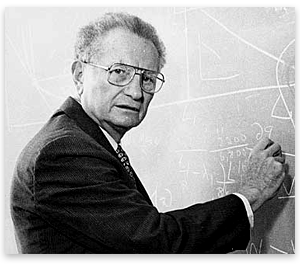

Paul Samuelson, Revolutionary Economist, Dead at 94

Paul Samuelson, described in the first sentence of his NYT obit as “the first American Nobel laureate in economics and the foremost academic economist of the 20th century,” died over the weekend at the age of 94.

Paul Samuelson, described in the first sentence of his NYT obit as “the first American Nobel laureate in economics and the foremost academic economist of the 20th century,” died over the weekend at the age of 94.

In receiving the Nobel Prize in 1970, Mr. Samuelson was credited with transforming his discipline from one that ruminates about economic issues to one that solves problems, answering questions about cause and effect with mathematical rigor and clarity.

When economists “sit down with a piece of paper to calculate or analyze something, you would have to say that no one was more important in providing the tools they use and the ideas that they employ than Paul Samuelson,” said Robert M. Solow, a fellow Nobel laureate and colleague of Mr. Samuelson’s at M.I.T.

Mr. Samuelson attracted a brilliant roster of economists to teach or study at the university, among them Mr. Solow as well as others who would go on to become Nobel laureates like George A. Akerlof, Robert F. Engle III, Lawrence R. Klein, Paul Krugman, Franco Modigliani, Robert C. Merton and Joseph E. Stiglitz.

Mr. Samuelson wrote one of the most widely used college textbooks in the history of American education. The book, “Economics,” first published in 1948, was the nation’s best-selling textbook for nearly 30 years. Translated into 20 languages, it was selling 50,000 copies a year a half century after it first appeared. “I don’t care who writes a nation’s laws — or crafts its advanced treatises — if I can write its economics textbooks,” Mr. Samuelson said.

His textbook taught college students how to think about economics. His technical work — especially his discipline-shattering Ph.D. thesis, immodestly titled “The Foundations of Economic Analysis” — taught professional economists how to ply their trade. Between the two books, Mr. Samuelson redefined modern economics. The textbook introduced generations of students to the revolutionary ideas of John Maynard Keynes, the British economist who in the 1930s developed the theory that modern market economies could become trapped in depression and would then need a strong push from government spending or tax cuts, in addition to lenient monetary policy, to restore them. Many economics students would never again rest comfortably with the 19th-century view that private markets would cure unemployment without need of government intervention.

That lesson was reinforced in 2008, when the international economy slipped into the steepest downturn since the Great Depression, when Keynesian economics was born. When the Depression began, governments stood pat or made matters worse by trying to balance fiscal budgets and erecting trade barriers. But 80 years later, having absorbed the Keynesian teaching of Mr. Samuelson and his followers, most industrialized countries took corrective action, raising government spending, cutting taxes, keeping exports and imports flowing and driving short-term interest rates to near zero.

[…]

Though Mr. Samuelson was President Kennedy’s first choice to become chairman of the Council of Economic Advisers, he refused, on principle, to take any government office because, he said, he did not want to put himself in a position in which he could not say and write what he believed.

After the 1960 election, he told the young president-elect that the nation was heading into a recession and that Kennedy should push through a tax cut to head it off. Kennedy was shocked. “I’ve just campaigned on a platform of fiscal responsibility and balanced budgets and here you are telling me that the first thing I should do in office is to cut taxes?” Mr. Samuelson recalled, quoting the president. Kennedy eventually accepted the professor’s advice and signaled his willingness to cut taxes, but he was assassinated before he could take action. His successor, Lyndon B. Johnson, carried out the plan, however, and the economy bounced back.

[…]

Remarkably versatile, Mr. Samuelson reshaped academic thinking about nearly every economic subject, from what Marx could have meant by a labor theory of value to whether stock prices fluctuate randomly. Mathematics had already been employed by social scientists, but Mr. Samuelson brought the discipline into the mainstream of economic thinking, showing how to derive strong theoretical predictions from simple mathematical assumptions. His early work, for example, presented a unified mathematical structure for predicting how businesses and households alike would respond to changes in economic forces, how changes in wage rates would affect employment, and how tax rate changes would affect tax collections. His relentless application of mathematical analysis gave rise to an astonishing number of groundbreaking theorems, resolving debates that had raged among theorists for decades, if not centuries.

In the “my, how times have changed” department:

But the publication of his dissertation was an immediate success. It won him the John Bates Clark Medal awarded by the American Economic Association to the economist showing the most scholarly promise before the age of 40; it would eventually help him win his Nobel, and it was frequently reprinted despite the heavy resistance of Professor Burbank, selling to economists around the world for more than 20 years. (“Sweet revenge,” Mr. Samuelson said.)

Among Mr. Samuelson’s fellow students was Marion Crawford. They married in 1938. Mr. Samuelson earned his master’s degree from Harvard in 1936 and a Ph.D. in 1941. He wrote his thesis from 1937 to 1940 as a member of the prestigious Harvard Society of Junior Fellows. In 1940, Harvard offered him an instructorship, which he accepted, but a month later M.I.T. invited him to become an assistant professor. Harvard made no attempt to keep him, even though he had by then developed an international following. Mr. Solow said of the Harvard economics department at the time: “You could be disqualified for a job if you were either smart or Jewish or Keynesian. So what chance did this smart, Jewish, Keynesian have?”

He managed to get by despite these obstacles.

Paul Krugman, himself a Clark and Nobel winner and a former colleague of Samuelson’s at MIT, remembers him fondly:

It’s hard to convey the full extent of Samuelson’s greatness. Most economists would love to have written even one seminal paper — a paper that fundamentally changes the way people think about some issue. Samuelson wrote dozens: from international trade to finance to growth theory to speculation to well, just about everything, underlying much of what we know is a key Samuelson paper that set the agenda for generations of scholars.

And he was a wonderfully down-to-earth human being besides. For a number of years I shared an office suite with him and Bob Solow; he always had time to talk, and was completely without airs.

Andrew Samwick, who studied at MIT, notes this ‘graph from the NYT obit:

Despite his celebrated accomplishments, Mr. Samuelson preached and practiced humility. The M.I.T. economics department became famous for collegiality, in no small part because no one else could play prima donna if Mr. Samuelson refused the role, and, of course, he did. Economists, he told his students, as Churchill said of political colleagues, “have much to be humble about.”

Says Samwick, “Everyone I met at MIT in those days paid this favor forward. It was a wonderful place to be a graduate student.”

Mario Rizzo, an economist at NYU, would “like to strike a discordant note,” lamenting the quantification of economics that Samuelson’s influence brought about.

I believe that economics would be far better with more philosophy and less mathematics. I believe that the profession has, because of the formalistic direction in which it has traveled, more than its share of idiot savants. The interesting thing for me is that when a man so influences the course of economics as Samuelson did those who enter the discipline after him are largely (though not entirely) those who like the kind of intellectual constructs, methods, attitudes he promoted — those who have a comparative advantage in this sort of thing. So in a way the whole phenomenon is self-congratulatory. “That Samuelson was great. He made economics into something I am really good at.” Selection bias at work.

I have the same lament about political science, including the study of international relations, which in most of the academy is over-focused on statistical analysis at the exclusion of theory or even facts on the ground (because datasets are often years out of touch). But just because something has swung too far doesn’t mean the impulse isn’t good. Applying methodological rigor and, yes, mathematics can help increase our understanding of social phenomena. That doesn’t mean statistics should become a cult.

It’s probably because if they based their work largely on past events and facts on the ground, they’d really be almost indistinguishable from historians. Maybe that would be a good thing – there is certainly a place for “political historians”.

There’s a recent interview of Samuelson which is a fun read if you like to read

curmudgeonsfree spirits scoring points on their peers and successors. Sample line:I think the notion proffered by Rizzo is correct: let’s not let statistical virtuosity come at the expense of well debated economic philosophy. Why? Because economics is not physics. We can learn so much from analytical techniques in economics, but the complex and rapid variability of data in real world economics renders much of the analysis a bit “fuzzy.” We must introduce expert judgment.

Statistical wizardry becomes the same “fastest gun in the west” debate between, say, Keith Richards and Eddie Van Halen.

Samuelson was obviously a towering intellect in the profession, and due all respect. Long time readers might rightfully expect that I have a preference for a certain M. Friedman, no stranger to data, but no slave to it, and its questionable manipulation. Friedman, I think, would echo the Rizzo comment, and invoke more empirical results.