Pandemic-Induced Inflation Ends

Our long national nightmare is over.

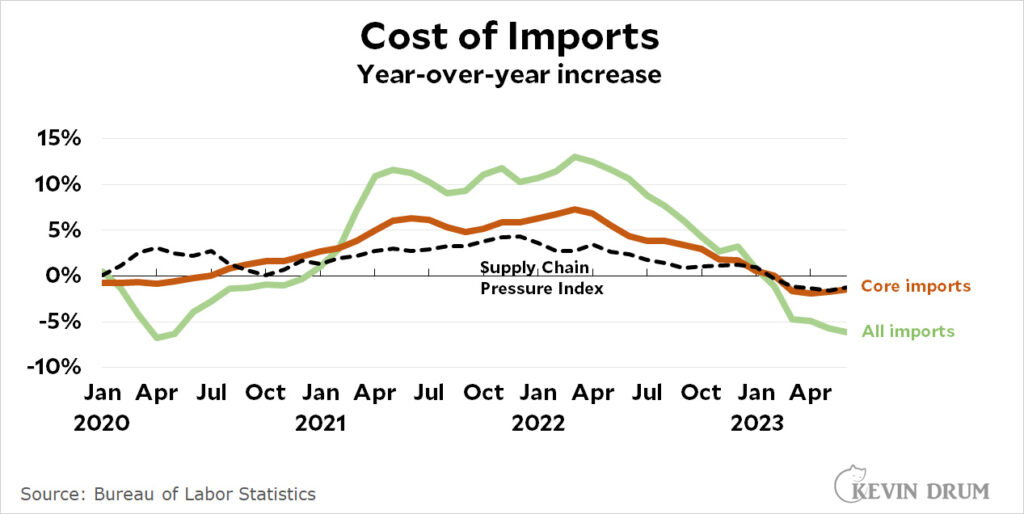

Kevin Drum had back-to-back posts on inflation yesterday. The most recent, “Imports are getting cheaper and cheaper,” is supported by this graph:

and concludes with this analysis:

What’s happened is simple: when production cratered during the pandemic, supply declined and imports therefore cost more. Once everything recovered, however, there was no reason to think that goods would stay at high prices. Instead, with supply restored to normal, prices are falling back to their old levels.

This is different from what happens during a monetary inflation: Even when the inflationary episode ends, there’s still way more money sloshing around in the system and prices remain at high levels. They just stop going up.

This is yet more evidence, as if any more were needed, that pandemic inflation was not normal inflation. It was not the ’70s; it wasn’t even the ’50s. It was purely artificial, caused by a virus that killed off supply along with fiscal stimulus that maintained demand. When the virus and the stimulus went away, so did inflation.

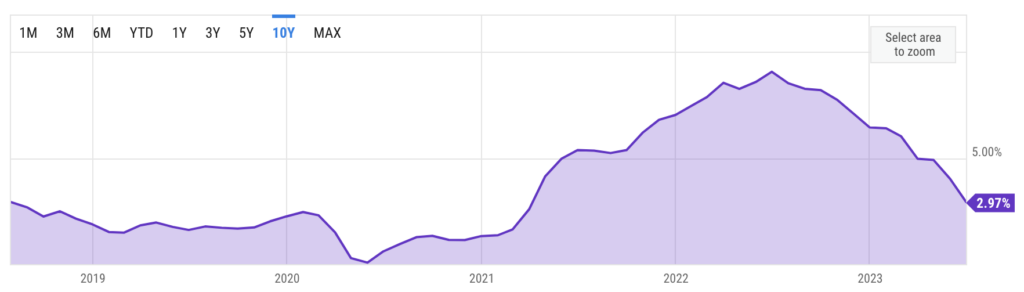

And, indeed, we’re currently at 2.97% inflation, roughly where we were before the pandemic and below the historical average.

This followed a reflective post titled “Team Transitory has been right all along—but way too optimistic.”

In 2021, when inflation started to take off, there were two opposing sides: Team Transitory and Team Structural. In particular, Team Transitory believed that taming inflation didn’t need a lot of help from the Fed because it was fundamentally the result of temporary pandemic supply shocks that would fade on their own.

I’ve been on Team Transitory consistently from the start because I think nearly every scrap of evidence points in that direction.

Agreed. Indeed, to the degree that I blamed policy for it, it was at the margins and related to the aforementioned stimulus, which I still believe was way larger than it needed to be under President Biden.

But every single member of Team Transitory—including, ironically, me—made a big mistake. We forgot Kevin’s Law: “Everything takes longer than you think.”

If prefer Hofstadter’s Law: “It always takes longer than you expect, even when you take into account Hofstadter’s Law.”

In any case, our initial notion that the inflationary burst would last nine months or so was laughable. We all should have known better. There’s absolutely no support in the historical record for such a short inflationary episode in the US.

Which he supports with yet another chart:

In fairness, since this bout was almost entirely a function of a global pandemic and its follow-on effects on the supply chain, comparing it to past episodes is probably not all that useful for forecasting. We know now that it seems to have taken a little over two years to sort itself out. But I don’t know that anyone was predicting the supply chain mess to begin with. How were they supposed to figure out how long it would take to get to a new normal?

Some are giving credit to the Fed for strangling the economy with rate hikes. But that was quite probably completely unnecessary.

“Some are giving credit to the Fed for strangling the economy with rate hikes. But that was quite probably completely unnecessary.”

And yet the Fed is planning to do some more rate hikes, possibly as soon as the end of this month.

This serves as a good reminder that you seldom go wrong doing the opposite of what Larry Summers says.

My first experience with inflation was the 1970s. At that time there was a lot of talk and theorizing, but it was largely ineffectual. Our current episode generated much of the same talk, but our government didn’t take obviously laughable measures like WIN buttons. Have we been lucky this time, or are the people in control of the money smarter than their last generation counterparts? I never hear anyone say that the economy is too big to understand; let me say that I don’t understand. Does anyone?

@Slugger: Drum outlines a working theory: this round of inflation was caused by side effects of the pandemic and so is retreating naturally as those effects wind down.

@Moosebreath:

Because Powell is a finance bro and a Trump appointee who is deliberately trying to cause a recession:

1. To get Trump back in office

2. Break the will of workers so we can get back to the “our way or the highway” era of employment

Reappointing Powell remains Biden’s single biggest mistake as President

If you look at all of the numbers what you see is that inflation is worse than it was in the 80s, yet confidence in the economy is much worse. Unemployment too and most other economic indicators. Some of that is due to tribalism so the GOP will say the economy is awful whenever a DEM is POTUS but a lot is the coverage by the media.

Steve

Hofstadter’s Law. I don’t recall having seen that before. But thank you for the blast from the past. Douglas Hofstadter is the author of Gödel, Escher, Bach.Possibly the greatest book ever. Scientific American had a book review column. It usually covered half a dozen books briefly. GEB got the whole column and the writer sounded like he was reviewing the second coming. I thought I wanted a copy, but book reviews come out months before the release, and I thought this is pretty specialty and weird, what department would it be in and would I remember to look. At the time I lived in Ann Arbor. About every week we’d spend a few hours in the Borders book store. The original and at the time only Borders. They knew their audience. When the book was released we walked into the store and found a case of GEB laying open on the floor by the door.

Later I was reading it and chuckling. My wife asked what was so funny. I said it was hard to explain, which miffed her. She asked me to show her. So I showed her a page of symbolic logic. It was funny, but took a chapter to get there.

I predicted the mess. So did many others. A tightly-linked, just-in-time supply chain is not a robust one. People have be warning about that for years before Covid-19. SARs and other scares should’ve been final wake-up call. Plus this first hit China, home to the greatest number of critical component and manufacturing businesses. The oscillating disruptions are still ‘ringing’ through our economies. I’d guessed it might take at least three years to work through the worst of the mess after the pandemic was finally managed.

We also get to see that the workforce is not infinitely flexible. It takes time to cover expertise loss from retirement, retrain workers & managers, and build new capabilities where they weren’t present before. This all takes years.

Aside: Russia’s war didn’t help, triggering whiplash in European energy sector and a massive spend on military defense. As the chickens finally come home to roost, Germany and other countries are finally addressing decades of neglect in energy infrastructure and defense.

The good thing is that a lot of the spend on infrastructure, geographical diversification, resilient sourcing and just giving cash to consumers (rather than tax cuts to the wealthy) will actually produce useful dividends in the long term.

Aside: Covid also suddenly dumped a bolus of inheritances on many families perhaps about 3-8 years earlier than anticipated. Not sure how that distortion will propagate…

Except aggregate prices haven’t returned to pre-pandemic levels. The inflation rate returning to pre-pandemic levels (still positive) is not the same thing.

Certainly some things have returned to 2019 prices for a net zero increase, but not overall.

And there were real wage gains during the pandemic, so there is more money “sloshing around” than pre-pandemic. Wages being sticky are not likely to go back down.

As an engineer I was trained to be very careful and explicit about units of measure. Economists and finance people make me crazy. An example: percentages can be handy, but the Arabs invented the decimal point centuries ago, why are there basis points?

Following the link to the graph above that shows 2.97%, I find nothing that says just what it’s a graph of. It appears to be U. S. CPI over 12 months, otherwise known, unhelpfully, as headline inflation. IIRC in another recent post Drum notes current inflation (think d$/dt) is 0.2%. And even he is sloppy in not noting that’s (I think) an annualized rate. (For the one or two people who may care, d$/dt is more correctly (delta$/month)/$(1).) Which is to say inflation (U.S. CPI) May to June was essentially zero.

So three points. One, economists (following finance people) are sloppy, as are financial journalists. Two, inflation right now is not 2.97, it is ~= zero. The target is 2, so three, unless things change, if Jay Powell raises rates any more it’s because he’s a partisan a whole who wants a recession before the election.

@Andy: Prices have returned (overall, roughly, kinda) to prior levels, inflation adjusted. Also, too, deflation would be bad.

@Argon: Good analysis. I’ve often thought over the last few years that economists don’t understand logistics. The supply chains took decades to evolve. You can’t take all the pieces, put them in the box, shake them, dump them on the floor, and expect them to reassemble quickly.

I recall the big Taiwan chip outfit saying at the height of the chip shortage that if GM wanted chips today they shouldn’t have stopped ordering them a year ago.

Right now, prices of Alaska king crab are sky high because the population of the critters has crashed. To me, that is not inflation, and playing with the Fed funds rate is not going to put more crabs into the sea. If the recent run up in all prices was due to widespread supply shortages, then the manipulation of the interest rates might have been unnecessary. I’ve recently been in Argentina, and confidence in the government is a factor in their inflation. Our government needs to maintain our confidence.

I remember lumber and other construction materials went thru the roof because all the mills and manufacturers expected a crash in construction. Instead, they just kept right on building.

If you look at the UK and the EU, our inflation is far lower. I would be wary of any theories and explanations that are global when you are looking only at US data.

I would also enjoy wary of looking at just the the US and Europe, of course. I just picked the EU as a semistable area with the same level of industrialization and consumerism, and added the UK for fun as they seem hell bent on deliberately shooting themselves in the foot.

I don’t think you have the data to back up your assertion about interest rates. And I don’t think Drum has the data to back up his assertions that it was all Covid supply chain issues — he might be right, but he isn’t showing the data.

(I suspect he is partially right, but that Covid affecting supply chains isn’t the only thing going on — large complex systems are large and complex and there are a dozen causes for everything. What’s the cost of labor in China and Vietnam doing these days?)

Also, on interest rates, we now have the ability to lower the interest rates the next time we need to stimulate the economy, which we really didn’t when they were so low. Is that worth the increased costs for large purchases now? I dunno, but it feels more like a return to the norm than anything else.

@gVOR10: I think basis points exist because, for somebody anyway, raising the Fed rate by “3 basis points” sounds a lot more like you’re doing something than raising interest rates “3 hundredths of one percent.”

Whereas I am cursing them, because the TIPS funds that I bought as a hedge against inflation actually LOST VALUE during the inflation bubble, because the Fed raised rates enough that the resulting depression in existing bond prices more than offset the inflation adjustment. Bastards.