Social Security Isn’t ‘Cash Negative’ – We Are

Social Security outlays are exceeding its income. Is that really a problem?

A Washington Post-Bloomberg special report offers an alarming assessment of Social Security. Liberal economists argue that it’s bunk.

Under the headline “The debt fallout: How Social Security went ‘cash negative’ earlier than expected,” Lori Montgomery explains:

Last year, as a debate over the runaway national debt gathered steam in Washington, Social Security passed a treacherous milestone. It went “cash negative.”

For most of its 75-year history, the program had paid its own way through a dedicated stream of payroll taxes, even generating huge surpluses for the past two decades. But in 2010, under the strain of a recession that caused tax revenue to plummet, the cost of benefits outstripped tax collections for the first time since the early 1980s.

Now, Social Security is sucking money out of the Treasury. This year, it will add a projected $46 billion to the nation’s budget problems, according to projections by system trustees. Replacing cash lost to a one-year payroll tax holiday will require an additional $105 billion. If the payroll tax break is expanded next year, as President Obama has proposed, Social Security will need an extra $267 billion to pay promised benefits.

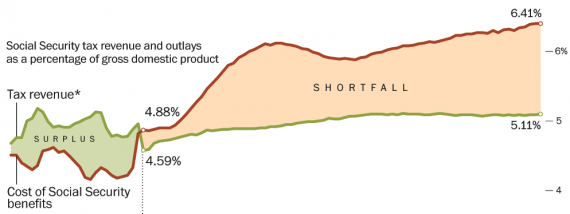

The story comes with this handy dandy graphic:

The facts here are not in dispute. But the interpretation most certainly is.

Dean Baker of the Center for Economic and Policy Research is incensed that WaPo would run “a lead front page story that would have been excluded from most opinion pages because of all the inaccuracies it contained.”

The basic premise of the story, as expressed in the headline (“the debt fallout: how Social Security went ‘cash negative’ earlier than expected”) and the first paragraph (“Last year, as a debate over the runaway national debt gathered steam in Washington, Social Security passed a treacherous milestone. It went ‘cash negative.'”) is that Social Security faces some sort of crisis because it is paying out more in benefits than it collects in taxes. [The “runaway national debt” is also a Washington Post invention. The deficits have soared in recent years because of the economic downturn following the collapse of the housing bubble. No responsible newspaper would discuss this as problem of the budget as opposed to a problem with a horribly underemployed economy.]

This “treacherous milestone” is entirely the Post’s invention, it has absolutely nothing to do with the law that governs Social Security benefit payments. Under the law, as long as their is money in the trust fund, then Social Security is able to pay full benefits. There is literally no other possible interpretation of the law.

As the article notes the trust fund currently holds $2.6 trillion in government bonds, so it is nowhere close to being unable to pay benefits. The whole point of building up the trust fund was to help cover costs at a future date when taxes would not be sufficient to cover full benefits. Rather than posing any sort of crisis, this is exactly what had been planned when Congress last made major changes to the program in 1983 based on the recommendations of the Greenspan commission.

This had me scratching my head. The “trust fund” consists of money that the federal government owes itself! Baker thinks this a minor point:

The article makes great efforts to confuse readers about the status of the trust fund. It tells readers:

“The $2.6 trillion Social Security trust fund will provide little relief. The government has borrowed every cent and now must raise taxes, cut spending or borrow more heavily from outside investors to keep benefit checks flowing.”

This is the same situation the the government faces when Wall Street investment banker Peter Peterson or any other holder of government bonds decides to cash in their bonds when they become due. In such cases it “must raise taxes, cut spending or borrow more heavily from outside investors.” The Post’s reporters and editors should understand this fact.

The article then goes on to incorrectly accuse Senate Majority Leader Harry Reid of misrepresenting the finances of Social Security:

“In an MSNBC interview, he [Senator Reid] added: ‘Social Security does not add a single penny, not a dime, a nickel, a dollar to the budget problems we have. Never has and, for the next 30 years, it won’t do that.’

Such statements have not been true since at least 2009, when the cost of monthly checks regularly began to exceed payroll tax collections. A spokesman said Reid stands by his comments and his view that Social Security is entirely self-financed.”Of course Senator Reid is exactly right. The system is self-financed under the law. In 2009 it began drawing on the interest on the government bonds it held. That is exactly what the law dictates, when Social Security needs more money than it collects in taxes, it is supposed to draw on the bonds that were purchased with Social Security taxes in the past. This means it is self-financing.

This strikes me as tantamount to treating accounting as a religion. Just because there’s money on the books doesn’t mean it actually exists. But Paul Krugman makes the argument in a more persuasive manner:

Social Security is a program that is part of the federal budget, but is by law supported by a dedicated source of revenue. This means that there are two ways to look at the program’s finances: in legal terms, or as part of the broader budget picture.

In legal terms, the program is funded not just by today’s payroll taxes, but by accumulated past surpluses — the trust fund. If there’s a year when payroll receipts fall short of benefits, but there are still trillions of dollars in the trust fund, what happens is, precisely, nothing — the program has the funds it needs to operate, without need for any Congressional action.

Alternatively, you can think about Social Security as just part of the federal budget. But in that case, it’s just part of the federal budget; it doesn’t have either surpluses or deficits, no more than the defense budget.

Both views are valid, depending on what questions you’re trying to answer.

What you can’t do is insist that the trust fund is meaningless, because SS is just part of the budget, then claim that some crisis arises when receipts fall short of payments, because SS is a standalone program.

This is actually a fair point. I’m further persuaded by the validity of that way of looking at it by this addendum to Baker’s post:

In a comment below, Art Dover calls my attention to another inaccuracy in the article. It asserts: “The payroll tax holiday is depriving the system of revenue.” This is not true. Under the law, Social Security is 100 percent reimbursed from general revenue for the taxes that were lost as a result of the payroll tax holiday. This is yet another fabrication by the Post in its crusade to cut Social Security.

#facepalm. Had he said, “The ‘shortfall crisis’ is largely a creation of the payroll tax holiday, which is a temporary stimulus measure,” it would been a pretty powerful argument that we’re not really in a crisis. Or, at least, that the “crisis” was a function of a historic downturn in the global economy rather than a structural problem with Social Security. But to claim that not taking money out of people’s paychecks to pay for Social Security doesn’t yield a shortage for Social Security because we’re moving money that we don’t have in the Treasury into a fictional pile of money called a “trust fund” is just crazy talk.

Since I don’t believe IOUs written to oneself constitute real money but do think that IOUs written to other people constitute real financial obligations, I must conclude that Social Security is just a part of the budget. By extension, FICA taxes are just taxes, since they go into the same pot as every other Federal Government program. Which means that Social Security isn’t in crisis any more than the Defense Department, the Marine Mammal Commission, or Radio Free Europe.

Under that analytic framework, all that matters is that we’ve got a massive federal debt and no real good options for dealing with it. Some combination of the following are required: Social Security, Medicare, Defense, and other big ticket items have to be cut; taxes have to be increased; or growth to the overall economy needs to happen. And these are somewhat interactive options: drastic cuts in spending or drastic increases in taxes may hinder growth.

But the bottom line is that Social Security isn’t in crisis. Rather, we’re spending more money than we’re taking in across the board and have to deal with it.

Just because Social Security is really no more than an item in the federal budget doesn’t mean it can’t be viewed individually. There’s some utility in the accounting fiction of a trust fund and separate outlay streams simply from a management and forecasting standpoint. Given that it’s such a massive part of the budget, it makes sense to talk about it as if it were a self-funded program in order to rationalize it. Knowing that our obligations are going to go up given present trends, we need to talk about such possibilities as slowly raising the retirement age, means testing benefits, raising the ceiling on payroll taxes–or even simply doing away with FICA altogether and just raising the income tax rate slightly. For that matter, we may conclude that these things are too high a price to pay and that we should consider changes in our immigration policy to bring in more young taxpayers and change the curve altogether.

The thing that jumps out for me is that the first article calls out a $46 billion problem for this year. Given that the deficit this year is $1.6 trillion … the net-net impact doesn’t even make the headline number. $46B isn’t considered a significant digit in $1.6T

Now, as regards the long term model and the trust fund, even if you run “cash accounting” for the “company” (nation) as whole, I think the trust fund is a valid way to run accounting on the Social Security “division.”

If the Social Security “division” of the “company” has been logging surpluses, then it isn’t actually the place to look for sources of the debt. You want to look for operations, say like the “war division” that go negative for something like a trillion … with no “trust fund” at all.

(I’m actually very comfortable calculating the trust fund separately though, because had social security been implemented slightly differently, as a monopoly corporation, no one would have a problem with a separate balance sheet. The “I can’t owe money to myself” thing hides as much in semantics as it reveals. Social Security with a different legal charter, but the same economics, would have the same balance sheet.)

Whatever crisis there is in Social Security, it’s due to Social Security now being a net reducer of the general fund rather than a net contributor. Since we’re spending so muich more than we’re taking in that means it’s increasing the borrowing that’s taking place.

I don’t think that we can import immigrants to solve our economic problems any more than the company that loses a little on every item sold can make up the difference in volume. We will continue to need income supplementation for the elderly for the foreseeable future whatever it’s called and however it’s funded. My preference for this is to make the system actuarially sound.

One more thing that should be added to the discussion: the interest that’s paid on the money that’s owed to the Social Security Trust Fund is paid at a higher rate than other intragovernmental debt, the interest income amounts to a sizeable chunk, and the faster we draw down the Trust Fund, the faster that income will shrink, putting further demands on the general fund.

@Dave Schuler: Mostly, I’m thinking that significantly upping the percentage of productive young people into the economy both increases the tax base for funding Social Security and shrinks the relative proportion of the society that’s in need of benefits.

We could also bias our immigration toward more STEM graduates (and/or millionaires).

There are constituencies here who oppose those, but I think they misunderstand network effects and the value of technical innovation.

@john personna: I’m not sure who first said it but the idea that we should staple a green card to every PhD in the sciences we issue a foreign student is just a no brainer.

@James Joyner:

Yeah. I’m sure you’ve heard the story that they cracked down in the Bush years, and Microsoft (who had been hiring many such graduates) had to set up an operation in Vancouver Canada to hire them instead. So the net-net was moving the research across the border and away from us.

Good blog. The only missing item is a more thorough discussion of the demographic problems affecting the scheme. Compare the raw numbers of Boomers who’ll be retiring over the next 5-10 years and their life expectancies with the raw numbers of “Baby Busters,” from whom payroll taxes can be drawn over the next 10-25 years. Then factor in the unemployment situation for the latter group. Not a pretty picture.

As far as solutions go, the best solution would be to create an opt out system and slowly but surely to scale back and then to eliminate the entire program. Obviously that’s not possible, politically speaking, and therefore is off the table.

Raising payroll taxes in a bad economy with double digit unemployment would be the worst idea since New Coke.

Means testing is de facto class warfare. Does the millionaire, self-made businessman who’s been paying maximum FICA taxes for 40-plus years deserve a return of some of that money any less than the perpetual semi-employed loser who’s been pissing away much of his life on booze, cheap women and seedy card clubs?

I would push for major increases in the retirement age (from 65 to 75 in two fast steps) and an elimination of the expanded benefit for delayed retirement. Then I would take steps to grow the economy and to create jobs. That would include massive expansions to the H-1b program, a guest worker program for illegals, tort reform, environmental reform, regulatory reform, tax reform, private school vouchers, right to work laws, labor and employment reform, budget reform and defunding the NLRB. Without macro and jobs growth Social Security won’t last and in any event won’t be worth it.

The Washington Post was my browser’s home page since the dawn of the internets. I’d give its website a thorough reading each and every morning. But about four years ago I noticed most of what I was reading there was crap and just deleted it from my favorites and stopped going there altogether.

Every single Washington Post article I’ve read via links or excerpts since then has convinces me I made the right decision.

What a downfall.

James, you’ve just scored a direct hit on one of the ugly secrets of Social Security – it was nothing more than a very politically savvy and cleverly disguised payroll tax, the purpose of which has ALWAYS been to bring revenue into the general fund. FDR and Morgenthau assumed that the SS payroll tax would always bring in more revenue than the plan paid out in benefits for a variety of reasons, not the least of which was the fact that the plan’s original recipients wouldn’t begin receiving their checks until age 65, which was average life expectancy in the 1930’s.

Of course things have changed dramatically during the last 75 years – the Baby Boom, expansion of the SS program to include supplemental income for disabilities, and the wild growth of government spending on social programs in general. And now that we have significantly more beneficiaries than the original architects of SS ever envisioned, combined with a serious recession, the General Fund now has to pay INTO the SS fund, instead of benefiting from surplus SS payroll tax revenue.

I wish there was an easily workable solution to the fix we are currently in, but there isn’t.

@Tsar Nicholas II:

For what it’s worth, any calculation based on the retirement rate during the housing boom is out the window.

Retirement age has been raised, by circumstance.

All that has happened is that the FICA is no longer collecting excess tax, i.e., more than required to operate. Therefore, they are no longer buying government bonds in excess of the amount redeemed to pay current benefit obligations.

As was explained by Sec. Geithner when explaining how Obama could hold old people hostage during the Debt Scuffle, each month SS redeems bonds to pay current benefits while simultaneously buying bonds with that months FICA taxes collected. He was adamant that they do not pay benefits out of current tax collections. In the past, it was a wash as far as benefits with the excess being use by Treasury to pay for ugly art and trips for the First Lady, etc. Now, however, the SS is redeeming more bonds than they are buying so not only are funds for the ugly art drying up, Treasury must find the cash to pay off the excess redeemed bonds.

So this is good news, FICA is no longer imposing a drag on the economy in excess of the needs to fund the program. The bad news is, from the prospective of having the excess money on the books to spend, is that not only has the cash cow dried up but it is eating more expensive grain as well.

Isn’t this a neutral transaction from the point of view of the federal debt?

Doesn’t each Social Security bond paid off actually reduce the federal debt?

@ponce: Doesn’t each Social Security bond paid off actually reduce the federal debt?

But the story it that SS is now taking in less in tax collections than it is paying out in current benefits. Therefore, they must redeem more government bonds than they are buying. The drain on the general fund is the difference between what is being redeemed and what is being bought plus interest.

No, that´s more complicated, essentialy because the government can´t store the money from FICA under the mattress. Unless you create a state owned bank you can´t store the money in savings accounts without affecting the economy. “investing” the money would create a even bigger nightmare(In Brazil most of the large industries are controlled by pension funds).

http://www.npr.org/blogs/money/2010/11/18/131420919/are-the-social-security-trust-funds-a-mirage

Social Security is – and always will be – a program that transfer money from workers to people that are retired. There is no problem with that, but people should stop talking like they are merely entitled to that money because they supposedly “paid” for it.

Besides that, the big debate is about how much money a society should invest in it´s past and how much money it should invest in it´s future. You need a safety net for seniors, but you can´t put money in Social Security while ignoring Education and Infra-Structure.

@ponce:

Only if you have enough tax revenue, otherwise, its time for another sale of government paper.

@Andre Kenji:

Countries with government surpluses create Sovereign Wealth Funds. The situation is not unheard of.

Right,

So if we pay off Social Security bonds by issuing regular bonds…the federal debt remains the same.

Until all the Social Security bonds are paid off, Social Security “deficits” won’t have any effect of the national debt.

If you are a “conservative”, you ignore education and infrastructure and kill Social Security. Problem solved.

cant understand why everyone iwould rather pay off the treasury bonds china holds than those held by the SSA:

http://www.ssa.gov/cgi-bin/investheld.cgi

Life expectancy was lower in the 1930s primarily due to higher rates of infant mortality.

Workers who retired in the 1930s could expect to live about as long as today’s retirees do.

@ponce: Until all the Social Security bonds are paid off, Social Security “deficits” won’t have any effect of the national debt.

Except, now, instead of the soft debt Congress can welch on be fiat, we’ll have hard debt that failure to pay means sovereign default. Basically, they’ve lost the captive lender.

One of the original goals of Social Security was to reduce unemployment by helping older workers to retire earlier, freeing up jobs for younger workers.

Raising the retirement age to 75 would probably make America’s unemployment problems much worse.

Government budgeting, like household budgeting, is always a matter of priorities.

When there is a proposal to increase funding for colleges on the order of billions, “we don’t have the money”

When there is a proposal to pursue a war, costing a thousand times as much, suddenly the money is found.

When millions of American are unemployed, giving them a few billions is considered a waste, like feeding stray dogs.

When a handful of banks see their investments go bad, a thousand times that much is readily found.

It is just priorities.

As Karl Marx, or maybe Saul Alinsky once said, “Where your treasure is, so shall your heart be.”

I wonder if some people welcome our current economic woes as a way to destroy Social Security, a program that a certain minority has always hated and will always hate and want to see eliminated…

@ponce: Workers who retired in the 1930s could expect to live about as long as today’s retirees do.

Actually, the life expectancy at age 65 had increased about 10 years from 1940 to 2010. In 1940, the median age at death was 67 for men, 72 for women. There was a modest boost to extreme old age in the middle of the last century but that leveled off although expected to start increasing again. SSA Source

Add in the improvement of infant survival, the high birth rate and the lag in reducing family size since we weren’t losing 40-60% of children by age 4 and we have a demographic problem.

But you are correct, raising the retirement age is a non-starter as many 50-yr olds are out of work and not expected to find new jobs. Hardly makes sense to extend their time scrounging as opposed to just dumping the whole system.

I suspect we’ll need to set a subsistence rate of SSA payments for all beneficiaries and not base the payout on what was payed in. SS becomes a poverty floor in payout but a progressive tax on contributions.

Re “Which means that Social Security isn’t in crisis any more than the Defense Department, the Marine Mammal Commission, or Radio Free Europe.”

Unless there is an agreement otherwise the Defense Department will be facing over $500 billion in cuts as agreed to in the last debt ceiling deal. There will be across the board cuts as well. Bad part is even with that we will not even be close to the spending cuts that are needed.

One small thing, Social Security surplus is considered part of the debt but is not considered part of the public debt. Also there is a difference between Social Security surplus and Social Security obligations. Obligations are not considered debt but will unless they get cut , they will impact future spending.

It shouldn’t take a genius to figure out if you have a program which earns more money than it spends then that it switches cash flow that it will impact spending habits. The assumption of “we can always borrow more money from somewhere else” is a recipe for disaster. It reminds me of the same faulty logic that lead to the housing crisis.

Since we’re giving up on the fantasy that “payroll” tax is not “income” tax, I’d like to see a new analysis of how much income tax is being paid by various segments of our population.

I think you have misread the data from your link, JKB.

Figure 2b—Life Expectancy at age 65

Looks like for men, life expectancy at 65 has gone from 12 years to 16 years between 1940 and 2011 and women have increased 5 years, from 14 years to 19 years.

One should also remember the Social Security surplus has been paying for other Agencies. Government agencies just don’t disappear. So even if the Government switches out the internal IOU for public debt to pay for SS obligation, they still have the ongoing expenses of those other Government agencies. Those agencies will either have to be cut or the government has to take on additional public debt.

@jd:

It’s not fantasy, there are alternate accounting views.

And certainly, if people who pay no Social Security then receive no Social Security, then it is in a real sense a separate operation.

It would be different, say, if Welfare and Social Security were one “dole.”

@jd: @john personna: Yes, it’s rather tricky. Part of the reason for creating the myth that Social Security is a separate, self-funded program was to create the illusion that it’s not a welfare program but rather that it’s a retirement program. In that light, it makes sense to put a ceiling on contributions since there will naturally be a cap on monthly benefits.

If, on the other hand, we were to simply increase taxes and do away with the payroll tax there would be no logic in a ceiling. But there would likewise be no rationale by which the well off–and here I mean people who draw, say, $100,000 a year in retirement pensions from private sources–should be drawing money from the federal treasury in retirement.

@john personna: I’m not sure that your case is accurate. Depending on the type of charter, Social Security might have been an entity with a $2.6 Trillion sovereign wealth fund. It is because of the charter allowing Congress to “borrow” those funds that the problem is what it is today.

But you are right in that the devil is in the details.

@Just nutha ig’rant cracker:

I’m not sure I follow that view, but note that I said “with a different legal charter, but the same economics, would have the same balance sheet.” By “the same economics” I mean the same contribution and withdrawal rates.

@ponce: Not in Tsar Nicholas-world. In Tsar N world, there is simply a 10-year gap between when the company forces you out the door and the when you collect Social Security.

@john personna: There would be the same contribution and withdrawal rates, but with a sovereign wealth fund, the money would have to have been converted by congressional act in order to not be cash or cash equivalents. (And no, in this case Treasury Notes should not be considered cash equivalents.)

We actually have had the same situation in Washington State. Until, the 1980s, state pension funds were not actually part of the state budget but separate entities. Sometime in that decade, the legislature passed a law that allowed it to “borrow” yields above bank interest levels (at the time, there was a 4-6% differential between the two rates). Currently, the state “owes” the pension funds about $26 billion IIRC. (Funding for the funds is comparable to funding for private sector pension funds–50% as part of the salary package and 50% contributions from employee.)

@Wayne:

Are you sure those are the only alternatives?

Turn your prism’s 90 degrees people.

You own a company that has two divisions: the “SS” division and the AO (All Other) division.

For decades the SS division generates excess cash. For decades the cash flow negative AO division eats cash; and for those decades takes SS’s cash and gives them a note saying it will repay them, and also borrows from a bank.

But SS’s physical capital is aged and in need of a massive capital program that will cause it to go cash flow negative; its been known for years but AO just kept stripping SS’s cash.

The corporate parent finally wakes up and goes to the bank with a loan request. The lender objects, saying “wait, AO is still massively cash flow negative, and SS has these looming cash outflows.” The parent responds “don’t worry – that SS stuff?, those notes we just owe to ourselves — and most of the other notes, too!”

The lender asks if the parent has spoken with its other funders, inquires about its debt to cash flow and fixed charge obligations……gets a blank look, and then kicks the parent out the door muttering something about the stupidest mf in the world.

Anyone who doesn’t understand this analogy has no standing to comment on the subject of the thread.

Drew,

I don’t think you understand how democracy works.

@Drew:

Most of that works for me. It’s the unstated implication that AO and SS had fixed funding/spending options in the past, and have fixed funding/spending options in the future that I don’t like.

Congress is slow to re-jigger SS, but it has done and needs do in the future.

One thing that we do know is that “by 2035” projections are conversational only. No way “in heck” exiting rules will actually be in place that long.

@ponce

I don’t think you understand how democracy or financing works. Drew hit it pretty much straight on.

@Sam

There is a couple more but they amount to about the same thing, which is the future spending of those programs that the surplus supported and money outgoing to Social Security has to come from somewhere.

This is crazy. Social Security by its very design ran a surplus to later draw it down. What would you have the program do? What would you have expected a privately run program to do? Pay out all the money it receives each month? Nowhere do you talk about the injustice of collecting more than was needed.

In what sense can collecting unspent revenue into a fictional trust fund help in forecasting? Why not pay me $1,000/month and I will run a fictional trust fund for you. Any time you like, I will give you a forecast on how close you are to retirement. There might have been some “utility” in this fiction, but not for anyone who has counted on social security as an essential pillar of one’s retirement.

No, I guess the only logical option would have been a program which every month is cash neutral. Up until recently, we should have been paying less into the program. Then again, we should now expect to pay more. But of course this is nonsense.

If the trustees did not feel that buying government bonds was a low-risk (as in zero-risk) option, then certainly they would have placed the money elsewhere. Under a matress would have been preferable when it comes to the grasping, duplicious James Joyners of the world. For them accounting is not a religion, it is war by other means.

The federal government is not a business. It is not revenue constrained and cannot involuntarily default, it can always pay its obligations. The notion that our government must balance its books like a corporation or household is what I see as the biggest problem in properly understanding how the economy works.

@Drew: OK, I will take the bait.

For years, the corporate executives stripped cash from the SS division pension plan to buy whores and cocaine.

Then one day the pensioners came to collect, and both the AO division and the pension plan were unable to pay out.

So the executives told the pensioners to suck eggs, because they had stupidly believed that the corporate executives would honor a committment.

“Countries with government surpluses create Sovereign Wealth Funds. The situation is not unheard of.”

That´s the same problem of the pension funds in countries like Brazil and Britain. In Brazil, the pension funds of state controlled companies in fact controls most of the big industrial companies. These are funds that the government injects money and has lots of influence. A Sovereign Wealth Fund of the size of all FICA contributions would require the federal government in fact controlling whole industries.

James is right regarding Social Security in his comments, even If I disagree with this post.

There are two key insights into our economy and banking one must understand:

1) The dollar has no intrinsic value. It isn’t convertible into gold or any other commodity, so it is not in fact “wealth”. Its only value is in its use as a medium for economic exchange. The wealth happens on either end of the deal.

2) The federal government can create dollars in any quantity it desires at any time, and it doesn’t involve printing presses. It can literally just credit accounts.

Once we understand this, taxation and spending must be viewed in a radically different way than that to which we are accustomed. Our government does not tax to obtain money to fund its operations; it can meet its liabilities without getting money from its citizens. It taxes solely to make its citizens accept its currency, forcing them to go out and obtain dollars in order to extinguish their tax liabilities.

Nor does a government which can create unlimited quantities of intrinsically worthless paper and electrons need to borrow in order to get more of that paper. Federal debt has two functions: it gives its citizens a way to save their money risk-free, and it drains reserves to achieve a target -interest rate.

The “IOUs” in the Social Security Fund are guaranteed to be honored, unless we get some sort of suicidal government which wants a default.

I know the bloated defense budget will get slashed long before Social Security benefits will.

An excellent post on one reason government debt can be good for the private sector: bonds have beaten out equities over the last thirty years.

http://pragcap.com/paper-beats-paper

Re “The federal government is not a business. It is not revenue constrained and cannot involuntarily default, it can always pay its obligations”

You are kidding right? Ask Greece about that. Ask the many other countries that have gone under using that faulty logic. Every government has a limit on how much it can borrow and spend. Let it get out of hand and disaster will follow.

@Wayne:

We aren’t Greece, as you might know if you’d bothered to read the entire comment. The United States is an autonomous currency issuer. Greece is a non-sovereign user of a foreign currency.

It isn’t a matter of logic or theory: it’s objective fact. The United States has no constraints on revenues because it creates the USD and is, in fact, the only entity capable of creating dollars. The only limit on how much it can spend is inflation.

@André Kenji de Sousa:

This is why Sovereign Wealth Funds which do not wish to interfere with their own industry, who do not wish to play favorites, go offshore for investment.

If we had a surplus, and the Germans were selling bonds, it would be simple.

Of course, for the US this is currently a pretty abstract question, and in practical ttierms a small but manageable debt is probably optimum.