Meanwhile, China’s Stock Market Has Been Crashing For The Past Month

In the past month, the Chinese stock market has lost more than 1/3 of its value.

While the world’s attention is focused on Greece, China’s stock market has been crashing for the past month:

SHANGHAI — Stock prices in mainland China fell sharply again on Wednesday, despite another series of government measures meant to restore confidence and stabilize a market that has grown increasingly turbulent in the last month.

The sell-off is putting pressure on the government to take swift action, as losses pile up for the millions of ordinary investors that piled into the market. Just days after Beijing introduced a number of bold measures to prop up share prices, regulators announced new initiatives Wednesday, including allowing insurers to invest more money in stocks and creating a fund to buy up shares in small and midsize companies.

But the slump, which is defying the efforts by Beijing to prop up stocks, presents a serious challenge for the leadership. If stocks continue to fall, it could erode consumer confidence, further weighing on the economy.

The social and political repercussions could also be significant for the government. Many ordinary investors have poured their savings into the stocks, making them especially vulnerable to the market volatility.

The losses have been brutal. And the full extent of the pain may be even steeper, since nearly half of the stocks have stopped trading.

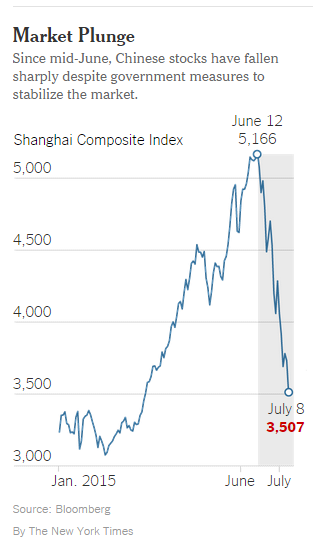

Even after the big sell-offs, though, stock prices in China are still considerably higher than they were a year ago. The Shanghai composite is still up 74 percent from mid-2014, and the Shenzhen composite is up 84 percent since then.

On Wednesday, the main Shanghai index plunged 5.9 percent, and the Shenzhen index fell 2.5 percent. Over all, the Shanghai index is down 32 percent and the Shenzhen is off 40 percent from the highs reached in mid-June.

In Hong Kong, which had escaped much of the mainland market’s rout, the Hang Seng index fell 5.8 percent.

The sell-off has also spread to other parts of the Asia-Pacific region. In Japan, the Nikkei 225-stock average dropped 3.1 percent, Australian stocks were down 2 percent and South Korean shares fell 1.2 percent.

Fear is gripping the markets after a phenomenal bull run in which mainland China’s major stock indexes doubled, tripled and even quintupled over the last few years. Sentiment has turned down too sharply and investors have lost confidence, analysts said, and because buying shares with borrowed money was a critical part of the increase in prices, there is now pressure to sell.

“China’s stock market remains under stress, as investor confidence will take some time to recover,” Li Wei, the China economist at the Commonwealth Bank of Australia, wrote in a report to investors.

Panic selling may also be extending the downturn because each day trading is suspended for hundreds of stocks after they drop by 10 percent, under exchange rules. Some companies are even asking that their shares be temporarily suspended, hoping to ride out the downturn.

Since late June, on almost every trading day, there have been more than 900 stock trading suspensions, according to Xinhua, China’s official news agency. On Tuesday and Wednesday, 900 to 1,700 stocks were suspended from trading. That means that among the approximately 3,000 listed companies on the two major exchanges, up to half may have been suspended during the first two days of the week.

This chart makes clear the extent of the market decline:

In The Wall Street Journal, Ruchir Sharma argues that what’s going on in China is much scarier than what’s going on in Greece:

Since the June 12 peak, nearly $3 trillion in value has been erased, as Beijing takes increasingly desperate measures to arrest the price collapse. The authorities have cut interest rates and transaction fees. They have directed mutual funds and state pension funds to buy stocks. Over the weekend they panicked and reversed course by suspending new initial public offerings, suddenly choking off a source of the new corporate funding they had been trying to create. This comes when the real cost of corporate borrowing is high. Any further reduction in interest rates could accelerate the outflow of capital, after a record $300 billion has already left China this year.

The continuing crisis is viewed, locally and globally, as a test of China’s control over the economy. The “Beijing put”—a perception that Chinese economy and markets are backstopped by the government—is under threat. That perception has underpinned the widespread belief that Chinese growth won’t fall much below 7%, because that is the government’s desired target and Beijing is omnipotent.

Looming over all of this is China’s massive run-up in debt, which has increased by over $20 trillion—to around 300% of GDP—since the global financial crisis in 2008. All along, the bulls argued that Beijing has successfully managed every challenge to its three-decade economic boom, and that it could overcome the threat this debt represents. At a minimum, the argument went, China’s financial woes would be smaller than those of other countries with high levels of borrowing. This faith in Beijing encouraged many global hedge funds to pile into Chinese stocks.

But if Beijing can’t stop the market’s tumble, there could be a sudden shift in the perception of exactly how far economic growth might fall under the weight of too much debt. If that floor crumbles and the Chinese economy spirals downward, it will make the drama surrounding Greece feel like a sideshow. China has been the largest contributor to global growth this decade; Greece’s economy is about the size as that of Bangladesh or Vietnam.

It’s worth noting at the outset that even with this decline, China’s markets are still higher than they were at the start of 2015. If nothing else, that seems to be an indication that there had been a massive speculative bubble building and that it just popped of its own accord starting last month. Given how things have gone, though, and the fact that the government in Beijing presently seems to be doing everything exactly wrong, it’s entirely probably that we’ll see the markets over there decline even further and wipe out all of the gains that have been made this year, and more. Indeed, given the fact that the fundamentals that have been driving the markets in China down all months are still in place, it seems logical to assume that we will see further losses regardless of what the government does.

The big question, of course, is what this means for China’s economy as a whole and, by extension, the rest of the world. For some time now, analysts have been wondering if and when we’d get to the point that China’s skyrocketing growth over the past decade, which included both a booming stock market and a booming real estate market, were headed for a correction of some kind. Given the natural course of economies throughout history, such an event would seem inevitable at some point. In the 19 Century alone, the United States experienced several financial panics that were related as much as to the fact that a quickly growing economy was becoming overheated as anything else, and even today its natural to expect that there will be another recession here at some point in the future. China, though, seemed to be avoiding a lot of that thanks largely to the government’s manipulation of the markets and economic statistics that made it impossible for outsiders to determine what the state of the Chinese economy actually was at any given time. Now, we may be reaching the point where those corrective measures no longer work, in no small part because China is much more connected to the world economy than it used to be. So, if this stock market crash does have wider implications for the Chinese economy, it’s likely to be felt elsewhere in the world, and it’s likely to have a much bigger impact than anything going on in Greece.

I wonder how much of this was do to a) speculation b) the sort of stuff that contributed to 1929 crash c) dodgy financials d) whatever.

It’s amazing–over and over you see the same thing in all sorts of areas. Exponential growth, followed by a crash. We see it in housing prices, stock market prices, bitcoin prices, number of papers published on string theory…..

P.S. Considering that that your graph is showing the rise in stock market prices only since January, this is a classic puffed balloon followed by collapse.

It makes sense we’re more focused on Greece; after all, it’s a bigger economy than China. (That may be a true statement in a few months.)

Look for more Chinese provocations of Japan and the US. They’ll want to ramp up nationalism to distract the populace.

@grumpy realist:

You are exactly right…the only people hurt are those that invested poorly – at the peak.

The Chinese market is still up massively from where it was a year ago.

Yeppers, it looks like the Shanghai stock market got into the same problem with margin calls as other stock markets have…..

Honestly, guys–if you’re not going to learn from history you are damn well doomed to repeat it.

Much of this bubble was created by uneducated investors trying to get out of the Chinese real estate bubble.

There is a (perhaps apocryphal) story about a tycoon in 1929 who sold all his stock just days before the crash. When asked why, he told of having a discussion with a barber about what stocks to buy. He decided that when even barbers were buying on margin, the market had ceased to be rational and it was time to get out. FWIW, in the last few months I’ve been noticing more and more talk amongst my Chinese colleagues about the market, people from all levels in the organization. Rather than the “should we get into it?” questioning of 3-4 years ago, it is more of the “what is the best stock/strategy/brokerage?” variety.

First off, Ron Beasley above has it right. Something like half of all the investors in the Chinese stock market are illiterate peasants without educations. It’s hard to predict what the political implications of their losing what little savings they might have will be.

However, the decline in the Chinese stock market needs to be put into perspective. Based on the FTSE China 50 stock index, the Chinese stock market is back where it was in October 2014. There’s been an enormous run-up since then and that’s evaporated. There’s quite a bit more to go before that run-up has been run down again.

Nobody seems to know what the implications of it all might be least of all the Chinese.

copy and pasted from Vox:

Ah, yes…de-regulation.

I’d say this Chinese market crash is a Republican wet-dream.

@C. Clavin: Except that if the peasants get shirty because they’ve lost all their savings (or even lost their “gains” over the last six months) China is liable to pull the “look! something shiny!” route and go for rattling the sword of nationalism.

And they’ll probably do it over that chunk of airstrip they’ve been putting the last touches to in the Spratleys….

Le sigh.

I’ve been following this for a week or two. It’s looking very bad to me. It is the equities version of the over-building that China went through a couple of years ago that resulted in veritable ‘ghost cities’ of apartment buildings built and completely sold out as investment properties but that no one bought from the original ‘plank holders’ (any navy vets here?). An amazing fact: The margin calls have caused so much gold to be put up for sale that the international price of gold is actually declining in the face of this collapse of prices.

I tried to leave after the above comment but I just couldn’t. The comparison in the original post to the booms and busts of the American economy in the 19th century is rather poor. During that period the US had no ‘Central Bank’. The federal gov’t (I s’pose the Treasury but I’ll speed by and not look it up) had chartered banks and the states had their particular ‘state banks’ and the law at the time required that dollars from one bank be accepted at face value by them all. The debt built up by the issuing of ‘greenbacks’ during the War between the States and the vast over-building of railroads combined with agricultural booms-and-busts (endemic to agriculture) would fill various parts of the system with worthless debt which would then flood the whole system. There was a ‘Long Depression’ from 1873 to the 1890s that was called (until the 1930s of course) the Great Depression. In fact, the Great Depression of the 1930s was actually first experienced as an agricultural depression that caused bank runs and bank failures to build and build during the 20s. Combined with the stock market crash of 29, there went that balloon.

The Chinese situation is due to the cultural behavior of the Chinese to save. The banks there have a very low ceiling on interest paid to account holders and combined with the one-child policy have created a huge demand for retirement security by the Chinese entrepreneurial classes. They latch onto almost any investment that seems to promise higher yields than their savings accounts which have actually been shrinking because interest is below inflation.

So the very strength of the Chinese central bank is working to magnify the error of encouraging margin-investments then discouraging then encouraging them.

@grumpy realist: You explained in some detail how the Greek gov’t had been ‘cooking’ their economic numbers for years leading up to the present Euro mess. Do you have any thoughts on the quality of economic data released by the PRC authorities? Over the years I’ve heard bits and pieces of complaints and predictions in the media that China does not release (or possibly even KNOW) the actual numbers of bad debt and worthless unrecoverable investments hiding on the balance sheets of banks. As someone said above – hello Japan 1980s.

And we know that there’s no corruption in China, don’t we.

(Snark, Ozark. That’s snark!)

@JohnMcC: Yah–we’ve already seen the $%#^ hit the fan when it has been Chinese companies doing a reverse merger to get listed on the US stock exchanges and then surprise surprise KABOOM Americans discover its all funny money.

Plus there’s been even more tightening down by the Chinese government on not letting statistics get out if it would happen to embarrass the government.

Unfortunately there isn’t a large enough rival source of power within China to face off against the government and let real data get out. And the Chinese government still hasn’t cottoned to why it’s so valuable to have true data available.

P.S. I was in Japan when the real estate bubble finally popped. Whee!

An informative article at VOX: The stock market crash is a symptom of China’s problems, not its cause

There are several things going on here.

The Chinese don’t release data on the amount of bad debt and in fact they may not even know.

China must transition from a largely export based economy to one more based on internal consumption which they have resisted.

The Chinese subsidized the construction of factories and infrastructure so much they created over capacity. Probably the best example of this is solar PV panels. They not only drove companies in the US and Europe out of business but Chinese companies as well.

@Ron Beasley:

There’s just something very communist about driving companies out of a solar panel-manufacturing industry with subsidies to the point you undo yourself in financial knots trying to show that making money off the Sun was an actual good idea.

And a lot of the articles about the surge in American solar energy credit China doing this very stupid business decision as being part of the reason solar energy might be getting a foot in the door. Life is a funny thing.

@grumpy realist:

“Tish! I just love it when you speak French!”

Two thoughts …

I’ve seen comments online in recent days about this happening because China is communist. As linked above, the reality is that they seem to have been a little too lenient about adopting some “free market” ideas.

This ought to lay to rest (for a while anyway) the talk of the dollar ceasing to be the world’s reserve currency. For us to lose that status, there would have to be a viable alternative. It’s obviously not going to be the Yuan, and the Euro isn’t looking all that much more attractive.

New Rules for the shanghai markets..

Not allowing major investors to sell doesn’t prevent the margin call, which they probably can’t meet. It also doesn’t force anyone to buy..

Some fun thoughts for the world:

What’s the stock price on a no-bid?

If a large investor gets a margin call and can’t sell his Chinese stock to meet it, will he be forced to liquidate his US stocks?

Gosh, it’s a funny coincidence that the NYSE is offline.

@Gavin: “What’s the price of a no-bid?” A quote from this afternoon’s NYT:

“There are no buyers, only sellers,” said Francis Cheung, a market analyst at CLSA, the brokerage house. “So the government is buying, and they’ll ramp up buying to stabilize the market.”

In ‘socialist’ systems the central gov’t has sufficient control over currency and markets that they probably can stabilize whatever ‘market’ exists. In the PRC that’s just whistling past the graveyard but you have some hundreds of millions of investors whose idea of what the gov’t can do is conditioned by their socialist/communist background.

This is not going to end well.

@JohnMcC: Can’t leave this alone dammit. The faith that millions upon millions of working- and middle-class Chinese have in their gov’t to manage their economy is hard for a cynical western SOB like me to wrap my head around. In the WSJ of 7 July (China’s Stock Plunge Is Scarier than Greece) it is noted that the Shanghai Composite crash began on 15 June when despite the fact that it was Premier Xi’s birthday, the exchange lost 2%. Apparently after that it was sell, sell, sell.

@Tillman: China is no longer really a communist country anymore but a capitalist oligarchy.

@JohnMcC:

My area of expertise is M&A, which directly involves this area, so I’ll state this with clarity – our rule of thumb on the Street is to consider any financial reporting issued by a Chinese company as suspect at best, and more probably outright fraudulent, until proven otherwise. IFRS is merely a suggestion in China, IMO.

@Dave Schuler: Dave, do you have any backing for the statement

The Chinese people I know that are investing in the stock market are middle class by US standards or by China’s. And I don’t have statistics at hand, but I would not at all be surprised to find out there are more middle class people in China than in the US.

As to motivation, at least a part of it is the fact that for the past 25-30 years it has been incredibly safe and lucrative to invest in real estate and starting two years ago for most of China, and last year in Shanghai, that market has flattened or even receded a bit. So the stock market with the big yields looked very promising.

@HarvardLaw92: I’d find it very interesting if you could put up a list (even off the top of your head) of national economies that do not publish (or do not KNOW) their economic numbers. ‘

And thanx for the — um — confirmation of my skepticism of the PRC as an economic foundation of the 21st century economic world. I’ve been watching them for a couple of years for some sort of failure on this order.

I have this concept that the best way to evaluate the Chinese economy today is to see it as the American economy ~ 1890-1910.

Volatile, unpredictable, but undeniably growing. On the cusp of world-making.

I am in no way an expert, but can someone tell me why China will not be the world economic superpower ten-twenty years from now?

There may be some variables that will delay it, but the end state is always going to be the same, yes? China will be the dominant economic power. The PNAC signatories will be bummed, but the 21st century will not be the American century, but the Chinese one.

As Great Britain is to us today, we will be be to China tomorrow. The little brother that produces entertaining niche TV.

I remember the scare that Japan put into so many Americans a couple of decades ago and we see how that turned out…why will China be the world economic superpower in ten-twenty years…

@de stijl:

That’s probably way hyperbolic. The USA is probably going to be the 800 pound gorilla of the economic world for the foreseeable future(USA f**k yeah!!)

China seems on its way to making all the mistakes the US made with regard to the stock market of the last 100 years (proving people never learn from history).

What is it with the idea of a magically self-adjusting free financial market that’s so fascinating to people?( Folks, that stuff doesn’t work- see 1873, 1893, 1907, 1929, 1998, 2008….)

And is it time to mention the stereotype of the Chinese being gambling addicts?( Probably not).

On PBS, a Chinese guy being interviewed about the stock market crash was saying things like ” People’s life savings are at stake! People might killing other people over this.” Let’s hope he was just blowing off steam, but as anyone who knows even a little Chinese history understands, the Chinese masses aren’t always as placid and servile as people think.

@de stijl: There are two hurdles I see against China become THE 800 lb gorilla: first of all, the language. When you have to spend 20 years learning how to become literate and STILL can’t write your own language it’s going to be tough to have Chinese become the language of trade. One of the reasons Latin/French/English became (cough) the Lingua Franca is because they could be more or less easily learnt and written. It MAY be possible to get around this with technology (in fact, that’s what’s doing in the writing ability of many Chinese)

Second hurdle: Government isn’t interested in putting out accurate statistics. Which is going to kill you in the end if you’re making your policy off of them. I can see China coming to grips with bad company data (there’s a learning curve–but if your stock market keeps having wiggles and blow-ups because of bad company data, the Chinese government will probably at some point learn to deal with it.)

But if you don’t develop a mindset that insists the government put out accurate stuff–well, then it’s going to be shove around the numbers so Comrade X looks good, and then down the pipeline surprise surprise something else blows up. The laws of economics don’t hit as quickly as the laws of Nature, but boy do they hit at some point.

Plus you’ve got a Chinese government leery of physicists–not because of what they might develop, but because they have a philosophy that there is something absolute and real out there that continues to exist, no matter how much propaganda the government puts out. That’s a problem.

@de stijl: Well, because China has a central gov’t and Communist Party with a solid grip on finance and banking and they are making huge mistakes like mistaking supporting the economy for supporting a bull market in stocks? The mistakes that the US made in 1890–1910 were dispersed and the result of the over-exuberance (to coin a phrase) of the millionaires of the gilded age. And the Spanish-American war and building an empire. We all devoutly hope that the PRC doesn’t attempt to duplicate that last mistake.

@grumpy realist: “…(A) Chinese gov’t leery of physicists…because they have a philosophy that there is something absolute….”

How interesting. Never heard of that line of thought before R/T China (either confucian or communist). Couldja refer me to an author or text? Explain further?

@JohnMcC:

I second this request. My understanding was that many of the Chinese rulers were engineers:

Seems like the rulers of China should like physics.

I think the Chinese government frankly is just unfamiliar with how capitalism works, so they run experiments and make mistakes about institutions like financial markets, which they aren’t very familar with. I think the Chinese rulers are cautious, though, so I think they will find a way to rein this stuff in before things get too wild.

@An Interested Party:

China has ten times the population of Japan. China has four times the population of the US. Population isn’t everything, but population plus a growing GDP is also everything.

@stonetools:

Me:

You:

Yeah, but it was cute and clever. If I can’t be cute and clever on the internet, I’d die. You don’t want me to die, do you? 😉

In spite of all the economic events you mention, the US economy as a whole grew like kudzu over that span. The stock market is not the underlying economy. A large population with a relatively large income makes a massive market. China’s economy grew ~10% per year for the last 30 years. China’s income per capita is relatively small, but is growing. We are stalled on income per capita since about 1970. We’re coasting on productivity gains.

@grumpy realist:

Chinese need not be the language of trade, but they can still be the dominant economic power. But if in 20 years China is the Big Boy, more kids around the world will be trying to learn Chinese. The lingua franca is a slippery thing – hell, French isn’t even the lingua franca anymore and it hasn’t been for a century or more.

What is the likelihood that will not self-correct? If your choice is between “We will crush the world with our aggregate economic might” and “We must protect ourselves from temporary bad news” you’re probably going to choose the former sooner or later. You even see that: “I can see China coming to grips with bad company data (there’s a learning curve–but if your stock market keeps having wiggles and blow-ups because of bad company data, the Chinese government will probably at some point learn to deal with it.)”

@JohnMcC:

We moved on from our Gilded Age. What makes you think that China will not? Their technocrats and bureaucrats are as smart and as well educated as ours. It will probably be very ugly, and there will very likely be the Chinese equivalent of the Spanish-American War, and we will not like the outcome.

In 20 years China will be the 800 lb. gorilla and we will be the 750 lb. gorilla and Europe will be the 700 lb. gorilla and India will be the 500 lb. gorilla. 20 years after that, China will still be the 800 lb. gorilla and we will the 650 lb. gorilla, etc, etc.

@de stijl: China will not blatantly try to build an empire like countries did in the age of imperialism. Hell, they are already softly colonizing many African countries which gets very little press. Everyone seems concerned over their saber rattling about some uninhabited islands but no one seems to notice the various infrastructure deals they are making all over the continent. Nor does the extreme resentment of the natives in many of these nations to the Chinese businesses get much press. The Chinese seem to be smart enough to have realized that soft power and money are the way to go. It is how they plan to regain Taiwan, a sweet free trade deal.

@JohnMcC: Several years ago (am too lazy to Google it) the NYT ran an interview with a Chinese dissident who happened to be a physicist. He said that it was his physics background that had led him to start questioning a lot f the statistics that the local government was putting out because said statistics made no sense. I seem to recall he also casually dropped the comment that this was why the Chinese government was worried about physicists, because the study of physics led them to start questioning other things.

P.S. I’m not saying that the US is any better at the moment, given the number of politicians who seem to have fallen for the “cut taxes, everything will immediately get better!” or the number of politicians who say “hey, we had a blizzard, therefore no global warming!”

And let’s not get started on the anti-vaxxers….

@grumpy realist: We at least don’t, as far as I am aware, cook basic economic statistics.

Apropos of nothing, I recall a story from years ago. The American Physical Society held their annual convention in Las Vega. They were politely invited to not come back. These are people who understand probability. They didn’t gamble.

Physicists and engineers get along as well as general relativity and quantum theory.

@gVOR08:

I remember when Minnesota passed their lottery. I tried to explain to someone that playing the same numbers every time did not increase their odds of winning. And that no numbers are “due” based upon the last result.

I failed.

@Dave D:

My best friend is Nigerian American, and he recently came back from Nigeria. He says the Chinese are deeply involved in the Nigerian economy, down to the village level.

The African governments generally welcome Chinese involvement. Hey, its another source of capital and the Chinese are less concerned with stuff like the African governments’ human rights record. Africa has lots of untapped natural resources, and the Chinese need raw materials for their expanding population and industry.

Here’s a primer for those interested in the topic. China’s also making moves in Latin America, too. The sleeping giant is awake and on the move.

@gVOR08: Yes, I heard some of the stories that floated back from that (some of my friends had attended.) A lot of them would stand around the roulette tables making comments on the probability of winning…..unnerved a lot of the guests.

I don’t think this was the same time as a bunch of APS members who were card-counters sat down at the baccarat tables and won a sizable chunk of change.

Then there was the group from MIT who managed to hack the roulette wheels. Good times, good times….

@gVOR08: Yes, it looks like it was the lack of playing that caused a problem

@stonetools: Understated though. I work hand in hand with Nigerians and Kenyans on agriculture. The issue isn’t the hands off attitude of the Chinese when it comes to humans rights issues. The problem is the Chinese companies ship over thousands of workers and refuse to hire Africans. Africans won’t work 16 hour days seven days a week. The Chinese view this as being lazy and hire only Chinese. This means Africa is being mined of its natural resources yet again with no benefit to the local populace. They need a place to unload their very large workforce and found a way to exchange people for raw materials. Good for them bad for the countries they make resource deals with.

@Dave D:

I’ve read about Chinese concerns buying up land and resources in Africa, but had no idea they were exporting “workers” in the manner your friend describes. That’s spooky.

Confucian principles about work and Calvinism are pretty much aligned.

@de stijl: I have heard of this first hand too. You can find bundles of Chinese workers all over Africa.