Shooting Fish in a Barrel: Democratic Underground Economics

Every now and then it is fun to stroll through the assylum…errr Democratic Underground and see what is going on. Of particular interest to me is the economic forum. Here is one post that I found amusing. It also gives me a chance to explain what exactly is hyperinflation.

Using Google I’ve found several definitions that are all fairly close,

Rapid, out-of-control inflation at double digit rates per month and more, usually occurring only during wars and periods of severe political instability. Hyperinflation was made infamous by pictures of Germans pushing wheelbarrows full of banknotes to buy pints of milk in the 1930s. Inflation was so high that the value of their money fell hour by hour, so the nation went out and bought everything it could in the hope that material goods might retain their value.–Google’s Definition.

Not bad. Double digit inflation at a monthly level would mean pretty rapid (nominal) price changes over a single year. For example, if the inflation rate is 10%/month then that would mean that prices (on average) would be about 285% higher at the end of a year.

In economics, hyperinflation is inflation which is “out of control”, a condition in which prices increase rapidly as a currency loses its value. No precise definition of hyperinflation is universally accepted. One simple definition requires a monthly inflation rate of 50% or more.–Wikipedia

Also not bad. Definitely in the double digit range, and at the end of one year prices would have increased about 8,650%.

So, is the inflation in the United States anywhere near this level? F*ck no. The Consumer Price Index measures the change in prices over time (at the monthly level) and does so using weights and a basket of consumer goods. That basket is pretty broadly defined and incorporates energy, food, housing, socks, movies, popcorn, and lipstick. And even if it is mis-measured by half, that would set the current rate of change in the CPI at around 10.2% which just barely qualifies as “hyperinflation”.

Further, there are a number of reasons to believe that the CPI overestimates changes in the cost of living. For example, suppose there is a sale for the following goods,

- toilet paper,

- paper towels,

- tuna fish,

- macaroni and chese.

Now if the consumer goes out and buys lots of these items because they are on sale, and then draws down these stocks when the sale ends, the current manner in which the CPI is calculated (a geometric means formula) will overstate, by a small amount, changes in the cost of living. The reason for this is that the CPI is not really a cost of living index, and most researchers in this area will tell you that these indexes usually have an upwards bias.

So if anything the 5.1% that we have seen for the first four months of 2006 is probably a tiny bit too high. There is no hyperinflation in the U.S. Taking individual comodities and trying to use the changes in prices to justify the claim of hyperinflation suffers from the fallacy of composition. Sure gasoline may have made some significant moves in recent months, and sure gasoline is something consumers spend alot of money on. But it is still a small fraction of consumption spending. For example, in 2005 annual personal consumption expenditures were over $8.7 trillion dollars, while gasoline, fuel oil, and other energy goods accounted for only $310.6 billion dollars. Medical services amounted to a larger share of personal expenditures, but still it was only $1,510 trillion.

There is other nonsense in that thread as well, such as,

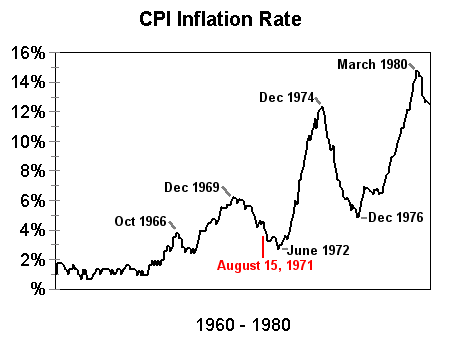

In the late 1960s and throughout the 70s we had real inflation where wages and prices went up together. What a lot of people have totally forgotten is President Nixon’s wage and price controls, imposed in August of 1971, which led to very high inflation rates of the late 70’s. Indeed, Carter is unfairly blamed for that high inflation, when it was Nixon’s foolish economic policies which produced it.

There are at least two problems here. If your wages go up by exactly the same percentage as prices (on average) then you are neither worse off, nor are you better off. If, on the other hand, you have a fixed income (e.g. a retiree with a fixed pension payment per month) then you are well and truly out-of-luck as the cost of living go up, but your income stays the same. In this case, your income’s purchasing power is declining. Hence, at best the inflation we had in the late 60’s and early 70’s was a bad thing. Which brings us to the other part of the post, the price controls. Price controls can indeed stop inflation. The only problem is that it can also lead to shortages, which is precisely what was observed. If prices are rising because of changes in supply and/or demand then price controls wont do much other than instead of paying more via your wallet, you will no pay by going without.

But were the price controls what lead to the high inflation under Carter? No.

Inflation peaked in December of 1974 and didn’t start to rise (consistently) again until well after December 1976 over 2 years later. What were the causes of that inflation? Well there are at least two things that come to mind. First off were the large increases in the price of oil. This made not only gasoline more expensive which would push up the inflation rate, but if such a price increase is seen as permanent then it would eventually push up other prices as well. The second cause would be the idea that unemployment and inflation were inversely related. Raise the inflation rate, drive down unemployment. This was a mainstay of macroeconomic thinking at the time, but eventually the public caught onto it and all you got was increasing prices and no change in unemployment. Were either of these things “Nixon’s fault”? No. Heck, it wasn’t even Carter’s fault either.

So while “Shrub” maybe a horrible president, and the economy may not be fantastic, this idea that we have hyperinflation is just moronic. Well, at least DU provides a home for these moonbats.

You use Google? You commie China sympathizer!!!!

Good post. Inflation in the 1970s converted more baby boomers to conservatism than any other problem.

A 4.6% unemployment rate is not great? Unlike the bubble experienced during the Clinton years due to tech stuff, this economy is based upon reality. Growth is big. What is it that is lacking?

Might I point out that the difference between 5.1% annual inflation and 10% per month inflation is more than a factor of two.

Sorry, but I don’t understand your numbers. An inflation rate of 10%/month for 1 year would be 1.1^12=3.138, or a 214% increase, not 285%. An inflation rate of 50%/month for 1 year would be 1.5^12=129.746, or a 12,875% increase, not 8,650%.