World Stocks Down $5 Trillion

This is bigger than President Trump's incompetence.

US stock markets are down more than 12 percent this week. While it’s tempting to blame that on well-founded fears that President Trump is poorly managing the US response to the coronavirus, it’s part of a global phenomenon.

Coronavirus panic sent world share markets crashing again on Friday, compounding their worst week since the 2008 global financial crisis and bringing the wipeout in value terms to $5 trillion.

The rout showed no signs of slowing as Europe’s main markets slumped 2-3 percent early on and the ongoing dive for safety sent yields on U.S. government bonds, seen as probably the securest asset in the world, to fresh record lows.

Hopes that the epidemic that started in China would be over in months, and that economic activity would quickly return to normal have been shattered this week as the number of international cases have spiraled.

Bets are now that the Federal Reserve will cut U.S. interest rates as soon as next month and other major central banks will follow to try and nurse economies through the troubles and stave off a global recession.“Investors are trying to price in the worst case scenario and the biggest risk is what happens now in the United States and other major countries outside of Asia,” said SEI Investments Head of Asian Equities John Lau.

“These are highly uncertaint times, no one really knows the answer and the markets are really panicking.”Disruptions to international travel and supply chains, school closures and cancellations of major events have all blackened the outlook for a world economy that was already struggling with the U.S.-China trade war fallout

MSCI’s all country world index, which tracks almost 50 countries, was down over 1 percent once Europe opened and almost 10 percent for the week — the worst since October 2008.

Wall Street shares had plunged 4.4 percent on Thursday alone which was its largest fall since August 2011. They have now lost 12 percent since hitting a record high just nine days ago, driving into so-called correction territory.

The CBOE volatility index, often called the “fear index,” jumped to 39.16, its highest in about two years, well out of the 11-20 range of recent months.

The index, which measures expected swings in U.S. shares in the next 30 days, typically shoots up to around 50 when bear market selling hits its heaviest and approached almost 90 during the 2008-09 financial crisis.

This seems to be a black swan event. Trump’s incompetence and untrustworthiness is not helping matters but they’re a really small part of the picture.

The impact on the global and US economy is certainly going to be substantial but nobody knows how far this will spiral.

It will almost certainly impact the US Presidential election. While one would think it would make Trump’s re-election prospects worse, that’s not a certainty. The American people may well not want to hand the reins to a President Sanders.

I’m a pessimist, but I’ll bet my next Social Security check that Trump’s journalistic minions find a way to spin this so that he looks good. Perhaps, “As the Democrats say, Presidents don’t control the stock market, and this is proof. How can anyone blame Trump for the market going down?”

You do realize that the flip side of that is also a possibility? Something along the lines of Trump can’t seem to fix this so why don’t we take a chance on Bernie…

I’ve believed the market (at least the US markets) have been overvalued for some time. There has been a party going on fueled by massive deficits. The tax cuts have been going into stock buybacks and speculation. The coronavirus is just the instigation for a long overdue correction.

My big worry is that we have not prepared for a recession. We don’t have any strong weapons to reinflate the economy through spending since we are already doing that. I am not optimistic. I hope I’m wrong.

And, OBTW, watch for more demands for cutting safety net expenses.

@An Interested Party:

I’m presenting this as the flip side. It was preceded with “While one would think it would make Trump’s re-election prospects worse, that’s not a certainty.”

@Scott: We also have little room to cut interest rates in response to recession, as they’re already low. The Fed seems to have found it difficult to raise rates in a slowly growing economy awash in accumulated capital. But it doesn’t help that Pud keeps beating on them to keep rates down.

@Scott:

Maybe. But, again, this is a global crisis, not just an American one. It’s not just the fears of a pandemic but actual hits to the economy: factories shut down, supply chains broken, and hundreds if not thousands of meetings, conferences, etc. canceled. There’s a strong possibility that the Tokyo Olympics will simply be canceled.

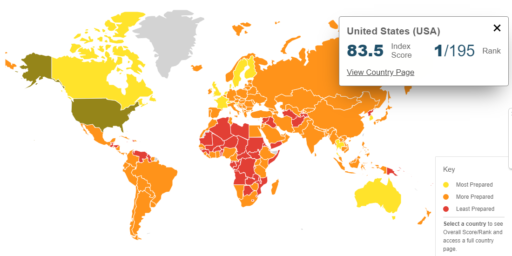

People keep calling this a Black Swan. The essence of a Black Swan is unpredictability. We knew this was going to happen. There were precursors in the bird flu, the swine flu, SARS, Ebola, and going back to the 1918 Spanish flu. Before Pud, the government was planning for such an event. We didn’t know when or any details, but we knew this would happen. Calling it a Black Swan excuses Pud’s response.

If we get out of this with less than thousands dead, as we likely will, Pud will declare it a huge victory due solely to his leadership. Don’t help him.

Not at all the point of the OP, I know, but is this really a black swan event? A pandemic or other major interruption to Chinese and other East Asian supply chains isn’t exactly something no one expected or considered likely. There have been tons of articles over at least the last 10 years about exactly that possibility and the importance of companies planning ahead for it. Granted, a lot of major companies apparently haven’t done as much to hedge against that possibility as they should have and the markets apparently haven’t sufficiently priced in the risk, but it’s not like it was some wildly improbable and unexpected event.

*ETA: Ha! I see gVOR08 beat me to it while I was typing.

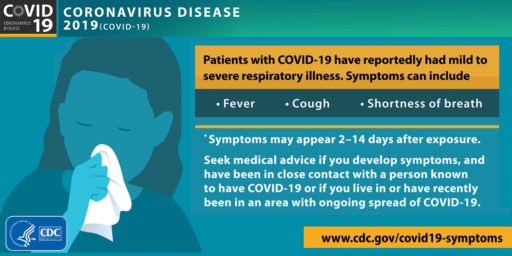

Oh FFS, it’s a very severe form of the flu. If you keep doing what you’re supposed to be doing to avoid the regular flu – wash your hands a lot, stay away of people who cough or sneeze moistly with their mouths open, etc. – then you should be fine. It’s not the bubonic plague or even SARS (remember that?). If the markets are being that spooked by this kind of thing, they’re their own worst enemy.

@James Joyner: I realize that, but Trump simply losing to the Democrat is a little different than Trump losing specifically to Sanders…

@James Joyner:

This. And honestly I feel like this aspect has been under reported up until recently. The fact is that the supply chain stuff is going to be a huge issue for even local manufacturing that relies on parts from other parts of the world. The more places this spreads and encounter temporary shutdowns, the more everything gets disrupted.

The other real question is how transmissible this is and how that will interact with refugee problems that are flaring up in key places like Turkey/Syria (Turkey is basically letting Syrian refugees pass through its boarders and into Europe with apparently little to no oversight) and internally in India, where sections of the Muslim population are feeling ethnic attacks. If the virus gets into those communities then things get really quite scary.

Well, 20 times more deadly than flu (before we even get to the overwhelmed health care system issues to come), but sure.

@R.Dave:

According to the Centre for Disease Control: “CDC estimates that influenza has resulted in between 9 million – 45 million illnesses, between 140,000 – 810,000 hospitalizations and between 12,000 – 61,000 deaths annually since 2010.”

So yeah, the regular flu is deadly enough without everyone filling their diapers about it. I repeat what I said above: if you’re taking precautions against getting the flu, then you should be fine. If you’re really worried, then wash your hands a LOT more times a day and get a face mask (if you can find one).

Also: if you’re really worried about how vulnerable you are, here is a non-hysterical article that explains things calmly: https://www.ucsf.edu/news/2020/02/416671/how-new-coronavirus-spreads-and-progresses-and-why-one-test-may-not-be-enough

@James Joyner:

While a global crisis may originate anywhere, the condition of any country when it meets that crisis does matter a great deal.

Consider Stalin had purged a lot of experienced officers off the Red Army, as well as some engineers and weapons designers, and then WWII began. He had to retrieve many from the gulags.

@Not the IT Dept.: The problem is that this “flu” has basically shut down China and its factories, with resultant knock-on effects all along the production and sales lines. Hence the world-wide stock market collapse (which was overinflated anyway.) And we have a collection of dolts in charge at the top of the U.S. which isn’t encouraging anyone with any brains. Trump will continue to blame everything on the Democrats, egged on by his merry band of lunatics, continue to cut money in our health system so he can have his “big beautiful wall”, and there are enough idiots in the U.S. who will go along with him.

This dovetails nicely with @Kit’s post on the open forum. Like @Scott:, my view is that the US (and quite likely other major) market has been over priced. The coronavirus correction is likely to return stock prices that are in-line with historic price/earnings ratios.

When the market corrected in 2018, stock price growth rebounded and all were happy again, but there is no guarantee that will happen again. Add to that problem is Tiny’s immigration policy will be a drag on economic growth, that is in addition to the factors that Dean Baker mentioned.

The current market crash, can’t be laid at Tiny’s doorstep (but let’s try), but his incompetence and shortsightedness will lead to tough times ahead.

@Not the IT Dept.:

The flu kills like 0.1-0.2% of people. I hope these numbers are wrong, but the epidemiologists are guessing 2 to 4% mortality on this thing right now.

And it’s already killed 2000+ people more than SARS, btw.

People keep trotting this line out to argue that COVID-19 is no big deal, but whenever I hear it, I just think it demonstrates how limited our ability to combat viruses really is. I mean seriously, “If you get this, you have a 1 in 50 chance of dying, and all we can really do to prevent that from happening is tell you to wash your hands more often,” is supposed to be reassuring?

@R.Dave:

A disease with a 2% fatality rate does not mean you have a 2% chance of dying from it.

While COVID-19 is worse than the flu, it’s also obvious people who don’t get statistics at all are freaking out far more than necessary.

@Stormy Dragon:

In particular, it’s becoming obvious there’s a distinction between SARS-Cov-2 (the virus) and COVID19 (a respiratory disorder caused by the virus). Part of why containment is failing is that most people infected by SARS-Cov-2 never develop COVID19.

Which is bad news for containment but good news for society

@Stormy Dragon:

Related to above, the WHO now has an estimate of the Infection Fatality Rate for SAR-Cov-2 of 0.3 – 1.0% vs a Case Fatality Rate of 2.8%

As I mentioned a week ago in a thread, most people were comparing the IFR of flu to the CFR of SAR-Cov-2 because at the time there was no IFR for SAR-Cov-2 yet.

Everyone just ignored it though because it didn’t fit their panic fantasies.

@Stormy Dragon: Interesting. I hadn’t seen your prior comment about IFR vs CFR. Good to know! So are you saying that the IFR for both ordinary seasonal flu and this virus are roughly similar (or at least beginning to look that way)?

Also, then what’s the CFR for seasonal flu, so we can do an apples to apples comparison?

As of right now the Dow has lost 15.8% off its peak from February 12.

@R.Dave:

For the 2016-2017 US flu season (last one I can find stats for), the IFR was 0.13% and the CFR was 7.6%.

(Keep in mind, COVID19 sufferers are probably seeking medical attention faster than flu sufferers, which helps the CFR for COVID19 since they get medical intervention sooner)

So SARS-Cov-2 does still have a significantly worse IFR than flu, just not as bad as the IFR to CFR comparison made it look.

@Stormy Dragon: Do you mind linking me to your sources for those various stats? Not doubting your claims, to be clear, just trying to wade through the mess.

@R. Dave:

The SARS-Cov-2 IFR vs. CFR is discussed here, in the “Advanced Analytics and Mathematical Modelling” section:

Coronavirus disease 2019 (COVID-19) Situation Report – 30

The flu stats I got from here in the “Estimated U.S. Influenza Burden, By Season” section:

Disease Burden of Influenza

Huh, it’s kinda remarkable that this post has been up for quite a while and our resident financial expert hasn’t showing up to tell us how crazy we all are and that, despite our liberal delusions, things are fine with the market.

@mattbernius: math is a liberal conspiracy. I hear some of it was even developed by Mooslims!

@Teve: You mean such marginal constructs as algebra, al jabr in Arabic? Or zero, invented various places but passed to the west through Persia?

ETA – And studiously ignoring guarn.

@Not the IT Dept.:

Yeah we remember SARs because COVID-19 is a VERY CLOSE RELATIVE of the SARs virus.

BTW most coronoviruses give us what we call the common cold.

Now is the time to buy. Coca Cola is down 5%. It always rebounds. Read investing strategies by Phil Town: “Rule 1”.

@Stormy Dragon: Thanks!

@Guarneri:

So this seems to be an acknowledgement that the stock market are currently overvalued for quite some time. I’d love your reflection on the latest news that the administration is considering additional emergency tax cuts and rate cuts in order to keep the markets (apparently artificially) overvalued.

Do you think that is a wise choice? Or is that a sign that the economy isn’t necessarily as strong as we’ve been led to believe?