Lady Gaga Stole My Pie

The super rich have a lot larger share of total income than they did a generation ago. Are they taking it from the rest of us?

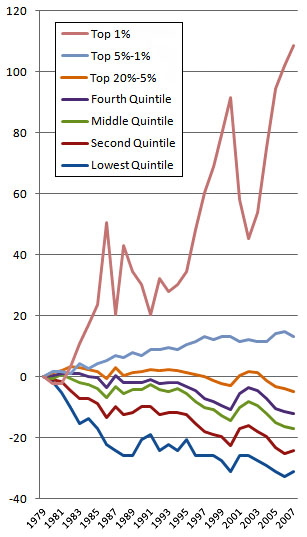

Kevin Drum takes on Will Wilkinson‘s assertions that America’s rising inequality is greatly exaggerated by an over-focus on the top 1% and poor statistical measures that don’t account for the lowered cost of goods. While granting that there “are bits and pieces of truth” to this, Drum counters “there’s still the raw fact that the flow of money in America has changed dramatically over the past few decades,” a point he illustrates, naturally, with a chart:

He concludes:

If you look at the raw CBO figures, they show that a full tenth of the national income has shifted since 1979 to the top 1% of the country. The bottom quintiles have each given up a bit more than two percentage points each, and that adds up to 10% of all earnings. That 10% has flowed almost entirely to very tippy top of the income ladder.

Is the middle class worse off because of this? Of course they are. Income matters even if plasma TVs are cheaper than they used to be or if CPI mismeasures middle class consumption or if average households now contain 2.6 members instead of 2.7. If this massive income shift hadn’t happened, middle class earnings would be higher, they’d be able to buy more stuff, and they probably wouldn’t be in debt as much. And the top 1% wouldn’t have quite so much idle cash lying around to do stupid things with.

This income shift is real. We can debate its effects all day long, but it’s real. The super rich have a much bigger piece of the pie than they used to, and that means a smaller piece of the pie for all the rest of us. You can decide for yourself if you think this is something we should just shrug our shoulders and accept.

But this seems to ignore the fact that the pie is a hell of a lot bigger than it was in 1979 and assume that those in the top 1% had nothing to do with that fact. (Full disclosure: I’m not in the top 1% and had very little to do with growing the pie.) Not to mention that these graphs trick the reader into thinking these income groups are static, consisting of the same people over the course of the movement.

Is it really true that Bill Gates, Warren Buffett, LeBron James, and Lady Gaga are taking some of my pie? Because, damn it, I like pie. And I’m not sure what it is that Lady Gaga does, so I’m really annoyed if she’s getting some of my pie. Yet, I haven’t noticed any of my pie missing and can’t offhand figure out how they’d have gotten into my kitchen.

Granted, Gates charges a lot for his software, even though it’s sometimes buggy. And I’ve bought quite a bit of it over the years. But no one held a gun to my head. And, I’m not sure how we’d have gone about lowering his margins so that I could have more pie.

Is the cost of stock going up because of Buffett’s big buys? Otherwise, Jimmy Buffett has more of my pie than Warren does. And Jimmy’s welcome to come over for pie any time.

Presumably, James’ high salary and endorsement compensation are somehow being passed on to us in the cost of the products we buy. But, since we’re apparently willing to pay those prices, wouldn’t somebody else be getting the excess profits?

And I haven’t bought a record album in quite some time (which you might have guessed by my calling them “record albums”) and sure as hell haven’t bought any of Ms. Germanotta’s stuff. If it were being played on the radio, I wouldn’t recognize it. So, I’m pretty sure her success hasn’t come at the cost of my pie.

Now, of course, we could go back to the days of 90% top marginal rates–or, more realistically, 39% top marginal rates–and take some of their pie and pass it around a bit. But, even if I were on board with doing that, I’m pretty sure that I wouldn’t get any of it. There might nonetheless be good reasons for doing that. But they don’t have anything to do with my pie.

Two things. First, we should always focus on net worth, not income. Income is noisy, and only important in so far as it secures our financial position. No one wants to live paycheck to paycheck.

Second, I don’t really see the logical construction of your counter-argument trumping the facts. We can construct what-ifs, for theoretical economies, even as net worth falls:

http://money.usnews.com/money/blogs/flowchart/2010/09/17/how-consumers-lost-a-fast-15-trillion.html

And poverty rises:

http://www.pbs.org/newshour/bb/business/july-dec10/economy_09-16.html

Apparently the what-ifs can’t quite fill the checkbook?

BTW, I think this is also an important part of the picture:

http://www.zerohedge.com/article/debunking-great-myth-us-consumer-deleveraging-or-why-us-economy-will-end-not-whimper-bang

Well said, Mr. Joyner. And with a bit of uncharacteristic humor as well. You’re getting better with age.

It was pleasant enough fiddling, Patrick. Too bad about the Rome burning part.

Ah, going for the hits with that title, I see. That should catch Google’s attention. I’ve posted several times on this subject albeit without your flair for catchy titles.

The increase in income inequality is beyond doubt, however reckoned. The open questions are

1) are the income increases of the top .1% coming at the expense of the lower 99.9%?

2) what are the causes of the tremendous growth in income of the top 1%?

3) is the increase in inequality a bad thing?

4) will the measures proposed for remediation actually have that effect?

5) will the adverse secondary effects of actions intended to remediate outweigh their benefits?

Since my ideal society is something resembling a 21st century equivalent of Jefferson’s yeoman farmers, I would answer “Yes” to #3. James has provided a bit of an argument for why the answer to #1 may be “No”.

I do think that policy is a major cause of the increase in inequality. For instance, the examples given by James (Bill Gates, Warren Buffett, LeBron James, and Lady Gaga) are all beneficiaries of government policies restricting the free flow of information. Maybe not Warren Buffett but definitely the rest.

Additionally, many of those in the lowest two income quintiles have lost ground or stalled due to other policies including immigration and trade policies.

I’m wary, however, of the focus on the top .1% of income earners. The next 4.9 percent (the top .9-5% of income earners) have seen income growth equal in dollars to the top .1%. That group includes hundreds of thousands of doctors of medicine (much of whose income is derived from tax dollars), thousands or tens of thousands of public officials (whose incomes are completely derived from tax dollars), tens of thousands of lawyers and dentists (protected or subsidized by the government), and so on.

IMO the large incomes of that next tier of high income earners is no less damaging than the very large incomes of the ultra-rich and a very large proportion of their income is the consequence of policy.

I had in mind a proposition for someone like Will Wilkinson. He probably wouldn’t like it, but it would be this: In the short term globalization implies a lot of poor people.

Low transportation costs and increased connectivity allow the talented people(*) to leverage across many consumers, but the flip side is that average workers become more average in a global sense. The global average is pretty poor.

Dave’s right that IP plays a role in this new world, and as I’ve said, our government knows it. Increasing IP protections are at the top of the trade agenda.

So I don’t really like James’ argument that “if I can’t see it, it can’t be real.” To me there is a framework that explains both ends of the widening income distribution. We have global superstars, and global workers.

* – my main exposure to Lady Gaga is via Saturday Night Live, but I liked her there

The problem, James, is not so much that the Lady Gagas and such are getting more of the pie, but that they’re keeping that pie. In generations past, the wealthiest 1% were still putting that pie (I suppose this is where the pie analogy falls down) back into the economy – starting business, building plants, creating jobs, and paying decent living wages to other people. That isn’t happening now, and its pissing a lot of pie-less people off.

BTW, to me the simplest argument for higher taxes on the rich is that “somebody’s got to pay for it.”

It’s really sad how many times a talking head on TV or a voice on the radio will say “it’s our money, a tax cut isn’t coming from the government.” Buddy, new words for you: Federal Debt.

First off you are committing the common mistake of lumping all the 1% together. Bill Gates marketed a product that permitted others to increase their part of the pie;Warren Buffet is not a stock speculator but brings management discipline to the companies he invests in thus cleaning up the disasters of Ivy league MBAs, making the products better and cheaper for the rest of us; Labron James and Lady Gaga are eye candy that offer people a brief respite from the dreary lives, in essence they are visual crack, offering little value other than something to talk about.

So Gates and Buffet increase the pie for everyone. James and Germanotta do increase their pie by taking a tiny bite of millions of other pies. So theoretically you could justify high taxes on the sports and entertainment types but it would be best to leave the productive types with a relatively low tax. But in reality it isn’t a pie but a stream.

I the stream analogy everyone ends up with more water to irrigate their lives. Buffet has a larger pool at his end because he works to improve the watershed leading the less rain running off into waste. Gates pool is larger because he takes others ideas, packages them and provide them to everyone to improve their irrigation. LeBron James and Lady Gaga’s pools are larger because people like to watch them splash around. But on down the watercourse, most have been getting more water due to the productive works of people like Buffet and Gates. So much so that they have time and resources to allocate some water so they can watch James and Germanotta play around in big pools.

As I see it the problem with that proposition is that globalization hasn’t resulted in poor people getting poorer. It has resulted in the very richest getting a lot richer and the very poorest getting a lot richer. Chinese farmers, a big chunk of those making less than $1 a day, haven’t been flocking to China’s factories because they’re fun. They work in China’s factories because they make a lot more money there than they could otherwise.

With the exception of the very lowest income earners in the United States, people who live on Indian reservations, rural black farmers in the Deep South, and so on, even the poor in the United States aren’t poor by any sort of objective standard. They’re only poor in relation to the rich.

That’s not really contrary to my proposition. The reason I put “short term” in there was that over time the global definition of poor will improve. It is already happening in places like China, relative to the old definition of poor in China.

But unfortunately, our poor is being dragged to their poor. There will be a dip in the graph until, we hope, global poor will reach the wealth of American poor circa 1980.

I guess it should have been “our definition of poor is” or “our poor are”.

News this week was that US poverty levels are at a 50 year high. I’d love to think that’s just because poverty levels are wrong, but I worry that they are not.

“Not to mention that these graphs trick the reader into thinking these income groups are static, consisting of the same people over the course of the movement.”

We do have less income mobility that most other OECD countries, so this is not a trick of the graph, even if you are technically correct.

Yes, the pie is growing higher, but the very large majority of that is going to the top 1%. Now, if that growth came from creating new products, jobs or services I would have no problem with it. If there was no rent seeking involved, ok. If they also risked losing money instead of having taxpayers bail them out, fine. If they were not using that extreme wealth to influence the political process so that they made money at the expense of others, that would be great. Lastly, if you are comfortable with our country’s economy and government being run by a few ultra-wealth folks, then inequality is great.

Look at it this way. With a net worth of 5-10 million dollars, you can go talk with your congressman almost anytime you want. With a net worth of 100 million dollars you can go talk with your senator anytime you want. Get up in the billions and they ask you to come talk with them.

1) Sometimes

2)Too long to answer. But, you should also ask if it benefits us in any way? Are our companies being run better, does our economy flourish because of the inequality? Answer that question with a long time horizon POV.

3)Yes.

4)Who knows. At some point the wealthy are rich enough and well connected enough to avoid any attempts at remediation.

5)See Goolsbee, Austan.

Steve

To put it forcefully, there was a time when transportation consts and tariff barriers protected the poor in western market democracies. We’ve traded that for the ability of Bill Gate to sell Windows in China.

JKB:

I have to take issue with your casual denigration of Gaga et al as providing nothing of value.

The arts are one of the relatively few things that Americans do better than anyone. Music, movies, TV, books, games, plays — we basically own the worldwide market. No music no iPod. No books no Amazon. No theater, no hotels or restaurants in the theater districts of New York or Chicago. No TV shows, no widescreens, fewer iPads.

I don’t know how many people Gaga directly or indirectly employs but it is surely in the hundreds and more likely in the thousands. I write kid’s books and in the average year I probably keep something like 50 to 100 people — editors, printers, shippers, store clerks and so on — employed by tapping keys on my laptop.

Take Hollywood, publishing, the music/performance business, the theater, gaming, etc… and you have a very productive, very successful, largely American industry without which computers would still be ugly putty-colored boxes owned only by geeks.

Historically speaking, gaming did not grow from traditional publishing. Geeks wrote games until they grew to support broader creative classes.

http://en.wikipedia.org/wiki/Nolan_Bushnell

Just to see what a hard time the rich are having, please see DeLong’s post in response to Henderson.

http://delong.typepad.com/sdj/2010/09/in-which-mr-deling-responds-to-someone-who-might-be-professor-todd-henderson.html

Steve

A large majority of Americans favor raising taxes on the rich.

Can the rich bribe enough politicians to thwart the will of the people…yet again?

“But this seems to ignore the fact that the pie is a hell of a lot bigger than it was in 1979 and assume that those in the top 1% had nothing to do with that fact. (Full disclosure: I’m not in the top 1% and had very little to do with growing the pie.) Not to mention that these graphs trick the reader into thinking these income groups are static, consisting of the same people over the course of the movement.”

The pie is also bigger than it was in 1890, what the hell has this got to do with income distribution in the US over the past 50 years. Apart from your cockamamie grasp of economics Jim you also seem unaware that these income groups are in fact largely static and have become increasingly so over the last thirty years. Social mobility in the US is behind that of France! In fact Jim this whole Lady Gaga nonsense is a total distraction which is why I Assuyou hung your rather threadbare arguments on her curvy frame. High earning entertainers have always been with us (how many times the median income do you think Gary Cooper earned?) but they are tiny minority of the top 1% of income earners. The fact is the richest 1% have been gathering an increasing share of the national income while the bottom 90% have been static or shrinking. You seem to think this is desirable so how much of the national income would you like them to have 30% 40%? No one is suggesting going back to 90% top marginal rates so that just another red herring. I take you do know what the effective rate of tax paid by the top 1% is? Well it’s around 16% and hence led to Warren Buffett’s famous comment that his secretary was paying more tax than he was.

Michael Reynolds

My point in that comment was that if we were to tax Lady Gaga or Lebron James at a level where they kept very little of their earnings over a certain amount, they like many might simply take the rest of the year off instead of performing or playing. Or suppose you chose not write another book for the year. But on the whole there would be little loss to society as someone else would perform or play in their place. Or write book. In effect, we’d be sharing the wealth in these instances. It is not the same if we tax Bill Gates or Warren Buffet to the point they take a long vacation as there is no one offer the same service, at least no one being prevented because they are working and just awaiting a big break when the headliner can’t perform. In Gates and Buffet’s case, society is all the poorer if we discourage their work by over-taxation.

In Lady Gaga or Lebron James’ case, the people who derive employment from their performances would still work support a different performer. But if Apple’s development of the next big thing is delayed because of over taxation of Steve Jobs or their key developer, those who derive employment from manufacturing to sales have a recession or if they lose their job, a depression.

“With the exception of the very lowest income earners in the United States, people who live on Indian reservations, rural black farmers in the Deep South, and so on, even the poor in the United States aren’t poor by any sort of objective standard. They’re only poor in relation to the rich.”

Rich, poor….these terms have no meaning in isolation, only in relation to each other. Compared to a Chinese factory worker, I’m rich. Compared to Mark Cuban, I’m poor. That doesn’t make me Schrodinger’s cat. It just means that the comparison is relevant.

In the original article James argues that, from his reasoning, the pie should be getting bigger.

Pesky facts: “More Americans are poor than ever before, census finds”

Read more: http://www.mcclatchydc.com/2010/09/16/100679/recession-sent-millions-into-poverty.html#ixzz104Z3gKoC

But this is the stupidist kind of statistical analysis known to mankind. We’re in the midst of the biggest recession in decades. Our population is larger than ever before and includes a large number of very poor immigrants, legal and otherwise. It’s hardly a shocker that we have more poor people than ever.

There’s no doubt that the pie has generally been getting bigger. But the last two years haven’t been good.

James, back up. It would have been different if you would have written your original piece acknowledging the increasing poverty, and then said “let’s divide the causes.”

You didn’t do that, right? You argued for bigger pie, and only now say that well I assert these causes … “hardly a shocker.”

If you ask me it leaves a loose argument in your wake. You want us to accept both things. The pie is bigger for … those of us who are not “poor immigrants, legal and otherwise?” Got numbers on that?

(You are arguing like one of your curmudgeonly commenters … from your closely held world-view rather than from measured facts.)

Here is a story about poverty NOT being concentrated among the brown immigrants:

“For the Unemployed Over 50, Fears of Never Working Again”

http://www.nytimes.com/2010/09/20/business/economy/20older.html

The piece argues a very narrow point: that the huge wealth at the upper reaches of the top percentile isn’t coming at my expense. It’s not an attempt at a unified field theory of economics.

As it happens, I think that’s poorly argued as well. What what do you consider your primary occupation these days? Writer?

Has the flattening created a higher average return for writers, or is it an example of the “superstar and also-rans” scenario?

Now its pie?… I’m still trying to figure out who took my cheese.

Completely different market now. Barriers to entry have lowered, allowing many of us to compete in the marketplace that were previously shut out. Most presumably are making very little, given the increased supply.

Right, James. That is my scenario:

You are doing exactly the right thing, using the new tools to establish yourself as a global player and a global brand.

At the same time we suspect that paid journalism has been contracting in general, as a percentage of the workforce, as newspapers and magazines fold, and more people look to less localized sources … such as OTB.

True. But that’s the general nature of the evolution of economies over time, right? We went from family farming constituting some vast percentage of the overall work force to a handful of agribusiness firms, employing a tiny percentage of the work force, vastly out-producing the old model. And the others moved on.

What worries me is that the direction of the economy has been towards one that rewards higher intelligence and skill levels. A great thing in theory but I haven’t the foggiest what to do as people simply can’t compete in that environment. And that’s to say nothing of the 50-somethings who were smart and educated but got outmoded.

But, again, that’s a different set of issues than the idea that the people at the top are depriving me of pie.

It is the same issue, we’ve just established that you are the depriver, and not the deprivee 😉

You’d look at it differently if you were a 50-something laid off journalist without a revenue stream in the new world.

Why not consumption, that is more of measure of welfare and is probably even less noisy than net wealth.

I guess I dislike consumption because it becomes a vice sooner than worth. Scrooge McDuck not withstanding.

BTW, above I quote an article:

That would seem to capture the risk in consumption as a measure of progress.

Well, we are all very grateful that we have you to choose the concerts we see and the books we read. I wanted to see Lady Gaga, but she hit her quota, so I guess I’ll go see Lady Gagga, the Lady Gaga impersonator, instead.

Listen up, jerk. Why don’t you stop worrying about “loss to society” and mind your own d***ed business.

Are they taking that wealth from the rest of us.. in some cases, yes. A given company makes a certain amount of money. They spend some on salary, some on investment, and some on rewarding investors. In the old days, unions forced companies to distribute more of their income to workers. Now that unions have little to no influence, workers are paid increasely less, executives increasely more, and investors were (prior to the recession) raking it in. So, if you view money as a stream, which another commentor did, the wealthy are damming the stream so that less and less flows down. Those folks justify their behavior by saying that these people drive the economy and wouldn’t work as hard if they made less. That argument is belied by plenty of historical evidence.

Keynesian Economics, 3% population growth, 3% inflation, stimulate from surplus.

Population Gov. Jane Doe, Inaflation Gov., Federal reserve, Stimulate Gov. National Debt

Gov. City workers 300,000 early out 50yrs of age, 90% of Salaries. Gov. Property Evaluation

from $13,000 sold 40yrs later for $150,000 not a free lunch cost 2.75 times that for replacement. (1380 sqft to 2600sqft)

Anyone notice a trend

James flat lands of Texas