Once Again, Nobody Wants A Dollar Coin

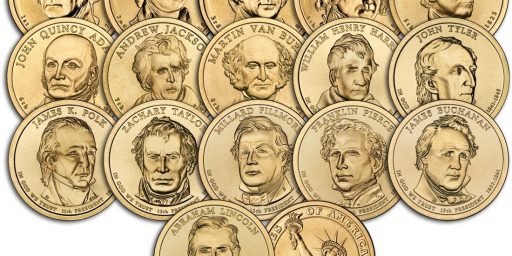

Take a good look at that dollar coin, because you're unlikely to see it circulation any time soon.

Today’s Washington Post reports that yet another attempt by the Federal Government to get people to stop using paper currency is failing:

How many $1 coins have you seen in circulation?

Since the Presidential $1 Coin Program launched in 2007, I have received just one during a commercial transaction. The cashier apologized profusely while passing me a tarnished coin bearing a likeness of John Quincy Adams. She told me she just wanted to get rid of it.

The Presidential $1 Coin Program is the federal government’s latest attempt to create a circulating $1 coin. To give the series the best possible chance of success, the authorizing legislation provided numerous measures to increase awareness and remove barriers to circulation.

By and large these measures have failed, as Americans continue to embrace paper currency. Louise L. Roseman, director of the division of reserve bank operations and payment systems, told Congress last month that “transactional demand for $1 coins has not increased materially since the start of the Presidential $1 Coin Program and overall demand continues to come primarily from collectors.”

Despite the lack of demand, the U.S. Mint has produced approximately 2 billion of the golden-colored $1 coins, with production continuing at about 500 million coins per year. This includes the four different $1 coins released each year featuring former presidents, plus one more annual design for the separate Native American $1 Coin Program.

As of May 31, the Federal Reserve Banks had nearly 1 billion $1 coins stockpiled in their inventory. The amount continues to grow with each $1 coin released and is expected to reach 2 billion by the end of the program.

This is the third time in 30 years that the Mint has attempted to get the American public to use a dollar coin. For two years starting in 1979, Americans were introduced to, and soundly rejected, the Susan B. Anthony Dollar. Then in 2000, the government came back with the Sacageawea Dollar, which failed largely because it wasn’t compatible with vending machines and the cost of converting the machines was too expensive. And, for the past three years, we’ve had the Presidential Dollar Coin, which, despite being widely unused still gets minted:

The obvious question is: If there is little transactional demand for the coins and an enormous stockpile already exists, why does the Mint continue to produce the coins in such great quantities?

The answer has to do with a legislative requirement of the coin program that was intended to ensure an adequate supply for commerce. By law, the Board of Governors of the Federal Reserve System must ensure that each design of the presidential $1 coin series released is available to financial institutions during an introductory period. To meet this requirement, the reserve banks are compelled to order new $1 coins from the Mint four times per year. The Mint diligently produces these. Quantities of the new $1 coins ordered by the Federal Reserve and not requested by financial institutions, as well as quantities that are ordered and then redeposited, continually add to the reserve banks’ inventory of $1 coins.

So, basically, there are vast quantities of dollar coins of at least two different varieties being minted that nobody uses.

The reasons for the failure seem rather obvious. First of all, carrying around, say, twenty dollars worth of dollar coins is a lot more inconvenient than a carrying around the same amount of money in paper currency. Second, people just don’t use cash of any kind as much as they used to. Credit cards and debit cards are both ubiquitous and far more convenient than either coins or paper for most transactions. If I can swipe my debit card to buy that Diet Coke at 7-11, why worry about how much cash is in my pocket ?

Of course, there’s one way the Mint could virtually guarantee that dollar coins end up in circulation, and that would be to follow the example of Canada, which eliminated the paper dollar after introducing the Canadian Dollar Coin in the 1980s. I’m not quite sure why this has never been tried in the United States, although I’m sure there’s some political, or pork barrel, reason behind it.

There is some good news, though, because it turns out the Federal Government actually “makes money” each time in mints a dollar coin that never gets used:

The Mint has been generating substantial “profits” from the production and stockpiling of unnecessary $1 coins. Each time a manganese brass disc of metal gets stamped into a legal-tender dollar, the Mint earns seigniorage based on the difference between the costs of production and the face value. In the most recent fiscal year, seigniorage earned through the production of $1 coins was $318.7 million, accounting for 63.5 percent of the Mint’s total seigniorage and net income.

Well, at least it’s something.

The rationale is that paper dollar bills are expensive to keep in circulation whereas coins last virtually forever. But you made the key point: For this to work, we have to get rid of the dollar bill.

Although I’d like to see us go cashless. It’s really a nuisance to constantly have small bills around for small transactions (tipping valets, bellmen, and the like). But I virtually never use cash aside from that sort of transaction.

“There is some good news, though, because it turns out the Federal Government actually “makes money” each time in mints a dollar coin that never gets used:”

If the Federal Reserve is the one paying the seigniorage (who else would pay it, if the Fed is the one commissioning the coins?), then isn’t it just a paper push between different governmental departments? Calling this a profit for the Mint is reasonable, but calling it a profit for the Federal Government is a joke.

The way the Obama administration and the fed are printing money it may not matter soon on the small bills. mpw

I’ve spent ca. 20 dollar coins just in the past week. Might have been more, but the last time I tried to get some at my bank they didn’t have any.

I personally prefer dollar coins as they are a lot easier to use in vending machines than bills that are worn, tattered, and generally a PITA to use in those machines. I was convinced when I was in the UK two decades ago and found the 1 pound coins very easy to use (they don’t have the 1 pounder in notes any more).

I use them to mark my golf ball on the green. I’m particularly fond of the Suzie B and the Sacagawea — seems I put better when I use them. Color me sexist, I guess.

Going cashless would be a disaster waiting, well, for a disaster. Those little pieces of plastic require a whole network to be operating to be of any value. In a disaster such as Katrina, there was a week when cash was king. Cash transactions require only two people, plus an asymmetric network in the background.

Of course, that doesn’t preclude the use of plastic for tips, but I suspect there would be some skepticism about having your card swiped by every Tom, Dick and Harriet and maybe it’d be a $5 tip plus transaction fee that appeared on your card. Does anyone expect the bellman to eat the bank charge? Not to mention the tax avoidance he’d miss out on.

Other than to replace the defunct paper dollar bill, I can’t think of one unique and necessary use for the dollar coin but as pointed out, there a several drawback, weight being a big one.

Carrying around 20 dollars in quarters is rather inconvenient too. That doesn’t mean no one uses quarters.

No, because the Federal Reserve isn’t a governmental department. It’s essentially a non-profit corporation.

My story is similar to DC Loser’s. Our family spent 2009 in Canada, and I quickly became fond of the loonies ($1CDN) and toonies ($2CDN) system. I believe part of the reason the $1 U.S. coins fail is because of the lack of a $2 coin, which decreases the quantity and weight of the change you carry around.

A second reason that the coins fail here is because you can’t use them in many vending machines. I vividly recall using a US Post Office machine to buy a few stamps, receiving something like $17 in silver dollars, and then realizing that I couldn’t use one of the silver dollars to buy one more stamp–the stupid machine wouldn’t take it.

There is a new Dollar coin?

Yes, that was also done in Brazil: the one real bill was eliminated.

The real key to making a dollor coin acceptable is to use non controversial, yet distinctive images applied with a rich traditional look. Literally marginalizing the mottoes was also a mistake.

I vote for a “Walking Liberty” obverse and an Ornate Spread Eagle reverse, with a traditional serrated edge and a “goldish hue” in the alloy.

A coin with universal accepability and universal imagery ,, something of substance and staying power, with just a touch of jingoistic jingle for the pocket.

I always thought the reason the dollar coins keep failing is that they’re almost indistinguishable from a quarter, at least by touch. The British pound is a wonderful thing — twice (at least) as thick as any other coin and fairly small, it’s impossible to mistake it for anything else.

“I always thought the reason the dollar coins keep failing is that they’re almost indistinguishable from a quarter, at least by touch. The British pound is a wonderful thing — twice (at least) as thick as any other coin and fairly small, it’s impossible to mistake it for anything else.”

Bingo!

I loved when they came out with the George Washington dollar. Same size, same weight, and almost the same image as the quarter. Its awesome when you think you are paying $1.50 for a toll but actually pay $6.

Yea, that’s certainly a problem. Don’t tell the government, though, instead of following the British example, they’ll bring back the Eisenhower Dollar.

I agree with Joyner, we want to replace the dollar bill we have to go all the way. We give people one year to get ready. At the end of the year all currency is replaced by new and all coins ad bills become worthless. In addition the new currency is set at a vaulue of 100 times the old. So the new penny is worth one old dollar, and the new dollar is worth 100 old dollars.

Finally, the new coin sizes range from the new penny being the size of the old dime and the new dollar the size of the old Eisenhower dollar.

Which does mean having to adapt a ton of vending machines, but that’ll give people something to do.