Euro Trillion Dollar Bailout: Is Too Much Enough?

After months of dithering on a Greek bailout that no one thinks will work, European leaders — seemingly out of nowhere — agreed to a €750 billion reserve fund to bolster the Euro.

After months of dithering on a Greek bailout that no one thinks will work, European leaders — seemingly out of nowhere — agreed to a €750 billion reserve fund to bolster the Euro.

In my New Atlanticist piece, “Trillion Dollar Bet on the Euro,” I round up the expert commentary and wonder whether this stunning development is a one-off or a signal of major reform to come. My strong inclination is to wager on the latter.

NYU economist Nouriel Roubini, famous for predicting the financial crisis during the fattest days of the bubble, predicts a “double dip” for Europe, telling Spiegel, “The Continent is vulnerable to falling back into recession. Even before the Greek shock, the outlook was rather moderate, but now euro zone growth is closer to zero.”

And FT’s Gideon Rachman is particularly scathing:

Many have come to regard early retirement, free public healthcare and generous unemployment benefits, as fundamental rights. They stopped asking, a long time ago, how these things were paid for. It is this sense of entitlement that makes reform so very difficult. As the British election has just amply illustrated, politicians are extremely reluctant to confront voters with the harsh choices that need to be made.

It’s a good thing that could never happen here in America, what with our Protestant work ethic and pioneer, can-do spirit.

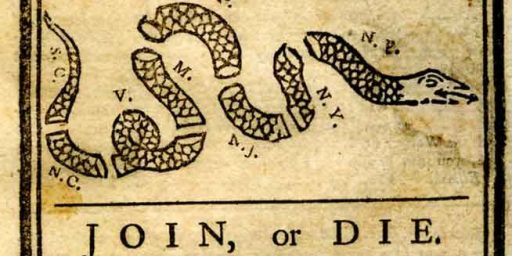

Photo credit: Reuters Pictures.

The PIIGS got into troubl borrowing too much, so the obvious solution is to borrow more? What is this, financial homeopathy?

I agree with Charles but would add we are on the same path. Time for the elected leadership to lead us another direction.

Strange to compare it to “shock and awe” in Iraq, rather than Bernanke’s saga.

Seems to me they took Bernake’s path for largely the same reasons (economic commonalities, political differences) and now they face the same problems unwinding the things.

The world has another trillion moved to government balance sheets. That certainly is not as healthy as a world that didn’t need it, though perhaps not as bad as a world that didn’t get it.

Difficult times. Markets that surge on anticipation of cheap money in the short term and inflation in the long term not withstanding.

(I’ve never been too sure that quantitative easing was the right thing here, seeing Europe have to do it leads me to think it was less avoidable than some suggested.)

There is no light at the end of the tunnel. The borrowing to support current operations indefintely is unsustainable and so far, no one in charge here or in Europe is seriously addressing it.