Social Security Payouts Too Low

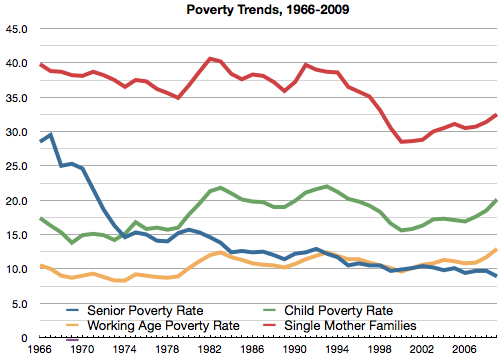

While Social Security has radically lowered the elderly poverty rate, it hasn't eliminated it. Should we do more?

Matt Yglesias seconds Dean Baker‘s observation that the Social Security benefit “is already small by international standards” and provides this handy graph:

Since the senior poverty rate is above zero and the point of Social Security was to eliminate it, he figures “doesn’t do as good a job of that as it could or should.” So, we should probably raise benefits at the bottom and cut them for those in “the middle class majority.”

I’m not opposed to means testing Social Security and am open to arguments about increasing the minimum benefit. But, just looking at the chart, for the last two decades seniors have had a poverty rate at or below that of the working age population. Wouldn’t it be bizarre to guarantee people who have retired higher real incomes than they were working?

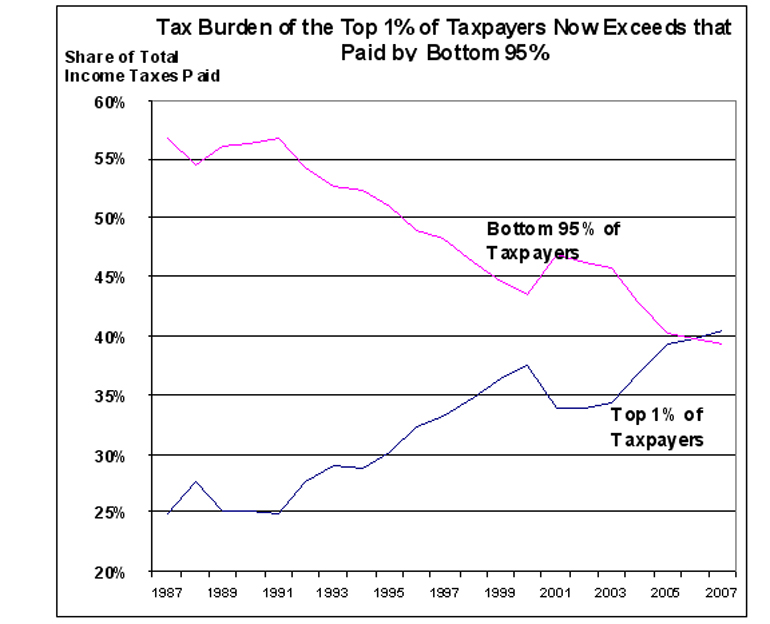

Further, wouldn’t that do away with the illusion that Social Security is a retirement system that people have paid for themselves, making it a pure welfare system? We already have the president out demagoguing the fact that high earners pay a lower effective tax rate because FICA is capped, eliding the fact that payouts are likewise capped.

Maybe we should just do away with the pretense entirely, and simply phase out Social Security benefits and eliminate the separate FICA tax while expanding welfare eligibility. We’re wealthy enough to provide a stipend for the old, sick, and injured who can’t make ends meet on their own. But it doesn’t really make sense for middle class — much less wealthy — people to get a paycheck from the government in their golden years. And that’s becoming more true every day, since our ratio of working age to retired people continues to get smaller.

I’d imagine that it would be quite a bit more feasible politically to means-test SS than eliminate it and call the new system welfare, even if the results end up being the same.

To wit: you said Obama was “demagoguing” the rich for paying lower effective FICA rates. If you want to see *real* demagoguery, try working “expanding welfare eligibility”, as you put it, into an appropriations bill.

I’m not old enough to have been paying attention to politics during the Golden Age of the welfare-queen-driving-Cadillacs mythology, so at least I wouldn’t be bored when it came back. But I doubt it would be healthy for what remains of our national political discourse.

That sounds reasonable. It could even be reduced further to the old Negative Income Tax model.

Of course, the problem is how you deal with wealth versus income. If someone is sitting on a million dollar property, and only making $10K in income, do you give them benefits? Or do you tell them to dump the property?

Andy/James, when you say “means test” do you mean a simple income-based test? Or wealth?

Since income is the main thing we tax and the only way we measure “poverty,” it’s the most feasible measure. Owing a major asset (say, a large house in an expensive area) that you’re not selling doesn’t generate income; it’s often a liability (taxes, upkeep). But most truly wealthy people have massive amounts of interest and dividend income.

Regardless, actually turning the concept into policy is complicated.

At first blush I’d say that someone with a million-dollar property and $10K in cash income is still living check-to-check (at best) and would be eligible for higher benefits. (A grayer area would be someone with the same million dollars in liquid wealth; would we expect them to draw down their savings?) One reason is that even though society is paying out more than it would if the retiree sold their house and became more self-sufficient, it’ll recoup at least some of it eventually when estate taxes are assessed and the house is sold.

Note that there is a framework for “total” wealth assessment already in place for, among other things, measuring things like eligibility for need-based student aid. And I remember hearing stories about my friends’ parents playing games with their assets to hide them from the formula. Some of that will go on regardless, but if society chooses to assess total wealth rather than income, it’s not like it’d be the first time.

Well, leaving aside homes for a moment, I think I can see how any middle class retiree could game it to win the income-based means test. Shift from bonds to equities. Take appreciation rather than dividend. When you take dividend, shift to safer and lower yielding investments.

For the bulk of retirees it probably wouldn’t take much. The average retirement fund is small and the minimum IRA distribution is small:

Basically the test would catch the top few percent of recipients and that’s all. It would be the people with so much income that they simply didn’t care about SS.

Another way to put it would be, go ahead and do an income-based test. I can dodge it.

The fact that I can dodge it might worry you, if you are looking for effective policy.

@John:

The fact that there are people out there right now who “simply don’t care about SS” and yet are still receiving checks is reason enough for some form of means-based filtering.

Establishing a means filter that only captures the top few percent and then iteratively gets more effective is probably the best move politically anyway, by far.

I wouldn’t guess that those few would change the full SS bottom line, but I guess if you have numbers …

I should point out that with Alan Grayson (about to be) gone, it probably falls to the blog commentariat to point out that the GOP’s HCR-repeal platform would probably go a long way towards fixing the looming SS shortfall as well.

When you include all the extra tee times that will open up, it’s really three birds with one stone.

@John,

“Have numbers”, oh, the lolz. I have a strict policy of only speaking out my ass.

I am of the impression though that the difference between a healthy surplus and a death spiral deficit is only something like a few percent of receipts or payouts when it comes to such a massive program. I don’t think many people really think wholesale structural changes are necessary to keep SS propped up, they’re just using the “crisis” as an excuse to implement them.

Well, certainly slapping on some income bar would filter out those too rich or too lazy to change.

I think you could probably combine that with a Chilean-style pension system, but I agree with your overall point. I’d much rather just have welfare benefits to cover people in certain situations (including the poverty-stricken elderly), than have an entirely separate system to subsidize people over 65.

One additional note about that graph – the poverty rate among the Elderly dropped like a stone between 1970 and 1975. What happened? Was there some sort of delayed time-lag from the creation of Medicare? Did Social Security benefits shoot up?

So, you’re saying turn Social Security into nothing more than a wealth redistribution strategy with the elderly being the beneficiaries? From each according to his abilities, to each according to his need?

That’s interesting because Social Security cost of living adjustments began in 1975 IIRC.

I know that complete Medicare registration and utilization didn’t occur until the early 1970s so my guess is that’s what caused the drop.

“Further, wouldn’t that do away with the illusion that Social Security is a retirement system that people have paid for themselves, making it a pure welfare system? ”

Actually there are two distinct requirements for old age income, the first being a retirement system, the other being a retirement income security system. In the case of a retirement system you expect people to plan for, and save for, the expected cost of their retirement. The retirement income security system would pool retirees together to diversify the risk of living (a lot) longer than was planned for. Traditional DB pension plans did this, and presumably using annuities, rather than equities, in DC plans would have somewhat the same effect – though the annuity writer might siphon off a large portion of the potential upside. (but hey, so do brokerages and other financial services providers)

The tricky business in all of this is trading off the benefit of diversification against the free rider and moral hazard problems of pooling risk. The current setup of Social Security at least takes a crack at this by having eligibility requirements at least partly determined by work history, and by taxing payroll to ensure that everybody is contributing at least some.

Folding all of this into welfare would substantially obscure the cost and risk shifting going on, so I think it would materially worse.

This quote from Andyman…

“I’d imagine that it would be quite a bit more feasible politically to means-test SS than eliminate it and call the new system welfare, even if the results end up being the same.”

…should put the fear of god into anyone who will someday need SS to make ends meet or, like me, who have parents dependent on it.. Because this attitude (unchallenged here in the following dozen posts) that SS is just glorified welfare is dangerous BS. For all of you that earn a wage or pay self employment tax, look at your pay stubs. That money is taken out of every single check (unless you are lucky enough to max out). I’ve been paying into it for 36 years! The idea that if I take money out when I retire that I am “on welfare” is one of the most pernicious and destructive pieces of propaganda floating around in the SS debate.

The second one is that the SS fund is just “funny money” because all of its bonds are government bonds, so the people paying into the fund today will never see their money. People that espouse this are essentially saying there is a special class of government bond, a class sold only to the elderly and infirm, and if it is convenient we can decide not to honor them. Bonds sold to other countries, to the institutional investors, to wealthy Americans and foreigners, all of those we will honor. But the ones to our elderly? Hey, screw ’em.

This is not a conservative outlook. You want to talk about anti-capitalistic tendencies, about confiscation of wealth? Here it is.

The current system also claws back some monies by taxing SS payments.

I’ve suggested in the past that this is the stealth means test, and that it will be the ultimate solution.

(Sorry Charles, SS has been income redistribution, several ways, for a long time.)

@charles austin: “So, you’re saying turn Social Security into nothing more than a wealth redistribution strategy with the elderly being the beneficiaries? From each according to his abilities, to each according to his need?”

I’m not sure why it’s not better to transfer wealth to the poor elderly rather than from the young to the old, regardless of need. The rationale, so far as I can see, is simply to provide the illusion that it’s “something that I paid for, so it’s not welfare” even though, in most cases, people get back an inflation adjusted return on their investment after a couple years.

MarkedMan, if SS was just “our” money, it would stop at some point. If we lived long enough we’d reach end of withdrawal and that would be it.

It can go on and on, with cost of living increases, because it is part annuity. If I die young, you get “my” money. If you die young, I get “yours.”

John Personna

Yes. It’s an annuity. So? You can buy annuities from private firms too. And if you die early, you’ve ‘paid too much’. And if you live long, you come out ahead. That’s the way annuities work. It doesn’t make them welfare.

I’m retired now and draw a monthly stipend from Social Security. I never considered that it would lift me out of poverty and it hasn’t. I believe that social security was never intended to lift anyone out of poverty. I think it was intended to provide a meager source of income to people who had no other source after retirement, no savings, no private retirement income plans, no interest or dividend income. Nothing. Remember, we have been fighting the War on Poverty 46 plus years now and we lost. If the point of Social Security was to eliminate it then that failed also.

If I read it correctly the chart above shows me that Seniors are much better off than I thought they were . Now where would I get that idea?

Honestly I think we have pushed the age at which you can qualify for social security about as high as you reasonably can. While a doctor or desk jockey can work into their late 60’s, I don’t see how a roofer is going to.

I have no real objections to means testing social security and I actually think you could probably provide a better benefit if you means test it than the way it is currently implemented where some people aren’t getting enough, but people who don’t need it are getting it.

I think there will probably be some objections since it has always been billed as an insurance program, but in the end this may be the best way to target the money in the program to those who need it most.

You know, one fact that’s usually not commented on when the subject of Social Security comes up is that the most needful group of beneficiaries comprises elderly women, you know, like your grandmother:

http://www.ssa.gov/history/reports/women.html

Something to keep in mind the next time you hear someone going off about Social Security.

Marked Man, SS is a mandatory annuity. It differs with many in that it has no death benefit. Private (non-mandatory) versions can give your estate something if you die early (it’s a plan option).

But I think the question Dave Schuler might ask you is whether anybody pays enough to cover their cohort’s benefits.

The fund invests in Treasuries, right? And must make cost-of-living adjustments. So depending on how they calculate, and the yield on investment after inflation, you can pay for yourself or you require that flood of younger workers paying in.

With all due respect James, you seemed to have bought in to the idea that the United States government is supposed to be in the wealth redistribution business. When the Founders created our limited government with enumerated powers, wealth redistribution just wasn’t among those enumerated powers. No matter how good your intentions, you’ve lost the argument when you concede the premise that the government should be redistributing wealth.

I’m 51 and expect to get next to nothing from all the Social Security “premiums” I and my employers have made over the years. Ok, I’ve been lied to and I know there is a price that has to be paid for those lies. I will have to pay it, but I expect those responsible for this wickedness to be held accountable, preferably with lifetime jail terms commensurate to the damage they have caused, though I would settle for tar and feathers for most of them. And no matter what, I expect that we immediately cease with the lies and fantasy that this can go on with the appropriate tweaking.

@charles austin: “No matter how good your intentions, you’ve lost the argument when you concede the premise that the government should be redistributing wealth.”

We lost that argument before my parents were born. Social Security has been around since 1935 — thirty years before I was born and 8 before my parents were born. It’s simply not going away.

Indeed, the much newer Medicare, enacted 5 months before I was born, is so engrained that we have Tea Partiers demanding that politicians “get their government hands off my Medicare!”

Not everybody thought “redistributionism” was a dirty word:

The Negative Income Tax

http://www.econlib.org/library/Enc1/NegativeIncomeTax.html

James, I don’t think “we” lost that argument before we were born and there is no more need to accept it as a fact of life than it is to accept Jom Crow which was also in place before we were born.

Feel free to accuse me of tilting at windmills, but for now I still have my principles.

So, you made a skeptical comment in the fast-food thread, charles. Over there I had said:

Since everyone (demonstrably) isn’t really like that, what would you really do, absent redistributionist Social Security?

Just bury the dead?

@Charles and @James – that argument was lost around the founding of our nation. One of the first things our founders did was to set up a centralized bank and nationalize the revolutionary war debt, to be paid for by levying taxes. Hamilton may have rigged the system to his (and his benefactors’) benefit, but it was a system set up by our founders to distribute the weight of the costs to the entire nation. Our country was founded upon income redistribution.

> simply to provide the illusion that it’s “something that I paid for,

I’ve been paying in since you were spending your days in a crib. How is an illusion to think I am getting something I paid for if I someday collect SS?

> You know, one fact that’s usually not commented on when the subject of Social Security comes up is that the most needful group of beneficiaries comprises elderly women, you know, like your grandmother:

Come on dude. Do you think a real American like Hannity or Beck gives a rats ass about your granny?

@Charles

Although he wasn’t one of the founders, so-called, here’s Thomas Jefferson on taxes, the wealthy, and poverty (from Sully’s site, Lincoln vs Limbaugh, Ctd

“Taxes should be proportioned to what may be annually spared by the individual,” – Thomas Jefferson to James Madison, 1784.

Thomas Jefferson, Communist.

@Charles:

All governments engage in some measure of wealth distribution. Unless everyone pays exactly the same taxes and receives, in turn, identical benefits, there is no other way around it, no matter how minimal that government is. It is endemic to the enterprise.