One of the Most Over-Rated Concepts in US Politics: “Skin in the Game”

This time via Senator Rick Scott.

Senator Rick Scott (R-FL) has an “11-Point Plan to Rescue America.” He apparently wants to save it from “the militant left” because “the hour is late for America”(whatever that means) but that is another conversation.* The NYT notes one element of the plan: Income Taxes for All? Rick Scott Has a Plan, and That’s a Problem. This means, specifically, as part of point number 5 (Economy/Growth), that “All Americans should pay some income tax to have skin in the game, even if a small amount. Currently over half of Americans pay no income tax.”

The piece raises the legitimate question of whether Scott is creating a political problem for Republicans by basically proposing raising taxes on over half the population, but I just want to focus on “skin in the game.”

Scott is quoted in the NYT piece as follows:

“The people that are paying taxes right now — I’m not going to raise their rates; I’ve never done it,” he said, before adding: “I’m focused on the people that can go to work, and decided to be on a government program and not participate in this. I believe whether it’s just a dollar, we all are in this together.”

The notion that it is advantageous for citizens to have some stake in government is not a new one, but the notion that the way for them to have “skin in the game” is specifically (if not exclusively) by paying one specific tax is just absurd.

First, and truly foremost, to have interest in how the government behaves does not require paying taxes at all. The outcomes on things like public safety, safe drinking water, and national security all accrue whether I pay nothing or a lot. This is all a collective enterprise. Further, the basic notion that somehow what one pays in and what one gets back is somehow commensurate simply doesn’t work.

Second, everyone pays taxes. One way or another we are paying sales taxes, property taxes, payroll taxes, and so forth, even if we end up not owing any income taxes specifically. The notion that a lower-wage worker who pays Social Security and Medicare taxes each paycheck is going to suddenly feel more invested in the system if they have to pay a token income tax makes no sense.

Also, the notion that people have just “decided to be on a government program” is just so much simplism. Further, if they really aren’t working, on what income will these persons be taxed?

Regardless, I know it sounds like some philosophical principle is being laid out to want people to “have skin in the game” but it really doesn’t mean anything. People aren’t going to care more because they pay one specific kind of taxes especially since most people do not know the difference between payroll taxes and income taxes (and often not between federal, state, and local taxes). All people mostly know that there is a difference between their gross income and their net income and that the difference is mostly “taxes” but the exact type is an abstraction.

Worse, all of this smacks of things like property requirements to vote: that the value of citizens is linked to their paycheck, not their inherent humanity.

Fundamentally people in a society have their literal skins in the game of life, regardless of their specific tax bill. They certainly don’t need some increase in a specific type of tax to make them have real stakes in government and its implications for their lives and those of there friends and family.

*Indeed, the whole plan is full of all kinds of fun, such as “We will secure our border, finish building the wall, and name it after President Donald Trump” and “We will protect the integrity of American Democracy and stop left-wing efforts to rig elections.”

I assume this is just a deeply cynical move. For years Republican politicians have justified tax cuts for the rich by cutting income taxes for everyone. But they have done this so often that many at the bottom of the income scale pay no income tax. So they need this group paying again so they can get their tax cuts for everyone scam working again. Maybe Rick Scott is disliked in the party and dumb enough to be duped into being the public face for this idea?

Ah, Rick Scott. If he’s really that concerned about the debt, I humbly suggest he pay back the money he accrued via fraud. After all, according to another annoying (in my view inaccurate) cliche, he stole it from the American tax payer.

Is it considered cosplay if you don’t need a costume to look like Lex Luthor?

I can even guarantee that lower income deciles face a higher relative tax burden (indirect + direct taxes as percentage of total income) than higher income deciles.

State taxes are highly regressive, causing households with lower incomes to face a (much) higher relative tax burden.

Combine that with a federal tax structure that is barely progressive, and you’ll end up with a situation in which poorer households pay a larger precentage of their income in taxes.

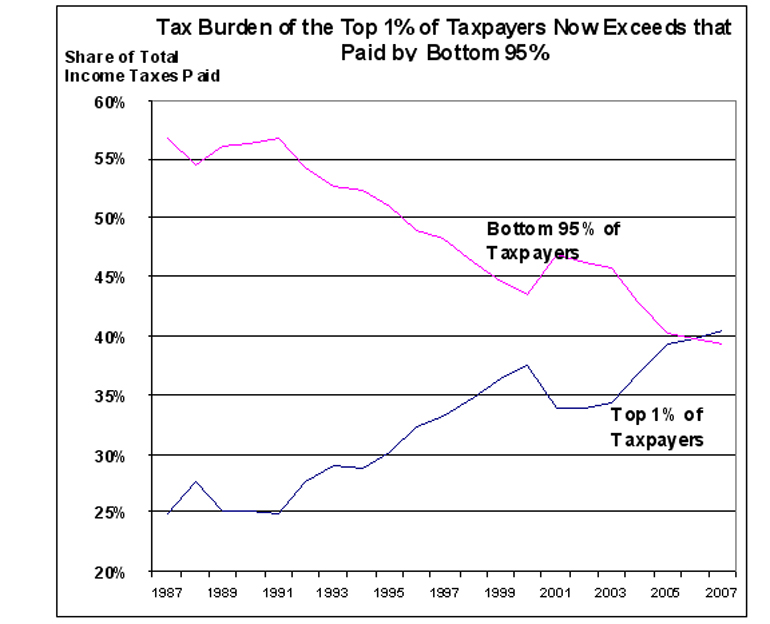

And this is only looking at income, not property, skewing this picture even further. Thus, the 1% in particular (who have lots of property but, relatively speaking, not much taxable income) are making out like bandits.

In other words, Republicans want to make a situation which is already very unfair (with the rich facing lower relative tax burdens than the poor) even more unfair.

Let that sink in.

The variation of this for which I have some sympathy was in Mitt Romney’s “47 percent” comment. It’s not so much that folks who don’t pay income taxes don’t have a stake in society—because, of course, they do—but that they are pretty easy to sell on “free” programs that someone else is paying for. While I support progressivity in the tax code, for reasons practical and ethical, I find the idea that we’re going to pay for Program X by “raising taxes on the rich” problematic even though I don’t fit into any normal conception of “rich.”

Oh, I think he’s using the word “skin” deliberately. It’s an iron rule with the GOP that certain people who usually vote Democratic are moochers on the system that hard-working Republican voters pay taxes to. Remember Mitt Romney’s famous speech in 2012 about “the 47%”? Here’s the main quote:

“There are 47 percent of the people who will vote for the president [Obama] no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that’s an entitlement. And the government should give it to them. And they will vote for this president [Obama] no matter what…These are people who pay no income tax.”

So Scott’s comments are nothing new, just repeating the same old complaints the GOP has always used. Lather, rinse, repeat.

I don’t. It’s about dawg damned time they paid their way.

Its always and only about the income tax. The next time you hear a Republican talk about the total tax package may be the first time for a lot of people. If you search around you can find some Republicans who are willing to address that, but those arent the ones who run the party.

Steve

If for a moment, we accept Scott’s concept of skin…, it becomes a simple, logical extension that those who benefit most from government, i.e. the wealthy, should pay more in taxes due to the benefits they accrue.

It’s hard to understand why Scott believes this is a political winner. As a throwaway, campaign trail sound bite, that will never go further than an utterance, sure, but in a larger proposal that pretends to layout the parties legislative plans?

Property requirements to vote aren’t about paychecks.

Several free associations to this:

I tend to be a big advocate for “skin in the game” — as a general principle and especially when weighing the merits of people’s opinions. That said, I am skeptical of its specific application to the income tax.

On net, I think that “skin in the game” is under-rated in principled application and over-rated in nauseating demagoguery.

It’s interesting to see people focus exclusively on income taxes in some respects and turn around and focus exclusively on the overall tax burden in others. The inconsistency is noteworthy but unsurprising. It’s almost like there’s something other than taxation that is being addressed.

In some charitable contexts, specifically those involving clothing/food/etc, there is a general policy of “you must pay something.” Although not framed as “skin in the game” per se, this policy is rooted in notions of self-efficacy and dignity. There’s something to be said for that.

It’s interesting to consider “skin in the game” wrt other issues like, say, the draft, mandatory public service, etc. My own hot-takes on these different issues are often inconsistent. This intrigues me — when I notice it — and makes me wonder why.

@James Joyner: I expected somebody’d bring up Romney’s 47%, but I was surprised it was you. I thought you liked him. That remark may have cost him the presidency, as it should have.

He said there were 47% who didn’t pay income tax, 47% who were dependent on government, and 47% who wouldn’t vote for him. There were indeed, at the time, 47% of households who didn’t pay income tax. The number of people dependent on government is undefined and unmeasured. And in delicious irony it turned out about 47% DID vote for Romney. And he implied his three 47% were the same 47%, which is silly. I was working for a defense contractor at the time. So I was dependent on the government. And I would never vote for Romney. But I did pay significant income tax. At a higher effective rate than many rich people.

Romney was just pandering to his wealthy audience (with one sneaky waiter who deserves a Medal of Freedom). And Scott’s plan is an effort to pander to the MAGA base by collecting a bunch of talking points. A clumsy attempt which shows how out of touch Scott is.

@James Joyner:

I pay a higher effective tax rate than the “rich” (due to both tax law and complex tax sheltering schemes), so I’d ask that you reconsider who is taking advantage of other people’s money. Knowing how wealth is distributed in this country, “soaking the rich” is merely returning the favor.

Scott is in the fundraising section of his presidential run. In the Republican Party that means attracting Koch money, or some other billionaire’s so he is talking about taxing the poor to attract them. When he declares and actually is trying to get votes it will have morphed into something else. It won’t matter, the billionaires who own him will be holding his chit.

@James Joyner: I understand where you are coming from, but I think there are some major problems with this notion if it is linked solely to income taxes. For one thing, health care and retirement programs are funded by payroll taxes, not incomes taxes.

Second, no matter what the real tax structure is, most people think that “the rich” are somebody else (or that one day they will be “rich” and don’t want to be taxed). I don’t think the actual structure of tax policy changes any of that.

Not too mention that aggregate numbers are so huge relative to the individual that it is an abstraction as to how much skin any specific person really has in the game.

Not to mention few of us really know exactly what income taxes we are paying until we do our taxes (e.g., I am getting a larger than expected refund this year because I over-adjusted my withholding to try and balance off having to pay more than expected the last couple of years).

I also have a hard time with this focus on income taxes since a lot of very wealthy people don’t earn income that is taxable under the same category as salary.

@Mimai: I don’t object to the concept in the abstract. I do, however, find any linkage of a specific tax to being the linchpin of citizen connectivity to the broader society to simply be incorrect on a number of levels.

I understand that, for example, if I am playing cards for money or have bet on a football game, my level of interest in the outcome is heightened, and that relative level of interest is linked to the amount I have on the line. I just find all of that not as analogous to living in society as some like to claim.

For example, the reality is that Bill Gates has a lot less to worry about as it pertains to various policies of the government than does someone who makes so little money as not to owe income taxes.

@Not the IT Dept.: ““There are 47 percent of the people who will vote for the president [Obama] no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims,”

The truly hilarious thing about that is that the entire Republican platform consists of believing they are victims, and thus they are entitled to do whatever they want to those they consider their oppressors.

@Steven L. Taylor: GOPs focus on the income tax because it’s the only tax we have that even pretends to be progressive.

Years ago J. K. Galbraith argued we should replace the income tax with a VAT or something similar. He had three reasons. One, economists always prefer consumption taxes. Two, it could raise more money, which the government needs. And three, resentment of the income tax drives a lot of Republican donors. Removing it would largely defund the Republican Party.

@gVOR08:

R’s will never trade the income tax for VAT