McCain Cuts Taxes More, Obama Cuts More Taxes

Megan Cerpentier observes that, “despite the stereotype that my taxes should go up under a Democratic tax plan and down under a Republican, it seems that Obama’s tax plan is most likely to lower my tax bills and McCain’s plan will do little or nothing at all for me.” This, because Obama proposes giving self-employed Megan a “Making Work Pay” credit whereas the McCain tax cuts won’t help her much because she makes a relatively modest income.

Megan Cerpentier observes that, “despite the stereotype that my taxes should go up under a Democratic tax plan and down under a Republican, it seems that Obama’s tax plan is most likely to lower my tax bills and McCain’s plan will do little or nothing at all for me.” This, because Obama proposes giving self-employed Megan a “Making Work Pay” credit whereas the McCain tax cuts won’t help her much because she makes a relatively modest income.

Ezra Klein expands on this insight

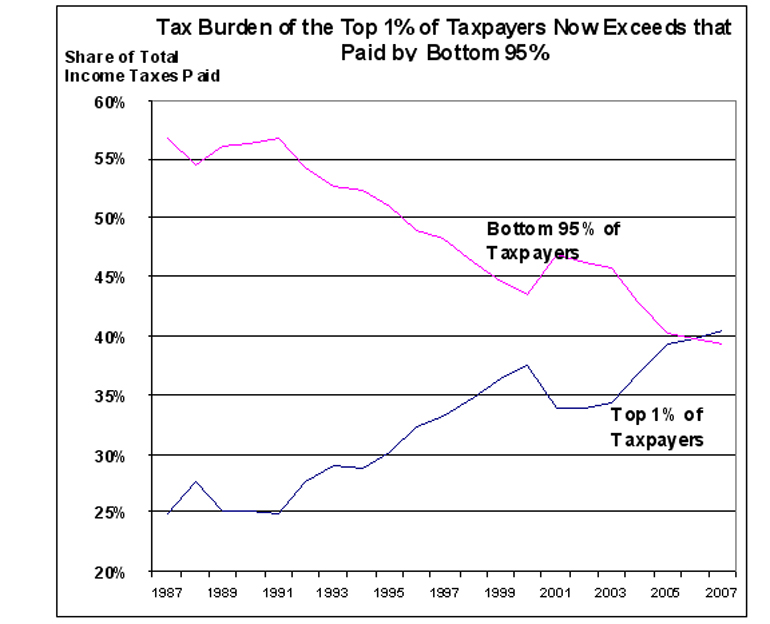

Just as a small sliver of the population controls a massive amount of the national income, so too does the same sliver pay the lion’s share of the taxes. In recent years, their tax burden has been easing even as their incomes have been rising, but in absolute terms, the folks with the bulk of the money are still the folks paying the bulk of the taxes. Democrats often raise taxes on these folks — who are often called “the rich” — which means raising taxes on 2 percent or 5 percent or 10 percent of the population, depending on how you’re counting. But in increasing the burden of the rich, they’re often able to lower it on the poor and working class. So even as revenues go up because Bill Gates’ bracket is raised to 41 percent, the tax burden of 60 percent of the country might go down. The government takes in more money, but the median American pays less in taxes.

To recap: Under Democrats, the tiny percentage of Americans who pay almost all the taxes will pay even more so that those who pay hardly any taxes can get a tiny rebate. Under the Republicans, those who pay the most taxes get the most tax relief.

Certainly, it’s a crafty electoral model. As my colleague Dave Schuler likes to say, “When you rob Peter to pay Paul, you can always count on the support of Paul.”

One could reasonably argue, of course, that cutting taxes during wartime is bad policy, let alone when we’re borrowing massively to pay for the war. But if we’re going to reduce the tax burden, it makes sense to do so in a way that targets those actually burdened by taxes.

Image: BlogNetNews

Your last line is why Obama’s way is better, as it disagrees with the rest of your statement. The fact is that burden is a pretty subjective word, and I’m sorry but most people don’t think that Warren Buffett is “burdened” by his taxes, despite the fact the fact that he pays more in taxes in a year than probably the GDP of Haiti. The fact is that the wealthy have gotten the gains from this economy at a near unprecedented level comparative to the rest of society. While wages for middle class people have stagnated, the CEO’s and VP’s have seen massive gains over the decade in their’s. If anyone is burdened by the tax code, it isn’t those planning their next vacation to the Riviera or purchasing that new 7-series.

I am not sure I understand why so much of the coverage on conservative or center-right sites is so down in the weeds on all of this. The big issue is that McCain’s plan will further decrease government revenue and hence increase our deficits and debt, while Obama’s plan actually increases government revenue and tried to bring things close to balance.

Neither plan is perfect, and frankly neither plan will be passed as proposed. But it speaks to intentions and character.

McCain is just pandering and he is supporting tax policies that a few short years ago he condemned. Obama, at least, is taking a shot at a responsible proposal.

Finally, this is the second time in recent days you have mentioned that Dems want to cut taxes on people who pay very little in taxes. That is simply not true. The poor pay little in federal income tax, but they pay a higher percentage of their income than the rich in social security tax, in real estate taxes, sales taxes, and so on. You don’t like progressive taxation? Fine, but at least be fair about considering the entire tax burden on individuals, not just that which is convenient.

it makes sense to do so in a way that targets those actually burdened by taxes.

Please justify. That’s a pretty low ball over the plate, in that you’re just asserting as such. There is such a thing as the “diminishing marginal utility of money” after all.

Exactly wrong. Every tax cut on those actually paying taxes, has had the opposite effect… raising the tax take. JFK proved that, as have several others since, including Reagan.

Bithead, that is simply not true. NOT TRUE.

Tax cuts diminish revenue. They always have. Always will. And Ronald Reagan never, NEVER, argued the contrary. He argued that tax cuts do not cost as much as you think they do because there is a stimulating effect on the economy. NO credible economist believes that tax cuts increase revenue. And there is NO empirical evidence to support it.

Your argument is simply inaccurate propaganda.

What do you mean by “burdened”? Because basically what everyone else said. The less money you have, the more of a burden the taxes you have to pay are going to be.

Yea, it’s hard to see how having literally millions or billions left over *after* you pay taxes is a “burden”. Not having enough money for health care, food, rent, gas, medical bills – that’s what we call an actual burden.

Social Security tax is a reasonable argument here, although we cap it because we also cap payouts. The other taxes are at the state and local levels and thus not part of the federal tax policy conversation.

Is it really true, though, that the poor pay more of their income in real estate taxes? That strikes me as implausible.

The bottom quintile pays no income tax; they’re thus completely unburdened by them. The highest quintile pays very high income taxes, translating into more of their time working for the government. That strikes me as burdensome, indeed.

Burden me baby, burden me.

James, that is because the poor are less likely to own their homes, so they pay real estate taxes indirectly. But they spend a much higher percentage of income on house than the wealthy, so if you allocate the underlying real estate tax to them…

And yes, state and local level taxes have to play into it. It is artificial distinction to only count direct payments into the federal treasury. You want to talk tax burden, then let’s talk tax burden, not parse it out into politically convenient categories.

My point ultimately is that saying that Obama wants to cut taxes on people with a low tax burden while raising it on people with a high burden is demagoguery. And come on, is that really the position you want to defend?

To me, the ultimate burden is who is paying the income that the lower quintile is so burdened in taxes with. I’ve been in that burdensome situation where increased expenses forced me to lay off employees. That’s happened many times. By raising taxes on the “wealthy”, they remove margin. In order to get that margin back in line, the burdened lower quintile lose their jobs. Look at what’s happening as Pelosi’s Dems stall the Bush tax incentives. What’s the point in hiring marginal employees you’ll most likely have to lay off in a year ( and get stuck with their unemployment as a consequence ). So, I don’t agree with Obama’s approach at all. You give the “poor” a 5% break in taxes and they create nothing. You give Warren Buffett a 5% break and he creates 1,000 jobs.

It’s disingenuous and a strawman argument to bring non-federal taxes into a discussion about…wait for it…federal taxes. Congress and the President have no say in what we pay in sales taxes, property taxes, etc., so they can do nothing to lower that burden. So who’s demagoguing now?

Social Security, both the tax and the benefit, has been a train wreck from the very start. While it’s a bigger burden, as a percentage of income, for everyone who makes less than the cap, at least it’s related to the benefit that is ultimately paid out, so it’s not really accurate to refer to it as a regressive tax, because that’s only looking at half of the issue.

And nobody, nobody, talks about reducing government spending. Gah!

The posts I’m referring to, and the candidates’ proposals, are about federal income taxes. Obama also talks about payroll taxes. The others are outside the control of the federal government.

It’s likely true that the poor spend a greater percentage of their income on food and shelter than the rich since, presumably, there’s only so much you can increase the quality of your diet and size of your home.

But the post is about the percentage of the national tax burden borne by groups. Even accounting for state and local taxes, the bottom quintiles pay are far, far smaller share than the upper quintiles.

Boyd… sure they can lower the burden… they can take it into account in determining federal tax policy… and guess what? There is an interaction between the two already. State taxes can already be deducted from income. So state and local taxes are already part of the discussion on federal taxes.

Moonage: “You give the “poor” a 5% break in taxes and they create nothing. You give Warren Buffett a 5% break and he creates 1,000 jobs.”

Two points here. First, that isn’t the issue. The question is whether those 1,000 new jobs will produce more or less tax revenue than the 5% cut to Buffett. They won’t. It does not mean you shouldn’t do it for all sorts of decent reasons. But the idea that tax cuts increase revenue is simply put, not true. Second, look, do you really know that the tax cut on on Buffett creates a 1,000 jobs? Are you sure it isn’t 10,000? Or maybe 100? Or maybe just 10? And why do you think that cutting taxes on 1,000 poor people will create less jobs than cutting taxes on 1 rich person? Yeah, Buffett might start a new business, but the others, in the aggregate will spend more money and that will also lead to economic growth. As a practical matter, there is very little evidence that cutting taxes on the rich has a particularly special stimulus effect. And people have looked for it. It just isn’t there, or is very small at most. General macroeconomic theory suggests that it does not matter whether a tax cut is distributed among the many or concentrated among the few — even if that does seem counter-intuitive.

James: “But the post is about the percentage of the national tax burden borne by groups. Even accounting for state and local taxes, the bottom quintiles pay are far, far smaller share than the upper quintiles.”

As a percentage of income? Or in gross terms? Yes, the rich pay much more, obviously. They would even under a flat tax, of course.

Or are you arguing in terms of percentage of income? There is it much more tricky when you actually figure out total tax burden. There is a weird spike on that one as you get to higher-income households, but then a drop when you get to the really wealthy — due to capital gains, incorporation issues, etc. But regardless, when looking at total tax burden as a percentage of income, the line is much less severe than is suggested by the percentage of federal taxes paid by the top 10%.

Personally, though I am more concerned by the prospect of increasing the debt burden we already face as a nation and slightly less concerned about relatively small marginal shifts in the amount paid by different income groups.

“As a practical matter, there is very little evidence that cutting taxes on the rich has a particularly special stimulus effect.”

That’s because it’s never been done. Cutting taxes has always been pretty much across the board by varyign degrees. Look at what happened after Bush’s tax cuts kicked in. His tax cuts were trashed mercilessly by the Dems as being “tax cuts for the rich”. If you don’t want to do research, just read the headlines. An economy that was in shambles miracously recovered practically overnight. Now, the closer we get to those “tax cuts for the rich” expiring, the economy is suddenly in shambles again. You say it’s coincedence. I say it’s employers anticipating higher operating expenses in the near-term as my company is doing right now. We have a guaranteed higher operating cost due to minimum wage increases over the next two years. And, we have no guarantee that the tax incentives will be around in 2010. So, once again, why would we hire marginal employees knowing full well we’d have to lay them off in a year or so? Just the mere discussion of the issue by Nancy Pelosi and Obama is enough to make employers stall. You’re talking about maybe a 5% increase in operating expenses. That’s 30 jobs where I work. That 5% tax incentive won’t do them any good.

It is worth noting that those who pay the most taxes also control a huge percentage of the nations wealth, so it is not as if they are being picked on.

I’ll address this in some detail tonight, being a little busy at work suddenly. (Damned hurry up and wait support positions…)

But the bottom line is that it’s economic groth, not tax rates, that controls the tax take in dollars. And tax rate hikes… particularly at the upper incomes… kill economic growth.

Also worth noting that if Bush were not leaving with the governments finances in such horrible straits, we might well not even be discussing tax hikes.

From the New York Sun:

If this is such horrible straits, Anjin, I’d be interested in seeing what you’d call ‘good’….

Bithead,

“And tax rate hikes… particularly at the upper incomes… kill economic growth.”

Let’s see, the most recent counter-example was in 1993. Everyone here remember the horrible recession that followed? Me neither.

Bithead,

During the period 9/30/2003-9/30/2007, the national debt (as reported by the US Department of the Treasury) went from $6,783,231,062,743.62 to $9,007,653,372,262.48, or by over $2.2 trillion. None of the annual changes were under $500 billion. I don’t think the Sun’s figures are accurate.

Bithead… if you want to be serious about the issue of deficits, don’t look at the “deficit” numbers that fail to account for “off-budget” expenditures. There is a really simple way to figure out our real deficit from year to year. Did the national debt grow? If so, by how much?

You might be surprised at what you find. Although I doubt it. I think you know the truth that the deficits are much higher than the figures you report. But that it would not fit into your politics to use the real numbers. Well, I am not going to bother debating with you. We are all entitled to our own opinions, but not our own facts. And you are violating that basic rule of debate.

Good day.

The New York Sun as a source? Please…

Just got home… that little busy burt turned into an ‘all hands’. I do have a few notes tossed together, but too tired at the moment to do much with them. But until morning;

So, the only diver of national debt, is income, and increased spending has nothing to do with this?

You know better.

Heh. One of the sources I took notes from which I’ll post tomorrow is the NY Times… and they say exactly the same thing the SUN does, if frm a slightly differing time perspective.

But of course, the NYT is naught but a tool of the BushhhhitlerChimpyMcCheney group, right?

PLease…

Okay, I’ll bite. Yes, we need to control spending. The prescription drug benefit was really over-the-top, and medicare is a disaster. The problem is… we need a serious dialogue about spending and taxes. And we won’t get it as long as people — mostly conservatives — insist on peddling half-truths and outright falsehoods. Cutting taxes does not increase revenue, even though it may increase growth, and privatizing social security will not save any money over the next 40 years, but will rather cost trillions. I would love to get rid of social security or at least means-test it, and medicare needs dramatic action, and farm subsidies need to disappear, etc. I am all for controlling spending. But to do it, we need to have an honest debate and stop promising everyone a free lunch.

The Grover Norquist approach is fundamentally undemocratic. He wants to lie us into a fiscal crisis that will make cuts unavoidable instead of actually trying to convince people of his cause. Yeah, his approach is politically easier, but it is also cowardice.

BTW, the NY Sun figures are accurate, but misleading. The official budget deficit numbers are an exercise in accounting fraud.

The Sun may sometimes use correct facts, but it is clearly a partisan rag. Not much of a source. The NY Times is not all that credible anymore, sadly.

What we are seeing is the legacy of the Telecommunications act of 1996 (a Clinton, not a Bush, screwup).

As a result, the sharks ate all the minnows, and now the MSM, as the right is so fond of pointing out, is kind of a joke. Unbridled capitalism at its best. Thank God for the internets…

Bithead,

“So, the only diver of national debt, is income, and increased spending has nothing to do with this?”

Assuming you meant “driver”, not “diver”…

If you compare the level of Federal taxes and spending to GDP since 1960, you see two things:

1. The current level of spending is approximately the average of that nearly half-century period.

2. The current level of taxes is near its lowest point.

In other words, we are maintaining the Great Society programs while taxing as if we never expanded the government in the 1960’s. It’s a pity that the general talking point is that the opposite is true, and we have typical levels of taxation and runaway spending.

(Weak grin) I Told you I was tired…

Which, one may assume, that sans the war effort, would seem to suggest that both spending and taxes are far lower. Assuming the growth in spending to which you refer, we’d be spending at a rate far higher than the average, no? As it is, even WITH the war, we’re only at average spending levels.

While I’m here… (And I recognize this is not complete, but last night put me off what I wanted to do…) let’s start with the most recent example of tax rate cuts generating more revenue:

Let’s start with the most recent example of tax rate cuts fueling tax take increases. From the WSJ, last October:

This was a point even the New York Times had to admit in July of 05

Bill Frist agrees, saying, based on the CBO reports, in USA TODAY:

Now, that’s just the most recent example. I have older references to hand (Bush 41, Regan, Kennedy, etc) and will be tossing together some notes. But I’m sure we’ll be busy with the denial on this long enough for those to come out.

Have at it.

LOL!

So now the only sources you will accept are the ones that back your position… and you exclude as a matter of that, the official (and need I say it, bipartisan) accounting? A cute move, Bernie.

Let me know when you want me to take you seriously.

“1. The current level of spending is approximately the average of that nearly half-century period.

Which, one may assume, that sans the war effort, would seem to suggest that both spending and taxes are far lower.”

Spending, yes. Taxes, no. That’s one reason why the Bush Administration prefers to use supplementals for war spending, it exempts it from any pesky rules like PAYGO which would require either reducing other spending or raising taxes to pay for it. Another (and likely more important) reason is that it keeps the war spending out of the deficit figures you are citing. When you add in the two wars and other off-the-books spending such as FEMA, we are running $500 billion annual increases in the national debt (as I cited yesterday). And if you don’t count the redirection of the Social Security Trust Fund to reduce the debt, it’s closer to $750 billion.

“Assuming the growth in spending to which you refer, we’d be spending at a rate far higher than the average, no? As it is, even WITH the war, we’re only at average spending levels.”

I don’t understand this. Please clarify. My point was that the public perception is that we are at record spending levels, and average tax levels, rather than average spending levels and low tax levels. Without the war spending, we’d be at low-average spending levels and low tax levels.

Bithead…. you are falling into the most basic logical fallacy… the notion that post hoc ergo propter hoc.

When taxes are cut, revenues decline. Over the next few years, assuming taxes are not cut again, they will rise along with economic growth and inflation. But the tax cuts did not necessarily cause the subsequent revenue increases, while they unquestionably caused the initial revenue declines.

You can’t ascribe all economic growth to tax cuts.

And again… no one ever used to believe this fantasy. There is a difference between the belief that taxes are sometimes too high and ought to be cut and that notion that taxes are always too high.

You are promoting the notion of a free lunch. And conservatives used to understand that there are no free lunches in this world.

I suggest that wouldn’t be a problem under a Republican Congress; They’d understand that social spending takes a back seat to the war effort. As it is, such nonsense would devlve into months of bickering, while we get defeated by the leftist-dominated congress.

If I’m reading you right, we tend to agree. This is a perrception issue. Spending is actually lower than the perception would suggest.

You see, I don’t regard military spending as discresionary.

An interesting argument, given wer’re being told pretty much that higher tax rates are without negative consequences in terms of economic growth and thereby tax revenue.

Bithead,

“I suggest that wouldn’t be a problem under a Republican Congress; They’d understand that social spending takes a back seat to the war effort.”

Then why do you think they did not do so between 2003 and 2006, when there was a war on, and the Republicans had undivided control of Congress? Instead, they increased spending, including adding a new program to spend on (prescription drugs).

“This is a perrception issue. Spending is actually lower than the perception would suggest.”

Taxes, too, as I have said before.

First, given the slim nature of the majority Republicans had in both houses, I question your qualification of “undivided’. All it took to turn votes to the Democrats was an Olypia Snowe, or a John McCain to turn a vote to the left. And they had far more than a few. Further, as an example, I’ve been saying since 2000, GWB is not a conservative, for all that he calls himself a Republican… he is a centrist and not enough to tip the scale back to even the center… it still tipped left in total.

Secondly, and as an extension of the first, that very slim majority provides an environment that tends to foster a lot of go-along to get along type of politics, which invariably will add to government growth. I stood up to a lot of flack from libertarins who suggested through that timeframe, that such a slim majority amounted to gridlocked government. This was supposed to be a good thing. And had there been an actual balance, I might have agreed. Trouble was, it wasn’t, and I said so at the time that the slim majority amounted to nothing of the kind, unless there were no liberal Republicans. Guess who was correct?

Thirdly, there was an understandable, if misguided desire on the part of the Repubicans not to too badly annoy various leftie groups over one government giveaway program or another. This attitude was brought on by a combo of the thin majority and it’s consequences as I described above, but also wanting to maintain PR; they didn’t want to be seen as the ogres the Demos had been projecting them as, lo, these many decades. That many of the peopole involved were not operating from conservative principles didn’t help matters, any.

IMV such things both individually and collectively, played directly into the democat party’s hands.

(Aside; The only combo that’s not been tried since the civil war, is a strong… and I mean strong majority of Republicans… strong enough that it’s not beholding to it’s own left wing.)

I see you’re not, but rethorically, I’ll tell you not to blame conservatives for the Republican failure through that period. The trouble was, there were not enough Republicans in elective office who WERE conservative. I said so at the time, And alas that’s still true, up to and including the current Republican nominee.

LOL. Dude, if you took me seriously I would question my sanity…

It’s OK, I’ve already got that covered, regardless.

“First, given the slim nature of the majority Republicans had in both houses, I question your qualification of “undivided’.”

Let’s see —

Senate 2007-08 D 49, R 49, I 2 (both caucusing with Democrats, although Lieberman seems to be going out of his way to compel the Democrats to change that), House D 233, R 202 = “leftist-dominated congress”

Senate 2005-06 R 55, D 44, I 1 (caucusing with Democrats), House R 232, D 202, I 1 (caucusing with Democrats) = “slim nature of the majority Republicans”

Nope, no inconsistency there.

“Thirdly, there was an understandable, if misguided desire on the part of the Repubicans not to too badly annoy various leftie groups over one government giveaway program or another.”

Which of course explains why the largest increase in discretionary spending of the Bush Presidency (the prescription drug benefit) was passed with zero Democratic support. Or not.

“democat party”

I am still laughing about this typo.

You cannt count conservative vs liberal by counting D’s and R’s, Dant.

And..

Of course it doesn’t. What does? That the Democrats didn’t like the Republicans stealing their biggest issue, and worked against it on that issue, largely… and of course claiming it didn’t go far enough.

“You cannt count conservative vs liberal by counting D’s and R’s”

No doubt. On the other hand, you are making the opposite conclusion that if the D’s are in the majority, Congress becomes “leftist-dominated” — which is especially silly when one realizes that the number of actual leftists (as opposed to liberals) in Congress can be counted on one hand.

“What does? That the Democrats didn’t like the Republicans stealing their biggest issue, and worked against it on that issue, largely… and of course claiming it didn’t go far enough.”

Neither was the case. Their objections were that the lack of ability to negotiate prices made the program welfare for the pharmaceutical manufacturers, as well as the blatant lying by the Administration as to the cost. Both of which have certainly been shown by the workings of the program.