Student Debt Relief is Expensive

A proposed $10,000 writeup would cost more than $300,000,000,000.

CBS News (“Forgiving $10,000 in student debt could cost the U.S. $300 billion“):

The Biden administration is expected to announce this week whether to extend a freeze on student federal loan payments, and possibly even forgive some college debt for millions of Americans.

The plan under consideration by White House officials would cancel up to $10,000 in student loans per borrower, although that would likely be limited to those with annual income of less than $125,000. People who earn above that threshold wouldn’t qualify for forgiveness.

For both ideological and practical reasons, I think we should expect people to pay off loan agreements they voluntarily entered into. To the extent debt burdens are problematic, my druthers would be to refinance the loans at more reasonable interest rates. And, to the extent simply writing off the debt is desired, I would target those who were swindled by for-profit degree mills (the government should never have allowed its loans to go to those schools) or those who are in public service. Wiping out the debt for, nurses and schoolteachers after, say, four or five years in those occupations seems reasonable.

Now, a new analysis estimates the total cost of forgiving that debt: almost $300 billion in the first year, according to the Penn Wharton Budget Model, a group of economists and data scientists at the University of Pennsylvania who analyze public policy to assess their economic and fiscal impact.

By any reasonable standard, that’s a whole lot of money. It’s nearly half our defense budget.

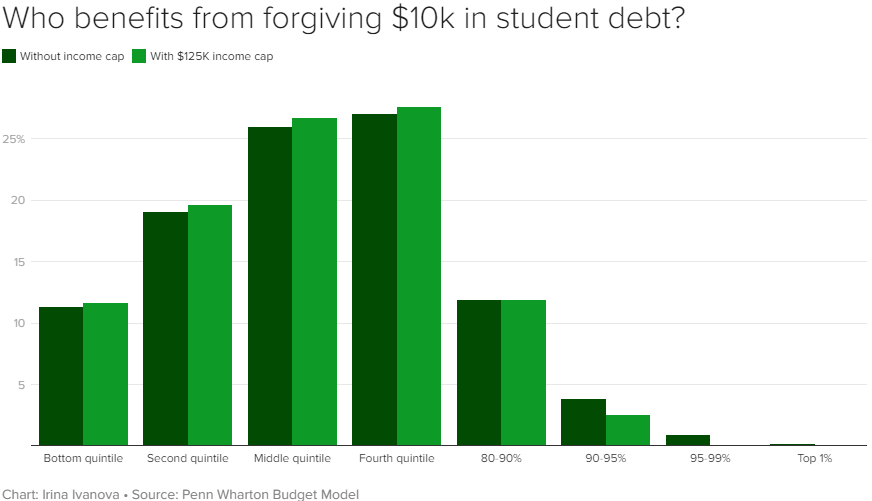

The benefit of erasing billions in college loans would mostly go toward Americans higher up the income ladder, the analysis also found. More than two-thirds of the debt forgiveness would help people in the top 60% of the income distribution — or those who earn $82,400 or more per year.

That could raise questions about the policy’s fairness. According to the Federal Reserve Bank of St. Louis, median household income in the U.S. in 2020 was roughly $67,500.

This stands to reason since those who went to college tend to make more money than those who didn’t.

For instance, some experts have raised concerns that forgiving student loans may effectively penalize people who already paid off their debt, often while making considerable financial sacrifices. A program offering mass debt forgiveness for college graduates also may be seen as benefiting more educated Americans, while offering nothing to those who didn’t attend college.

College grads typically earn more than people with high school degrees — a boost that can amount to $1 million in additional income over the course of their careers compared with people without a bachelor’s degree, one analysis found.

Those are powerful arguments.

It’s also true that a lot of student debt is a function of going to expensive schools—and especially unfunded graduate and professional programs—without holding part-time jobs and debt financing a posh lifestyle while doing it. It’s rather absurd to expect blue-collar workers to subsidize writing that off.

At the same time, the argument for relief is not without merit.

At the same time, college grads have been weighed down by their loans, with more than 40 million Americans holding a combined $1.7 trillion in debt. Those loans have taken a toll on the economy as they force many grads to delay major financial and life milestones, such as buying a home or starting a family.

Some consumer advocates and grads have argued that $10,000 in loan forgiveness is insufficient, noting that the average amount of debt held by grads is about $38,000.

Some policy experts have proposed forgiving up to $50,000, but that would be far more costly than wiping away $10,000, according to Penn Wharton’s analysis. The price tag for the former would amount to $784 billion in the first year, assuming an income cap of $125,000.

The cost of running a debt-relief program would be incremental in following years, since the bulk of the forgiveness would occur in its initial year, according to Penn Wharton. For instance, under a plan to forgive $10,000 per debtor with a cap of $125,000 in income, the cost in the following year would be $3.7 billion.

It’s important for those of us over a certain age to understand that we managed to get through school with little to no debt because tuition was so much lower relative to median income until the last 20-25 years. For a whole variety of reasons, it’s a lot more expensive to run a university now than it used to be and state treasuries are contributing ever-declining proportions of that in subsidy, leaving it to parents and students.

Still, as noted earlier, my strong preference would be to target this much more carefully. And, while I understand the rationale for tying this to income, it would be absurd to make it all-or-nothing, with those earning $124,999 a year getting $10,000 and those earning a dollar more getting nothing. There should be a phase-out.

Regardless, spending hundreds of billions of taxpayer dollars is something that should have to go through Congress. The notion that the President could commit so much money simply on a whim stands the Constitution on its head.

Now do PPP grants.

Agreed. And get the private lenders out of the business entirely. They add nothing of value and assume no risk.

The response to this by most schools is to raise tuition.

Old guy here. We didn’t get loan forgiveness in my day. We got our government subsidies for education up front in the form of low, low tuition*.Universities and colleges got research contracts either directly from the government or indirectly via private industry that was tax incentivized. Government subsidies can take many forms.

*I was charged $400 per semester at a Big Ten state school, but an academic grant took care of half of that. The scholarship came from a private charity that was tax advantaged, of course.

Couple of caveats before getting to my point:

– I was really lucky that my parents were able to pay for my education back in the 1990’s at around $21K a year, so I left undergraduate with no student debts. That’s a lot of privilege right there.

– I did take on debt for my Master’s program (which was only one year and I had partial funding). It took years to pay off (due in part to working on a PhD) and while I was unemployed following my Master’s, I defaulted on the debt. I was able to enter a program and paid the remaining debt off (around $10K plus interest) once I started working again (and got the default cleared from my credit history).

Ok, all that said, I am on-board with student debt forgiveness. I am not yet on board with this policy. It feel like it’s a case where compromise is just going to piss off both sides with little positive impact.

Obviously, $10K isn’t a small amount of money. In my case, it would have paid off most of my debt. But, as suggested in the articles James cites, if you owe at or above the $38K average in loans, this won’t feel like it makes an impact (it would be great to see how many years it would take off repayment for those folks).

I don’t see that as worth the political flack that Biden and the Dems would get for serving that weak tea. Or how that might motivate Republican voters (and further entrench the message that Dem’s don’t care about ‘common folks’).

This is a case where they should either go big, or focus on a different issue the base cares about (descheduling Marijuana would be such a better move for a variety of reasons–including appealing to farmers).

OK, when I was in collage in the late 70’s early 80’s tuition was a fraction of what it is now even controlling for inflation. The state school I graduated from charged 45 dollars a credit hour, that is $161 in real dollars (that was for upperclassmen). Now its closer to $600. I now work at that institution and we get about %15 of our funding from the state (it’s less then our biggest privet donor). That is the issue. A lot of the same people making James argument got a sweet deal when they were students, they love the “tax cuts” but they want to pull up the ladder on the current generation.

I think we need to start by fully funding, at least Jr. collage and up the contributions to state institutions. the problem is that cuttings funding to higher Ed was always an easy thing to do as tax cuts are popular. Anecdotally, you can find stories of kids who made significant investments in spring break at Cabo and flat screen TVs but this country’s had a very difficult time with the idea that someone who didn’t deserve it got something from taxpayers. Crafting a nuanced policy that combines debt relief, refinancing debt, and means testing is really hard and in a political climate where having “big dick energy” is a legitimate applause line at political rallies, I don’t think we can handle it.

Ed Note: Before anyone pulls out the right wing argument that the reason public universities are getting less as a % from states is because they have all become featherbedded, over-funded bastions of woke and useless administrators, you can save your breath. Sure, there is some of that but just enough to make the argument seem plausible. A university today requires things that we never even heard about in the mid 20th century, at a minimum, a vast data network with large ERP systems and computers on every desk (and the staff to support it).

Science and engineering programs require a lot of hardware that never existed before, diagnostic machines, bespoke systems for the discipline as well as computing and storage space and a medical school is off the charts in terms of what is required for even basic instruction. Add in the reporting requirement from governments local, state and federal, accreditation organizations, new insurance requirements (HIPPA FERPA the list goes on) and the army of people that are now employed to raise funds at these institutions has led me to think that the argument is, at best, poorly thought out.

I’ve always supported permitting student loans to be discharged in bankruptcy but with the surrender of the credential and transcripts. Colleges could only acknowledge the person was there, but not classes or grades and degrees would be withdrawn. The individual could keep and use any knowledge/skills they had gained, but without the credential.

And institution who violated the bankruptcy and acknowledged grades or credentials would immediately be on the hook for the total discharged debt including interest. Just to keep the universities honest.

This would benefit the 40% who enroll but never graduate. But it would also incentivize the biggest debtors, with graduate and professional schooling, to pay their debt since they find benefit in retaining the credential. And 42% of those who graduate end up in jobs that don’t require a college credential so they could use the knowledge without the credential.

This “forgiveness”, i.e., transfer of debt to the non-college credentialed, may buy a few votes. But then, come next April, many will find “forgiven” debt is taxable income. The most noisy on student loan debt, those with high 5 and 6 figure debt are unlikely to be quelled by a mere $10k discount.

And it is not state treasuries who funded state colleges, but state taxpayers. However, in this time of population mobility, many do as Milton Friedman did upon graduating from a state school, leave the state never to contribute to the continuation of the taxpayer funded colleges in that state.

@JKB:

Sure, because when your life has gone badly and you’re forced into bankruptcy it’s important to have things made much worse so that some self-satisfied MAGA prick can revel in your pain while reassuring himself of his own superior virtue.

Cruelty for its own sake. Do you spend your weekends burning down homeless tents?

ETA: I assume you have the same approach to corporate bankruptcy? If a manufacturer goes into bankruptcy they have to cease manufacturing. Right?

Sorry, a loan is a contract, and not a moral obligation, and it’s absurd to believe that the college loans are voluntary in the way that financing a vacation to the Maldives on a credit card would be. Loans for college are more like being forced to go into debt to buy the overpriced tools at a company store you need to work in a company town.

10k is not enough but it’s a start, and that’s the important thing here.

Here is how I calculate college tuition costs:

I went in the early seventies (SUNY). It was $400/semester. At $2.00/hr minimum wage, that was 200 hours of employment labor or about 50 hours/month (12.50/week). Not unreasonable parttime work burden for a college kid.

Today, at $5000/semester tuition state college, it would take about 625 hours of minimum wage (5000/8) labor to pay that cost. Part time work burden would be about 38 hours/week for a college kid.

Yes, I could easily pay my way thru college in 1972-76. But it is very difficult, if not impossible today.

BTW. Why aren’t personal bankruptcy law changes being considered also? It seems as though lenders are reaping rewards without assuming any risk.

@Matt Bernius:

The reporting is manipulated as the averaged debt is 39k, the median debt is $19k.

Of course, those getting this “forgiveness” are going to be in debt to the IRS since they’ll have to come up with the $1000-$2400 income tax out of their current cash. Many will lament that 1099-C

@JKB:

Of course, that’s exactly why when tradespeople file for bankruptcy we require their hands to be surgically removed. Or at least their licenses.

What’s the cost of not forgiving any student debt?

@Michael Reynolds: When you go bankrupt, they repossess your fancy car. And nothing says employers and licensing entities can’t shift away from requiring the credential and go to s knowledge/skill based hiring/licensing process. Does a lawyer really need a law degree to practice law? That’s a requirement less than a century old. Does a professor really need a PhD to teach undergraduates?

Also, doing something quick and simple–like forgiving debt–is actually the best way to start reforming institutions. How do I know? Because we have done nothing otherwise. College costs have been going up for decades, and nobody done anything about it, and the same people who have done nothing are telling us why they think debt relief is a bad idea and we should instead do anything but debt relief. Well, you know, fuck you. Where were any of these financial wizards when college costs were going through the roof? What did they think was the outcome?

@mattbernius: But they do often lose their tools and vehicles which are what were purchased with the loans.

We are talking credentials here, not denying the use of any knowledge or skill gained. Just the paperwork. Is it the magic parchment or the education that matters?

When in American history has student debt been a problem until the last few decades?

A lot of people are freaking out about debt relief for “privileged” kids. Scoldy Boomers. “Back in my day….”

This problem is new. Unprecedented. It used to be you could work a summer job to pay for a full school year. You cannot anymore.

I went to a private school and paid the debt off over like 4 years at $150 something bucks a month. That amount stung when I was fresh out. I ate a lot of potatoes. I curtailed my recreational opportunities.

That was the eighties. It’s not the 80s anymore.

Nowadays kids routinely graduate with several hundred thousand dollars of debt. That is new. The ratio is new. The ratio is off. Paying off college for twenty or twenty five years of your working life is new and unprecedented. I think it is unacceptable and absurd.

Today is not yesterday. The old rules of thumb no longer apply in this instance.

It illustrates how the American system of post-secondary education for profit is extremely at odds with the rest of the world where it is seen as a public good rather than a potential profit center.

Exorbitant fees also serve as a cultural and economic gate-keeping mechanism. I hate that. I really, really hate that.

@JKB:

And when people with degrees declare bankruptcy they don’t also often lose important tools for practice as well? Up until recently, losing a vehicle, for example, greatly impeded someone’s ability to do office work.

The answer in many professions is “yes.” Which for some reason you cannot seem to wrap your head around.

@JKB: Actually, historically most legal systems which had legal mechanisms in them for bankruptcy exempted the “tools of the trade” from being taken. Because they’re not idiots.

Also, the reason that lawyers used to be created in the US without the requirement of a) attending law school or b) passing the Bar was because of the many many years of apprenticeship they undertook before being considered qualified. If you want to try going back to that period be my guest…I would think that 3 years in law school is quicker than 7 years of apprenticeship, but hey, whatever floats your boat…

@JKB: “We are talking credentials here, not denying the use of any knowledge or skill gained. Just the paperwork. Is it the magic parchment or the education that matters?”

Always amusing to see how much you resent the people who have accomplished things you were incapable of. How different your life might be if you had stuck it out and gotten that AA degree… or that high school diploma.

“both ideological and practical reasons, I think we should expect people to pay off loan agreements they voluntarily entered into.”

At face value I would agree with this. On a deeper level, I’m conflicted. Are many of the young adults that get swept up by brilliant marketing slogans, and powerful social pressures to sign on the dotted line, actually freely volunteering? Would Individuals that are financially sophisticated grant them loans for degrees they are likely to have a difficult time paying off, if they were able to discharge them in bankruptcy? Speaking as a blue collar worker who has no children, I am totally bought in to investing in the younger generations, but skeptical about moves that may reward predatory lending to naïve folks prior to entering the workforce.

@de stijl: My feeling is that we should a)cut down on the amount of money that can be borrowed for a college education via gov’t loans. b) come up with a cheap(er) but qualifying alternative for people who really want to “just get the education” and don’t give a crap about “the entire college experience” involving Spring Break in Cancun. Maybe split it into recorded lectures on line together with any required labs in a local building.

If we provide a cheap as well as an expensive alternative, we’ll soon know how much people want to in fact pay for “the whole college experience.”

@wr:

He hasn’t handled his lack of formal education well. He should follow my example: go around with a chip on your shoulder which will motivate you to outperform better-educated people. Few things give me more quiet pleasure than watching someone with a Masters in lit, or someone from the Iowa Writers thing fail to accomplish what I can do working three hours a day.

Got lemons? Make better lemonade.

@ImProPer: Exactly right. College loans are marketed as financial aid. As my kids know (because I told them) financial aid is scholarships, internships, work-study. Anything but loans.

@JKB:

Are you joking? Have you ever read a help wanted ad? Wanted: Primary Care Physician, degrees not required, just show us you know how to use a stethoscope.

Question for the lawyers in our midst: Is there a reason Biden can’t just declare that the interest rate will be dropped to a token 1%? That’d do more good than 10 grand.

This Just In:

The Biden administration is cancelling up to $20,000 in student debt for Pell Grant recipients, up to $10,000 for individual borrowers who make under $125,000 per year and extending the pause on repayments by four months, the White House announced on Wednesday.

@Michael Reynolds: And don’t forget that the businesses should surrender any patents they hold, documents related to their business, licenses, and so on. They have their knowledge, so they’ll be able to rebuild their businesses without the patents, plans, licenses…

@Modulo Myself: WA! Great simile! I’m soooo stealing that!

@Scott: Hey now! Lenders worked very hard getting the bankruptcy laws to the conditions they stand at now. Let’s not go reinventing the wheel. Especially to make the wheel rounder and more easily rolling for the debtors. That wasn’t the plan at all!

@JKB: “Of course, those getting this “forgiveness” are going to be in debt to the IRS since they’ll have to come up with the $1000-$2400 income tax out of their current cash. Many will lament that 1099-C”

Isn’t this the same math that Bob the Plumber used to explain that a 20-some thousand dollar tax bill was going to make buying a $250,000 plumbing business impossible because the tax increase was going to make the $175,000 salary increase not worth having?

@Kathy: Doesn’t matter. The costs of not being able to buy a home, get married, raise a family, take vacations, own automobiles and what not are not borne by taxpayers, so they don’t exist.

@ImProPer: This is what gets me. Most people, when they sign up for this debt, are 17 or 18 years old. They have – to that point – been told that college is a pathway to future employment, that not going to college is some sort of personal failing and it’s going to be hard to be successful (which I’m sure @Michael Reynolds will tell you is true).

Colleges then propose a trade: you pay us X, we’ll give you the means to that promised future employment. Can’t afford it? New deal: You give us X/10 now and promise to pay “X” over your lifetime, we’ll still give you the means to that promised future employment. I mean, yeah, X is a number that can buy a house, but promised future employment opportunities! [fine print: ok, it’s 10X over your lifetime, but did we mention the employment?]

The college has 90% of the leverage in this transaction, bolstered by a generation of college-bound adults and a century of increasing relevance of the certificate class, against a 17-year old kid. It’s a predatory mess of our society’s making. We created a system of predatory messages and predatory lending to the most vulnerable population (literal kids), and we owe it to them to right that.

Did they sign on the dotted line? Yes. Did they have a choice? Yes, in the most literal sense, they absolutely did! But do we all bear some collective responsibility for making the alternatives seem irrational/illogical/untenable for success, making a multitude of jobs highly dependent on irrelevant diplomas, making college the “standard” without actually paying for it? Yuppity yup yup yup.

@JKB:

Well, Indentured Servitude was first introduced to the Americas in 1607 at the Jamestown colony, so why not bring it back and teach these young people that freedom is not free.

The conservative vision for America today seems to be that if it doesn’t hurt we can’t use it.

@JKB: The paper *is* the credential. To get the “Professional Engineer” credential in most states, you have to graduate from an ABET-accredited undergraduate program. No paper – no P.E. – no civil engineers working for Depts of Transportation, etc.

Not to mention how absolutely cruel it is to saddle students with debt in the first place and then to take away the credential that allows them to practice their profession.

@ptfe: Also there’s now the fact that the first year of college in a lot of places is spent a) doing remedial education that the students should have had in high school, and b) forcing the students to “have a rounded education” which usually consists of insisting that the science & engineering students take liberal arts courses, never the other way around. (I’d love to see journalists and business majors be required to have sufficient math and statistics shoved into them so they could at least understand how to design and carry out an applicable survey, or understand when “a survey” is producing crap.)

@Just nutha ignint cracker:

I’m reminded of my old econ professor, who during a discussion of taxpayer-funded schools (and childless taxpayers!) asked what those children would be doing if they weren’t in school, and how much it would cost the (childless) taxpayer to prevent them doing it. Or catch them and appropriately punish them if they did it anyway. Society always ends up paying for bad policy, one way or another.

@grumpy realist:

UW Madison requirements for a BA in Afro-American Studies:

@Mu Yixiao: I think a lot of schools are like this. There’s a distinct feeling of “anybody can do that!” to the STEM-taking-LA complaint. But most people in, say, a physics program couldn’t write a critical inquiry paper on one author’s major body of work any more their English major counterparts could step into a particle physics class. That doesn’t make it some sort of gotcha when the English major takes Bio 101, since the physics major is probably taking English 101 just for the credit.

I don’t think universities are to blame for an overall lack of critical thinking skills. Practical application of a skill makes it stick. If you let your critical thinking skills dull (or if your critical thinking skills are outpaced by events), it’s easy to fall into traps of lazy analysis, unfounded conclusions, and general gullibility.

@ptfe:

Ironically, what’s undone the humanities the most in American universities is their emulation of science, as if every Phd is expected to produce new results on the ‘texts’ of Joyce, like they’re quasars. Same goes with economics and its equations, and don’t even get me started on analytic philosophy, or how the French in the 50s were bringing in topology to map the human psyche and voila Jacques Lacan.

At a basic level, I would ban normal economics, except for orthodox Marxism plus bookkeeping, accounting, and finance. And for the humanities I’d also reverse the standard order. You’re a freshman you start off at 400-level courses deep in the weeds and you would slowly work your way up to writing a coherent essay about a matter that concerns you. And no 101-level courses, which would hopefully–fingers crossed–eliminate libertarians and future pundits entirely from this world.

I worked in the kitchen at Sorin Hall at 5 in the morning to prep for breakfast.

I worked campus security at night. Pulling on locked doors to make sure they were still locked. Walking people back home. Basically being awake and aware while walking around. Either 6 to midnight or midnight till 6. Same deal. The late shift was quieter Sunday through Thusrsday, but Friday and Saturday nights were insane.

Half the time I was on the other side of the coin partying my brains out. Weird, interesting gig. I wouldn’t recommend it. I had no choice – I was obliged. I had to.

The head of campus security was a blatantly alcoholic dude retired from St. Paul cops. He was drunk and drinking constantly. He barely hid it. Vodka in a Sprite bottle was his go to. He was one fucked sorry-ass man. He was my boss.

The folks who ran the student meal service were much more professional. They had processes and knew where to to stick newbies. I hauled and cleaned.

On campus security detail I mostly fucked around. There was nothing to do 90% of the time besides walk around.

Nowadays, they would not have students walking around in dumb-ass uniforms pretending to be security guards. At least, I certainly hope so! Liability issues would presume so.

I think meal service probably runs the same way it did back then only with a bit more formality. Those folks were pros in 1981 and still are now. They knew the job.

Campus cops and “security” are fuck ups today. Hell, us campus kids were probably better than these assholes are now. We knew when to let things go and pretend we did not see harmless high/drunken shit that was not destructive. No harm, no foul, but you need to go home now. It was a 4000 pop campus. I knew almost everybody to some degree.

I think I made 4 bucks an hour. 4.50 – in that range. I made more money donating blood plasma.

@ptfe:

I fully support bi-directional instruction between humanities and sciences.

When I was teaching HS, I’d have kids ask “Why do we have to learn this?” So… “‘I’m an artist, why do I need to know chemistry and physics?” Because pigments are a function of both chemistry and physics. How does light absorb, reflect, and refract in your oil paints or glazes? Need a special color of glaze that you can’t fine elsewhere? Use chemistry to create it.

“I’m a scientist/engineer, why do I need to know art?” Because you’re going to need to write papers that non-scientists/engineers can read, and do it well enough to convince them to give you money. You’re going to have to build physical models of the stuff you draft on the computer for testing purposes. And you’re going to need to understand how people are going to use the stuff you build–including the psychology behind design choices.

You could just see the wave of realization sweep across their faces. 🙂 Apparently no other teacher told them these things. They just said “Because you will.”

@Mu Yixiao: I didn’t mind the “humanities diversity” classes I was supposed to take at my alma mater because we had some really good teachers and the level of classes was very high. It’s when you’re forced to take the 101 “writing for physics majors” after you’ve just sold another popular science article for $250/edited a book that you want to chew your teeth off. At least let us place out of the 101 humanities stuff, for heaven’s sake.

P.S. and one of the most remarkable courses I’ve ever taken is the one on Iconography in Renaissance Art.

@grumpy realist: I fully support being able to place out of classes like the one you describe. That sort of class has was always an option to fulfill a general humanities requirement, not a requirement in and of itself.

I took an upper division lit class my first quarter as a frosh. I did well in it, too. Also took the writing 101 – which was “Science Fiction” – read sci-fi and write papers about what you read. It wasn’t a chore, it was catnip. Loved it. And I took calculus, which was also catnip.

I do wonder what might have happened if you had taken an example of your published work to the instructor on the first week of class and said, “Here’s my work. I don’t think I’m going to find this class valuable, and yet I am required to take it. Can we come to some arrangement?” I’ll bet the answer is “yes”. I’ll bet you weren’t the first person in this situation.

This is something I never did, though, and I probably should have in a couple cases. It can be hard to know that it’s an option.

@grumpy realist:

Interesting. When I went to college (late 80s) as–initially–a science major, I had to take X credits of humanities, X credits of English (Y of which had to be writing emphasis), and X credits of sciences. The specific classes were up to me.

@Michael Reynolds: “Few things give me more quiet pleasure than watching someone with a Masters in lit, or someone from the Iowa Writers thing fail to accomplish what I can do working three hours a day.”

The founder and director of the University of California MFA I’ve taught in for fifteen years now set out to create a program that would nurture, teach and grow all sorts of writers — and with a special welcome to those who want to write popular or genre fiction. (Until his book sales recently got so big that teaching no longer made financial sense, Stephen Graham Jones was one of our most popular fiction professors.)

When we were just starting up in 2008, he described the program on a panel at AWP, the national conference for writers programs. One person in the audience was outraged and insisted that we were destroying the very concept of teaching writing with our approach, and we should model ourselves after Iowa or one of those other programs where they teach students to write short stories that no one will ever read.

When asked to comment by the moderator, our director just said “Sounds like a guy who hasn’t had a book in Barnes and Noble in twenty years.”

@ptfe: “Colleges then propose a trade: you pay us X, we’ll give you the means to that promised future employment. ”

I agree… but it’s worse than that. Because it’s not just the colleges selling the need for and rewards from an expensive education — it is (or was) the entire culture. The government, the media, just about every corner of society was sending out the message that college was not only good, it was necessary.

And now we’re told that the kids — and most were kids at the time — who accepted what just about everyone in the country was telling them were a bunch of suckers and they deserve whatever happened to them.

I worked three jobs to put myself through school without debt. Granted, I went to a junior college for two years then a state school for two years. No private university for me.

My nephew just graduated from LMU in Los Angeles debt free, due to the generosity of my mother towards her grandson. She couldn’t do that for me, but I’m thrilled she was able to do it for my nephew.

Having said all that, I think this is a really bad idea. I think it’s a bed idea morally, and I think it’s a horrible idea politically.

That is all.

@ptfe:

This. When you sign a mortgage or a car loan, everyone knows exactly what you will be getting. There is a tangible, solid good at the end you receive, not a promise of potential future gains. No bank will give you a mortgage if you tell them you plan to have a house in the future using this to gain entry to Zillow, maybe Redfin- you better show them a property and some solid facts and figures. Education is the only time you can get hundreds of thousands of dollars for a product who’s buyer thinks the end goal is to maybe get you a job. You are actually paying for the education itself and what you do with it is tangentially related to employment. Silents and Boomers tricked the following generations into thinking education = job instead of education -> job, then making ridiculous credential demands for entry-level jobs at low pay.

Can you imagine if buying a car worked the same way? You rack up crushing debt when you’re young to learn how to drive, having been told your whole life it somehow makes you magically eligible for a car, likely a Maserati. When you finally go to get your car, you are told nope, you get a Pinto at best and it’ll cost ya upfront. When you complain that you can’t make payments on your drivers ed class in your broken down Pinto, people tell you to be quiet because back in their day they paid it off in a week and managed to score an Audi on the side cheap, ya slacker. Why are you demanding to not pay back the scam classes? Society never promised you a Maserati in writing, just hinted at it and socially pressured you to get it! Don’t you know how expensive it would be to write off driver’s ed classes for millions of people?! Why, we’d have to take money from the defense budget or wastes of time like investigating Big Lie election fraud!! You signed a contract – pay up or we’ll take your drivers license and then how you gonna make money, hmm?

@Han: Yeah. Now all we gotta do is sell that idea to the “I don’t want teh gubmint using MY taxes for stuff that I don’t need and can’t use”-ers.

@Blue Galangal: “Not to mention how absolutely cruel it is to saddle students with debt in the first place and then to take away the credential that allows them to practice their profession.”

Ummm… That’s more of a feature to JKB than a bug. 🙁 Think of it more as “tough love” (or maybe “tough luck, chum”) steering young people to realize that seeking a better life than your parents had is just uppity and not knowing your place.

@grumpy realist: “after you’ve just sold another popular science article for $250/edited a book that you want to chew your teeth off. At least let us place out of the 101 humanities stuff, for heaven’s sake.”

Times must have changed. When I was in university, the type of situation you describe was why “challenging for credit” existed. On the other hand, when I was older, I knew students who had taken 3 or 4 years of foreign language who tanked the foreign language placement exam specifically so that they could take one class in a term for which they wouldn’t need to do any preparation. (At the time, the University of Washington required a year of foreign language even if you’d taken more than a year in high school, and the GPA for entrance to the School of Engineering was 3.8/4 according to what kids reported to me.)

@KM: Absolutely. When students sign their Master Promissory Note, they are essentially committing themselves to a series of legally binding Terms and Conditions that essentially make them an indentured servant to the US Dept of Education.

90% of what we consider normal when we take out an installment loan is missing. There is no Truth in Lending Statement. The interest rate is not disclosed. The College is not required to provide with them with a fixed cost structure and an amortization schedule that covers the repayment.

And there is absolutely nothing that prevents the College from changing the financial aid package year after year, or from raising the cost of attendance year after year.

Anyone pretending that a 17 or 18 year old understands what they are getting themselves into when their parents, grandparents, aunts, uncles, guidance counselors, teachers, etc., are all telling them to just sign the form is not someone I can take seriously on this issue.

I have literally had students whose grandparents or parents told them what College they had to accept admission into, what classes they had to take, what dorm they had to pick, what their major was going to be, whether or not they were allowed to drop a particular class. For every one of them that was too miserable and beat down after years of being controlled to fight back, there have been two or three who are legitimately grateful for what they perceive as guidance.

@Jay L Gischer: I’ve known teachers whose practice was to “dog” challenge essays, but it was unusual. In one school I taught at, a challenge required 2 readers with a third tie breaker reader if necessary.

@EddieInCA:

As a complete aside, this is a really great example of the importance of inter-generational wealth in setting younger folks in a family up for success.

This also brings us to the challenges that debt creates in creating said inter-generational wealth. Which is ultimately a critical component of this larger conversation.

@Rick DeMent:

Ok, but you have to at least acknowledge that gender studies got a lot more expensive to teach once they added 37 new genders.

It was offset a little by savings in planetology once they dropped Pluto, but not by much.

@grumpy realist:

I have suggested at nearly every job that our interview process for software engineers should involve an essay. I don’t care on what — “what’s a movie that you have abnormally fond memories of, and why?” would be fine. Or “name someone you think did something heroic.” Something everyone can manage to get something on.

Or an LSAT essay question.

I just want to know: Can you communicate a fucking idea, you semi-literate computer geek on the spectrum?

Can’t make eye contact but can write three pages on the struggles of Frodo the Hobbit and how it parallels their own struggles deciding whether to have non-fat milk in their latte? And can write a for loop? Hire them now.

I see you all talking about how you got through college, and that’s great. But very few have stopped to note the increase in tuition since then (Scott mentioned this, but few others).

In 1985, in state tuition for a California State University school was $500. Adjusted for inflation, that comes to $1,350.

Tuition for a Cal State school in 2022 will be $5,700.

Sure we, myself included, could work our way through college because, in real terms, our four years of college cost the same as a single year does now. We are placing a heavy burden on young people who want the opportunity to get a good job, and we are pricing out a lot of people who ought to have the opportunity.

Student loan forgiveness? Sure. But also, let’s demand our government invest in education.

@Kari Q:

Wanted to say:

Invest in higher education and make lowering tuition a key part of that investment. Easy access to education has been a key part of the country’s economic success, and we are killing it.

Further thought, not directly related to the above:

Cal State University was free until 1975. The push to charge for education was lead by Reagan when he was governor.

I think it was about punishing the hippies. The dirty hippies didn’t appreciate their free education so older generations decided to take it away. Never mind that by the time this happened, hippies weren’t in college and it was later generations who are suffering.

@Kari Q:

As early Gen X I now have another thing to thank the Boomers for. Thanks, Boomers!

My first job out of college was as a temp file clerk. I had to do a test to ascertain how alphabetical sorting worked before they hired me on. You don’t care what I learned in college, you care about things I mastered in the third grade, okay…. Atherton gets filed after Anderson. I know how alphabetical sorting works.

I left as an Assistant Vice President. It was for a big national bank. I had direct reports and staff and a budget and spent almost all my time in meetings about boring stuff that were annoying and mostly meaningless.

I left. I resigned. I joined up with a friend who was setting up a consulting IT contract firm. I had actual skills. The first year I made 3x my old salary while working 9 months. The crazy part was I was working for / contracted to the company I resigned from. It was incredibly liberating.

I actually got to do stuff I was really good at. In the bank I had been promoted above what I good at. I was decent / average performer as a manager, but I was a rock star at data analysis, SQL, database management, and query optimization.

I graduated with a degree in Linguistics and Marketing. The linguistics helped a lot actually, the Marketing none whatsoever.

The credentialism required for entry level positions is beyond stupid. Give me bright and curious anyday.

For all the people claiming You Went To School And Paid For It By Working A Job At The Time:

Are you also supporting the push to increase minimum wage to the level such that college’s wild costs could be paid for [without any loans] using only the same number of hours per week as you worked? No? Shocking.

Using their logic, since clearly today’s college costs are The Rightful Costs, we’ll just make up the difference by increasing current taxes on Boomers to cover the costs they didn’t pay at that time. Boomers had their college costs subsidized by local, state, and federal governments — and government therefore has a duty to remedy that error.

Boomers wouldn’t possibly be showing their permanent IGMFY brain-worms, now would they?

Who also wants to bet that making student debt dischargeable in bankruptcy once again would see the single greatest increase in BK’s in history?

I am one of those folks who was not entirely on board with student loan debt forgiveness, as my kids worked their way through school to avoid racking up significant debt obligations. My reservation was based on the fact that by working and going to school it took my kids longer to get their degrees, therefore they lost a significant of valuable time. However, Biden’s approach to this limited debt forgiveness is something I can support. It provides relief to those most vulnerable students who were sold on to-good-to-be-true outcomes by assuming unrealistic amounts of debt at stupidly high interest rates. In my view, Pops Biden is proving to be a thoughtful steward of the Executive Branch of government.

@JKB:

In my experience employers care more about the magic parchment than the actual education. I’ve been turned down for a variety of jobs when I’m already doing the job just because I don’t have that magical parchment. Meanwhile our new hires have the magical parchment and still require training/educating from me…

@Matt: I’m also annoyed by the incessant demands for degrees that we’re seeing, even when unnecessary.

Of course, there is the other side when looking for a job: demands for N years of experience even at the lowest levels. HR departments are notorious for this in the CS field–demanding 5 years of experience in a computer language that was developed 3 years ago.

@Matt: wish I could remember the name of the CEO who said a major reason businesses like college graduates is that it shows commitment, that they finish what they start.

Being deeply indebted also tends to make for a docile workplace, so that’s helpful, too.

Trump’s Tax giveaway cost $2T.

Guess which giveaway will benefit the economy more?

At 1/6th the cost.

Ironically I’m at the airport now heading home after dropping my oldest kid off for college.

We considered taking out a loan for her after these ideas got floated since Biden took office but thought no, Biden won’t be that dumb. Oh well… Looking at the details we would have qualified and got much of her Freshman year for free.

This is a pretty terrible and dumb move IMO. It doesn’t fix ANY of the underlying problems with higher education funding, it will actually make them worse. And it’s a big FU to the majority of Americans, particularly those without college degrees, those who paid off their loans, and those who will be borrowing and going to school in the future. Biden could have made this much more targeted to those in actually desperate straits, but did the opposite and put in few restrictions except an income cap that extends well into the upper class. The cherry on top is the dubious legality of this – using emergency powers to basically give a shit-ton of money to please part of the Democratic base. Oh and the moratorium on loan payments are – coincidentally – extended to just after the mid terms.

It’s like something Trump would do.

I voted for Biden and except for Afghanistan have thought he’s done an OK job but I have to wonder how he thought this would be a good idea politically because it is so objectively bad on the merits.

@becca:..CEO…

When I was in High School (Homewood-Flossmoor HS class of 1966) I hung out with a kid whose family had recently relocated from Minnesota to the Chicago suburbs. His father was the top dog in the Chicago office of what was then called Minneapolis-Honeywell. The dad told me that it did not matter what anyones college major was, his company wanted to see a Bachlor’s Degree on a job applicants resume for the very reasons you just mentioned.

Not like I ever listened to anyone. I spent two years in Junor College followed by five more years from ’68 to ’73 of allegedly attending classes at Sleepytown U now and then. Never did get a degree.

I did pay back the $5000 Student Loans I owed sometime in the early ’80s.

@grumpy realist: I was a poli sci major and at my college–a private, liberal arts school in Ohio–we were all required to take a certain number of math classes, science classes, literature, etc.

I took statistics, geology, biology and several interdisciplinary classes.

It was fantastic, and I wish more schools required that sort of course load.

Given how angry all the worst people are about this, I think Biden should sweeten the pie. $15/30k.

My big problem with this is that it doesn’t fix the underlying problem. If anything it makes it worse. We made an open-ended commitment to financing higher ed through a loan shark system and then acted all stunned when the price of college skyrocketed. While some small schools are struggling, big state schools — of which I work at one — have seen their budget double over the last decade thanks to fed money, donations and overseas students. Now that we’ve said, “Hey, the first $10,000 is on us”, what do people think is going to happen? They’re going to act all shocked when the price of higher ed jumps by $10,000.

Some possible fixes: the vast majority of defaulted loans are from trade schools like barber colleges; eliminate or reduce licensing requirements and cut those schools out of the system. End loans for graduate school that isn’t medicine, law or something similar. Make loans dischargeable in bankruptcy, maybe on a sliding scale where every year post-degree is another 10% that can be discharged. Put schools on the hook for part of this. Focus relief on those who never got degrees and therefore never got he benefit of the loan.

If we don’t start controlling higher ed costs, all we’ve done is delay the eventual reckoning.

@Hal_10000: This is where I am. My issue is that the loan forgiveness doesn’t solve the underlying problems in higher ed.

A college degree equates to higher earnings, so parents (understandably) encourage kids to go to college. This then means that more kids exit colleges with degrees, so that becomes a baseline requirement for a job. But then some workplaces start requiring graduate degrees, while keeping the salaries the same. This also has to stop.

It is completely idiotic for a PR firm to require a Masters for a barely-above-entry-level job that pays $50K a year, but I’ve seen it. Students are taking on mountains of debt to get in the door for jobs that just don’t require a masters degree.

We shouldn’t continue to develop better cancer drugs because people have died from cancer before! And because some slaves bought their own freedom, the rest of them were just lazy!

So tell me.. what underlying industry problem did the airlines immediately fix last December when they were bailed out? Or after which bailout did Wall Street stop speculating with taxpayer money? Or what the oil&gas industry fixes each year when Uncle Sam cuts Exxon a check for $20B in budgetary “subsidies?”

This has never been a requirement [or even a consideration] for handouts for businesses.

Are you possibly suggesting businesses aren’t people any more? We were getting along so well!

It’s amazing the extent to which people don’t defend this policy on the merits or even address the relevant criticisms that are coming from both the right and left – instead, it’s a whole lot of whattaboutism and trolling for hypocrisy. All that does is tell me that one doesn’t have arguments on the merits and nothing to deflect the material criticism of this policy.

@JKB:

Thanks for pulling those numbers. Also seeing the median debt is $19K shifts my thinking as well on this. Not to mention learning about the additional relief for those with Pell Grants. It seems much better policy than I first realized (at least in terms of having an meaningful difference in people’s lives).

@Hal_10000 & @Andy:

[Andy I’m using this quote from Hal because it echos what you wrote.]

I completely agree with this statement. And I think we have to also address the issue that there is no way to unilaterally or quickly “fix” the underlying problem. This one especially has so many interlinking factors at multiple levels of government (especially when we’re talking about funding or licensing reform), institutions (both academic and commercial), and social (whether you scoff at it or not, the reality is that the degree itself has taken on a “magical” quality in the same way that we all accept that scraps of paper and bits of metal represent currency). There simply is no magic wand.

Which makes it different than, say the Immigration system, which is completely within the Federal government’s purview and… largely due to the construction of the Senate, we have not been able to fix for decades.

So in lieu of that, we end up with unilateral band-aides from the executive branch or milktoast reforms that ultimately preserve the underlying problem. And that doesn’t mean that these actions would have an immediate impact on folks lives. And for some folks it will be positive and for others it will be negative. The question, that we’ll have to see, is what are the relative real and imagined impacts of the legislation.

@mattbernius:

I’m not sure this even qualifies as a band aid considering it could make future educational financing worse than would otherwise be the case which would, as a consequence, make actual fixes more difficult.

Various interested parties will now factor in the possibility that similar actions will take place in the future (and there will be political pressure to do so), which will not at all put any kind of brake on the insane higher education cost growth we’ve seen in the last few decades.

And I think you’ll see a lot more people will start getting loans they don’t need hoping for a similar windfall in the future. My wife and I are thinking of doing exactly that since we have one kid starting college this year and a second kid starting next year and will have very significant college expenses. The incentives make this a rational decision.

@Andy: This still exists. I tested out of a year of German II with a 15 minute interview with the dept head (in German, of course). And I had professors who allowed me to change final projects/assignments as long as what I submitted was within the scope of the course.

@Just nutha ignint cracker: You’re right, of course, but it’s stunningly short sighted.

I think a big piece that would help would to cut out the for profit actors. you want a degree from Phoenix, get a private loan. Don’t wad up the federal system for that. There’s a woman on Twitter who’s got 300k worth of debt from a for profit for a PhD she can’t find a job in (where they jerked her around during her program to milk more $$ out of her). That absolutely sucks for her, but she also represents she couldn’t find an online only program from a regular university. I don’t think so – I think she was victimized by a for profit system and too ignorant to know better. If Phoenix et al. didn’t have access to VA benefits and federal loan programs their prospective students might be a little more wary.

@Andy:

The policy has been defended on the merits – whether you personally like it or not.

Buddy, your entire stated reason for DISliking the policy is.. the exact definition of whataboutism.

All that does is tell me that you don’t have any argument on the merits.

You’re not special – and you definitely aren’t The One True Setter of Goalposts.

@Gavin:

Well, I already listed the problems I have with the program on the merits, you are free to take them or leave them, and I have no expectation that everyone should or will agree or disagree with them.

It’s not me that is what-about-ing on airlines or the PPP. I’m not here trying to convince people that previous bad policies and previous bailouts somehow prove that this particular one is justified.

Whether or not bailing out airlines or Wall Street or whatever was good policy or not is irrelevant to whether this student loan forgiveness is good policy or not.

What a strange claim to make – I’m merely giving my opinion here, which seems to be what you’re doing as well.

@Jen: ” My issue is that the loan forgiveness doesn’t solve the underlying problems in higher ed.”

And Small Business loans don’t solve the underlying problems in capitalism. And Green Energy loans don’t actually pull carbon out of the air. And child tax credits don’t eliminate poverty from the earth.

We must always allow the perfect to be the enemy of the good!

@Andy: “All that does is tell me that one doesn’t have arguments on the merits and nothing to deflect the material criticism of this policy.”

Actually, I’d flip that around. It’s because the arguments on the other side are so clearly in bad faith it’s not worth the time to respond seriously.

@Andy:

Just wanted to note that this is very much the same arguement as many have made about the Reagan era relief to undocumented immigrants. And sadly we have seen little to no meaningful reform in the 30 years since then (beyond DACA, which again was executive action).

So to some degree this line of thought is true… and also misses the point of deliver some form of immediate relief in the moment.

In general my thoughts on this are a bit muddled and still working themselves out. I hope to write on it later this weekend, probably from the angle of whether or not “fairness” is a good framework for crafting or evaluating policy.

@wr:

These same arguments are coming from former Obama officials and several Democratic politicians. Are they operating in bad faith too? Are you really suggesting that none of the criticisms of this policy are valid and that all of them are in bad faith?

I would just note again to you, as I have before, that it’s difficult to have a conversion, much less a debate, when one party persists in impugning motives. In contrast, I’m not assuming that those who support this action (which presumably includes you) or think it passes a cost-benefit test are motivated by bad faith arguments.

@mattbernius:

I think the Reagan-era immigration relief is both a good example and a cautionary tale about the problems with kicking part of the can down the road.

But it’s important to note that what happened during the Reagan administration was much different because the amnesty was part of a bigger immigration bill that was passed by Congress and signed by Reagan. In contrast, Biden’s action uses a 9/11 law intended for first responders that was shoehorned into a Covid “emergency” while the administration, in other contexts, is stating that Covid isn’t actually an emergency.

If this came out of a legislative effort, it would be one thing, but it’s about as far from that as one can get. One thing I frequently say here is that process matters – how you politically achieve some desired end often matters more than the end itself.

I look forward to the post.