Eliminating The Debt Ceiling: An Idea Whose Time Has Come?

Perhaps it's time to consider getting rid of the debt ceiling entirely.

The Washington Post is reporting that during the course of yesterday’s White House meetings that resulted in a short-term deal on the budget and debt ceiling President Trump and Senate Minority Leader Chuck Schumer agreed to pursue a deal that would ultimately lead to the elimination of the debt ceiling entirely:

President Trump and Senate Minority Leader Charles E. Schumer (D-N.Y.) have agreed to pursue a deal that would permanently remove the requirement that Congress repeatedly raise the debt ceiling, three people familiar with the decision said.

Trump and Schumer discussed the idea Wednesday during an Oval Office meeting. The two, along with House Minority Leader Nancy Pelosi (D-Calif.), agreed to work together over the next several months to try to finalize a plan, which would need to be approved by Congress.

One of the people familiar described it as a “gentlemen’s agreement.”

Senate Democrats hope they will be able to finalize an arrangement with Trump by December.

“The president encouraged congressional leaders to find a more permanent solution to the debt ceiling so the vote is not so frequently politicized,” White House press secretary Sarah Huckabee Sanders said.

The three people spoke on the condition of anonymity because they were not authorized to discuss details of the meeting.

Another person familiar with the meeting said Vice President Pence is open to changes he considers in line with the “Gephardt Rule” — a parliamentary rule making it easier to tie raising the debt ceiling with Congress passing a budget. The rule is named after former House majority leader Richard A. Gephardt (D-Mo.).

The deal comes after Trump sided with Democratic leaders Wednesday on a plan to temporarily raise the debt ceiling and fund hurricane relief, rejecting a Republican plan and vexing many in his party.

(…)

Article 1 of the Constitution sets up Congress’s powers, giving it the authority to write and pass legislation and appropriate government money.

The U.S. government spends more money than it brings in through taxes and fees, and it covers that gap by issuing debt to borrow money. The government can borrow money only up to a certain limit, known as the debt limit or the debt ceiling. The government routinely bumps up against this ceiling, requiring Congress to raise it again and again. These votes are often politicized and can cause panic among investors.

If the debt ceiling isn’t raised, investors have warned that the stock market could crash because the government could fall behind on its obligations if it isn’t allowed to borrow more money.

Treasury Secretary Steven Mnuchin has suggested scrapping the existing debt-limit process and replacing it with one that automatically lifts the borrowing limit every time Congress appropriates future spending.

The discussion between Trump and Schumer came during an Oval Office meeting that included other congressional leaders. At the meeting, they agreed to suspend the debt limit until Dec. 8. If Congress approves that suspension in the coming days, then they will have to revisit the matter again soon, potentially setting up another difficult vote for lawmakers.

The U.S. government spends more money than it brings in through taxes and fees, and it covers that gap by issuing debt to borrow money. The government can borrow money only up to a certain limit, known as the debt limit or the debt ceiling. The government routinely bumps up against this ceiling, requiring Congress to raise it again and again. These votes are often politicized and can cause panic among investors.

If the debt ceiling isn’t raised, investors have warned that the stock market could crash because the government could fall behind on its obligations if it isn’t allowed to borrow more money.

Treasury Secretary Steven Mnuchin has suggested scrapping the existing debt-limit process and replacing it with one that automatically lifts the borrowing limit every time Congress appropriates future spending.

The discussion between Trump and Schumer came during an Oval Office meeting that included other congressional leaders. At the meeting, they agreed to suspend the debt limit until Dec. 8. If Congress approves that suspension in the coming days, then they will have to revisit the matter again soon, potentially setting up another difficult vote for lawmakers.

The idea of eliminating the need for frequent debt ceiling votes is not a new one. Economists and political pundits on both sides of the aisle have argued for some time that placing a legislative limit on the Federal Government’s ability to pay its bills and float debt when necessary makes no sense either politically or economically. From a political point of view, it gives Congress far too much power over the Executive Branch in general and Treasury Department policy and procedures specifically by requiring an Administration to continually seek Congressional permission to do something that, at least ostensibly, appears as though it ought to be far more discretionary than current law allows it to be. Economically, the fact that the debt limit has frequently become a bargaining chip in broader power struggles between Congress and the White House over fiscal policy introduces an element of uncertainty into the economy that makes financial markets nervous and potentially could have a negative impact on both bond and stock values as well as the value of the dollar and on international trade. As we saw during the debt ceiling showdown in the summer of 2011, such showdowns also have a negative impact on the economy generally and have even led rating agencies to downgrade their quality assessment of U.S. Government bonds and Treasury Bills. Finally, the existence of a debt ceiling also hands legislative minorities an inordinate amount of bargaining power in that enhances their ability to extract concessions at a time when passing legislation extending the debt ceiling is most essential.

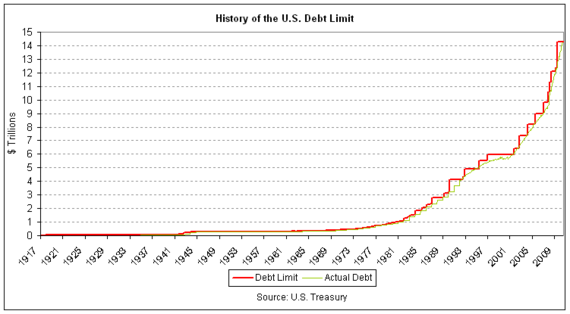

Opponents of past proposals to eliminate the debt ceiling argue that eliminating the debt ceiling would lead to an explosion in debt that would be catastrophic for the economy, but this argument is undermined by reality in several key respects. Primarily, of course, there’s the fact that the existence of the debt ceiling has done little to control the explosion of either the annual budget deficit or the increases in the national debt that have become commonplace. The national debt has essentially doubled under the Presidencies of every President going back to Ronald Reagan, with the only exception to that rule being George H.W. Bush since he only served for four years. This occurred notwithstanding the fact that the issue of raising the debt limit has been debated on yearly, semi-yearly, or more frequent intervals throughout the time each of these men was in office. Clearly, then, the existence of a law requiring Congress to vote on a debt ceiling limit did nothing to control the growth of the national debt. Additionally, it’s worth noting that the United States did not have a debt ceiling law until 1917, and the reasons for it coming to existence are fairly interesting:

The debt ceiling was first enacted in 1917. Why? The date tells all: we were about to enter the Great War. To fund that effort, the Wilson government needed to issue Liberty Bonds. This was controversial, and the debt ceiling was cover, passed to reassure the rubes that Congress would be “responsible” even while the country went to war. It was, from the beginning, an exercise in bad faith and has remained so every single second to the present day.

As this chart that shows the growth of the debt through 2011 shows, that law has had the seemingly counterintuitive effect of increasing the national debt:

Clearly, the existence of a debt ceiling law has done nothing to slow the growth of national debt and instead appears to have increased the pace of its growth over the course of the 100 years that it has been in effect. Given that, there appears to be little good reason to keep it in effect now. The fact that debt ceiling has done nothing to stop the growth of the National Debt really shouldn’t be a surprise because that’s basically what it is intended to do:

Judging from the NY Times coverage of the 1917 episode, legislators paid little attention to the implications of mandating a ceiling. They focused instead on Treasury Secretary McAdoo’s request for a higher borrowing limit so as to fund an expensive war effort. The ceiling was created to empower, not rein in, Treasury (prompting a failed effort to create a congressional committee to oversee Treasury’s actions). Similarly, the creation of the aggregate ceiling in 1939 reflected congressional deference to Treasury, granting the department flexibility in refinancing short term notes with longer term bonds. As the Senate floor debate makes clear, senators viewed the move as removing a partition in the law that hampered Treasury’s ability to manage the debt.

In other words, the debt ceiling law was intended to take the issue of the issuance of Federal Debt out of the hands of Congress, and place it in the hands of the Treasury Department in order to make it easier for the Federal Government to issue debt.

In the end, the debt ceiling is not the way to control either Federal spending or the growth of the Federal government. For that to happen, Congress needs to exercise restraint where it matters, at the appropriations stage where the Federal Government and its various departments are granted the authority to spend money, to begin with.

National debt exists simply to pay for obligations that the government has already incurred and which could lead to the ultimate financial crisis of the United States failing to pay interest on government debt. As I noted when the debt kamikazes that led us down the road to a near crisis in 2011 reappeared two years later, though, that’s not the only potential consequence of a failure to raise the debt ceiling:

Interest obligations on the national debt and paying off redeemed bonds is only one of the many payments that the Treasury Department is required to make on a regular basis. In addition to those payments, there’s everything from salaries for Federal Employees, Social Security payments to beneficiaries, Medicare payments to providers, obligations owed to contractors who have provided services and supplies to the Federal Government, and any number of other obligations that the Federal Government owes that come up on a regular basis. As a simple matter of mathematics, it is quite often the case that the money that the Federal Government owes under all of these obligations is more than the amount of revenue (from tax payments and other sources) that comes into Federal coffers. Under ordinary procedures this isn’t a problem because the Treasury Department regularly floats new bonds to cover ongoing obligations.

If the debt ceiling is not raised, the Treasury Department’s authority to issue new debt to cover these already-incurred obligations would would be in serious legal doubt to say the least

(…)

So, that leaves us with the probability that tens of thousands of Federal obligations that don’t fall under the “sovereign debt” category would go unpaid if the nation went along for an extended period of time without raising the debt ceiling. That means, potentially, Social Security and pension recipients not being paid, Federal employees not being paid or being paid late, and Federal contractors and suppliers not being paid. For better or worse, the Treasury Department will be forced to make choices about who gets paid and who doesn’t, and those who don’t get paid are going to suffer real economic harm even if it just means that there is a delay in receipt of payment. The economic implications of this should be blindingly obvious. Cut off payments to the contractors, and they won’t have money to pay their employees, who won’t have money to pay their own bills or spend money in their community. Delay or cut off payments under Social Security, Medicare, or to Federal employees to cover salaries, and the same thing will happen. The economic chaos would, to borrow a phrase, “trickle down” and, absent a quick resolution, would quite obviously do real harm to the economy.

What all this means, of course, is that a law requiring frequent Congressional votes to authorize increases in the national debate is redundant and potentially dangerous. Congress already possesses the authority to authorize any Federal spending that is necessary to pay for the nation’s obligations. If Congress were truly concerned about the level of the national debt, it would focus not on the borrowing power of the Treasury Department, but on the fact that it continues to authorize massive increases in spending at all levels of government on programs of dubious merit. Additionally, the law as it currently exists does little other than to allow politicians on both sides of the aisle to pander to interest groups and voters back home by claiming that the voted to control spending because they voted against a debt ceiling increase. If they were truly interested in controlling spending, they would act at the point when it matters, when Congress is actually voting on the budget and on the appropriations bills for the various parts of the government itself. The fact that they choose the route of grandstanding over doing something that would actually have an impact on Federal spending and the growth of government should give the reader all the information they need to determine their true intentions.

As with everything that comes out of Washington, this proposal to eliminate the debt ceiling needs to be looked at closely before it can be judged. As a general idea, though, it has far more economic sanity about it than anything we’ve been doing for the past century or more. That’s reason enough alone to consider it seriously if and when it’s actually proposed.

Yeah…sure…but what about Trump liking it when Ivanka calls him “Daddy”? Now that’s real click-bait!!!

http://people.com/politics/ivanka-trump-calls-father-donald-trump-daddy/

Meh. I believe it when I see it.

If Trump was a vaguely normal president with vaguely normal political skills, maybe this will be possible. But Mitch and Paul can simply let everything die in committee, blame the Democrats, and Trump will probably believe it.

“Chuck and Nancy” will inevitably discover that Trump and his supporters will be as faithless and feckless to them as they are to the Republican “establishment.” All they want is their white anger erogenous zones tickled, NOW.

Would it have seriously killed you to acknowledge that Trump is the ONLY Republican President under which eliminating the debt ceiling would be even vaguely possible? Does it really chap your behind that much to connect him to anything positive?

As for the issue itself, this the real world. None of us are angels. If the GOP could be trusted to keep its debt ceiling-related shenanigans within reasonable limits, it wouldn’t matter. But not only have they demonstrated they can’t be trusted, they’ve proven repeatedly that they don’t even understand what the hell it is they’re actually doing.

Mike

I’d question if the debt ceiling law is even constitutional.

We know from Train v. City of New York that the President isn’t allowed to not spend money appropriated by congress.

We know from the 14th Ammendment that the President isn’t allowed to default on debt.

How is the President supposed to enforce the debt ceiling?

Next article, “Water is wet”

I can think of no good (or even semi-good) arguments for keeping the debt ceiling.

There’s a group in congress which believes the following:

Science is bullshit

Global Warming is a Liebral scam like evolution

supply-side economics is the answer for everything

White people have it worse than anybody

Poor people are too well off

Obamacare made everything worse for everyone who matters and poor people can always just go to the ER for free

defaulting on our debt obligations would have no bad consequences and finally help fix our freewheeling ways

In other words, an Ideology of Stupidity. This is the fundamental problem with congress, corresponding to a fundamental problem with a percentage of the electorate. They used to be contained and somewhat disempowered. Changing technology allowed new opportunistic media to inflame them and blogs and comment sections to network them together. Their power increased, moderate republicanism was kicked to the curb, and the deplorable Party of Stupid now corrodes everything it touches.