FEDERAL FUND DISPERSAL

Megan McArdle has an interesting response to Kevin Drum’s observation that the “red” states get back a lot more from the Federal tax system than they put into it and are thus subsidized by the “blue” states.

Kevin is himself a bit tongue-in-cheek, conceding that there are several “red” and “blue” states that don’t match up with this. Megan provides a breakdown showing that the difference goes away when controlling for income; this is largely obvious but usually ignored. She goes on to make two points that are more novel:

In other words, the variance seems to be explained almost entirely by two things that blue staters are heavily in favor of (presumably): progressive taxation, and hog-wild entitlement spending.

<...>

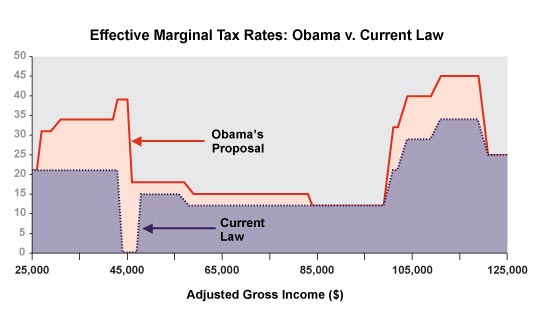

…Californians and New Yorkers with a combined family income of, say, $120K, don’t think of themselves as the rich that they’re trying to tax. And of course, because of the cost of living in those two places, they aren’t rich — they just look that way to the IRS. So when they advocate taxing the rich, they aren’t thinking of themselves, but the guy up the line, maybe the one making $300k — he’s the bastard who deserves to get soaked. Then they’re surprised to find that their red-state neighbors, to whom $120k is wealth beyond dreams of avarice, have managed to put them on the hook as well.

This strange impact of progressive taxation–and, indeed, taxing of income, period–is seldom discussed in popular discussion: The meaning of “poor,” “middle class,” and “rich” not only vary considerably with time but also with geography. So, some poor bastard in Manhattan whose $80,000 income affords him a luxurious one-bedroom efficiency apartment and no car is taxed at a very high rate while someone in Little Rock, whose $35,000 income is sufficient to buy a small house and a new car, is taxed at a lower rate. With some of the Manhattanite’s largess being used to fund subsidies for Little Rock, no less.

Update (2215): The IRS tax brackets for 2003 are here. If my calculations are correct, a single earning $80,000 owes $17,146 in federal income tax whereas a single earning $35,000 owes $5560. Obviously, deductions make the bills smaller. To add to the irony, if the $35,000 fellow in Little Rock has a home, he can deduct the mortgage interest whereas the Manhattanite, who is stuck in the apartment, has to foot the entire–much higher–bill.

It’s true, of course, that most of this is explained by the fact that blue states trend richer and more urban than red states. That’s actually a pretty obvious point.

However, Jane’s suggestion that it’s due to hog wild entitlement spending is rather curious, and not backed up by anything. And her further suggestion that the red states are just innocent recipients of lots of military bases is hysterical. Surely she’s a bit more aware than she lets on of how Congress works?

Regional cost of living adjustments are just a fantasy that hardly seems worth talking about, although I would point out that when we lefties complain about the steady lowering of taxes on the rich, we are generally not talking about folks making $100,000 anyway. We’re talking about millionaires.

A final comment: I can’t prove this, of course, but I wonder if Jane’s commenters really think that it’s just a coincidence that the urban liberal blue states are also the richest, while rural traditionally minded red states are the poorest? I don’t.

Kevin,

There’s no doubt that much of the explanation for the rural areas having the preponderance of military bases is political. Most of it is a matter of inertia, though, as the location of those bases is now decades-old. Also, some of it is a matter of NIMBY, as well: Richer states wouldn’t want the aggravation and downsides of military bases, whereas poorer states are glad for the revenue.

As to, “I wonder if Jane’s commenters really think that it’s just a coincidence that the urban liberal blue states are also the richest, while rural traditionally minded red states are the poorest? I don’t.” I’m not really sure what you’re driving at.

Is it a coincidence that agricultural workers make less than factory workers? No. That people employed in the military or the service sector make less than those employed by major corporations? No.

If your argument is that political mindset explains wealth, I’d certainly disagree–especially since, as Democrats constantly point out, most of the very wealthiest Americans vote Republican. I’d say that the regional variation in politics is explained by natural rural/urban trends that are seen throughout the developed world.

> would point out that when we lefties complain

> about the steady lowering of taxes on the rich,

> we are generally not talking about folks making

> $100,000 anyway

Bullshit. I have never broke 6 figures in my life, but am counted as “rich” by every democrat that has ever held office. In addition, dems constantly try to deny tax decreases for those like me so they can try to soak a few at the top, who have enough money to pay accountants and the like to avoid the new rules anyway.

> Regional cost of living adjustments are just a

> fantasy

Said like a true Californian who has no knowledge of the outside world and has never lived anywhere else.

I moved from Texas to California. Texas house: 4,000 square feet for $172K. California house: 2,000 square feet for $450K (now worth nearly $800K). In order to move me out here, my company had to adjust my salary considerably upward so I could have the SAME standard of living. So I got this big pay raise and got pushed into a higher bracket just for a COLA.

Get out and see the world some more Kevin. You have gotten too sheltered here.

Well, Kevin, as you’ve pointed out time and time again, the majority of the budget is entitlement spending and defense. If California is being seriously shortchanged, then it’s got to be one or the other, hasn’t it? Farm subsidies are of course a boondoggle, but a shocking amount of their largesse goes to good old blue states like New York, Vermont, Wisconsin, Michigan, California and Illinois. Roads are trivial. And everything else is even more trivial.

—