The Great Wealth Transfer!

As the Silents and Boomers die off, their assets will be redistributed.

YahooNews senior editor Mike Bebernes ominously proclaims, “America’s ‘Great Wealth Transfer’ is underway. How will it impact the country?” It turns out to be something rather routine.

As a generation, baby boomers, those born between 1946 and 1964, have done very well for themselves.

Blessed with the good fortune to have entered adulthood at the start of an era of exploding housing values and sustained stock market growth, the roughly 20% of Americans who fall into the boomer generation have amassed $80 trillion in cumulative wealth — nearly as much as all other living generations combined. With the oldest boomers now approaching 80, some of that wealth has started to be passed down to younger generations, marking the early stages of what’s become known as the “Great Wealth Transfer.”

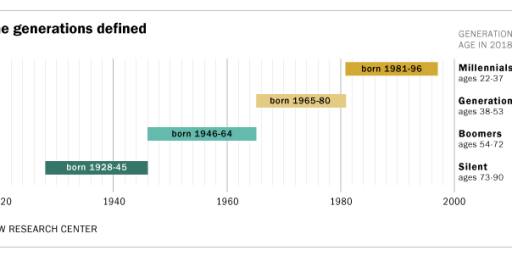

In the coming decades, economists estimate that the children of boomers, most of them millennials born between 1981 and 1996, stand to inherit as much as $70 trillion to $90 trillion in real estate, stock, cash and other assets in the U.S. alone. It’ll be enough to make millennials “the richest generation in history,” according to one recent analysis.

So . . . old people are dying and leaving money to their kids? The horrors!

Yes, the oldest Boomers (including Presidents Bill Clinton, George W. Bush, and Donald Trump) were born in 1946 and have or will turn 78 this year. The youngest, born in 1964, have or will turn 60; most of them should have a lot of years ahead of them. So, even though the Boomers were a huge generation, the transfer of wealth will be slow.

I’m also struggling a bit with Bebernes’ (actually, likely KnightFrank’s Liam Bailey‘s) math. The early Boomers presumably mostly had kids when they were in their 20s, so roughly 1966 to 1976. That would make the kids Xers, not Millenials. The parents of the oldest Millenials, assuming an average age of 25, would have been born in 1956 and just hitting retirement age.

Not everyone stands to benefit, of course. The wealthiest 10% of Americans hold the lion’s share of the country’s assets, so their heirs are in position to take in the majority of the wealth that will be passed down.

Sure. Then again, many of the super-rich, who hold a stunning share of the wealth, are relatively young and aren’t going to be transferring that wealth any time soon.

But that still leaves tens of trillions of dollars that will be transferred to the children of middle-class, and even some lower-class, boomers.

The amount of wealth that’s set to change hands is so massive — two or three times America’s annual gross domestic product — that experts say it will have an impact not just on the economy, but also on our culture and politics.

That strikes me as a stretch. Yes, it’s a ton of money. But it’s going to be transferred over a very long period of time. And, again, inheriting money isn’t something the Boomers invented.

Some experts view the Great Wealth Transfer as millennials’ best hope for making up the economic ground they’ve lost after enduring two recessions, the coronavirus pandemic and recent cost increases that have made things like homeownership increasingly out of reach. With their increased wealth, millennials — along with some Gen X-ers (born 1965 to 1980) and Gen Z-ers (born 1997 to 2012) — will have the buying power to shape the country to fit their tastes and political worldview.

Again, it’s going to be a long time before Millenials start inheriting money in drives. And I suspect most Xers who are going to buy a house have already done so.

But others fear that the Great Wealth Transfer will only serve to further entrench inequality by ensuring that only the children of the well-off benefit from the gains made by older generations. Many in that camp argue for stronger inheritance taxes to help distribute boomers’ wealth more equitably throughout the country.

Wealthy people put their assets into trusts to shield them from inheritance taxes. But, yes, families with the wealth to do so tend to invest a lot of money into their children throughout their lifetimes, giving them substantial advantages over those whose parents can’t do so.

Hey! Not so fast! Not yet ready to go to the great beyond. At 70, I’m hoping for another 15-20 years. At which point, if there are still some assets to pass on (actually my wife’s assets since she’s 10 years younger), we may just skip the children and just go straight to the grand and great grandchildren. Then again, I will probably have dementia (wonderful family genes) and the kids will be putting me on that ice floe. To which I already told them: “Ha! Screwed you again! With the boomer caused global warming there won’t be any more ice floes.”

More fodder for the internet meme that Xers are basically the invisible generation, because they are frequently left off of/out of charts, news stories, etc.

The expense and need for long-term care is the wild card here. It’s SUPER expensive, and we don’t yet know how that’s going to impact boomer wealth. There might not be a whole lot to pass on to kids. Everyone wants to age in place, but it’s not feasible for many, and LTC can cost many thousands of dollars a month.

@Jen: For the record a few years back, I got a notice from each of my school districts that my (former, now) state, Washington, instituted a payroll tax dedicated to the state’s share of long-term care costs. Employees who did not want to pay the tax would be exempted if they could show that they had long-term-care coverage. (I’m still in the camp of people who believe–and can see from my parents own experience–that banking the premiums would provide more care at less net cost. I also know that most people are likely to free ride if they can. The number of long-term care policies out in the wild is indeed small. Washington was wise to take whatever efforts it could avail itself of.)

[…]

I suspect that this part of the “wealth transfer” phenomenon will account for the observation a generation and a half away that said wealth transfer didn’t turn out to be the sea change people now are imagining. It will still be a welcome boon to those who receive it all the same. We’ve done a good job of ripping apart the middle class in America; any changes that can paper over any of the damage will be salutary.

Real estate seizure policies for those that pass while on Medicaid will blunt this for the working classes. Much generational wealth has historically been tied to being on passing the family home to the next generation to either live in or sell off in the lower income levels.

@Jen:

And that’s before prices get jacked up as demand increases.

The big change now is the easy money is drying up as people retire and move their lifetime savings into less volatile instruments or just consume it. Interest rates will be higher and risky ventures will find it hard to find loose cash among investors.

I expect retirement and healthcare to eat all of this, for most people.

I have generally been pretty philosophical about my mortality. I have had a very good life and have achieved some wealth. I’m sorry, but I can’t be bothered with the problems my heirs will have. They will simply have to accept a pile of money. I hope you don’t think that I’m too callous. The wealth accumulated logarithmically, and by the time I had a decent pile I was too fatigued for spectacular vices, addictions, or sexual escapades.

@Jen:

So much this.

My situation is a little unusual. I’m the youngest of four and GenX (’68). My three siblings are all Boomers, and my parents (now passed) were born in the mid-20s. My dad was a WW2 vet.

I’ve mentioned before I’m the legal Guardian for my sister, who has dementia, she’s currently 71. She’s institutionalized and is at the stage where she is unable to do anything without assistance. The memory care for that level of need is $8k/month. If it hadn’t been for our dad leaving much of his estate for her care, it would be pretty challenging – well, actually, it would be about impossible. Between what she inherited, social security, and the small amount of retirement she got from her late husband, she has enough to last a few more years, which will probably be enough.

And just this week, my brother – now 73, approached me to be a cosigner on most of his accounts, including for his business, and be a POA due to some medical issues – he’s worried if he gets incapacitated or dies about being able to pay his employees subs and if it comes it, he wants me to make medical decisions if he can’t.

So yeah, this getting old thing sucks.

And the thing about the Boomers is that contrary to the “wealth transfer” thesis, a lot of them are not wealthy at all. I know a lot of Boomers who have gone into retirement or can’t retire because they’ve saved nothing, or had bad luck, or for any number of other reasons. My siblings are one example. My wife’s parents are another.

Do you have a source for this? I suspect that it is not true — the Zuckerbergs and Musks of the world are celebrities in part because they are so rare. For every boy billionaire, there are 100 old man billionaires. (Including former boy billionaires like Bill Gates and Richard Branson.)

I think the more important story is how much of this wealth is held by people who inherited it. That’s the pyramid scheme that is really driving increasing wealth disparity. The libertarian objection to taxation is that it punishes people for striving and succeeding, but the truth is that most wealth was created generations ago, and is now on autopilot for a cohort that have collectively never striven and never succeeded. The billionaires aren’t stupid — they fight against inheritance taxes even harder than they fight against income taxes.

@Thomm:

Well, except that “lower income levels” don’t have any generational wealth at all. Most of them, in fact, have no wealth to speak of. Generational wealth really is a top 10% thing, and most of it is a top 1% thing.

@DrDaveT: Indeed!!!

@DrDaveT:

Fixed it for you.

ETA and taxes are the price paid for not living in a dystopian hell hole, in my opinion.

@Jen: @Andy:

A big part of the reason we moved to Las Vegas was to save money, because we’d seen my wife’s mother take the dementia road, and now it’s my dad’s turn. I’m only pitching in a grand a month because the old man has VA, SS plus some other assets, but to be blunt, if he lives another year, I’ll be the bank. We’re also supporting our two kids. (Plus, there’s my travel and booze and weed and dining out expenses.)

The only reason either of us is still working is to leave enough for our kids. Without that incentive We’d be in Seville, or San Sebastian. Paris. London. Amsterdam. Nice. Edinburgh. Prague. I had a long-running debate with a blogger in which I argued that taxes made me more productive because they were just another expense I had to pay in order to maintain my desired lifestyle. The money going out has to be covered, regardless of the payee. Albertson’s, American Express, the Fontainebleau, the IRS, it’s all one.

@Michael Reynolds:

Interesting. And here I assumed you were at the fuck-you-level of wealthy.

Dementia is the worst – I can only hope the journey for your dad is as painless as possible for your family.

@Andy:

It’s a not surprising but I suppose rueful observation that no one ever entirely outgrows their fears, and mine are 1) money, 2) the kids and 3) the fucked up world, which are actually just aspects of the kids.

I will never stop worrying about money – growing up it was Christmas on an E-4’s wages, and as an adult a lot of cockroaches and piss smells – but I will also never start handling money prudently. One of our resident shrinks might suggest I deliberately hold onto a fear of poverty to justify working because if I’m not writing I don’t know what I am. It’s a terrible cliché but when I’m anxious, the cure isn’t booze or weed or Wellbutrin, I’m sort of immune to drugs, it’s work. If I write 7 to 10 pages and the sun is shining, all is well. An unproductive day with clouds? Gloom and defeat.

We aren’t close, which is entirely my fault. Chief Warrant Reynolds was a good soldier, and is a good man who deserved a better son. But life is what it is.

@DrDaveT: The characterisation that most wealth is inherited in ultra-wealthy does not seem to be statistically supported – but if you have a statistical source then of course do share.

That said the statistics I am aware of do indicate rising levels of multi-generation wealth transfer in the USA and that is indeed problematic. Inheritance taxation should indeed be elevated over a base level, aimed at prevention of an aristocratic-oligarchical strata as that is just economically unhealthy and inefficient

@Slugger: My sentiments exactly.

@Lounsbury:

Part of this is a question of definitions. Most of the studies of inherited wealth that I have seen restrict the definition to posthumous transfers of money or property. That’s not how much of the intergenerational transfer happens — it comes in the form of transfers while the parent is still alive, or through irrevocable trusts and similar. That’s clearly wealth that you only have because your parents had it, but it doesn’t count on the ledger as “inheritance”.

Similarly, the interest on the inherited wealth isn’t counted either. If I inherit $X from my parents and live another 30 years, even a boring index fund will turn that $X into $8X by the time I die, but 7/8 of that will not count as “inherited” in the stats.

One could get closer by looking at earned income plus growth at an individual level, and subtracting that from other wealth. Even that, though, would miss transfers in the form of paying for school, venture capital, and general financial security. I am not aware of any study that attempts to quantify how much of national/global wealth was personally earned or created, vice being a direct consequence of parental wealth. I would find that a fascinating read.

I think that was well considered writing, James.

No, it won’t happen that fast. And the Feds will get theirs, trusts be damned. But its been the way of the world forever. The issue is just the huge rat going through the snake, called the baby boom, and its effect on the metrics.

Everyone makes life choices. Do I spend it on me. Do I leave it to the kids? Charity?

Shorter: its life.