Why We’re Screwed

The American public doesn't think we can afford to cut any category of government spending, even imaginary ones.

Stan Collender points to a poll from Ipsos Public Affairs showing that the American public doesn’t think we can afford to cut any category of government spending, even imaginary ones:

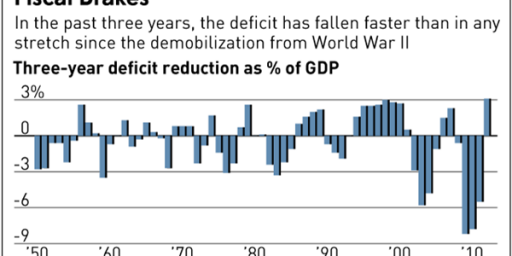

Q.6. As you may know, the US federal budget has a significant deficit. Here are the main view, which of the following areas can we afford to cut back on? (Select all that apply)

All voters/Democrats/Republicans/Independents

Social Security 9%/6%/13%/6%

Medicare 10%/5%/16%/11%

Defense & the Military 35%/49%/22%/38%

Education 12%/6%/205/14%

Alternative energy development 31%/16%/49%/24%24%

Law enforcement 9%/9%/9%/12%

Other 28%/23%/36%25%

None 16%/19%/13%/19%

While hardly anyone picked “None,” there was not a single category that got over 35% support; even the seemingly low-constituency “Other” garnered less than a third.

Oh, by the way, the same survey showed that 75 percent of the public thinks we’re on the wrong track with respect to the national deficit. There wasn’t a question asking how they feel about raising taxes but I’ll go out on a limb and guess that they’re opposed, unless it involves other people paying the increased taxes.

So, closing the deficit will happen only if American politicians exercise bold leadership and make tough choices. I can’t even type that without giggling.

We have met the enemy and they are us.

I’d be open to cutting them all, but then I sometimes look like a fiscal conservative.

(The only “cut” that I can readily propose for Social Security and Medicare would be means testing, but I’d do that. On all the rest I’d look at restructuring.)

While there’s more truth to the “both sides do it” refrain on this subject that most others, this is another instance where the majority of the blame for the problem goes to the GOP. Democrats used to believe in lots of spending but also lots of taxes to pay for it. Republicans countered with lower taxes and less spending. It used to be possible to meet somewhere in the middle on that, even as recently as the 1990s. That’s no longer the case because the Right has abandoned any serious interest in spending restraint while becoming even more absolutist on no rich person every paying one dime more in taxes than they do today. It’s made it impossible to have any intelligent discussion on budget policy, which I suspect is a factor in public irrationality on the issue.

Mike

@MBunge:

Of course not, that would be class warfare.

It’s striking that the only options that come close to buy-in from any party are cuts affecting defense and alternative energy, and not even with majority buy-in.

I wonder if the results imply a non-vocalized feeling that government spending as a whole has been cut too much, but not too much since no one is going to favor tax increases.

I agree we’re screwed unless and until we really start juicing the economy fiscally even if it means we reach the 2% inflation target.

What a straw man survey! When Mitt Romney pays 15% iin taxes, and I pay 30% I certainly don’t expect anything that I am paying for to be cut!

This is why the GOP’s borrow and spend plan is the worst possible fiscal option. Want a war? Want a tax cut? Want to increase defense spending? Want a prescription drug benefit added to Medicare? Done, with no pain to anyone now.

The Democrats at least make an attempt to pay for their proposals. (Obamacare, Medicare Part D, PAYGO)

We’re not having an honest discussion about paying for he government that we have.

Just look at the current Medicare discussion – nowhere in the discussion is there any mention of increasing the Medicare Tax as part of a fix. There is only talk of privatizing the plan and shifting the burden of increased health and medical costs away from the program and onto retired Americans. We’re afraid to discuss a tax increase to ensure the financial viability of Medicare.

We are a dumbed down country.

Well, may I say: duh.

I said the other day, there are no fiscal conservatives in the GOP, the supposedly “conservative” party. How many are you going to find elsewhere?

Everyone loves the idea of small government. No one actyually wants small government. Small government is a slogan. It’s a pipe dream. It’s irrelevant to modern life.

So can we please cut the sloganeering bullsh!t and have an honest conversation in this country about what we need, what we want, what we can afford, and how to pay for it? Without libertarian fantasies or liberal can-kicking?

@al-Ameda: I agree. The conversation has to take a turn to: If you want some program to continue, you’re going to have to pay for that. We must insist, in turn, on asking our politicians, to be specific in their proposals, always asking: “how are you going to pay for that?” That goes for our wars, benefits, everything.

The media and both parties are at fault. But I blame the Democrats more than Republicans.

Why? Republican voters appear to believe in the Republican mantra: lower taxes increase revenues (about as counter-factual as one can get), cut “waste, fraud and abuse” (code words for welfare and welfare cheats but not for, say, Halliburton cost overruns), wasteful government regulation (no details given because it turns out that even most Republicans like clean air and water), etc.

But Democratic politicians have been running scared for 30 years from the label of “tax and spend” Liberals – although why that should be worse than being “borrow and spend” Conservatives is beyond me. They have been unwilling or unable to educate Americans about where their tax dollars go, to spell out what has to be given up in order to reduce taxes by x%. They have bought in over the past decades to the Conservative objective of always lowering or at least not raising taxes on anybody, on reducing the number of tax tiers so that people earning vastly different amounts of income pay the same percentage of income in taxes, and of the preferential treatment of some kinds of income (e.g., earned interest) over other kinds.

But I am rambling a bit here. The media aid and abet both sides because journalists don’t think it is their job to spell out the numbers, day in and day out, to badger every politician with numbers, concrete numbers.

And the problem exists at every level of government. Americans want a whole bunch of services, they expect government aid when there are forest fires, droughts, hurricanes, tornadoes, earthquakes, etc. but seem to think the money falls from the heavens. Just for once, I would like to hear a politician, even a city councilman, tell voters that nothing in life is free, to spell out what it costs to run a school, or collect garbage.

I sometimes wish that every June, the IRS would send out a tax receipt to each citizen listing down to the thousandth of a cent where that person’s taxes went.

Yea, I know, probably none of this would help because the opposition would just assert that said service could be done more cheaply by paying lower salaries or outsourcing to a private company, etc.

al-Ameda is, I fear, correct. We are dumb. Or selfish. Or both.

And I apologize again for rambling but I am frustrated and infuriated by a voting public that knows less than nothing about the government, that doesn’t follow the news (even Fox), that doesn’t accept the fact that, in a democracy, we are bound to disagree about how much the government should spend on what activities but that there has to be some give and take, that some of our tax dollars will be spent on things that we don’t personally think are worth the money, and that, yes, in any human enterprise (even the sacrosanct private sector) there will be some unavoidable waste, fraud and abuse.

@al-Ameda:

I actually think a tax increase for Medicare should be one of the lower priorities, as Medicare has the same financial problems that private health insurance is facing. I’d much rather we focus on reducing the overall growth health care costs so they stop growing faster than inflation and then see if a tax increase is even necessary.

@LC:

Not rambling at all.

Yep.

I’m wearing suspenders today, so as a fiscal conservative*, I think we have to go back to the traditional tax rates that made America great. The Reagan tax rates — 50% at the top tier.

* I believe that the only requirement for “fiscal conservative” is having your pants not fall down too often. That kid down the street, with his pants hanging almost off his butt and his underwear showing — he’s the only person that does not self-identify as fiscal conservative.

Well, we definitely can’t cut federal funding for Cowboy Poetry Festivals. That would be mean-spirited.

@michael reynolds:

It’s pretty sad, but the first thing that popped into my head after reading this was “This Reynolds guy must be living in La-La Land if he thinks this will EVER happen.”

But when it comes down to it, you’ve reached (in my opinion, anyway) the MOST important set of questions we should be asking. I think in the past we actually asked those questions (or at least had our representatives debate them). What do we NEED? What do we WANT (i. e. don’t necessarily need but would be nice to do)? Can we afford all of both? How do we pay for it? Of course there wasn’t unanimous agreement on the answers, but at least there was a process by which we could reach reasonable compromise.

But today that seems to have been lost.

Actually the list shows that 205% of Republicans think we can cut education spending, which sounds about right.

@Mikey:

Well, I do live in the Bay Area, which if it isn’t La-La Land is at least La-La-adjacent.

@Septimius:

It’s comments like this that contribute to the problem (along with John McCain’s habit of mentioning random things that he personally finds wasteful).

Whether you love or hate federal involvement in cowboy poetry, the amount of time that it should be in discussion regarding a 3.8 trillion dollar budget is about a millisecond.

But let’s not focus on the expensive things. There’s cowboy poetry and otter mating to complain about!

Where can go to vote for bread and circuses!

Which is exactly why Romney and Ryan never talk about the specifics of their mathematically impossible economic plans.

@Tony W: Just go to your regular polling place – that’s all we are ever voting for and it doesn’t even matter who wins.

@ LC…

It may not be to the 1/1000 of a cent….but here you go.

http://www.whitehouse.gov/2011-taxreceipt

Hamilton was right and Jefferson was wrong.

In any event, just because Zombieland has been dumbed down nearly to a state of catatonia doesn’t ipso facto mean we’re screwed. The reality is that leaders can get done what needs to get done, the public be damned. You just have to have the right leaders. Truman comes to mind. Maybe Reagan in an alternative universe, one that didn’t include Tip O’Neill nor George Mitchell. Maybe not. Reagan wasn’t exactly a paradigm of true leadership. It’s a rare breed. Obviously Obama doesn’t make the cut. We don’t really know about Romney. Of course the presumption is that he’s a lightweight, and for good reasons, but stranger things have happened. We might not get a chance to find out. Even if Romney wins we might not get a chance to find out. Fiscal sanity is a thin Reid.

As far as cutting the federal government goes, hell, there’s literally no arena that couldn’t use a haircut, from ATF to the VA and everywhere in between, DOD included. Again, we just need a critical mass of political will. If we get there we can make some needed and material improvements. If not, however, then, yeah, we’re screwed.

Well, here we go. We’ll have to cut back spending dramatically and then raise taxes steeply. We need to do the spending cuts first based on historical experience and the nature of politicians in general. Then we’ll raise rates across the board, do away with the mortgage interest deduction, farm, alternative energy, ethanol subsidies to name a few. Oh and some of those, what is it 40 or 50% who don’t pay any income tax now, they’ve got to start paying some.

Now, I’ve made the proposal, assume in all other ways I’d make an excellent president or senator, who’ll vote for me?

Oh and we’ll need to drastically cut back on regulations to try to compensate for the loss of investment capital in the private sector. We’ll get back to basics with the regs, then cut way back on regulators and their travel.

We are at a point where the only hope is pain and suffering across the board with a diminished economy is the only way we can hope to sort things out. But remember, we can pay down the deficit but it won’t stay down unless we abolish programs and free up business from government mandates and damaging regulations.

In other word, the country and the government isn’t going to be like any thing anyone imagines.

@Scott:

I agree completely, although a war presents some difficulties apart from an ongoing social benefit program..

Unfortunately we’re in a Zero Sum environment where compromise and joint solution are viewed by one party in particular, as a sign of weakness, and not beneficial to their electoral efforts.

@michael reynolds:

Those of us in Los Angeles would be offended at that statement…. IF we cared enough to be offended.

@David M:

If we’re going to wait for a fix to to the rate of increase in private sector health and medical costs, then we’re all but resigned to never discussing the Medicare Tax rate.

Why can’t we walk and chew gum at the same time? Why isn’t there a negotiation to look at Medicare program details, reform and fix some of them, and also increase the Medicare Tax as part of larger Medicare reform bill?

All we’re presented with now is ending the program as we know it, without any discussion of the Medicare Tax at all. Preposterous.

@michael reynolds: I also like the idea that a separate check has to be written out for every tax, including “fees, permits, licenses” which are taxes also. At the end of a month, everyone could look back at their checkbook and see how many checks they wrote. Of course, everyone would have to order 3 new boxes of checks each month. I know the banks would go crazy with all of the checks going through, but people would see just how many different taxes they pay a month. That is why the Federal, state, and local tax systems need reforming and simplifying.

@al-Ameda:

Controlling the increase in health care spending, both public and private is more important than just increasing the Medicare tax rate. I’m certainly not advocating just passing those costs onto the seniors, but Medicare costs are a symptom of a bigger problem, not a stand-alone issue. Raising the Medicare tax rate now isn’t necessary yet, and the rising health care costs are not good for the private sector either.

Part of this is due to the fact there are a lot of other ways I’d rather raise taxes.

@JKB:

I can see why you say this, but as al Ameda said, walking and chewing gum at the same time is possible.

Wow…. you just slaughtered a whole herd of sacred cows there. Actually I agree with some of that but raising rates across the board and doing away with the mortgage interest deduction will slaughter the middle class. When it comes to subsidies to cut I would definitely end the subsidies to very profitable big oil and leave at least some for alternative energy. (peak oil is coming whether we like it or not and while nat gas looks good on paper I would like to see some data actually collected from around fracking sites.)

Well, there is a reason they don’t pay income tax, they don’t have enough income TO tax. If you taxed them something, just to say “they got skin in the game” my bet is it would cost more to collect then would be received.

Every time I here this, I always want to hear what regulations would you cut back on? And I mean that seriously. Clean air? Clean Water? Endangered species? OSHA? MSHA? Yes, regs are everywhere, and yes, some of them have outlived their usefulness and others are redundant. But most of them came into being for a good reason. So to say, “we’ll need to drastically cut back on regulations” is not much different than saying, “You need a haircut.” Where do you stop? At the neck?

Unfortunately JKB, the diminished economy… We got. The pain and suffering? We got. Across the board? Not so much. My wife and I pay about 25%. Mitt and his? 13%. And if Ryan had his way, it would be .82(?)%

Doesn’t sound much like shared sacrifice to me.

@OzarkHillbilly:

See, we are only talking and you already are trying to save our sacred cows. My point was, we have to cut spending and raise taxes, a lot of both to come close to becoming a viable entity again. To keep from wiping the economy out, we have to reduce the burden of government on business. Maybe we could do this with refining the regulations but we may just have to live in a world that is a bit less regulated and accept the bad effects.

As for cutting spending and raising taxes at the same time, Reagan tried that and lo and behold, the spending never got cut. I don’t know which party people blame but it is certain that Congress raised the taxes but then just didn’t get around to cutting spending. So, to keep the same scam from being repeated, we cut spending first, then a year or so later, we can raise taxes.

My point is, there is no either or. Only across the board cuts and taxes with a roll back regulatory state.

@JKB:

People always talk about cutting spending, but I’m always confused as to exactly why we should want actual spending cuts. Assuming population growth and inflation, an increase in absolute dollars is pretty normal.

And given that it’s the spending cuts that are hard, exactly what did you have in mind? (Raising taxes is comparatively easy, for the policy at least.)

This is why it’s always dangerous to try to craft policy or even messages based on poll results. Everyone wants everything plus a pony, and they don’t want to have to pay for it. I think most of us are realistic enough to agree that some changes need to be made, and that those will involve cuts, but none of us like it so if asked we’re going to say “no.” If we had two responsible parties running the government, they could reach a compromise that would enact some cuts and some tax increases and help reduce the deficit. Lacking two responsible parties, we get what we’re getting.

@David M:

Do costs really only track population and inflation?

I think institutions “accrete” programs with a more “organizational” dynamic.

The fact that the deficit and obsession with spending cuts is meant to be the cause celebre at all, is why we’re screwed.

@JKB:

No, i was only talking, and I said, “So many sacred cows, (snark) maybe we can slaughter a few of them together?

Truth is…. yeah I have a few sacred cows, so do you, I tried to meet you at the rubicon… you said, “no”

Some people and their fairy tales…

My ideas for reducing deficit and making government work better. Some are mine, some are borrowed from somewhere over time.

Across the board cut of 10% for every program. Let each agency and department figure out how.

Study all agencies and departments. Eliminate, consolidate, audit. Some agencies were started long ago, back in the 19th century and even Congress is unaware of their existence.

Many agencies are serving people who should not qualify. I know some people on Medicare that do not need it. I know others who need it and can’t or won’t get it. This needs to be looked at as well as fraud and waste.

Pork barrel spending . Sen. Proxmire used to give out a Golden Fleece award to the week’s biggest ripoff of taxpayer money. The most infamous was the university study of why children fall off tricycles, funded of course by the taxpayers.

Go to a flat tax, or eliminate the income tax and go to a national sales tax: 3% on everything. No larger “sin” taxes (such as the proposed tax on tanning beds): the Federal government has no business trying to control someone’s personal habits.

Modernize and update to current technology. It is reported that some agencies are still using rotary telephones and manual typewriters. They are really working down in a dungeon.

Privatize. This is underused. Many states have gone to this and are saving money.

Cut out most foreign aid.

Adopt a balanced budget amendment. Many states have these.

You know why we’re screwed? Because a substantial % of the population inhabits a fantasy land.

Example:

I got an email from my mother tonight. It was an email forward about the “Dhimmitude” exemption in “Obamacare.” It actually claimed that if you checked, snopes had verified the claim that Muslims had a special exemption from the ACA.

Of course, if you actually go to snopes, they point out at length that the claim is a lie. A flat-out disgusting lie.

my mother passed this on because she’s a gullible person with right-wing inclinations, and she never even bothered to do what the email said she should: check snopes

The woman has some quote from Trump up on her fridge. She gets a couple of emails a day from “patriot” and “tea party” groups, full of misinformation. She believes this crap. And yet, when I or another family member (we tend to take turns) explains why the email she has credulously forwarded is false (completely with links), she says nothing and learns nothing. But she votes, like clockwork.

THAT’S WHY WE’RE SCREWED.

Apologies, all. I’m upset, and I may have had a couple glasses of wine.

@Clanton:

3 percent national tax? Did you mean to add a zero to that?

@Console: Sorry – meant 13% national sales tax – only exemptions would be lemonade stands, yard sales, flea markets, and sales at churches.

@KariQ:

Exactly right. We get the government we (collectively) voted for.

@Clanton:

It’s been a while since I looked at articles concerning a National Sales Tax (a VAT of sorts). And I recall that the numbers I saw then ranged from 15% to 20%.

Yes, let’s just cut regulations. I’m willing to take a chance with my kids’ food and medicine, aren’t you? Hey, come on. Thalidomide wasn’t that bad, right? Right?

@john personna:

I’m sure there are plenty of spending increases for other reasons than population growth and inflation, but all else being equal actually cutting spending is more difficult than it sounds due to those two factors. This is one reason it should be easier to cut military spending, as it doesn’t have to keep up with population growth.

@michael reynolds:

We can cut the burden of regulation while have control or we have them tossed aside in the crisis.

What seems to being lost here is that small ball and favored ideas aren’t going to be enough. We have to go across the board.

@Scott: “We must insist, in turn, on asking our politicians, to be specific in their proposals, always asking: “how are you going to pay for that?”

To the degree that this helps the conversation, that was the point that people were making about “runaway government spending” in 1970, too.

@Console:

Indeed.

We need to get the unemployment problem squared away above all else. Once the money is flowing through the hands of a middle class, which lacks the power to loop-hole themselves out of taxation, a lot of the problem goes away.

The stats have been monkeyed with over the years, primarily by pretending that after a certain amount of time then they are no longer “unemployed”. It’s much worse than 8%.

Here’s a big problem: The old high tax rates were designed to prevent too much wealth accumulating at the top, and that horse has left the barn. We need ways to claw it back into the economy. Jefferson suggested confiscatory estate taxation. I do not have confidence we have that much time.

Another problem is preventing this cash from flowing overseas. We used to make stuff, and we must once again start making stuff. It’s not going to be easy either. The story of the Apple I-pad is most illustrative. They needed to find someone who could make a million glass face plates in two weeks, and since large scale manufacturing is the norm, somebody could point to a plant just up the street that could do it.

Then we need to get our per-capita healthcare costs cut roughly in half. Everybody else managed to do it, so there is no excuse.

Now that I have solved America’s problems, it’s Miller Time. Good night.

@Tony W: For bread and circuses, go to the polls. Vote for any candidate with a “D” or an “R” next to his name,

@JKB:

Unless you talkin law enforcement, our regulatory state isn’t really that expensive. I don’t see where there would be some sort of crisis where we’d jettison regulation. Small potatoes.

The real question will always be services. We have to decide once and for all what services we want. There’s no magic privatization or modernization bullet that’s going to make government services less expensive. Cutting most agencies will decrease service (you want a half-assed air traffic control?) and efficiency. It certainly won’t help with productivity since tech upgrades are usually the first thing halted.

It ain’t about trying to do the same things but do them on the cheap. That’s that Al Gore better government nonsense. If there are cuts to be made, then it has to be on the basis of what we really want out of our government. Not the idea that we can get something for nothing.

@john personna:

As the Foreigner that speaks other languages other than English I can say that Medicare should be more like the other single payer system in the world. Some caps and limitations, maybe a waiting time and better protection against fraud. The United States does not have a budget for Health care, as Andrew Walker says, that´s insane.

And, yes, I think that the number of doctors should be increased, and that all levels of government should build and own hospitals and clinics.

Funny but the Small Business Administration has a study that put the cost at $1.75 trillion annually. Maybe you work for Congress but out in the rest of America $1.75 trillion is expensive. Especially when that money could have been spent upgrading or expanding the business, invested or applied to higher wages. The study found regulation cost small business, those with less than 20 employees, $10,585 per employee.

And yes, I get, you were only considering the FTEs and office space paid for by taxes but regulations are a drain on the economy. One we really need to get a valve own before they bleed us dry.

@Andre Kenji:

Great idea, let’s put grandma on a waiting list, she’s got lots of time. Old people vote and the politicians don’t want them voting while they are on a waiting list. At least an overt one.

More doctors, well, outside of slavery how do you propose we get more doctors. True we do need to wipe out the AMA throttle on Med school enrollment but those doctors are going to expect some high pay and if you make the government workers, they are going to want lots of time off.

all levels of government should build and own hospitals and clinics. – what exactly does this accomplish except create another drain on the Treasury?

Yep, the burden of rivers that don’t catch on fire, of restaurant kitchens than are not infested with rats and cockroaches, of knowing what is in the medicine you give your children, of having 18 wheelers with brakes that work.

Heavy indeed are our burdens.

And JKB – those future generations that might want to enjoy an old growth forest or an unspoiled coastline? F**k them, right? It’s all about our generation and our God given right to have 50 inch flatscreens in our houses and SUVs and pickups that get 12MPG…

@C. Clavin:

Thank you for the link to the income tax receipt. I wish it were a bit more detailed because the categories are so broad that I suspect most citizens wouldn’t grasp the effect of a change in one category on them, their family, their friends. But it is a start.

So why doesn’t the IRS simply do the calculation and send it out?* I consider myself to be somewhat nerdy about IT and politics, and if I didn’t know about that web site, well, the percent of surfers who do know is probably not very large.

Thanks again.

*Yes, I know. The Republicans would accuse the IRS of wasting taxpayer money on a useless exercise.

I’ve got a better idea. Let’s give grandma a voucher. Then she can call the 800 number of an insurance company that does not want to sell her insurance. That beats sitting in a waiting room any day.

@JKB:

I’m not sure why the $1.75T number is believable, and the OMB would like to differ.

@anjin-san:

Try to be fair now, okay?

The insurance company would probably be willing to sell grandma a policy – it’s just that the deductible will be $2,500 and the monthly premium will be $2,000, and the monthly voucher will be for $1,000. Grandma will be out of pocket $1,000 per month, not including the set-aside for her deductible.

Now do you see how forcing consumers go to the competitive private insurance markets will benefit senior citizens?

@JKB:

Re the cost of regulations: one also needs to ascertain the cost of not having those regulations.

Regulations are not created by nameless bureaucrats out of thin air in order to irritate people and businesses and stall progress.. Every regulation ever written has been in response to some interest group demanding it in order to solve a problem or prevent a problem. They become ever more complicated because the interest groups affected lobby for changes, for exceptions, for clarifications.

Consider wheelchair access. It cost money for businesses to comply. They may or may not have gained additional business because of the increased access. But, guess what, the structural changes also end up helping women with baby carriages, technicians rolling in laser printers, students with their mobile backpacks and adults with their rolling suitcases – none of which existed when the handicapped access regulations went into effect. But even if this regulation had not produced unexpected future benefits, it was worth the cost to business because, quite simply, it was the right thing to do.

There are, no doubt, regulations that nobody would fight to keep, but I have a sneaky suspicion that the percent is small. Democracy is a very, very messy business.

@JKB:

If she does not want to wait she can pay for private insurance. Public health care is meant to be a safety net, not a five star hotel.

The biggest drain in the Treasury are expenses related to health care(And not only that, “private” money used for health care has similar economic effects as taxes). Public hospitals and clinics can be used to provide basic care for low cost(Clinics can be used for basic care, freeing space in hospitals).

Well, there you go, “it was the right thing to do”. So the worker who didn’t get a raise or the ones who lost their job when the small business went unprofitable are an acceptable cost? Perhaps it was. But my point was if we are going to raise taxes which will negatively impact the profitability of business and we cut spending which will remove some benefits that business may now have to cover, then we have to consider removing some of the regulatory burden. Or, businesses will go bankrupt or have reduced profits to pay taxes on, reducing the tax take even as taxes were increased. If the economic activity is down, if it regulations cost to much, tax revenue will be down and we’ll make no progress toward solving the problem.

Just like there is a limit on how high taxes can be, there is a limit on how costly regulations can be and the limit changes with different mixes.

when we can vote ourselves a raise…….duh.

@al-Ameda: well, if they can order umpteenth tests on her and keep her alive just to milk the process? sure, it’s all good. even if she’s basically at dnr stage, why not? keeps the unions and hospitals going and nobody really knows where the money comes from, no harm/no foul. typical.

@ bill

When Democrats tried to address end of life planning, conservatives had several years worth of hysterics over “death panels.”

@Rob in CT:

I know. I often feel as if Conservatives and Liberals live in parallel universes. I can excuse the stereotypical Tea Party member on the grounds of inadequate information, but what about Conservatives like Paul Ryan? I wish I could get inside his head for a moment to find out if he truly believes what he is saying or if he is just a political Madoff.

And now it appears that liberal and conservative brains are different which, if true, means there is no chance of our ever reaching agreement on anything.

Differences in Conservative and Liberal Brains

@David M:

But David Axelrod has figured out that the best way for the Democrats to increase spending is to limit the tax increases to the smallest part of the population possible. That means that the number of people support tax increases goes up and the demand for more spending goes up.

What Axelrod and his type refuse to face is what happens to the economy when $1 trillion dollar a year is taxed out of the economy but the level of economy activity goes down.

@Scott:

But how will the voter react when the answer to the question of how are you going to pay for that is: We will get the other guy to pay for your benefits.

Politics is becoming nothing more than a discussion of government goodies, who gets them, and who pays. And the answer will be that the top 5 to 10% of the population will pay the taxes that will pay for everyone else’s benefits.

@Gustopher:

Have you thought about what the U.S. looked like in 1979 with top marginal tax rates at 70%. Do you really want to go back to what NYC looked like in 1979?

@superdestroyer:

I’m not sure what the connection is between the federal tax structure in 1979 and the state of New York City (by which I presume you mean crime) in 1979.

Perhaps you can connect those dots for me, with the sooper sekrit decoder ring you got out of the cracker jack box.

With regard to the top 5-10% of the population paying for everything… first off, no, only if you totally ignore FICA taxes, which is a BS thing to do.

Second, if wealth continues to concentrate in this country, of course the haves will higher and higher shares of the total. Other people won’t have any money.

A large middle class is not a natural thing, you know. It was engineered. Those marginal tax rates that horrify you so were part of it (but only part. Things like the GI bill after WWII, Pell Grants, etc were also key).

A large, happy middle class is a good thing. Protects against revolutions.

Otherwise, I’m afraid the 0.01% are going to discover the hard way that when the lower 99.99% have nothing….then they have nothing to lose.

Me and four up-voters were ready to cut them all? A small minority.

For what it’s worth, I don’t think anyone should object to cutting any of them in abstract. You should really wait until you see what cuts are proposed, to see if they are sensible and not “harmful” by your values.

In the original poll, people should have seen a yes vote as an open-mindedness vote.

@michael reynolds:

I think (hope) you are off by about 10,000 years.

@michael reynolds:

According to Herb Caen, you are a few hundred miles north of La-La land.

Isn’t this the natural end result of “enlightened self interest”?

When we encourage everyone to think only in terms of their own self interest, enlightened or not, we end up with a nation of petulant children unwilling to pay the bill for the things they receive.