The Incredible Shrinking Federal Budget Deficit?

The Federal Budget Deficit appears headed in the right direction, for now.

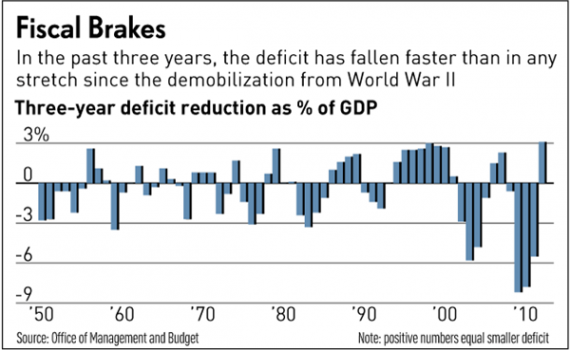

You may not know it from the tone of the debate in Washington, but the Federal Budget Deficit has shrunk at a faster rate over the past three years than at any time since 1945:

Believe it or not, the federal deficit has fallen faster over the past three years than it has in any such stretch since demobilization from World War II.

In fact, outside of that post-WWII era, the only time the deficit has fallen faster was when the economy relapsed in 1937, turning the Great Depression into a decade-long affair.

If U.S. history offers any guide, we are already testing the speed limits of a fiscal consolidation that doesn’t risk backfiring. That’s why the best way to address the fiscal cliff likely is to postpone it.

While long-term deficit reduction is important and deficits remain very large by historical standards, the reality is that the government already has its foot on the brakes.

In this sense, the “fiscal cliff” metaphor is especially poor. The government doesn’t need to apply the brakes with more force to avoid disaster. Rather the “cliff” is an artificial one that has sprung up because the two parties are able to agree on so little.

Hopefully, they will agree, as they did at the end of 2010, to embrace their disagreement for a bit longer. That seems a reasonably likely outcome of negotiations because the most likely alternative to a punt is a compromise (expiration of the Bush tax cuts for the top and the payroll tax cut, along with modest spending cuts) that could still push the economy into recession.

Rather than applying additional fiscal restraint now, the government needs to make sure it sets the course for steady restraint once the economy emerges further from the deep employment hole that remains. In fact, a number of so-called deficit hawks are calling for short-term tax cuts to spur growth, rather than immediate austerity.

From fiscal 2009 to fiscal 2012, the deficit shrank 3.1 percentage points, from 10.1% to 7.0% of GDP.

That’s just a bit faster than the 3.0 percentage point deficit improvement from 1995 to ’98, but at that point, the economy had everything going for it.

Other occasions when the federal deficit contracted by much more than 1 percentage point a year have coincided with recession. Some examples include 1937, 1960 and 1969.

Now, the deficit hawks out there will make the point that the reductions that we’re talking about here come after some of the highest budget deficit numbers in American history. For three years in a row, the Federal Budget Deficit exceeded $1 Trillion per year. Additionally, the deficit surpassed 10% of Gross Domestic Product. Now, to be fair, a significant part of this was due to the fact that the economy had been thrown into a deep, deep recession that had a significant impact on the tax receipts that the Federal Government was receiving on an annual basis. Additionally, Gross Domestic Product has been growing at a pathetically anemic rate ever since we came out of the recession which does tend to exaggerate the deficit-to-GDP ratio to some extent. The deficit hawks also have a good argument when they point out that the current budget deficit, which will end the current Fiscal Year somewhere north of $600 billion will still be higher in pure dollar numbers than it had been at any point prior to the Great Recession. For that reason alone, it is foolish to argue that we’ve “solved” the deficit problem, or that now is the time to start opening up the spigots of Federal spending once again. Indeed, what it actually argues in favor of is continuing the policies that have helped us make so much progress on the deficit in such a short period of time.

At the same time, though, the fact that the deficit is now headed in the right direction, and will hopefully continue to do so, is an argument in favor of a shift away from the old Washington arguments about spending and toward policies that will both help to continue to bring order to our fiscal house and promote the economic growth we need both to create jobs and to create the conditions that will make it easier to bring the deficit under control. Comprehensive tax reform, at both the personal and corporate levels, is one of those areas. There is much about our current tax code that is wasteful both fiscally and economically, and some fairly straightforward changes that could be made that would both reduce the burden on businesses and taxpayers and, thanks to economic growth, increase the amount of revenue that the Federal Government actually collects. This applies to several other areas of government policy. If the budget deficit keeps moving in the right direction, we’ve got plenty of opportunities to address these areas, if the political will in Washington exists to do so any the parties can get beyond their partisan differences.

Oh, who am I kidding?

The point I’ve made a couple of times over at Schuler’s blog is this: no one predicted that in May of 2013 we’d be discussing sharply lower deficits.

Why does this matter? Because prescription is prediction, that’s why.

A whole lot of people who confidently declaim on what should be done to fix the economy failed utterly to see this coming. Why? Because they don’t know what the hell they’re talking about.

If you prescribe a medicine it’s because you are confident that you can predict its effects. But if a pundit/blogger/economist cannot see this coming, then on what basis should I accept their ability to prophesy? And if they have no ability to prophesy, than on what grounds shouldI accept their prescriptions?

So now the economy can handle higher taxes and more regulations?

I have to think that a part of the strategy behind the GOPs faux scandal sound and fury is to take oxygen away from the story of ongoing economic improvement. Falling deficit, complete recovery of the stock market, recovering real estate market, recovering job market, & our economy staying in positive territory while austerity countries head south.

Once again, a Democratic President is doing a good job on the economy.

@michael reynolds:

That the federal government has been under continuing resolution for four years means that the government cannot really start any new programs. Having a slowly growing economy along with no new programs and the expiration of some temporary programs help the budget deficit. Also, the slow reducton of defense spending also help the deficit.

Of course, this will not stop all of the Krugman-ites from claiming that the federal budget must be much larger and the budget deficit is not big enough. But then again, progressives never bother to be consistent in their policy proposals.

@anjin-san:

And, as I mentioned on another thread, it seems Obamacare will not result in higher premiums.

So much good news. Time fot the GOP to pretend to care about the rights of reporters.

@superdestroyer:

Right, so that’s you, too, failing completely to predict this.

If you can’t predict, you can’t prescribe.

@michael reynolds:

But does it also mean that Krugman and the Keynesians are wrong. That a slow steady recovery is better than a deficit-driven, public sector dependent faux-recovery.

@superdestroyer:

What it means is that the so-called science of economics is in the delicate stage where they can measure things without having a clue how those things form a larger picture. The analogy I use is of, say, 16th century physicians. They could look at stool and urine, they could tell whether you had a fever, but they had no idea what caused illness or how to cure it. And in trying nevertheless to cure what they didn’t understand, they generally killed the patient.

Unfortunately, this is exactly the opposite of what we should be doing. We should be running a higher deficit now so we can help lower the unemployment in the short term–another temporary stimulus if you will, and then cutting the budget in the midterm.

As usual, DC doing everything backwards.

Let me see. Could this be due to President Obama’s handling of the economy? No of course not, he only increases the deficit according to the gospel according to Fox News and others! Won’t see any parties being held by Republicans now it’s beginning to shrink. They couldn’t stop talking about until recently, then a hush came over them it seems. Could it be things are starting to look better?

Oh damn that Obama, why can’t he mind his own business and let us keep ranting about the deficit? Oh well Darrell, can’t you drum up another investigation for us and take the heat of us as this deficit thing seems to be going down too fast for our liking? Hurry up man, there’s not a minute to waste. That’s what I think Republicans may now be thinking and saying.

Before going on, its time to review the record of the right wing economists that Doug has been relying on for his recommendations.

Since 2009, they have warned against increased government spending because it would lead to huge , enduring government deficits that would “burden our grandchildren.”

They argued that increasing deficits beyond a certain level would lead to disaster.They’ve argued that increased government spending would rekindle inflation.

These have been their predictions. They have been proven wrong at each and every instance.

It’s time to stop listening to these right wing carnival barkers, who frankly should be dismissed in disgrace for their incompetence and blind devotion to right wing ideology over facts.

As for Doug’s proposals? The ONLY reason is that we are not stuck deep in a recession like the Europeans is that we ignored the right wingers and enacted a stimulus that was inadequate but sufficient to pull us weakly out of the greatest depression since the 1930s. Unfortunately, the right wingers in Congress have prevented us from enacting further stimulus, or the economy would be doing still better and unemployment and the deficit would be sinking faster.

We do need to focus on economic growth. but the way to achieve that is not through “tax reform” or continued belt tightening. The way forward would be more stimulus now. For God’s sake, let’s start listening to the folks who got it right (Krugman, Summers, Romer, deLong, Thoma) and let’s start ignoring the charlatans at University of Chicago, Heritage Foundation , Reason.org, and Cato who got it 100 per wrong.

Why don’t you read a real economist, Doug, then get back to us. Start here:

Excerpt:

@michael reynolds:

Actually, Michael, I would disagree with you. LIBERAL economists have gotten it right. RIGHT-WING economists have gotten it wrong.

Krugtron the Invincible

One of the problem with liberals is that they don’t want to recogonise just how complete the liberal victory in economic prediction has been. There is now no doubt that right wing economic theory has been disproved.

The problem for liberal economists is that, unfortunately, the Democratic Administration refuses to listen to them. Had the Democrats enacted the stimulus that Romer, Summers, and Krugman wanted, the economy would have been better and unemployment lower. But Obama wanted to be “bipartisan” , so he chopped the stimulus. Big frickin’ mistake.

How long until the Republicans start screaming that we’re in danger of running surplusses, and a surplus will destroy the world economy…. and so we have to start slashing taxes on rich people?

And when they do, will anyone in the press call them on it? They sure didn’t in 2001…

The deficits that have accumulated over the last years generated long term debt that is financed by securities that have an average maturity of five years. It is that mismatch which will generate horrendous debt refinancing burdens laid on our children and grandchildren when something happens, as it inevitably will, to drive interest rates towards real market levels or higher. Since so much debt was incurred the deficit needed to not only go down, it needed to turn to a surplus during the recovery. We need a long series of surpluses to rid our offspring of the burden of the long-term time bomb. But there will, statistically, most likely be another recession during Obama’s second term. Sadly structural changes were not made so the deficit reductions are temporary. You progressives, lefties and big spending Republicans have merely bought time while screwing over the next generations.

Well, we were on the right track not so long ago. Republicans put an end to that.

@Let’s Be Free:

Let me guess, the prescription to “helping” the next generation is to cut entitlements: i.e. cutting social security and medicare benefits for the next generation.

Essentially, Obama took the correct path, and Paul Krugman was right.

@ Console

Romney did not want to even wait for the next generation. I’ve been paying in for 35 years, and he wanted to cut my benefits.

@Let’s Be Free: The government’s “debt” as you call it will impose no burden on future generations. None. Zero.

Where do you think the reserves used to purchas those securities came from?

Wonkblog looked at the curves and (as many above suggested) found something opposite of what we want:

It isn’t JUST that we are pulling back now, it is that we start increasing the deficit again later, when we hope we will be in expansion and require less stimulus.

@superdestroyer:

It is factually wrong that the government cannot make spending changes.

A new Farm Bill was debated today.

There are a number of reasons why, as Doug says, we should still be worried about the deficit:

1) The CBO’s numbers show we are nearing a temporary lull. By the end of the decade, the deficit will be going up again even under optimistic assumptions like the sequester staying in place, tax breaks expiring and unspecified Medicare spending controls working. Baby boomers will continue to retire and the Obamacare subsidies for insurance will begin to kick in. Long-term it’s still grim.

2) Somewhere between $100-200 billion of that is temporary relief, such as increased payments from Fannie and Freddie.

3) We are at historically low interest rates. With $16 trillion in debt and most of the debt financed on short term bonds, spending could spike by hundreds of billions if interest rates go up.

That having been said, I think this does make the case that we should be concentrating on long term reform of entitlement instead of more cuts in discretionary spending.

I wouldn’t crow too much about the liberal economists being right, BTW. According to them, the “austerity” of this year — the spending cuts and jump in payroll taxes — were supposed to plunge us back into recession.

@Hal 10000:

I don’t think that was it. The full austerity that Republicans demanded might have dragged us back and etc.

Short of that though, our “half-austerity” was surely less stimulative than even steady state spending (measured local + state + federal).

Which are determined by a vote of the Fed’s open market committee

Government securities are not subject to some sort of variable APR.

A $10,000 Treasury sells for 2% at auction. 2% of $10,000 is $200, so the Treasury sells the bond for $9800. When the bond matures and is redeemed the holder receives the $9800 it originally paid, plus $200 for an even $10,000.

No variable rate, no compounding interest. The only possible issue is whether the yield being paid out could generate inflation by pushing aggregate demand too high.

(Maybe not you Hal, but some conservatives make a strange suggestion – that since we are growing, our level of austerity could not have been a negative. Our slow growth doesn’t prove that, in fact it suggests that without a reduction in local + state + federal spending growth would have been even higher.)

@john personna:

If they do not pass a budget then the new farm bill will be operating on the continuing resolution budget. No additional spending. Of course, what the new farm bill should be doing is cutting subsidies to farmers but both parties want them to continue.

This is all predicated on the assumptions in the CBO’s baseline scenario being true, which has never been the case historically.

@stonetools:

How can anyone claim that Krugman was right when there has been no new stimulus spending in four years and the economy is growing and the unemployment rate is doing down. According to Krugman, the deficits should be $1.5 trillion per year to get unemployment rate down and that deficit reduction is pointless.

How do the Democrats take credit for deficit reduction when they have fighting against it for four years. Or is this just another example of everything that is positive is due to Democrats and everything that is wrong is the fault of Republicans.

@wr:

A more likely scenario is that was the deficit is reduced that the Democrats will push for expanding entitlements, expanding the public sector employment rolls, and new programs. It is called the ratchet effect and has occurred many times.

Folks, I think we can all agree that we owe it all to that unsung redoubtable, the Tommy Henrich of the Texas First District, Louie Gohmert.

@michael reynolds:

There’s no acknowledgement when one is right and no price to pay for being consistently wrong. No matter how many times you slay a notion it comes back as a zombie because we’re dealing with a theology even self-proclaimed “bright people” on various blogs cling to, come hell or high water.

@superdestroyer: “A more likely scenario is that was the deficit is reduced that the Democrats will push for expanding entitlements, expanding the public sector employment rolls, and new programs”

I sure hope you’re right. We need all of the above.

@john personna:

Republicans never demanded “austerity”. They demanded tax cuts and some pretty unrealistic plans to cut Medicare, but not Austerity. The only Republican that is demanding austerity is David Stockman, because he is willing to have tax increases.

Just as an aside for those who have an interest: the raw data indicate a slowing economy and a Fed concerned by disinflation.

Invest appropriately.

@wr:

But what are you willing to give up to get it and are you willing to risk making the next recession worse because of it. It growing entitlements and spending sustainable in the long run. Virtually every country in Europe is running up to the demographic wall where their birthrates are so slow that they cannot sustain the entitlements that they have promised. Why do you want the U.S. to head down the same path instead of trying to find a way to decrease the demand for government entitlements and limit the percentage of the GDP that the government consumes?

@Andre Kenji:

I would love for all of the progressives who are screaming about Republicans and Austerity to show one program that the Republicans, by themsleves, managed to kill.

@Ben Wolf:

And what happens in five years when that debt has to be rolled over and interest rates are higher? What happens if people will not lend the Fed money at 0% interest? NYC almost bankrupted themselves with that sort of thing. 1% of $16 trillion is $160 billion per year. Interest rates do not have go up that much to be a problem.

@Andre Kenji:

What? There were no requests for food stamp cuts, or opposition to unemployment extension?

@Hal 10000:

To split the difference perhaps between you and Ben, the answer is “no one knows.”

We can say that the Fed has had much more power to set interest rates, both short and long, than pessimists expected. I mean, we still have a possibility of bond vigilantes gaining sway, but no concrete demonstration that they are out there.

I was always some cautious about the BVs, but I’ve come to believe that the global savings glut renders them powerless. Or rather the people who might be vigilantes if they had an option simply must stuff trillions into government bonds. Every place else they might put it is pretty stuffed full as well.

@superdestroyer: “But what are you willing to give up to get it and are you willing to risk making the next recession worse because of it.”

I’m willing to give up an economic culture that has seen the value of work degraded and the value of wealth magnified. I’m willing to give up low taxes on the rich. I’m willing to give up obscene corporate profits and an economy almost entirely based on financial trickery.

In other words, I’m willing to give up the “Reagan revolution” that has enriched the super-rich and beggared everyone else.

@wr:

Hear, hear.

Summarizing the thread, I hold the view that all economists are idiots but that conservative economists are even bigger idiots, while most people will only go so far as to say that conservative economists are huge idiots.

The thing that is not in doubt is that conservative economists are idiots.

@Hal 10000:

The interest rate is determined by the Federal Reserve.

We have banks called primary dealers who are required to bid on all government securities auctions. There can never be a case of a failed Treasury auction unless our government ceases functioning, in which case we’ll have much bigger problems to worry about than an accounting structure.

New York City is not the federal government, which has its own currency and is monetarily sovereign. There is no chance of insolvency or involuntary default (running out of reserves). If it weren’t for the Republicans I’d say there was zero chance of voluntary default, but they took us down that road once before.

If there is no inflation problem, there is no deficit problem.

@michael reynolds:

Read yourself some Robert Shiller (or take his upcoming Coursera MOOC).

[I did not down-vote, but I don’t think it is a terribly well-read idea.]

@john personna:

Since I am not Jehovah I don’t hold that one righteous man is enough to justify the existence of an entire field.

OT, I note that since California made Republicans there irrelevant by electing Democratic super-majorities in both Houses, the state is experiencing a new problem: a projected budget surplus.

Meanwhile Texas, the conservative Great Red State Hope, is looking at a $5B deficit.

Can we now bury the meme that Democrats are profligate spenders who recklessly run up deficits, while Republicans are careful stewards of the public purse?

@michael reynolds:

Irrational Exuberance is a very good book exploring both the strengths and limitations of economics.

Animal Spirits is a very interesting book, which surprised me with its mistrust of both markets and consumers.

It sounds like you have the weaknesses down, and just need to gain the strengths.

@Andy:

{Citation needed}

Why Economic Models Are Always Wrong

Via Scientific American. Of course it comes down to “wrong, and wrong.” Sometimes you’ve got to model, because an estimation of a change is better than a blind jump. See climate.

@john personna:

I think the weaknesses are fatal, at least at this stage.

I have a philosophical problem with the whole notion of “the economy.” I don’t see what in life is excluded from the economy. What is not the economy? Culture? No, culture clearly plays a role. Religion? Ditto. Environment? See Fukushima. Random chance? See Steve Jobs takes a calligraphy course. If you can’t make a list of things which are not the economy, then the economy is essentially everything, or at very least affected by everything. Systems of everything cannot comprehend themselves. Find me even a single human being who completely understands himself. That’s the core philosophical problem.

Can economists measure all those factors I rattled off? Can they measure culture or randomness or sudden inspiration or unexpected synergies or environmental events or fads or inexplicable changes in mood? No.

What can they measure? They can measure the things they can measure. They can measure things easily reducible to numbers. In other words, because they cannot measure a whole range of things which clearly influence the system of everything, they choose to rely on whatever they can measure and happily exclude factors whose importance they of course cannot gauge.

What you have here is doctors who can measure temperature and see whether the stool is too dark or the urine is cloudy, but who have not yet been introduced to bacteria, viruses, fungi, amoeba or DNA. They know what they know and for the sake of convenience, and because they can’t bear to admit ignorance, and because they want power, they wish away everything else. “What the hell, leeches and cupping it is! Because according to our self-selected data, which is only a tiny subset of the entire data set we might some day be able to have, that’s the best we’ve got.”

Like medicine I imagine economics will grow and eventually manage to come up with cures that don’t make things worse. But right now you have a bunch of academics pretending to wisdom they don’t possess who then distort what little they think they know into servicing one of a handful of political interests. So, both ignorant and corrupt.

@michael reynolds:

To collapse this into a thumbnail, but consider history versus economics versus astrophysics.

At the historical end of the three we have something all about confused patterns of human behavior. Numbers help, they can catalog things like births, plagues and wars, but we don’t expect historians to be predictive (“a global war expected in 2035”). They’d be mad.

At the other end of the list we have a field perfectly free of human behavior. We can plot and predict the path of a comet for a thousand years into the future. That because comets don’t change their minds. Models are quite sane.

Economics sits somewhere in the middle. Numbers and models can be used with caution, but the ability to use numbers and models does also seduce many practitioners into too-bold prediction

And of course bold prediction gets you on TV, which doesn’t help at all.

@wr:

Increasing entitlements, increased public spending, and increased public sector employment does not help increase the value of work. If people have the same health care, the same educational opportunities, and the same future for their children whether they work or not, then why work. Why not live on the dole and let others have to get up in the morning.

It would make more sense if progressives talk about those who skim value from the economy such as investment banker, NGO types, or others that do not add to the economy. Yet, I do not see those on the left helping to value work as the degrade manufacturing, health care, STEM, energy, or transportation. Maybe a better way to help the economy is to promote making things instead of being freelance writers or club promoters.

I think one of the reasons that Michael believes as he does is that economics treats wrong theories and results differently than they do in the natural sciences. Natural scientists get things wrong all the time: but they discard wrong theories and results, even if those wrong theories are held by eminent scientists. You don’t get natural scientists any greater than Newton, Darwin , and Einstein: but they got things wrong. Newton believed in alchemy, Darwin thought whales evolved from bears, and Einstein rejected quantum mechanics. Its now known they were wrong, and those ideas have been discarded.

Not so economics. Wrong theories and wrong results aren’t discarded: rather, they are defended by conservative politicians, think tanks, and mass media if they fit in with conservative dogma. There is the Hoover Institute and the von Mises Institute, despite that Hoover presided over an economic disaster and von Mises’s ideas aren’t taken seriously by practicing economists. Hayek is worshiped by conservatives and his book Road to Serfdom is viewed as gospel, although its predictions were dead wrong.

We don’t have well funded, politically powerful organizations pushing alchemy, fixity of species, or heliocentrism, thankfully, so natural scientists can get on with the business of doing science. Economics isn’t like that, so the crap is presented, advocated for, and enacted into law alongside the good economics. All this means that the public has the view that all economics is a matter of crappy predictions and practitioners who are as much in the dark as medieval physicians.Michael , you need to take another look and sift the wheat from the chaff. Have to admit that, thanks to right wing support of chaff they like, it’s a difficult process.

(tl;dr – my reason to believe that there will always be limitations in economic models is that they include not just a few, but billions of minds with choices. No one can model the animal spirits, and even if they could, the spirits would have too many random choices. A funny or sad YouTube video becomes the butterfly’s wings.)

@stonetools:

the local media does not agree with your non-cite. http://www.yourhoustonnews.com/tomball/news/texas-lawmakers-adopt-final-budget/article_414cd358-c592-11e2-9df9-0019bb2963f4.html

@stonetools:

The problem with the left is that its idea from marxism to state control to keynesian also fail most of the time. Eventually the left drifts into the idea that the government should run the economy and eventually the government makes a bad decision. History is litter with as many failures of the left as of the right.

@michael reynolds: “The thing that is not in doubt is that conservative economists are idiots. ”

And the biggest idiots are the ones who try to “prove” something by stating that it’s “Econ 101.”

The only “science” in the world in which all the knowledge and complexities are to be found in a ten week survey class…

I am so confused. Doesn’t this mean we just had the largest 3 years of Austerity since WW2?

@stonetools:

1-) Economics is not a science, and economists are the first people to state that.

2-) A big problem among many Academic Economists is that they blend economics with partisan politics.

3-) Historically speaking, there were occasions where Keynesian solutions proved to be disastrous( Carter tried to fight inflation with the policy prescribed by Keynesians at the time: easy money and high interest policy, and that did not work). Many protectionist measures in Latin America that proved out to be horrible policy were influenced by Keynesians like Raul Prebisch.

Yes, there were also disastrous policies endorsed by Conservatives(The dollarization of the Argentinean economy, for instance),but that makes Economics more, not less important.

thank gawd we have the congress we have!, beetches, now obama can claim he did something the past 5 years,

Doug wrote:

Yeah, I’m going to have call this pablum pure b.s. unless Doug is prepared to tell us which policies that have actually been enacted that contributed to the deficit reduction that he actually supports.

@stonetools: Here’s a quote from the latest CBO report:

So, how does that extrapolation of current law affect things? Here’s the CBO again:

The baseline scenario has never been accurate for that, and other reasons. For example, the Bush Tax cuts had a sunset provision – since that was existing law, the baseline scenario assumed they would end. To account for these factors the CBO also provides an “alternative fiscal scenario” which, generally, has been much more accurate. Again, from the CBO:

@Andre Kenji:

How do you manage those two at once?

I think some of my text yesterday was garbled by my multitasking (sorry), but I thought of another way to say it, and that is to give economics a percent confidence level.

Let’s say my confidence is 60%.

I believe more than half the ideas out there, but there might be something like 40% claims that I think are unsupported.

As I say, I think you’ve got to do some digging, some reading, to develop a sense of which bit is which.

(My having a confidence of 60% implies that I’d have differences with someone at 80% confidence, or someone at 40% confidence. Though perhaps I do think the higher confidences are more dangerous. Related:

Who’s the dumb money now?)

i blame the party of “no” again…..oh wait, looks like they were right!

@bill:

Wait, the party of “no” wants to own the sequester now (again)?

@superdestroyer:

Did you just infer that people who are on welfare have the same healthcare and educational oportunities? Get a clue dude! The value of hard work being diminished by “entitlements” is a simple-minded arguement. However, there has been outside factors that directly impact one’s upward mobility through hard work. In a nutshell, we have gone through three decades (since Reagan) of policies that encouraged corporate greed at the expense of the labor force.

@LaMont:

One must look at policy initiatives that progressives push such as single payer health care, nationalizing educational standards, free undergraduate education, urban planning to force people to move back into inner cities, and very high marginal taxes,

Even the NY Times admits that social welfare programs can trap people in poverty and create disincentives to work harder or do better. http://www.nytimes.com/2012/12/09/opinion/sunday/kristof-profiting-from-a-childs-illiteracy.html?pagewanted=all&_r=1&

One only has to look at the cities and counties with high levels of poverty to see how the easy government check can become a trap.

@superdestroyer:

This is my biggest problem with conservatives that think like you. You fail to recognize that not all, perhaps not even a majority, of welfare recipients are there becuase they prefer to be. You treat this as THE problem while ignoring the fact that policies, that mainly benefit the wealthiest among us, has restrained the average welfare recipient’s upward mobility. That is, for the past 30 or so years it has become exceedingly harder for a welfare recipient to get out of welfare once in it. But you look at these people and buy the simple-minded stereotype that these people prefer to be there becuase, they get free money – as if welfare pay represent anything close to poverty level?

Yes you have to work hard to get out but there use to be a time when you did not have to work so hard to stay above the poverty level, let alone stay out of welfare. In the last 30 years public education has been drastically defunded while the cost of high level education has increased exponentially. The cost of healthcare has increased exponentially, Minimum wage has not kept up with inflation (i.e. the overall cost of living has staedily increased). And tax loopholes has taken a toll and is making a mockery of the national treasury. All of this restrains the average middleclasser’s upward mobility, let alone a person trying to get out of welfare! Therefore, what you mentioned in your first paragraph are all efforts liberals believe in to roll some of this back. The irony of it all is the fact that we had less welfare recipients with more governmental assistance 30 years ago. So how do you explain having more welfare recipients with less governmental assistance today?

@LaMont:

It is hard to take you seriously when you are dead wrong on education spending. It has grown much faster than inflation and population growth. http://www2.ed.gov/about/overview/fed/10facts/index.html

If you want to talk why the middle class is stuck, I suggest you read Elizabeth WArren’s book, “The Two-Income Trap.” What is holding back the middle class is housing costs, taxes, and insurance. Of course, the reason living in a good neighborhood with good schools is so hard is that the policies of the U.S. through immigration, busing, and diversity have created a huge number of bad neighborhoods with bad schools.

If you look at the media reports on the increasing numbers of people of workman’s comp, social security disability, food stamps, etc demonstrates a huge number of people are working hard to get on welfare instead of off it. For the poor, it is probably better to be on welfare and work off the books than to actually have a job.

Heya! I’m at work surfing around your blog from my new apple iphone! Just wanted to say I love reading through your blog and look forward to all your posts! Keep up the great work!