Lying With Statistics

Are people fleeing blue states to avoid repressive taxes? It depends who you're asking.

In our discussion about the challenges of collecting taxes from the ultra-wealthy, a conservative commenter remarked, “People aren’t leaving CA, NY, NJ, IL – blue states all – for no reason.” The point

I’m amenable to the larger argument but the specific factoid adduced there simply isn’t right. First, while the populations of New York and Illinois are indeed declining, it’s growing in California and New Jersey. Second, there’s no large trend of people leaving blue states.

But, doing a quick Google search to gather evidence, one could see why one could believe otherwise. This January 2018 report from Fox Business was typical:

“US populations growing faster in lower-tax states”

The states where populations have grown the fastest over the past year include a handful with either

low, or no, state income taxes.

According to data from the U.S. Census Bureau., in the year ending in July, states with no income taxes – like Florida, Nevadaand Washington – saw among the largest jumps in population growth.

The two states that saw the fastest rates of population growth were Nevada and Idaho – at 2.1 percent apiece. Nevada charges no statewide income tax.Utah, which has a flat-rate 4.95 percent income tax., saw the third-largest population growth during the same time period – at 1.9 percent – followed by Arizona, where rates range from 2.59 percent to 4.54 percent. Utah was also listed by the Tax Foundation as one of the states where middle-class Americans will see the biggest savings. from the new tax law.

For reference, the top income tax rate in California is more than 13 percent.In Florida and Washington – where residents don’t pay any income taxes. – populations grew by 1.5 percent each.

Florida also gained the most residents out of any state from net domestic migration. Since 2010, more than 1.16 million people have relocated to the state.Additionally, Nevada, Arizona, Texas, Washington, Utah, Florida

and Colorado were among the states with the fastest job growth over the past year, as reported by The Wall Street Journal. Half of those states do not charge residents any income taxes.

That’s a strong argument, based on information from the most credible source possible on this issue, Census Bureau.

And yet.

Following

The U.S. population grew by 0.6 percent and Nevada and Idaho were the nation’s fastest-growing states between July 1, 2017, and July 1, 2018. Both states’ populations increased by about 2.1 percent in the last year alone. Following Nevada and Idaho for the largest percentage increases in population were Utah (1.9 percent), Arizona (1.7 percent), and Florida and Washington (1.5 percent each).

So far, so good for Fox Business. The very first paragraph confirms that some of the fastest-growing states are low- and no-state income tax states.

Washington, D.C., reached a population of 702,455 in July 2018, surpassing 700,000 for the first time since 1975, according to the U.S. Census Bureau’s national and state population estimates released today. The change is due primarily to an influx of people from other parts of the country that began early in the decade. While the increase has begun to slow, the District of Columbia still grew by almost 1 percent last year.

Hey, now. Wait just a cotton pickin’ minute. How can DC—the bluest state-like entity in the country and with high taxes—be growing?

Population declines were also common, with losses occurring in nine states and Puerto Rico. The nine states that lost population last year were New York (down 48,510), Illinois (45,116), West Virginia (11,216), Louisiana (10,840), Hawaii (3,712), Mississippi (3,133), Alaska (2,348), Connecticut (1,215) and Wyoming (1,197).

So, only nine states lost population and, sure enough, high-tax New York and Illinois are leading the pack. And Hawaii is known as a high cost-of-living state, too. But what are West Virginia, Louisiana, Mississippi, Alaska, and Wyoming doing there? They’re among the reddest of the red states. Why, Alaska actually pays you to live there; they’re the opposite of high-tax.

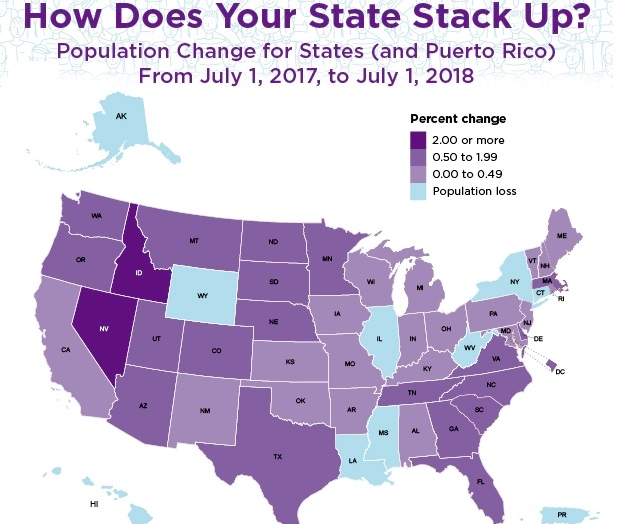

Nosing around the site, I oddly couldn’t find summary tables that had the precise data for each state. But I did find this chart:

I’m seeing no obvious patterns here. Some blue states are gaining population rapidly; others are losing it rapidly or staying about the same. Ditto with the red states. (Our standard “red” and “blue” terminology is odd when referring to a chart that’s mostly shades of purple but ¯_(ツ)_/¯ )

Now, a related argument being bandied around is that, while the overall population of California is growing, that’s a function of immigration and birth rates. The real evidence that taxes and regulatory burdens

A February 2018 report from the nonpartisan Legislative Analyst’s Office found,

For many years, more people have been leaving California for other states

than have been moving here. According to data from the American Community Survey, from 2007 to 2016, about 5 million people moved to California from other states, while about 6 million left California. On net, the state lost 1 million residents to domestic migration—about 2.5 percent of its total population. These population losses are low in historical terms. The graph below shows data from the Internal Revenue Service on the movement of income tax filers in and out of California since 1990. (Data on tax filers does not cover the entire population because some people do not earn enough income to necessitate filing taxes.) As the graph shows, net out-migration from 1990 to 2006 was, on average, more than double whatis was in the most recent ten years.Although California generally has been losing residents to the rest of the country, movement between California and some states deviates from this pattern. The figure below shows net migration between California and individual states between 2007 and 2016. California gained, on

net , residents from about one-third of states, led by New York, Illinois, and New Jersey. On the flip side, top destinations for those leaving California were Texas, Arizona, Nevada, and Oregon.

While hardly dispositive, it’s certainly interesting that people moving to California are doing it from other high-tax states, including two from the list that started our discussion, and that people are leaving California for a couple of low-tax states (although also a couple of high-tax states).

But there’s a kicker!

Although California has had net out-migration among most demographic groups, it has gained among those with higher incomes ($110,000 per year or more) and higher levels of education (graduate degrees).

Brian Uhler and Justin Garosi, “California Losing Residents Via Domestic Migration”

One would think those would be precisely the sort of people who would be fleeing California to avoid paying high taxes.

The bottom line is that there’s no evidence of an overall trend of people leaving high-tax blue states for low-tax red ones. Which makes sense: high taxes mostly impact high earners and most high-earners have to live in a handful of pricey urban centers because that’s where the jobs are. There simply isn’t a Wall Street or Silicon Valley equivalent in Texas or Florida.

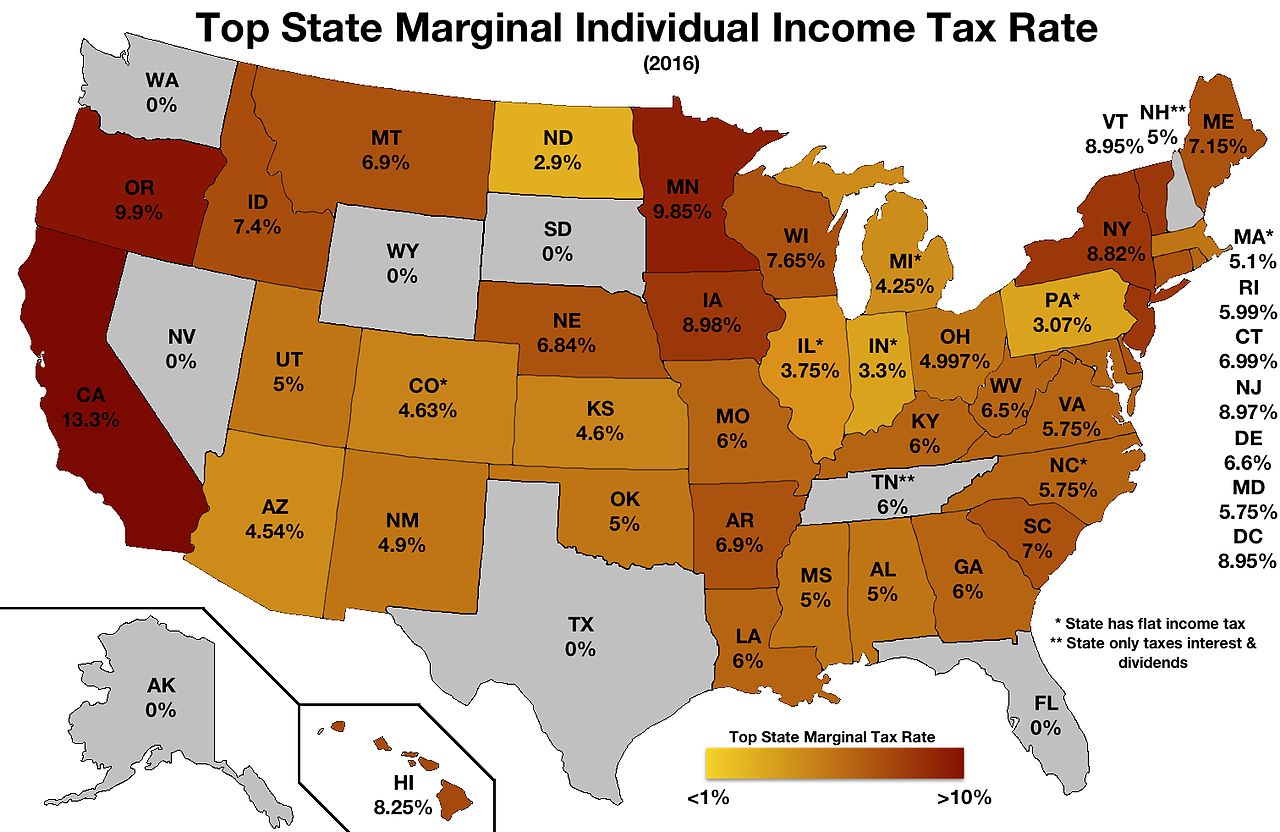

UPDATE: There’s a lot of discussion about state income tax rates in the comments below. This map from Wikipedia is current as of 2016 is a rough guide.

One other point to consider:

Correct, but looking at total head count is a little misleading…

In 2017, NY State’s population was 19,590,719 (according the the census site). So that 48,510 who left represented a whopping 0.25% of the total state population. It’s a net loss without a doubt, but not some type of mass exodus.

In fact, when controlled for population, West Virginia, Louisiana, Mississippi, Alaska, and Wyoming all lost a greater percentage of their overall population than any of the blue states listed above.

@mattbernius:

Yes, very good point. It’s odd to issue a press release and not link to the actual report but that’s what they did. The above map was linked but no state-by-state statistics.

looking at the state level only can also be misleading. I saw a story last week that said that the urban counties within states are gaining population and the rural counties are losing it, so there’s that, too.

After retiring I recently moved from OH to FL. Weather, beaches, and family. Taxes had nothing to do with it and the state of governance was a strong negative. Air conditioning made TX and FL popular, not RW politics.

You get what you pay for.

I live in, and pay high income taxes in, California because of… California. I enjoy 300+ days of sun a year. I enjoy being able to rollerblade in January. I enjoy being able to go to the beach in February. I enjoy golfing year around. I like being 2 hours from either Santa Barbara or San Diego. I like being 90 minutes from Palm Springs.

While alot of geniuses who don’t like California complain about high income taxes, they conveniently ignore Prop. 13 and our ridiculously low property taxes. My mother lives in a $1M house in Highland Park. It’s a piece of crap house, but in a great neighborhood. Her property taxes are $283 per year, because she bought the house in 1970 and has never sold or refinanced it.

I live in a $700K house that I purchased in 2013. My property taxes are less than $6K per year.

My sister in law lives in the low-tax state of Texas, city of McKinney. Her property taxes are over $21K per year, on a house worth less than half of mine.

Low tax, my ass.

Washington is a conservative bastion, with low taxes and regulation, since when? The last Republican to win the Presidential race was Reagan in 1984. (Yes, I know the rural areas are crazy conservative.)

And whether a state has an income tax or not is an absurd metric. The proper metric to use would be some measure of total tax and governmental fee liability as percentage of income. If Florida charges you $20 every month as a tax on your cell-phone service does that make up for not paying an income tax?

@EddieInCA: Oh man moving from Illinois to Texas was quite the eye opener for me. I went from paying a minuscule amount of income state tax to paying no state income tax which was great. The not great part is that in Texas EVERYTHING else is taxed multiple times over and or stacked with fees. The state of Texas WILL get their money and the overall cost of the extra fees and taxes certainly outweigh the income tax I paid in Illinois… I’ve done the math multiple times just to check. Cause I have family in Illinois whining about tax rates that I have to respond to…

@Timothy Watson:

2 years ago I moved from Florida to Washington in large part to get away from shitty ignorant Fox Geezers here and around better people there. And I got paid about 20% more for doing exactly the same job. (Unfortunately family and business reasons required me to move back here a short while later but it was really nice out there.)

Oh and one of the things about Florida being a low-tax state is it’s an extremely low benefit state. You basically can’t qualify for any assistance under almost any circumstances, and the incredibly underfunded schools here are among the worst in the country.

I like to think the California and New York are sending out colonists into the rest of the country.

I don’t know how significant this is, but here’s an anecdote from a lifelong friend I just had lunch with. He has lived his whole life in the Chicago area and raised 3 kids there. He probably makes has a mid six figure income. He travels a lot for his work (140 days a year) and now that his kids live in three different states he and his wife visit them a fair amount. He realized that if he was out of Illinois. 180+ days a year he could transfer his residency to a low tax state. His company has an office in a Texas city so he “moved” there a couple of years ago, although he’s probably in that condo less than 90 days a year.

Austin touts itself as the Texas version of Silicon Valley. While far from identical, the idea has merit. When you add in the claim of being the Live Music Captial of the World, Austin can be pretty attractive to Californians.

Then again, many of us who live close by Austin transform “Keep Austin Weird” into “Keep Austin, Weirdos.” Californians can only enhance that even more.

@gVOR08: My guess is that most of the commentators in OTB are not concerned about post-retirement finances, at least in terms of day-to-day living. That is not true for the country at large. About 40% of the population 55+ who have not retired has less than $100k in savings. These are people who are banking on living on their social security, so they have to be considering relative cost of living. My wife and I will live where we want in retirement, and not worry about tax rates. For us, FL is looking pretty good because we both hate cold weather.

I do have increasingly less sympathy for middle class people who can’t manage to save any money. Granted there is a segment who are in that state primarily due to health issues, but a lot just live beyond their means for their whole life. I know so many people who eat out four or five times a week who seem to not be able to make the connection that there is a reason they can’t save any money.

Most of the people that I’ve spoken with who have left Cali, did so because of property values. They either couldn’t afford to buy a house and rent was a stupid figure, or the cashed in on the house they bought 20+ years ago. And second gVOR08 point on moving to warm weather.

Loss of population only tells part of Illinois’s story. Illinois doesn’t have enough total inmigration to make up for the total outmigration and on average those leaving are wealthier than those staying. Living in Illinois is basically a business decision. It doesn’t have mountains or oceans or a benign climate going for it. When asked why they’re leaving the answer many give is “taxes”—not just today’s taxes but the prospect of higher taxes tomorrow as well. It’s not a closely-held secret.

Where I live in Chicago we’re paying sharply higher taxes for services that are deteriorating. My property taxes are ten times what they were when I moved in but the value of my house has only increased four-fold.

I think that the obvious government corruption is a factor, too. People are losing hope.

@Dave Schuler:

Those of us from Illinois would like to sharply distinguish between Chicagoland, a major city on the Great Lakes, and Illinois, a midwestern state south of Chicagoland. Culturally, Illinois stops somewhere around Kankakee as you head north on I-57, or around Lasalle if you’re going east on I-80.

@DrDaveT:

80% of Illinois counties lost population in 2017. It isn’t just Chicagoland that has a problem.

What @EddieInCa said. I am one of a very small slice of the population that is able to just get up and relocate to anywhere I can plug my laptop. I’m also self-employed, so my taxes don’t just disappear from my paycheck, I sit down and write checks. Painful checks.

But when it came right down to it, it was worth paying the 13% top rate for. . . California. There’s a reason property costs are batshit. If working people, middle-class people leave CA it’s not about taxes, it’s about real estate. If rich people leave CA it’s so they can spend 6 months plus a day in NV or FL and still live half the year in CA.

@SenyorDave:

Americans as a whole are somewhat unprepared for retirement. I have no plans to retire, but know that I might get “aged out” of my business eventually, so I’m making plans as if I will have to retire. For me the answer was/is Mexico or Ecuador (or both). I want to live nicely, but inexpensively. I have no desire to live in Alabama or Mississippi, where I could live like a king for $4000 per month. For that same $4000 per month, I can live ocean front in Ecuador, or in San Miguel deAllende, where I recently bought a two bedroom house in Colonia Guadalupe. It’s purely a rental now, but it’s there if and when I decide to use it.

With technology now (Satellite TV, Satellite Radio, Internet, International Airlines), it’s a much smaller world than it used to be. One doesn’t have to retire in the USA. There are alot of cheap countries with alot to offer Americans.

New Hampshire has no state income tax AND no sales tax, and our current unemployment rate is hovering just below 3%, so why aren’t we booming?

Property taxes are high, snow & cold, and unless you are into the great outdoors, culture (museums, restaurants, etc.) are a bit of travel. (I personally don’t mind this and find plenty of good restaurants and fun things to do, but a young, hip scene we are not.)

I wilt in the heat, so I’m happy here, but we have a fair number of friends who are looking south for when they retire–almost all of it is weather-related, not taxes, for them.

I’m not here to say that CA is a low tax state – the state income tax speaks to that.

But, I know that in many other so-called ‘low tax’ states, property taxes as a percent of assessed valuation is at a rate much higher than in CA. Prop 13 limits the property tax rate to 1% of assessed value, and is established at date of purchase. Purchase a home for $700,000, your tax will be $7,000 + other taxes approved by the voters, say another $1,000, or $8,000 total. In other states the property tax can be 2% to 3%, that $300,000 home could have $6,000 to $9,000 in property taxes.

I suspect the influx of population for some states may actually be problematic. Or rather of the three main types of population growth, two may be problematic. The first is uneducated immigrants. Overall, immigrants and most especially, immigrant’s children, boost the national value. But when they first arrive, no matter how hard working and ambitious they are they just don’t contribute that much to the economy of a state. And their children, who are supercharged when it comes to starting businesses or becoming well educated high earning taxpayers, tend to move away from the states that view their ethnic background in a Trumpian fashion. So although I have no real evidence, I can easily believe that a racist agricultural state like Mississipi gets the hardworking but low taxes of the initial immigrant and New York, Oregon and California gets their ambitious, high income and tax paying children.

The second type is even more problematic. Retirees flee the high tax states and end up in Florida, Arizona, etc. My niece lives in Sedona and worries constantly about the influx of retirees. When they where in their original states they fought for good schools and well maintained roads and clean water and air. But once they move for their retirement they vote against everything that might cost them money. They don’t really care about the state they moved to and have a very short term view of what the city/county/state should spend money on. Senior centers and curbside van service to bring the elderly to the shopping malls? Hell yes! A new computer lab for the high school? Bitter, angry kvetching.

I came here to say what Eddie and Michael already said. It isn’t the taxes that are driving people away in CA, it’s the property values. What brings people TO California isn’t just the high-paying jobs, it’s also the opportunity to work in world class industries – tech, aerospace, and entertainment, to name a few. If you work in finance, then New York City (or maybe London) is the big leagues. If you’re in tech, it’s Silicon Valley. If you’re in movies, then it’s Hollywood.

As for aerospace – well, the man who was my neighbor when I first moved here has his name engraved on a plaque sitting on the moon, because he helped build the LEM. It’s as much about the impact as it’s about the money.

@SenyorDave: Haven’t been here in FL through an August yet. Got here full time last Sept and it’s been really nice. Haven’t shoveled snow even once. We’re off I75 a little south of Sarasota. If you want to get in touch I think James can give you my emai.

Well that was me, James. CAs population remains stable only due to immigration, and its huge income inequality where some can afford the Malibu’s of the world.

You need to get out more. I have two homes, one in Naples, FL and one in Asheville, NC. It is a torrent of refugees from IL, MA, NY, NJ, Etc. A torrent. Come on down, I’ll buy you dinner and we can talk to some realtors. The joke is will the last IL person turn out the lights. Meet my neighbors. This isn’t even debatable. Look at the license plates. Talk to the people who voted with their feet. And the number one issue is taxes: income and property. It used to be the weather. Now, younger and younger people who can work from anywhere are moving. The only people who stay anymore have deep family reasons and just decide to get hosed.

I can’t imagine it isn’t the same in AZ and NV from CA.

@Guarneri:

Which appears to make you an expert on what’s going on in CA. In your own mind.

It’s not just you. Lots of people out there are absolutely certain that CA is a hellhole and they know the reason why. And they love to say “taxes!”. It would be funny if it weren’t a cliche.

One more question: If it’s so terrible, why are all those immigrants coming here? I mean, they must be complete inhuman beasts to like it here, right?

As it turns out, lots of countries with low net immigration are facing a demographic crisis, where they will soon not have enough prime-age workers to take care of all the old people in the manner to which they have been accustomed. It’s a problem here in the US, but far less of one because of, yes, you guessed it, immigration. Those people get jobs, are productive, and buy stuff. They prosper. They contribute. As do lots of people here, regardless of creed or color.

@mattbernius: Well yes, but that really makes sense overall. If any of those

fouroops 5 states were individual countries (and particularly if they were in Latin American or Africa) Trump and his band of merry pranksters would be identifying them as “sh!thole countries.”Certainly that idea has been used to explain why states near California (like Nevada and Colorado) are becoming more liberal…

@Guarneri:

The income tax in NC is higher than in IL. In Florida it’s zero. So you’re spending six months plus in FL and free-loading on NC taxpayers?

Oh, and again: your plausible, innocent explanation for why Trump refuses to have any other American in the room when he talks to Putin and Putin’s translator and advisors?

@Michael Reynolds:

This strikes me as a true statement.

This much is certain: claims that taxes drive internal migration in the US appears to have no basis in fact. Do some people make choices based on taxation? Of course. But the notion that it is major factor in most people’s decisions about where to live lacks foundation. I can certainly see how retirement decisions can be influenced by tax issues–but only for the handful of folks who are truly mobile.

Also: there is some weird right-wing narrative about CA that needs to go away. It is not a hellhole–indeed, it is quite nice. Expensive, but nice. It is also too crowded for my tastes, but that has nothing to do with the tax rate.

BTW, Asheville, NC is a lovely little town, I lived just over the hill from there for six months. But it’s the equivalent of one of those first-wife alimony shops – knickknacks and mediocre art and dreamcatchers. It’s more California than California is.

As for Florida, I lived in Niceville, Orlando, and Sarasota. The state is a green scum on a rising ocean. Fly over it and look out of the window, it looks like a series of lily pads. I kept expecting to see a giant frog. The biggest company in Florida is Publix supermarkets. In the hellhole that is California? Apple. Both good companies. One sells eggs to retirees, the other defines communication and entertainment and is worth more than entire countries.

@Steven L. Taylor:

To some of us, that’s a feature, not a bug. I grew up in NYC. And my favorite cities in the world are NYC, London, Mexico City, Paris, Hong Kong, Vancouver, Madrid, Rome, and Zagreb. All of them are crowded.

Crowded usually equals diversity, great ethnic food, lots of music and art, and fascinating people watching.

@EddieInCA:

This certainly true, and a plus. The traffic and waiting in line gets to be a bit much, but yes: more people can lead to more stuff. I was a young man in SoCal and lived a year in Bogota. I see the appeal of big, but ultimately prefer medium, I guess.

@Guarneri:

https://en.wikipedia.org/wiki/Anecdotal_evidence

@Guarneri:

Asheville? Seriously? That’s like saying you’re in Austin because it’s so conservative. Asheville is a sea of blue in a Red State. It’s more Monterey than North Carolina. Go to Carmel by the Sea sometime and you’ll think you’re in Asheville, except there is no Pacific Ocean 15 minutes away in Asheville.

People who move to Asheville AREN’T doing it for the taxes. They’re doing it to open a tchotchkes shop or B&B, or to retire in the mountains. There are more hipster coffee shops in Asheville than Confederate flags. It’s as blue as Atlanta.

You need to do better with your arguments.

@EddieInCA: You raise an amusing point: Asheville is not where Mr. Conservative should want to be.

@Steven L. Taylor:

Understood. I was truly stunned, driving across country last year, seeing how many “medium” cities across the country have been hollowed out, literally. And it’s not going to get any better.

I am too lazy to look it up right now, but surely South Carolina would be the better place in terms of taxes if one is choosing a Carolina. Heck, put your money where your mouth is and come to Alabama: the income taxes are low and the property taxes are almost nonexistent.

@Michael Reynolds:

Damn. Should have kept reading. You made the same point better.

@Steven L. Taylor:

Be careful what you wish for. Alabama has a new great Film and TV incentive, and are actively seeking Film and TV Productions to come film in Alabama. Additionally, the Atlanta IATSE Local, 479, has also now taken over jurisdiction of all Alabama productions. You will soon see Hollywood invading Birmingham. Watch. It’s coming.

@Jay L Gischer:

With Tech, there are a fair number of alternatives — Seattle, Austin, NYC, and Boston and Raleigh-Durham all come to mind. The last two, less so. And then smaller communities of tech in Plattsburgh, Salt Lake City, etc.

(Also San Francisco, which is about two hours away from Silicon Valley at many times, might as well be considered separate)

It turns out, people don’t all want to live in the same place, and the need for engineers is strong enough that jobs are going to where people want to work.

Some of those places are pretty close to identical though. I think San Francisco is just a bigger version of Seattle.

@EddieInCA: I read something about this the other day, in fact. I welcome it (and Birmingham is actually quite nice for a moderate sized city–I enjoy hanging out there. At a minimum, some nice local breweries).

The states comprising our nation are not uniform. I know Illinois a little. The Chicago area has lost 15,000, but downstate has lost 40,000. I would like to see a county by county breakdown for California, New York, and Texas to see the impact of taxes. I’m sure that taxes as a part of the whole cost of living has an impact, but it’s not the only thing. I can imagine a guy who likes going to Fenway, likes the Celtics, fishes for stripahs, and eats chowdah staying in Boston despite some tax penalties.

@Guarneri:

So, basically, the people that moved out of a state because they can’t afford it feel the state they moved from is too expensive? Well, there’s a surprise. As for “no one wants to move to NYC”, I just don’t know what to say. Prices keep going up but no one wants to live there? There are lots of places in NYS where the only young people that stay are bound by family connections, but I guarantee you property values aren’t going up.

I’ve seen several people say that people live in California because it’s California and people who leave it aren’t looking for lower taxes but affordable housing. I completely agree with this. (I have in in-laws in Oklahoma and they asked if we were going to leave California. I said “I was born in paradise. Why would leave it?”)

But, I have wondered if California can afford higher taxes because it’s California. If you are a multimillionaire you can live anywhere you want, and California (especially the central coast) rates very high on everyone’s “where I want to live” scale. Who wouldn’t love to live in Santa Barbara? Or Pismo Beach? California does not pay a price for taxes because it has so many other things drawing people in.

Would Oklahoma or Texas experience the same? Oklahoma is okay, but just okay. People from all over the world don’t dream of coming to Tulsa. Raise Oklahoma’s taxes, and wouldn’t people who can afford to leave just move some place else?

I’m not saying I’m certain this would happen, but I have often wondered about it.

@EddieInCA: Michigan had one of those film incentives. I guess there were a few films made before the Repubs killed it.

@MarkedMan:

@Franklin:

It’s actually pretty interesting what happens. Georgia, Lousiana, and Michigan all went in big on incentives around 2007-2009. Of those, Georgia’s has done the best. Michigan’s was great for a long time, but the GOP killed it, as they did in Louisiana. I got to work in South Florida for five years before Rick Scott and his GOP buddies killed that incentive also. Here’s the rub, in those places, Georgia, Louisiana, and S. Florida, people flocked to the business. When a film company comes into your town or jurisdiction, they do one thing: Drop Cash. That’s it. They spend money locally. They don’t pollute the water. They don’t pollute the air. They don’t create problems, other than spending money.

In Atlanta, film jobs have become huge because outside the film business, there aren’t alot of $30/hr jobs. Most film jobs start around $30/hr, plus benefits, daily lunch, and craft services. The PA’s start around $650 per week. This is good money in these places. In Georgia, if you work in film, you own a house, a boat, and you probably have a second home on a lake somewhere where you like to go on vacation to boat, hunt and fish. But the GOP knows best, and has taken these jobs from the citizens of Florida and Louisiana. But other states are rushing in. Tennessee, Alabama, Kentucky, and North Carolina are starting to push their incentives.

@Slugger:

I’d be curious how many of those 40,000 from downstate actually moved to Chicago. In the early 80s I briefly lived in Richmond IN. Stock line, and I believe literally true, was that there were more Richmond High graduates in Indianapolis than in Richmond.

@Dave Schuler:

Oh, I understand the exodus. The causal mechanisms you cited are unique to Chicagoland, though. My relatives in Truck Stop and Coalville aren’t leaving because of corruption or taxes.

@gVOR08:

It’s pretty much the same process that led to there being vastly more Irish-Americans than Irish.

I don’t understand how people can keep asserting that it’s not. Come on, it has both blacks and Mexicans living there. If that’s not a hellhole, well…

ETA:

Why I know I’ve met maybe one or two myself. A torrent. Who knows, maybe even 10 or 12.

@Gustopher: I was just reading an article somewhere where the author was noting that “Californication” has been replaced by “it’ll turn into Seattle” as the insult du jour.

I grew up in Seattle, but it’s not the city that I grew up in anymore. Personally, I miss that city, if only because of affordable housing. But time marches on and I’ve lived in bigger cities that I liked better.

@Dave Schuler: @Guarneri: I’ll bow to both of your expertise on living conditions in Illinois. Surely, though, it’s not income taxes that are driving out-migration? The top marginal rate of 3.75% is among the lowest in the nation. All of the neighboring states save Indiana have higher rates; most much higher. Is it property taxes? Local income taxes?

@Guarneri: “Come on down, I’ll buy you dinner and we can talk to some realtors”

Yes, because as every great Business Mogul knows, we should always believe anecdotes over statistics.

@James Joyner:

The map you show above is out-of-date with respect to Illinois. Illinois’s present income tax rate is 4.95%. Illinois also has the highest sales tax rate in the country along with among the highest if not the highest property taxes. Taken together its tax system is incredibly regressive.

The present governor ran on a platform that included a graduated income tax to fall primarily on the richest. In principle that’s fine but there’s no way of keeping the richest in Illinois once you’ve raised the tax. Consequently, even if the legislature were to amend the state’s constitution to allow a graduated income tax, few believe it will achieve the revenue objectives that have been set for it.

IMO the best strategy for Illinois is more along the lines of shared sacrifice with tax increases, public pension reforms, and cutting back on services all playing a role. So, for example, I see no reason that Cook County should pay a pension of $750,000 per year as is the case for one employee, the state should pay pensions over $200,000 per year at all, or retired public employees should be able to collect multiple public pensions. But even commonsense trimming of Illinois’s extremely generous public pensions are completely off the table.

@Dave Schuler:

That makes more sense. Many “low tax” states, Tennessee and Texas for instance, make up for low or nonexistent income taxes with massive sales and property taxes.

Virginia’s 5.75% rate is high and we compound that with 4.3% sales tax (which municipalities augment), plus high taxes on land (which is usually assessed at higher than fair market value) and even a wildly unpopular annual tax on motor vehicles. But we attract a lot of in-migration because of government-related jobs and our taxation is less onerous than DC’s or Maryland’s.

@Dave Schuler:

@Dave Schuler:

Surely you see the irony of saying the system is incredibly regressive (i.e. falls heavily on the poor) with the belief that if you raise taxes on the wealthy you will drive them from the state? This is the Ferguson mentality, wherein the wealthier white residents brag about their low tax rates while the police endlessly harass and fine the poorer black people, and a white town official felt perfectly ok to go on the record and say that it was impossible to correct this injustice because the town would go broke.

Another way of saying it it is that for all their faults, NY, CA, MA etc actually provide good services and expect all citizens to pay for them. Whereas the failed Trump states provide crummy services and employ the modern version of share-cropping to pay for the little they do have, or suck off the federal teat because their two Senators have outsize influence compared to population. And so retirees move into those states once they no longer are producing an income and demand state of the art hospital facilities but vote no on every school funding bill that comes their way. What do they care about the students in Arizona or Florida? Their kids went to schools in the Northeast or big cities in the mid-west.

It’s not an irony or contradictory. Both are true. Our system is regressive and the rich, being more mobile than the poor, do move to avoid taxation. Just because a tax falls more heavily on the poor does not suggest that it does not fall on the rich at all.

@Just nutha ignint cracker:

And Washington has no state income tax. Okay, so I’m not precisely correct about the sales tax. Illinois has one of the highest sales taxes in the country. In Chicago the combined is sales tax is 10.25%.

@Dave Schuler: As noted, it varies by location. I had the pleasure of looking my Washington sales tax rate up recently (doing taxes), and it’s 9.9%. The # of relatives who think it’s awesome I don’t pay income tax don’t quite believe me until they visit and get sticker shock. And the less said about my property taxes the better.

Government is going to get their taxes. Lots of ways to do it. And yes, there are higher tax and lower tax states, but the overall burden is only a few % points different at most. Virtually everyone arguing about people leaving because of tax rates is cherry-picking which tax rate they use, not the overall taxes paid.

Y’all a bunch a homers.