to prevent Americans and American corporations from hiding assets overseas has made the process much more onerous.

While I’m a critic of our complicated tax code, I’m not sure why those who wish to retain the rights and privileges of American citizenship while living abroad shouldn’t be asked to pay into the kitty with the rest of us. After all, they get to vote in our elections, have the protections of the American consulate, and the benefits of an American passport. Further, in most cases at least, they’re not being double-taxed; there’s an exclusion up to $94,000 for money that’s taxable in the host country.

I’m reminded of the JK Rowling “manifesto” widely circulated among the left blogs a few days back (see Kevin Drum, Matt Yglesias, and Chris Bertram)

I chose to remain a domiciled taxpayer for a couple of reasons. The main one was that I wanted my children to grow up where I grew up, to have proper roots in a culture as old and magnificent as Britain’s; to be citizens, with everything that implies, of a real country, not free-floating ex-pats, living in the limbo of some tax haven and associating only with the children of similarly greedy tax exiles.

A second reason, however, was that I am indebted to the British welfare state; the very one that Mr Cameron would like to replace with charity handouts. When my life hit rock bottom, that safety net, threadbare though it had become under John Major’s Government, was there to break the fall. I cannot help feeling, therefore, that it would have been contemptible to scarper for the West Indies at the first sniff of a seven-figure royalty cheque. This, if you like, is my notion of patriotism.

But, of course, Rowling chose to continue living in her homeland whereas the American expats are domiciled and earning their living abroad. It may simply be the case that, after some lengthy period of time, living abroad loosens the bond one feels to one’s homeland.

As a formerly American in Paris, back temporarily in NYC and planning to move back to Paris, I definitely understand this.

In fact, the $94K exemption (actually, I just checked and it’s $91,400) is for earned income from overseas. But once you go over that (and with the exchange rate in euros, that is increasingly likely) then you need to file another form to claim a Foreign Tax Credit for taxes paid overseas.

But the US has incredibly made it so that you must pay taxes at the marginal rate for your last dollars, as opposed to what you would pay if the exemption reduces your taxable income directly.

And in a comparative sense, paying taxes overseas “makes sense” in that you actually get some benefit from paying them, in terms of infrastructure, health care, etc., whereas in the US one wonders where the money goes. After the Pentagon gets its share, what is the benefit to the average citizen, or more importantly, resident?

Once again, as you point out (or Time does in the passage you cite), the US is the only country which tries to tax citizens who are not resident in the country during the year.

Well let’s see, there’s that whole federal court system thing, plus all these things called “interstates,” and “roads,” and “highway,” which may seem unusual to a long term resident of France but, trust me, are very beneficial to the average resident of the United States.

I’m an expat living in Sweden. There are various reasons why I am here, but mainly it starts with my wife being Swedish. One annoying thing is that since I freelance and have my own business I am still liable for the full social security and medicaid. No exemption touches it. Sucks now, but assuming it’s around when I retire I guess it will be nice to collect state pensions from Sweden and America and have made the contributions I will have made to social security all these years.

It’s confusing as hell to figure out and expensive to keep up. You really can’t just do it on your own cause the potential for a simple mistake really messing things up is high.

I’m most likely going to go dual citizen soon so I can vote locally, have the right to live and work anywhere in the EU, just in case, and the benefits of traveling in Europe on a European passport. As to the benefits of the consulate/embassy, it’s helluva expensive for the simplest services and they won’t take a check drawn from a US bank account and only use arcane forms of payment locally (basically a cashiers check that Sweden is phasing out due to internet banking/bill pay making them obsolete).

Ultimately I wish since I didn’t reside in the US they’d drop it, and I’m fine paying even though I’m not so sure how directly I benefit, but I sure wish they’d simplify things for those of us who have moved out of the country not to avoid taxes and have legions of lawyers and accountants, but are simple folk who just happen to live outside of the US for one reason or another.

I hope they make those traitors pay their part of the US Debt before their citizenship and tax obligations can be renounced.

And, if they don’t pay, toss them in jail if they ever set foot in this country again.

Bingo. The one argument I keep hearing against (or for reducing) our progressive tax code is that wealthy folk do more for the economy by spending their wealth either a) investing in/starting businesses that employ people and b) buying expensive luxury items that employ US workers. If these expats aren’t doing either, then losing them as citizens is not something I see as a net loss for the country…

Well, the ones who are denouncing their citizenship are doing it right. If they don’t want to pay American taxes they shouldn’t call the American Embassy when the end up in trouble or expect an American Marine to fly off an American carrier to pull them out of harms way.

Funny JDescrete gripes about the US defense spending when he enjoys the benefits of that spending more directly than those of us who remain in country. Sure we enjoy the deterrent effect of that defense spending but it is those Americans in foreign countries who are more likely to enjoy the direct rescue by a guy with an American flag on his shoulder.

I’m all in favor of creating an international system where there is vigorous tax competition.

JKB:

Yeah, the Marines make regular visits to France to rescue Americans from the frequent violence there.

This points indirectly to a loss of mission, a diminution of the uniqueness that defined us for so long. We are simply no longer the only free, safe, stable, wealthy democratic nation. There are actually quite a few, starting with western Europe but including Japan, South Korea, Costa Rica, Argentina . . .

There are a lot of places you can choose to live and work. The USG insisting on this go-it-alone, screw-the-expats approach isn’t going to matter to many people, but it matters a lot to a few. If they have to work overseas they are bankrupted by their own government. At the very least there should be a compromise position that allows US citizens to pay into SS and Medicare without paying the IRS on top of their local tax.

I’m an expat living in the Netherlands. Know who my Congressional representatives are? *NOBODY*. Yet I’m expected to pay taxes every year. Ever heard of “No taxation without representation”?

I’ve quoted you and linked to you here: http://consul-at-arms2.blogspot.com/2010/04/re-americans-giving-up-citizenship-over.html

@Yo Mamma:

You can register based upon your last address in the U.S. and vote in all elections in that state/district/jurisdiction. Please check the U.S. Consulate General Amsterdam’s website for information about overseas voting & registration here: http://amsterdam.usconsulate.gov/voting_information.html.

@Consul: I’m aware of this. Now which representative is protecting the interests of Americans abroad? Like I said: NONE of ’em. Taxation without representation.

Also: Congressfolk attempt to repeal the $91K exclusion each session, claiming it’s “welfare for fat cat corporate types living abroad off ‘real’ Americans’ sweat”. Seriously.

@Dwight. Yes, our complaints are the same. Just so others know, I’m not a fat-cat corporate type. I freelance, like Dwight. The $91k exemption is great for me.

I also don’t mind paying my taxes. I like voting in the U.S. I also like having access to consular services. So, that’s not a problem. What is a problem is how ridiculously easy it is to make an error in reporting your income. I got burned to the tune of $2k last year for a simple error.

@Yo Momma:

You’d perhaps be surprised how active some of your senators and congressmen/women are in providing constituent services to their overseas voters, particularly in sending congressional inquiries to the Department of State and to individual U.S. embassies and consulates abroad.

Aren’t there some exceptions to the rule due to bilateral tax treaties?