April Jobs Report Brings Very Good News

Good news.

Heading into today’s release of the April Jobs Report, the consensus forecast called for roughly 200,000 new jobs created and, perhaps a small drop in the unemployment rate. While the First Quarter GDP number released earlier this week was disappointing to say the least, other economic indicators released over the past several weeks seemed to indicate that the economy had started to revive itself after an unusually cold, stormy, winter. The biggest such number was released yesterday and showed that consumer spending had jumped a much higher than expected .9%% in March, perhaps indicating that the economy was waking up from a winter slumber. Those optimistic assumptions are likely to be reinforced by the release of the Jobs Report today, which showed that 288,000 jobs were created in the month of April:

Total nonfarm payroll employment rose by 288,000, and the unemployment rate fell by 0.4 percentage point to 6.3 percent in April, the U.S. Bureau of Labor Statistics reported today. Employment gains were widespread, led by job growth in professional and business services, retail trade, food services and drinking places, and construction.

In April, the unemployment rate fell from 6.7 percent to 6.3 percent, and the number of unemployed persons, at 9.8 million, decreased by 733,000. Both measures had shown little movement over the prior 4 months. Over the year, the unemployment rate and the number of unemployed persons declined by 1.2 percentage points and 1.9 million, respectively. (See table A-1.)

(…)

The number of long-term unemployed (those jobless for 27 weeks or more) declined by 287,000 in April to 3.5 million; these individuals accounted for 35.3 percent of the unemployed. Over the past 12 months, the number of long-term unemployed has decreased by 908,000. (See table A-12.)

The civilian labor force dropped by 806,000 in April, following an increase of 503,000 in March. The labor force participation rate fell by 0.4 percentage point to 62.8 percent in April. The participation rate has shown no clear trend in recent months and currently is the same as it was this past October. The employment-population ratio showed no change over the month (58.9 percent) and has changed little over the year. (See table A-1.)

(…)

Total nonfarm payroll employment increased by 288,000 in April. Job growth had averaged 190,000 per month over the prior 12 months. In April, employment growth was widespread, led by gains in professional and business services, retail trade, food services and drinking places, and construction. (See

table B-1.)Professional and business services added 75,000 jobs in April. Employment in this industry had increased by an average of 55,000 per month over the prior

12 months. In April, employment growth continued in temporary help services (+24,000), in management of companies and enterprises (+12,000), and in

computer systems design and related services (+9,000).Retail trade employment rose by 35,000 in April. Over the past 12 months, employment in this industry has grown by 327,000. Within retail trade, job

growth over the month occurred in food and beverage stores (+9,000), general merchandise stores (+8,000), motor vehicle and parts dealers (+6,000), and

nonstore retailers (+4,000). Electronics and appliance stores lost 11,000 jobs in April. Wholesale trade added 16,000 jobs over the month and has added

126,000 jobs over the year.In April, employment rose in food services and drinking places (+33,000), about in line with its prior 12-month average gain of 28,000 per month.

In April, employment in construction grew by 32,000, with job growth in heavy and civil engineering construction (+11,000) and residential building (+7,000). Construction has added 189,000 jobs over the past year, with almost three-fourths of the gain occurring in the past 6 months.

Health care employment increased by 19,000 in April, about in line with the prior 12-month average gain of 17,000 per month. Employment in other services,

which includes membership associations and personal and laundry services, rose by 15,000 over the month.Mining added 10,000 jobs in April, with most of the gain in support activities for mining (+7,000).

Employment in other major industries, including manufacturing, transportation and warehousing, information, financial activities, and government, changed

little over the month.

In what it likely to be a common, and perhaps correct, interpretation, CNBC attributes the strong numbers to the economy waking up from winter:

Job creation accelerated in April as the U.S. economy shook off its winter doldrums to add 288,000 new positions, while the unemployment rate plummeted to 6.3 percent.

Economists had been anticipating 210,000 new jobs and a 6.6 percent rate.

(…)

The report comes amid economic growth of 0.1 percent in the first quarter that consensus expects to reverse higher for the rest of 2014. Friday’s number added to those hopes.

“Weather, sequestration, a significant buildup of inventory and other factors have helped bottle up some (economic) strength,” Bart van Ark, chief economist at The Conference Board, said in a statement. “Now, it would appear, the absence of these factors is finally allowing the economy’s underlying strength to come to the surface. The result is not just a relatively strong gain in jobs in April but probably more of the same in May and June and perhaps right through the summer.”

Employment surged across sectors, with professional and business sectors adding 75,000 and retail gaining 35,000. Food and drinking establishments rose 33,000 while construction added 32,000 positions, according to the report from the Bureau of Labor Statistics.

“Over the prior 10-year period, the second quarter has always been the most robust for job growth; so it was critical we have a pop in April,” said Todd Schoenberger, managing partner at LandColt Capital. “This figure bodes well for the rest of the quarter. Challenges may appear in the second half of the year due to slower GDP rates, but today’s report is reason to celebrate.”

The New York Times is similarly upbeat:

The American economy gained steam in April, adding 288,000 jobs, while the unemployment rate fell to 6.3 percent, the lowest rate since September 2008.

After a sharp slowdown in December and January, and a modest improvement since then, economists had been forecasting a healthy gain for April as consumer and business activity rose in tandem with temperatures in many parts of the country.

The consensus among economists polled by Bloomberg before the Labor Department’s announcement Friday morning called for an increase of 218,000 in nonfarm payrolls, with the unemployment rate falling by 0.1 percent to 6.6 percent.

To be sure, month-to-month swings in hiring are a snapshot of the economy, rather than a portrait, and frequently blur.

For example, government statisticians on Friday revised upward the number of jobs added in March, suggesting the economy was stronger than first assumed. And the April data could be significantly revised upward — or downward — next month.

There are some caveats in this report, of course. The drop in the labor force participation rate by some 800,000 workers, for example, is the main reason we saw such a large drop in the Unemployment Rate. If those 800,000 workers had not left the labor force last month, then the unemployment rate would have actually gone up in April to 6.85%. This drop in labor force participation has been a concern virtually since the beginning of the recession, because of what it potentially portends about that segment of the American public that fell into the category of “long term unemployed” in recent years. Obviously, some portion of the numbers of people who leave the labor force are people who have retired, or retired early. From an employment perspective, that’s not really a problem. However, it seems pretty clear that some significant potion of the dropouts that have led to the lowest labor force participation rates since the early 1980s is made up of people who lost their jobs in the recession and were never able to find employment. Those people are still going to need to support themselves somehow, though, and they likely end up either on public assistance or disability. The fact that we’ve seen a sharp increase in people on Social Security Disability over the past several years may indicate where some of these people have ended up. Obviously, it would be better, for the economy as a whole and for these people individually, is they were gainfully employed rather than on public assistance.

The other caveats are the fact that average hours worked remained steady at 34.5 hours while average hourly earning remained steady at $24.31. Obviously, it’s better when both of those numbers are increasing.

That being said, though, there is no denying that this is a good jobs report. The job creation numbers, which are unaffected by the labor force participation issue, are the highest we’ve seen in two years and the fact that we’re seeing job growth in areas like manufacturing and construction bodes well for the economy heading into the rest of the year. Over the last three months, job growth has averaged 238,000 jobs per month, and that includes the three months of winter from January through March. Over the past six months, job creation has averaged roughly 202,000 jobs per month. These are both increases from the running averages for the same period a year ago, and a year before that, which would seem to indicate that the job creation engine isn’t going to sputter out like it has in previous years of this “recovery.” If we can continue improving those numbers, then we may finally reach the point where we should have been at a long time ago.

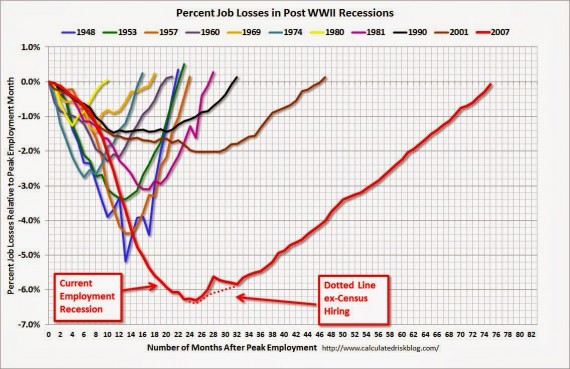

Even Calculated Risk’s “Scariest Jobs Chart Ever” is starting to look good:

The jobs report has teased us in the past, of course, giving us good numbers for awhile and then pulling the rug out from under us. Hopefully, that won’t happen this time because we could use about six or seven months of numbers like these, at least.

Construction has started to pop.

Still all Private Sector jobs and no Public Sector jobs…which is in fact a net loss.

Hard to sit on a two legged stool.

The drop in the labor participation rate is not surprising considering the number of boomers reaching retirement age. Both my sister, 64, and me, 68, are officially retired so not officially part of the labor market although we both have incomes from consulting.

I blame George Bush. Wait, what?

Given Doug’s propensity to find a cloud in the silver lining of every economic report in the Obama Administration’s tenure, this must be a very good job report indeed. Kudos to Doug for admitting this.

It would be great if this is finally a sign of an accelerating recovery. IMO, not only is this a sign of the economy waking upn for a bad winter, it is also a sign that the econnomy is finally shaking off the effects of the Republicans’ austerity/economic sabotage program.

If we do see sustained growth from hereon in, we will not only see relief from economic misery from millions of Americans, but politically , a revival in the fortunes of the Oama Administration and, maybe, the Senate Democrats.

Anyone who thinks that this last winter didn’t have any effect on people’s shopping habits has never had to deal with stepping out into a -14 F day and trying to get things done. A lot of us were just hunkering down.

I expect this is a blip (or will be revised). The reason I expect this is a blip is that I don’t see any reason to think that the bottom, oh, 90% of the workforce is seeing wage increases. If/when we see incomes rising (broadly), I think we’ll see more of a recovery. Right now, wages have risen, but it’s been all about the top ~10%, I think. It’s certainly better than no wage rise, but it’s still hard to see how you’re going to get a lot of sustained consumer demand out of that.

What @stonetools: said. Good to see a little optimism. Credit where due. Thanks, Doug, for an encouraging post.

We used to regard about 4% as full employment. The primary achievement of Reaganomics was to make 6% look good. Almost there, at least.

@gVOR08: Many economists consider a 5% unemployment rate to be healthy, As I stated above @Ron Beasley: the number of boomers reaching retirement age may have skewed this calculus a bit.

Oh, this is hilarious. Clavin said that Doug would write a negative article. But Doug wrote the story based on the actual good news. Then Clavin shows up with a negative spin blaming the Republicans. So which one read a canned speech and which one reported the news? Clavin not only failed to predict Doug’s writing, he even seems to have failed to predict his own.

@gVOR08: @Ron Beasley: I was wondering about this actually. I don’t know a lot about the labor statistics but have always figured there must be some background level of unemployment, something like 3 – 5%. So if that’s the background then we’re, what, 1 or 2.something percent away from “full” employment? And if you flip the number, isn’t that also saying that we’re 94.something percent employed? That seems like a pretty good place to be, but again, I’m not very knowledgeable about the stats. It seems like when we talk about the state of the economy we’re referring to perception more than reality.

@Pinky:

I did not blame anyone…and merely stated facts (with the exception of the stool analogy)

Reading comprehension problems?

@C. Clavin: Oh, come on. You expected Doug to write the same old article. He didn’t. You wrote the same old response anyway.

@Chris M.: Many think an unemployment rate of 5% just represents the number of people changing jobs. The bad news recently is that the jobs created have been low paying service jobs. The good news is that the retirement of the boomers may eventually create a labor shortage which would result in increased wages. In the late 90s when the tech boom was in full force the service industry here in the Portland area had to pay 2 to 3 dollars above the minimum wage just to get anyone willing to work for them.

@Pinky:

Again…I did not blame anyone…as you accused me of.

And the fact that you don’t recognize taunting;

as opposed to predicting…tells me that you have real comprehension problems.

Maybe some remedial courses would help.

@C. Clavin:

If we’re going to claim limited-government speech is a cover for racists, can we claim laments about lack of government employment as a cover for Republican-haters?

No, you didn’t explicitly blame anyone, but anyone following the news knows who to blame.

@grumpy realist: Heh. The amount of school closings here in the last two months suggests a lot of people got to know their kids better than they’d hoped.

@Tillman: The school closings in major metropolitan areas is the result of people having less children. When the schools were built families had 3, 4 or 5 children. Now it’s more like one or two. There are more families but less children. Closing schools only makes sense.

I wonder if the PPACA played a role in those dropping out. I.E. Older generation not yet at the age to get Medicare, but working or continuing to look for work due the necessity of health care. Now with a credit from the government, can possibly pay less and afford to retire early? UE Rate better now than compared to 80’s at the same time (6 years in to a new administration) while dealing with a much larger and systemic recession. It’s not bad considering around 20% of homeowners still have negative equity and housing in general is still very flat. Could be an interesting next 6 months, will have to wait and see…

There are more than 92 million Americans remain out of the labor force. Think about that number.

The economy is still stagnant.

http://www.nytimes.com/2014/05/03/upshot/jobs-report-looks-great-but-looks-are-deceiving.html?action=click&contentCollection=The%20Upshot®ion=Footer&module=MoreInSection&pgtype=article

Gosh, Doug. Do you ever get whiplash from all that back & forth? It’s actually giving me multiple-personality disorder just reading your … varied missives on the economy and job numbers.

I would like to see a really good study on labor participation Until we do it is a lot of speculation. I happen to think the ACA may be part of it. I also know that the stock market at an all time high fattening those 401k portfolio allowing people to finally leave the work force.

Hopefully, the clog of workers at the higher age limits will finally retire and get out of the way. At work today, there was a conversation and lamenting on the lack of promotion opportunities because the old folks (which I’m near) just won’t retire.

@Tillman:

well yeah…of course.

@Scott: I’m the perfect example of this. We’ve been talking about my husband taking an early retirement – he’s fought cancer, has heart problems and feels like it’s about time to stop working 12 hours a day. Our 401K balance is looking better than a few years ago, the prospects of part time employment are looking up and since he’s a few years short of Medicare, we can now buy insurance on the open market where before he’d never have been able to get it with his pre-existing conditions. Maybe his leaving the job market might be looked at as a bad thing by Fox News but we think it’s a great plan for his remaining days.

U6 is still north of 12%

One out of every 20 households has no job holders at all.

Welfare use up sharply.

We have more unemployed (U6) than at an time in our history, save 1978, under Carter:

Yep. Things are going just swimmingly.

@beth: I’m almost there myself. I hit 60 but the savings are up. Got a few more years to go but feeling more comfortable. And no, I don’t see myself as lazy but current work is not terribly satisfying. My Dad retired at 58 and had a good 13 years before passing away. I don’t want to work until the end.

@Scott:

I’m only in my mid-30s, and I can already tell you that I will work until the day I drop, and retirement is a cruel dream-like concept that I choose not to think about to avoid torturing myself. I’m never going to make enough to be able to afford to put enough money in my 401K to retire. Real wages aren’t going to stop stagnating (and if you look at median instead of mean, real wages are actually down from 1969). It’s not going to get better. Corporate America isn’t going to just give back all of that money they’ve taken from labor over the last 40 years. It’s going to get worse, and keep going from there.

@Ben: I feel for you Ben and fear you are right. At 68 I was lucky enough to work during some of the best economic times and had a fair amount salted away.all of which is now in CD’s since I think Wall Street is a Ponnzi scheme now. I also have a skill set that allows me to make a few thousand dollars a year consulting. But you and my own sons are not going to be as fortunate.

so can we all just stop the lame “long term unemployment/minimum wage increase/food stamp nation bs now?!

@Ron Beasley: An interesting factoid, I used the term “salted away.” What is the source of this you might ask. In the days before refrigeration they used to soak meat, especially fish in brine to preserve it for the long winter months. This is why Gmunden, Austria became a center of civilization, they had both fish and salt and supplied both to the Roman empire. The residents of Gmunden were the Celts who eventually found their way to the British Isles.

@JR: Well, the vast majority of these are either retirees, stay at home mothers, or students. Labor force participation hit 68% at its peak in the 1990s, and is at 63% now, and some part of that decline is due to the aging of the American population.

Now, we do have a vast un/underemployment problem, that spills over to the decline of the labor participation rate an it is indeed a vast economic problem, as well as a mostly preventable vast human tragedy, but I have a strong feeling that people that throw around that decontextualized 92 million figure are opposed to any and all measures that would agressively attack it.

@Eric Florack: The Great Depression, did you ever hear about that little thingie?

@Eric Florack: Oh and by the way, the U-6 measurement is with us only from the mid-1990s. Prior to that, all other measures we have indicate that post-Depression pre Great Recession unemployment peaked during the 1983 recession, under Ronaldus Magnus.

http://data.bls.gov/timeseries/LNU04000000?years_option=all_years&periods_option=specific_periods&periods=Annual+Data

Really, why tell lies that are so easily checked?

@bill: You are the guy who keeps arguing that real inflation is actually much higher than it is reported, especially on basics like food and fuel, right? How the hell someone with that opinion can oppose a minimum wage hike, unless he is a) a sociopath (let the minimum wage workers, who spend much of their income on food and fuel eat less, and possibly make it impossible for them to commute!) or b) someone who is just randomly stringing words along without a modicum of understanding of what they actually mean and how the economy works? Which one is it, bill?

@humanoid.panda: @humanoid.panda: But don’t fret, you are in the same boat with every conservative economist , pundit, and politician that believes that

a) we are experiencing a hidden hyper-inflation

and

b) adjusting wages to compense for that hyper-inflation is communism.

The big difference is that those people are paid good money to lie and obfuscate and sow confusion.

You, on the other hand, is the product of their fine work.

Here the local stations had it this way:”New Jobs Lowest Since 2008″ “April Report Dismal” “Country Sliding Into Recession -Again” . And the local Saturday call in am radio show asked people how they were doing: responses were flat or lower pay, lay offs, higher prices on just about everything, complaints about gas prices, worries about Obama care effects. Many are upset about trade deals moving manufacturing out and costing jobs around here. A home builder said that construction materials have gone up and banks have such strict lending policies for construction (25% down required to get a construction loan – who has that kind of money?) . Around here everyone is just hanging on – barely. People are wanting some changes.

@humanoid.panda: why don’t we just give everyone a million dollars, then we’ll all be rich!? same logic, and it doesn’t work. living within your means is tough, but it’s necessary.

speaking of sociopaths, what kind of person strings along people by throwing table scraps at them – knowing all the while they’ll never get enough? there’s a reason for signs in parks that say “don’t feed the birds/bears/etc.” – they’ll develop a dependency and expect to be fed all the time.

@humanoid.panda:

Labor force participation rose steadily from the 1960’s to the 1990’s as more and more women joined the workforce. About 20 years ago, however, the participation rate for women stopped increasing, and therefore no longer boosted the overall participation rate. Since then the rate for women actually has declined slightly regardless of economic conditions, as yesterday’s old-fashioned housewife has given way to today’s trendy stay at home mom.

Congratulations. You’ve just discovered trickle down economics.

I know a few “stay at home moms” who work from the internet. I have looked into a lot of opportunities to do this type of work and most of what I have looked at were some sort of scams that advertised thousands of dollars a week working at home for a few hours a day. If anyone knows of legitimate work from home sites, please post it.

Actually, many jobs could be done from home, especially in the banking and medical information fields

@Tyrell:

Here you go: https://www.mturk.com/mturk/welcome

Welcome to the future.

@bill: What the hell this drivel even means? If, as you believe, w have hidden hyper-inflation, raising minimum wages is not giving anyone scraps, but a necessary compensation for lost purchasing power, nothing less and nothing more.

@Tyrell: @bill: Well, it seems your local stations are all wrong, no?

@Ron Beasley: Gmunden is near Salzburg, a city named after salt.

Oh I see…so some people are no better than animals? I’m sure that includes all those hogs feeding at the trough such as those who gobble up the farm subsidies or those who suck up all the tax breaks or the defense contractors looking for the next handout, among many others, although I’m sure you weren’t referring to those particular piggies…